CSX Corporation (CSX) provides rail-based fright transportation services. The Company offers rail services & transportation of intermodal containers & trailers as well as other services such as rail-to-truck transfers & bulk commodity operations. It transports chemicals, agricultural & food products, minerals, automotive, forest products, fertilizers, metals & equipment & coal, coke, iron ore to electricity-generating power plants & industrial plants. It is based in Jacksonville, US, comes under Industrial sector & trades as “CSX” ticker.

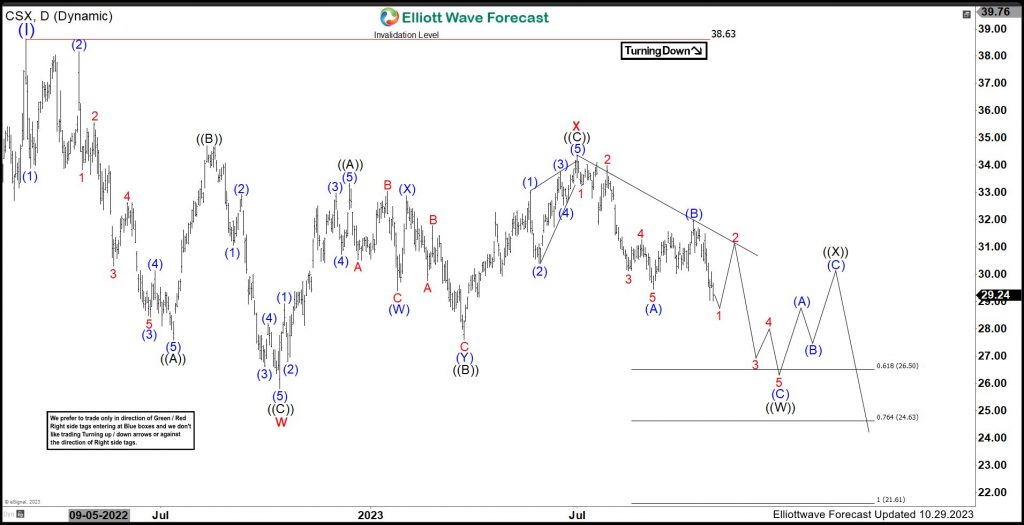

CSX placed (I) at $38.63 high in daily sequence & favors pullback in (II) in double correction. It expects to remain sideways to lower, while bounce fail below $34.38 high of x connector.

CSX - Elliott Wave Latest Daily View:

It placed (I) at $38.63 high in March-2022 as impulse sequence in weekly. Below there, it ended w at $25.80 low in zigzag correction on 10.13.2022. It ended ((A)) of w at $27.59 low as 5 swings sequence. It bounced off in ((B)) as sharp correction, ended at $34.71 high. Later, it resumed lower in ((C)) in 5 swings lower, ended at $25.80 low as w of (II) correction. Above w low, it reacted higher in x connector in zigzag, which ended at $34.38 high on 7.03.2023. It placed ((A)) at $33.33 high as 5 swings move, followed by ((B)) at $27.60 low in double correction. Finally, it ended ((C)) at $34.38 high as diagonal to finish x connector.

Below x high, it resumed lower in ((W)) of y of (II) & can extend towards $26.50 - $24.63 area. Within ((W)), it placed (A) at $29.45 low & (B) at $32.00 high on 10.11.2023. Currently, it favors lower in 1 of (C) & soon can bounce in 2, which expect to fail below (B) high to resume downside in 3 of (C). Alternatively, if it breaks above $32.00 high, it can do flat correction in (B), which yet expect to fail below x high to resume downside as the part of ((W)) of y of (II). It expects y to extend lower towards $21.61 - $13.69 area to finish (II) correction, where buyers expect to enter the market.