Tuesday (UTC+10) We can see that the AUD has weakened substatialy from yesterday and the JPY has strengthened against all other Majors as was correctly indicated 24 hours ago… Simple…

And our short from yesterday’s data, the CADJPY is now up 70+ points early in the Asian session… I’m not even going to include other positions opened with a strong JPY yesterday…

Now we have to choose the best opportunities from this weeks tumultuous market… And there is lots to choose from…

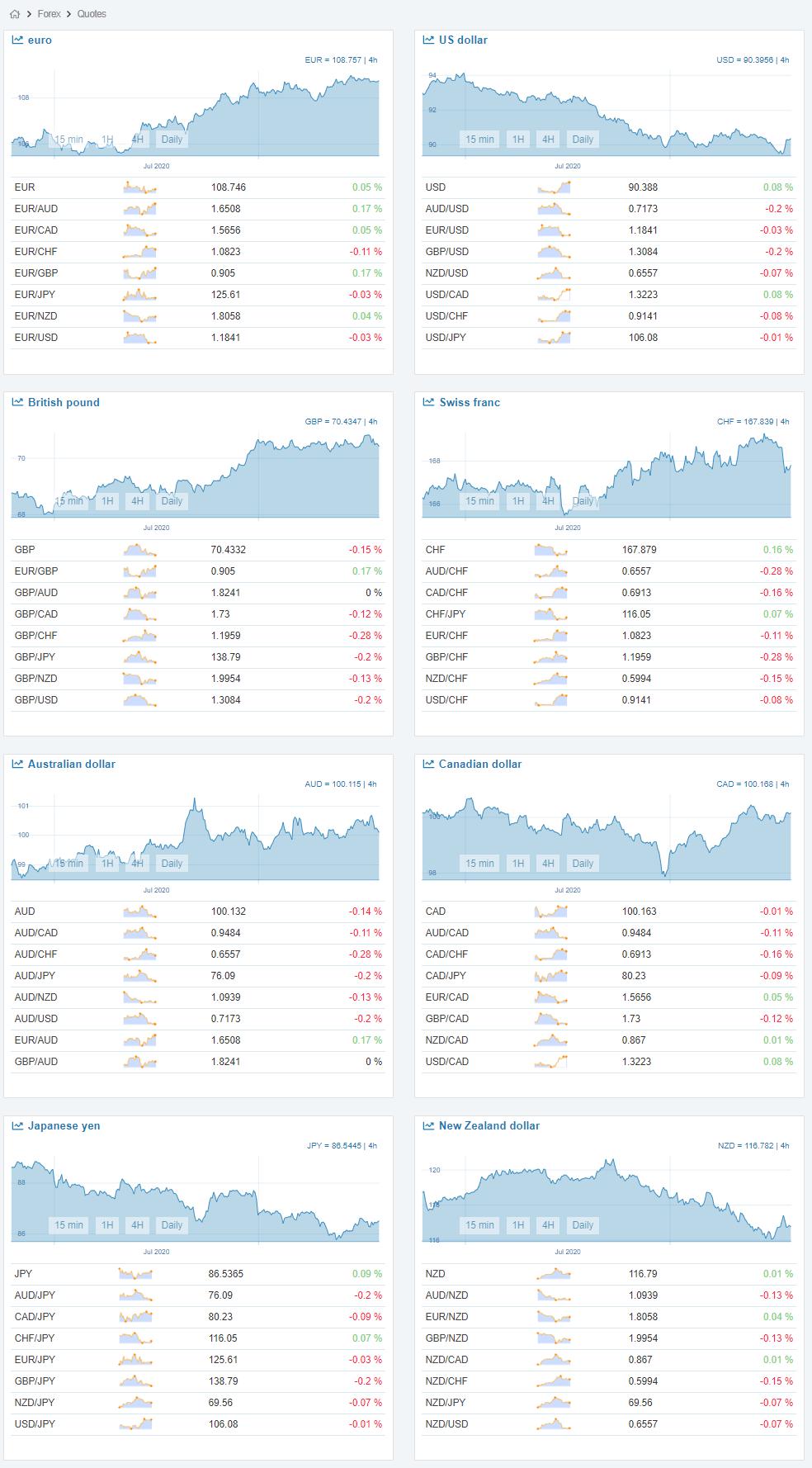

On appearance it looks as if he USD has shot up the rankings… wrong, in actual fact it is weaker than the 17th and 18th… ALL currencies have once again weakened against the Yen…

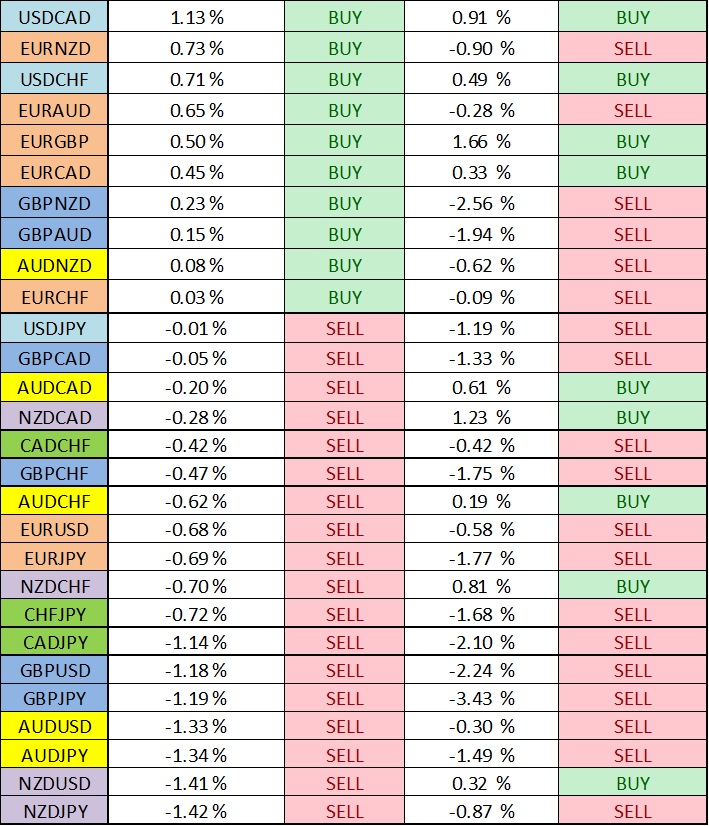

So we look for the weakest weak and the strongest weak. This is done by calculating the percentages within the Matrix… ie: CAD has weakened -1.27% since the 17th (3 periods) while the JPY (base) is still 0.00% confirming our short on the CADJPY is still in play 24 hours later… Let’s find another pair…

NZD has weakened 1.35% since 17th (3 Periods) and the CHF is 0.82% weaker over the same period.

This leaves a variance of only ~0.5% (I prefer 1%+ Variance) giving us another pair, other than all the JPY crosses, to keep an eye on.

NZDCHF is changing, AUD is weak, JPY Still Strong, confirmed on the CSW Meter… (4 Hour)

OTC market behavior has to be carefully considered when using the CSW strategy. It is generally what can cause the prefered pair (ie: Strongest/Weakest Pair) to reverse sharply from each end of the Matrix…

Once a sizable volume and momentum is obvious, the “market” will Sell into Long and Buy into Short sentiment. As happened yesterday with most of the JPY pairs… This is how the LP’s take liquidity out of the market and make their money… the Brokers are just along for the ride…

Summary: ALL JPY pairs remain shorting opportunities…

Edit: Is there a possible arbitrage opportunity between the Matrix and the CSW Meter???

Would you (or

Would you (or