lets c how much differs from dennis data. GOLD rocks

hi, how do get colorfull lines in currency in excel.

New Top Trade as GBP races to the top spot, EURUSD finishes the week with a new high before pulling back with what could be a reversal. Markets are moving, make sure you stay on the Strong side

can you add silver to this as Silver has been out performing gold for a few weeks now

@Dennis3450, I tested this a few weeks back (after @Makneel’s original post) to see if it has any real world trading significance…

While it can be used… It really has to be formulated with the quote currency (say USD, CHF, EUR) to give Metals, Gas, Oils etc. movement inside the matrix…

The other issue is unless your broker offers multiple Silver and Gold pairs ie: XAUEUR, XAUCHF, XAUAUD, XAUJPY etc. (fortunately my Broker does) It is of limited value when applied to a strategy.

The high percentage the high value of these pairs generate has to be addressed in some way as well, which is the reason these pairs need to be calculated against it’s quote currency.

@makneel, your concept is outside of the box thinking, fantastic to see…

Do not follow the crowds…

Hey @makneel, I have a graphics application that I cut and paste either Dennis’s matrix or my matrix into where I am able to overlay with notes, lines, formulas etc… I release completed months of Dennis’s data overlaid with the currencies “telltale tracks”… See Here…

Offers a proactive approach when applying Limit or Stop positions…hence my trading inside the graph…

Edit… GBPJPY should be next No.1 trade…

I posted in awhile ago but seems to be a lot of new users, if you want a chart version that shows this indicator graphically (and allows you to see at a glance when currencies are gaining or losing strength) I created one on TradingView. Just search for the indicator called Relative Strength v JPY or you can find it at https://www.tradingview.com/script/3LoiU6iP-Relative-Strength-v-JPY/.

You’ll need to open it on a 4H timeframe and expand out the indicator pane to see it.

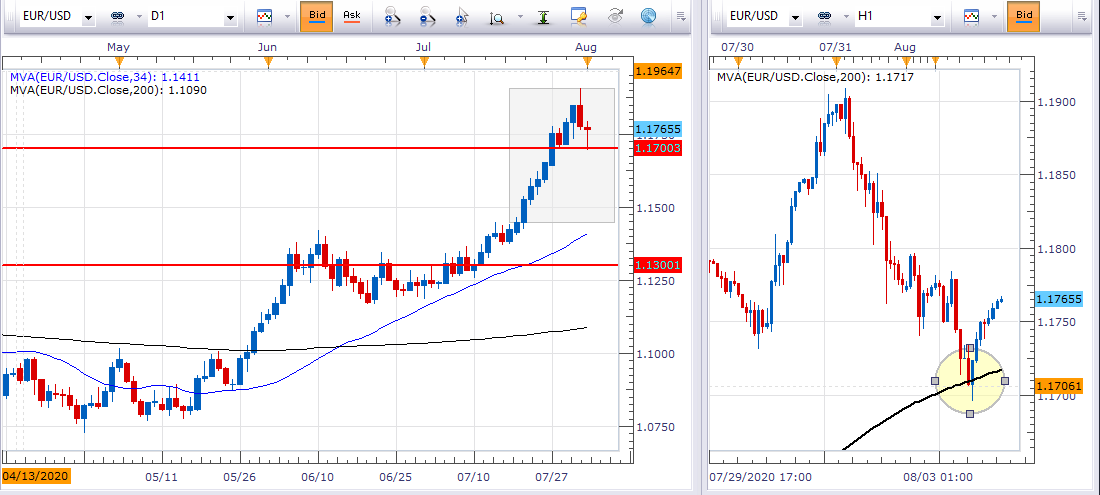

Top Trade EURUSD gives gave us a classic reentry at the 200 ma on the one hour chart, GBPUSD is looking like the EURUSD and should be moving higher after a pullback

Keeping my eye on EURUSD we had second testing of the 200 ma on the 1hr chart, now if we can get that 1hr close above 1.8000 I feel good about this going higher

GBPUSD is now positive after the pullback

a little more consolidation, GBP and EURO look ready to break higher

I hope you own some silver,

Instead of getting our breakout move we saw both Euro and Pound pullback against the dollar, My normal charting service is down for maintenance so I can’t update my rankings but these two charts below should tell the story.

Note; I will be traveling this weekend and into next week, my next update to this thread will be Wednesday

Safe travels

I am back, it does not look like a missed much as we consolidate

Here is where we stand compared to Friday, Top 3 and Bottom 3 have not changed