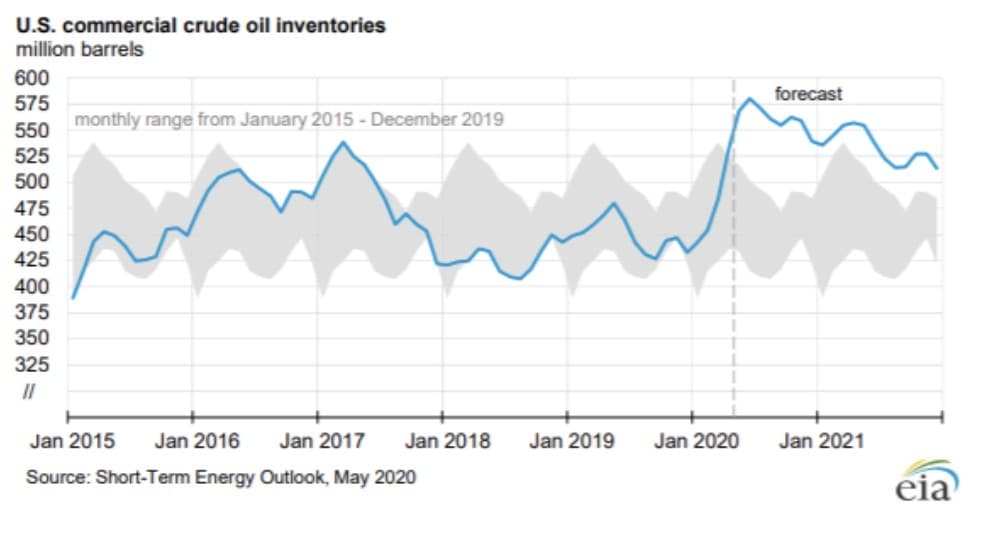

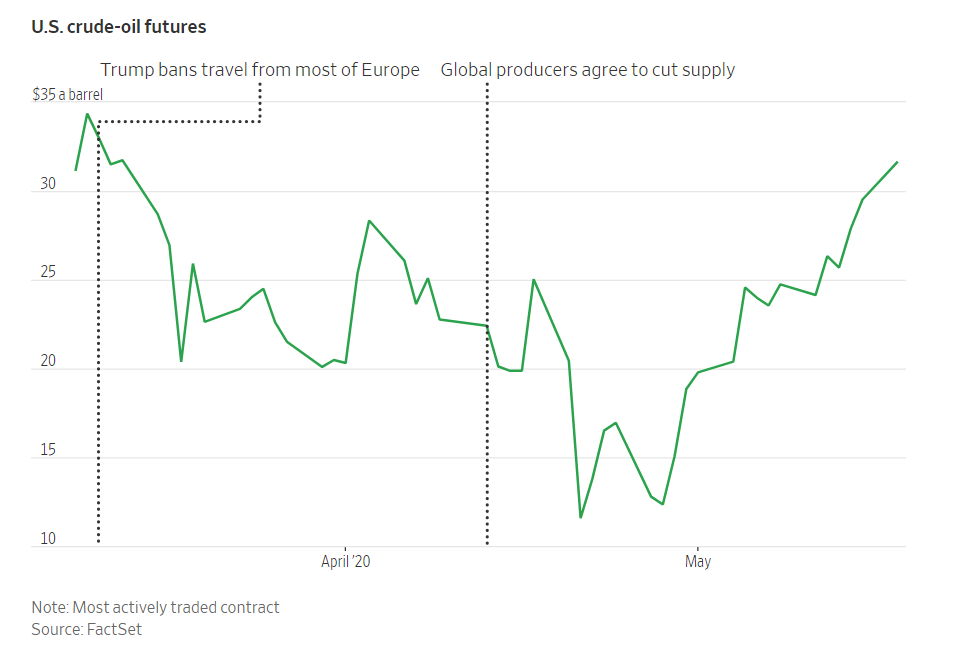

Crude Oil prices are staging impressive comeback after last month’s collapse to -$30. Sentiment in Oil has vastly improved in the past few weeks. Hopes of the supply cut as well as demand rebound help to support oil. China’s oil demand has come back to the pre-Covid 19 level at 13 million barrels/day. Crude storage report on Tuesday turns out to be not as bad as the original forecast. The projection by analysts is for an inventory build of 1.151 million barrels. The EIA forecast was for a slight build but it turned out to be an actual decline of 0.7 million barrels. This fuels the bets that the worst of the industry’s storage crisis has passed.

Prices are still below levels which most producers can make profit. Thus, many companies and shale drillers shut down the operation. The OPEC+ production cut, combined with shutdown of most oil producers, and rising factory activity in China finally lifted Oil’s price up. As the world’s biggest oil exporter, Saudi Arabia has said they would cut supply to the lowest level since 2002. Demand for gasoline also starts to recover as drivers slowly return to the road as US and Europe plan to relax the lock down measures.

Crude Oil 4 Hour Elliott Wave Chart

4 hour chart of WTI Light Crude Oil July contract (CL N20) above shows a possible impulsive rally from 4.21.2020 low. The nest is a possibility but what is clear is that the rally from 5.8.2020 low is an impulse. Short term, the area of 35 - 37.5 may see sellers for 3 waves pullback. This is the 100% extension from 4.29.2020 measured from 5.8.2020. From there, if the nesting structure is playing out, then the pullback should find buyers for more upside.