WTI crude oil is trending like a champ, surging around $25 a barrel since the end of June, underpinned by strong global demand, a growing the belief the United States will avoid a hard landing and supply cuts from the two largest exporters globally, Saudi Arabia and Russia.

It’s the perfect environment to fuel big gains, excusing the pun.

But who doesn’t know that? And, more importantly, who’s yet to position for it in the near-term? Bears are an endangered species, overrun by waves of buying since the start of September. Such is the enthusiasm for ‘black gold’, it makes me wonder whether long positioning is more than a tad stretched right now, making it vulnerable to anything that doesn’t fit with the broader narrative? Crude has run a long way fast with plenty of late-to-the-party bulls continuing to chase it higher.

WTI crude oil vulnerable in risk-laden week

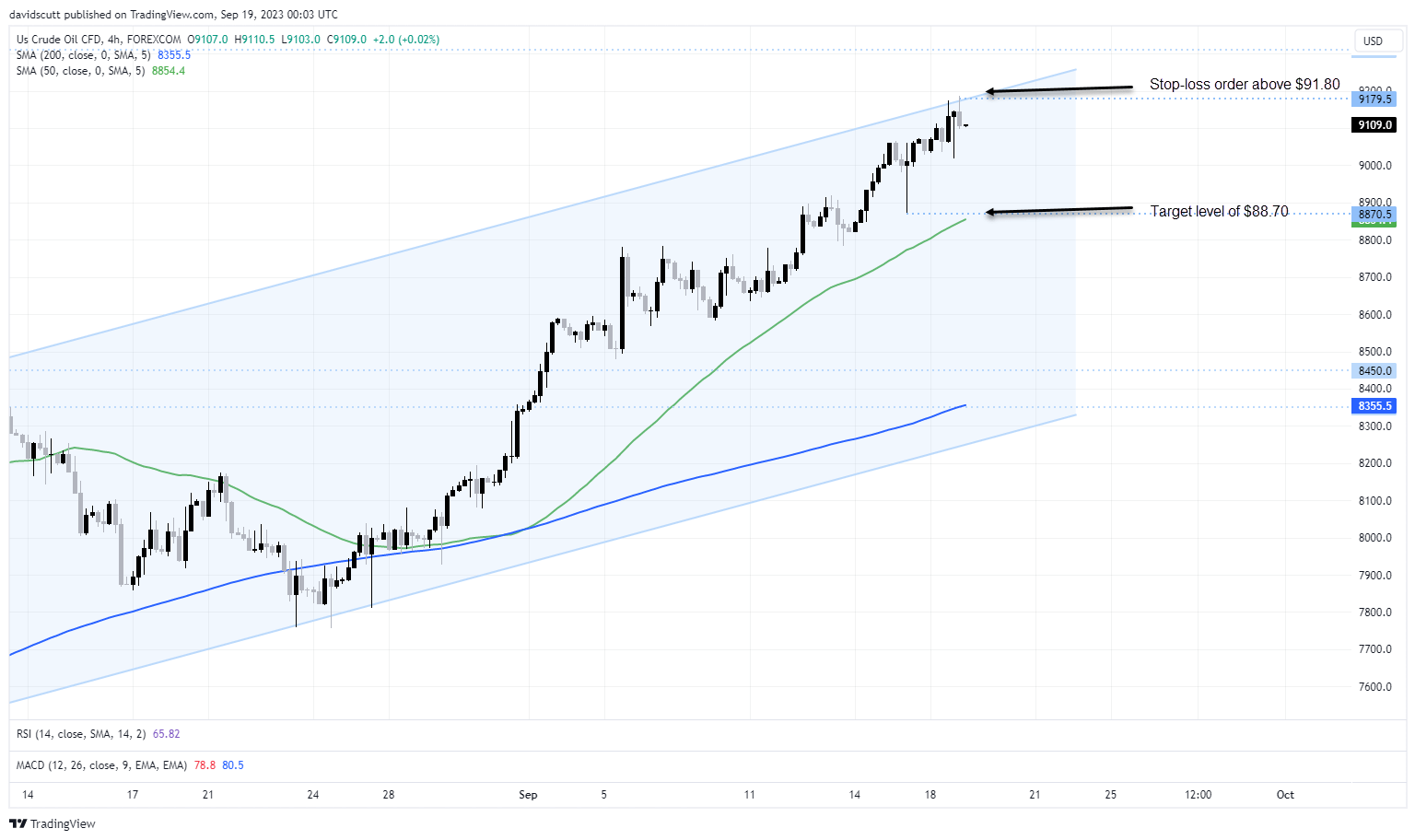

My view is it goes higher longer-term, but probably not in the near-term given what’s discussed above. And having failed to break above the top of the uptrend range it’s been in for months over the past 24 hours, it suggests we may some short-term downside, especially if we see tweaks to positioning ahead of a risk event-laden second half of the week, headlined by the Federal Reserve’s FOMC interest rate decision on Wednesday.

A pullback towards $88.70 is not a stretch given how lopsided near-term sentiment and positioning appears to be. A stop above $91.80 would protect against a successful test of uptrend resistance.