Information provided today: I will provide here the currency score and later on this day I will update this thread with the review on the Hybrid Grid strategy.

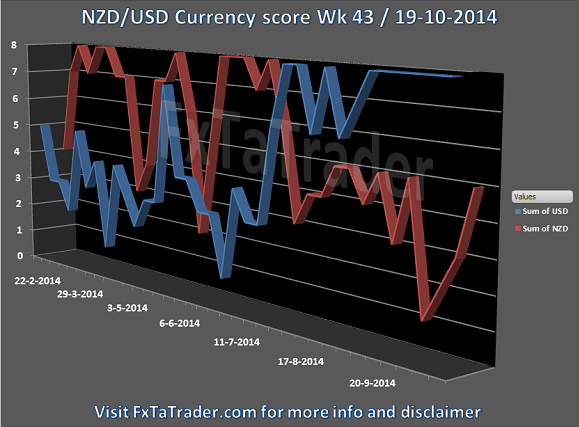

In this article I will provide my analysis and the FxTaTrader Currency Scrore chart which is my view on the 8 major currencies based on the Technical analysis charts using the MACD and Ichimoku indacator on 4 time frames, the monthly, weekly, daily and 4 hours. See for full details the page “Currency score explained” on my blog FxTaTrader.com.

The FxTaTrader Forex Currency Score chart is meaningful data for my FxTaTrader Hybrid Grid strategy. Besides this chart I also provide my weekly analysis on my strategy and the Forex ranking and rating list which is available 3 times a week on this blog.

[ul]

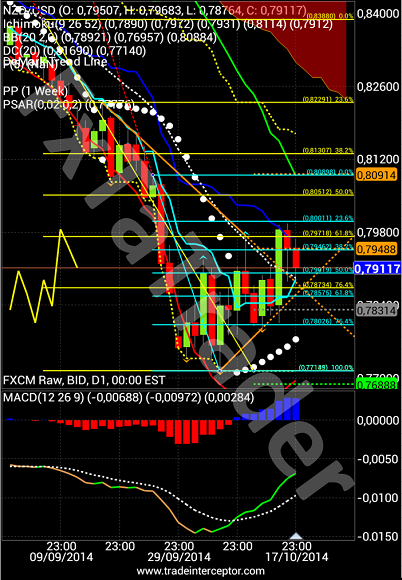

[li]The USD, CHF, GBP are currently the stronger currencies. The AUD, CAD and EUR are the weaker currencies. The best pairs to look at are a combination of those currencies.[/li][li]Currencies with a score of 4 and 5, meaning the JPY and the NZD are difficult to trade because they are in the middle of the range. However, the NZD is weak from a longer term perspective, see my previous article Forex Currency Score Wk 42. This currency offers opportunities to go short in the current pull back.[/li][li]The CHF has a high correlation with the EUR so it does not have the preference to go long with unless going long against the EUR. Conclusion for going long is that for the coming week it seems best to go long with the USD and the GBP and on the CHF with the EUR as the counterpart.[/li][li]For the weaker currencies the AUD seems to have a temporary dip according to the currency score chart of this currency and may recover soon. For more details see my previous article Forex Currency Score Wk 42. Conclusion is that for the coming week it seems best to go short with the NZD, EUR and the CAD.[/li][li]The best combinations for the coming week also according to the Forex Ranking and Rating list, see my previous post of this week, are the USD/CAD, GBP/CAD, EUR/CHF and the EUR/GBP, These pairs are having a good ranking in the ranking & rating list of resp. 2, 6, 10 and 11.[/li][li]There are some rules for taking positions according to the FxTaTrader Hybrid Grid Strategy. The strategy can open multiple positions of a currency pair but each currency may only be present once in the pairs chosen for trading. It means that not all the possible positions of coming week can be opened. For more information see the page “FxTaTrader Hybrid Grid Strategy” on my blog.[/li][li]Last week (pending) orders were placed for the NZD/USD and profit was made on 1 position. More on this in my strategy article later this day.[/li][/ul]

___________________________________________

Stronger currencies

In the previous week we looked into the weaker currencies from a longer term perspective using the data of the Currency Score. In this article the stronger currencies will be handled. This way there is a clear view on the best combinations to trade for the coming period. Unless these currencies go complete to the other side of the range they remain interesting. As can be seen in the chart above the dips are of a short nature with fast recovery. This makes clear on which side they are, same counts for the weaker currencies discussed last week.

The stronger currencies are the USD and the GBP. In the last 3 months only the GBP dipped once and recovered fast. When looking at a period of 6 months also the USD dipped. In that period the USD was not yet one of the stronger currencies. The currencies had a score of 6 or higher without the dips which is a strong performance. At the moment these 2 currencies have the preference for going long.

This analysis makes it possible to look at currencies from a longer term perspective and provides the inner-strength which cannot always be seen clearly when looking at different charts of a currency and its counterparts. It is an additional analysis that can be used besides the Technical analysis charts and the Forex Ranking and Rating list and it may also diminish risk. Next week I will go into details on the average performing currencies from a longer term perspective.

[B] ___________________________________________

[/B]

Later on this day I will provide the weekly review on my FxTaTrader Hybrid Grid strategy. Good luck to all of you in your trading the coming week.

Although the explanation may seem simple and clear there is always risk involved. I added a disclaimer to my blog for this purpose. If you like to use this article then mention the source by providing the URL FxTaTrader.com or the direct link to this article.