[I]Information provided today: I will provide here the currency score and later on this day I will update this thread with the review on the Hybrid Grid strategy.

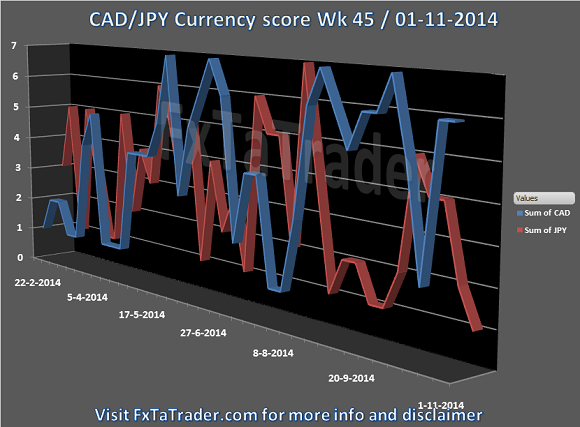

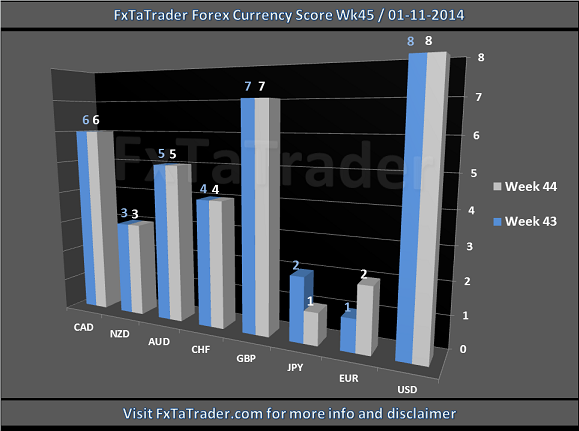

[/I]In this article I will provide my analysis and the FxTaTrader Currency Scrore chart which is my view on the 8 major currencies based on the Technical analysis charts using the MACD and Ichimoku indacator on 4 time frames, the monthly, weekly, daily and 4 hours. See for full details the page Currency score explained on my blog FxTaTrader.com.

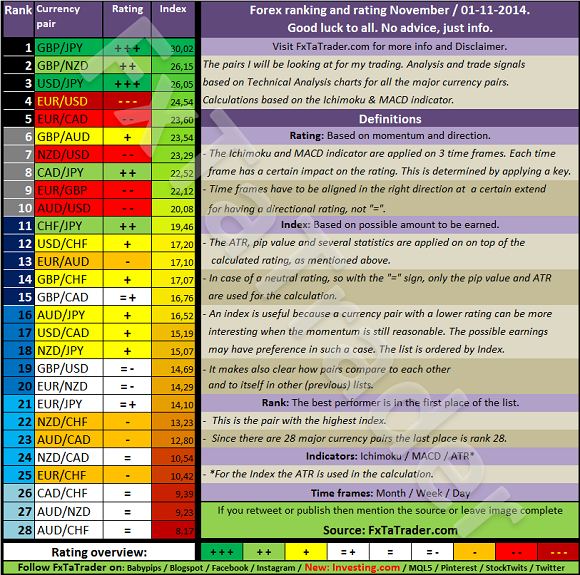

The FxTaTrader Forex Currency Score chart is meaningful data for my FxTaTrader Hybrid Grid strategy. Besides this chart I also provide my weekly analysis on my strategy and the Forex ranking and rating list which is available 3 times a week on this blog.

[ul]

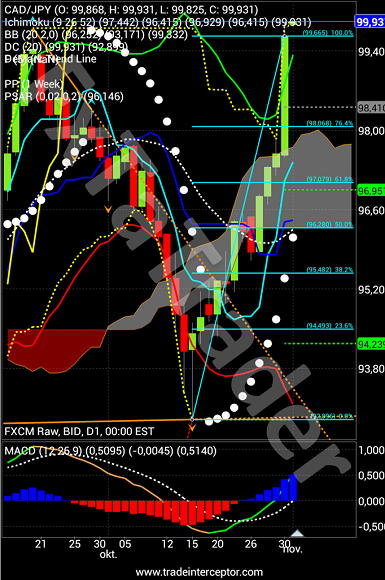

[li]The currency score almost did not change compared to last week except for the EUR and JPY, they switched places.[/li][li]The USD, GBP and CAD are currently the stronger currencies. The EUR, JPY and NZD are the weaker currencies. The best pairs to look at are a combination of those currencies.[/li][li]Currencies with a score of 4 and 5, meaning the CHF and the AUD are difficult to trade because they are in the middle of the range.[/li][li]Conclusion for going long is that for the coming week it seems best to go long with the USD, GBP and the CAD. However the CAD is an average performer from a longer term perspective so it does not have the preference. See my previous Currency score article of last week for more information.[/li][li]For the weaker currencies the conclusion is that for the coming week it seems best to go short with the EUR, JPY and NZD. The JPY was an average performer from a longer term perspective but the last top in the currency score chart was not higher than score 5 and it went down again to a score of 1 in less than 3 months. It seems like this currency is becoming one of the weaker ones for the coming period.[/li][li]The best combinations for the coming week also according to the Forex Ranking and Rating list and the TA charts are pairs in the Top 8 of the current Ranking & Rating list. These are the USD/JPY, GBP/JPY, EUR/USD, CAD/JPY, NZD/USD, GBP/NZD and the EUR/CAD.[/li][li]There are some rules for taking positions according to the FxTaTrader Hybrid Grid Strategy. The strategy can open multiple positions of a currency pair but each currency may only be present once in the pairs chosen for trading. It means that not all the possible positions of coming week can be opened. For more information see FxTaTrader Hybrid Grid Strategy.[/li][li]Last week (pending) orders were placed for the EUR/USD, NZD/CAD, GBP/CAD, CAD/JPY and the NZD/USD. Profit was made on 5 positions and losses on 2 and ending the week slightly higher. More on this in my strategy article later this day.[/li][/ul]

In the previous weeks we looked into the weaker, stronger and average performing currencies from a longer term perspective using the data of the Currency Score. The conclusion was briefly:

[ul]

[li]a stronger currency can be traded against a weaker and average performing currency.[/li][li]a weaker currency against a stronger and average performing currency.[/li][li]the average performing currencies can be traded against the stronger and weaker currencies.[/li][/ul]

The average performing currencies may be traded against each other when it complies to a certain condition. In this article the currency score difference will be handled. This is a method of looking at good currency combinations taking into account their performance as a whole in the market.

The Currency Score is displaying a score in absolute numbers from 1 to 8 so each major currency has a score. However, that a currency is having the highest or lowest score does not mean it will reverse because the score only tells the relative score compared to each other. It does not tell anything about being overbought or oversold once it reaches the highest or lowest score. With this information we can determine the stronger, weaker and average performers.

The Currency Score difference is especially important when looking at the average performers and at an opportunity between them. The average performers are not in a strong trend and a good way to determine if the trend is significant can be done by using the Currency Score difference. When we look at this we can calculate what the Currency score difference is of an average trend.

[ul]

[li]A strong trend is having a currency with a score of 8 against a currency with a score of 1. In this case the Currency score difference is 7. There is only one pair that complies to this. This is currently the USD/JPY.[/li][li]A weak trend is having currency which is just 1 score point higher or lower as the other. In this case the Currency score difference is 1. There are 7 currency combinations that comply to this.[/li][li]This means that the higher the Currency Score difference, the smaller the amount of possible currency combinations.[/li][li]So an average performing trend would have a Currency Score difference of (7 + 1)/2 = 4. When finding a currency combination with a Currency Score difference of 4 or higher then you know it belongs to the few better performers according to the Currency Score.[/li][li]This score difference of 4 is just an indication and additional information besides the TA charts of the specific pair. It may very well be that the specific pair is performing better than the other pairs used in the calculation of the Currency score. However when the Currency score difference becomes too small it means that other pairs are not supporting very well the specific pair and direction to trade.[/li][li]Although this explanation is mainly for the average performing currencies it is also something that can be used when looking at the stronger and weaker currencies being traded against an average performing currency.[/li][li]An average performing currency may become easily a stronger or weaker currency and when this develops during the weeks it becomes harder to trade this currency as an average performer. Using the Currency Score difference can be used as a precaution in these situations.[/li][/ul]

When looking at the average performers against each other it is important that a trend is being developed because there is no clear longer term trend. The mentioned analysis may support the TA Chart of this specific currency combination. So the average performers can be traded against each other but only when there is a trend being developed. It may very well be that one of the currencies becomes a stronger or weaker currency. This may also be for both going each to the other side of the range meaning one becomes strong and the other weak.

[B]___________________________________________

[/B]

Later on this day I will provide the weekly review on my FxTaTrader Hybrid Grid strategy. Good luck to all of you in your trading the coming week.

Although the explanation may seem simple and clear there is always risk involved. I added a disclaimer to my blog for this purpose. If you like to use this article then mention the source by providing the URL www.FxTaTrader.com or the direct link to this article.