[B]Forex Technical & Market Analysis FXCC Jul 05 2013

EUR and GBP Crushed by ECB and BoE

Big moves are happening in the FX market yesterday. The euro and British pound dropped to 5 week lows against the U.S. dollar, taking out key levels in the process. The absence of U.S. traders most likely compounded the volatility in currencies. The European Central Bank and the Bank of England left monetary policy unchanged but Mario Draghi and Mark Carney made it clear that both central banks have a bias to ease. The dovish comments from European central bankers were motivated by the recent volatility in interest rates and a desire to set themselves apart from the Federal Reserve who is on a path to reduce stimulus. The ECB and the BoE wants everyone to know that they are still prepared to increase stimulus if the volatility in the bond markets persist or their economies weaken. In the Eurozone in particular, the EUR/USD dropped through 1.30 and 1.29. The currency started to fall as soon as Draghi said that policy will remains accommodative as long as needed, there are downside risks to their economic outlook and rates will stay low for an extended period of time. The sell-off gained momentum when the central bank took the unprecedented step of forward guidance. The ECB said there is no exit in sight, they are keeping rates low for an extended period of time, their decision will be data dependent and they are keeping an open mind on negative deposit rates. Draghi also reminded everyone that the central bank is “technically ready” for negative rates. They had an extensive discussion about the possibility of a rate cut and unanimously decided that the guidance was needed which included saying that 50bp is not the lower bound. The central bank is screaming their bias to ease from the top of the mountain - they don’t want to leave any room for ambiguity because the risk could be a further rise in yields. Having dropped below 1.29, the next support for the EUR/USD should be at 1.28.

https://support.fxcc.com/email/technical/05072013/

FOREX ECONOMIC CALENDAR :

2013-07-05 10:00 GMT | Germany. Factory Orders n.s.a. (YoY)

2013-07-05 12:30 GMT | Canada. Unemployment Rate

2013-07-05 12:30 GMT | USA. Nonfarm Payrolls

2013-07-05 12:30 GMT | USA. Unemployment Rate

FOREX NEWS :

2013-07-05 04:51 GMT | EUR/GBP limited below 0.8580 asks

2013-07-05 04:46 GMT | NFP amid low liquidity; drastic moves ahead?

2013-07-05 04:22 GMT | GBP/USD hovering around 1.5050

2013-07-05 03:39 GMT | AUD/USD extends decline below 0.9130

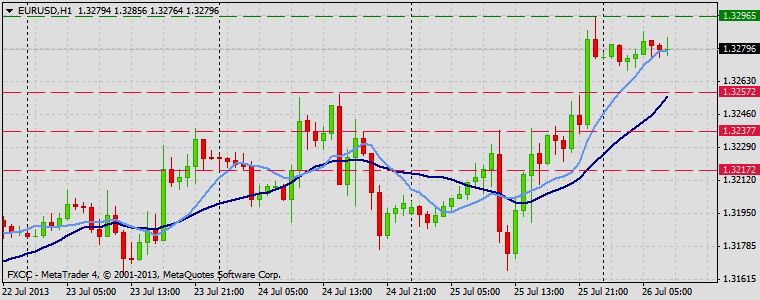

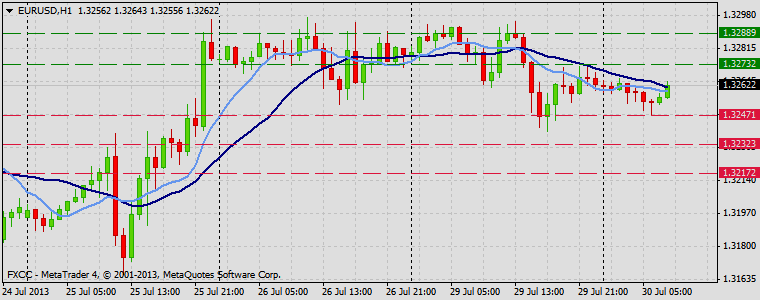

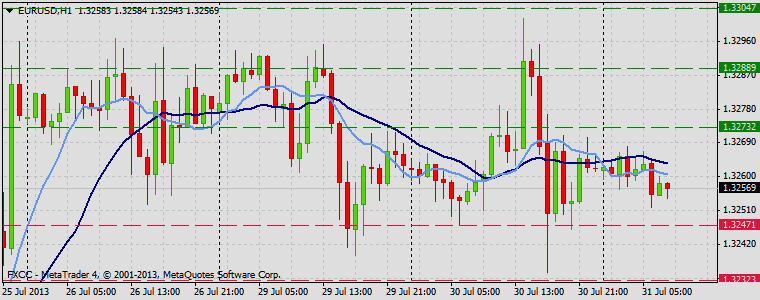

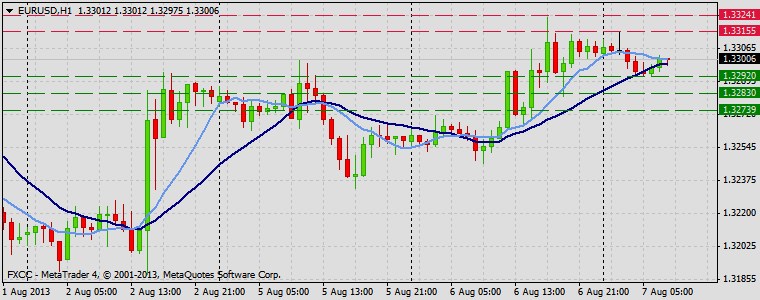

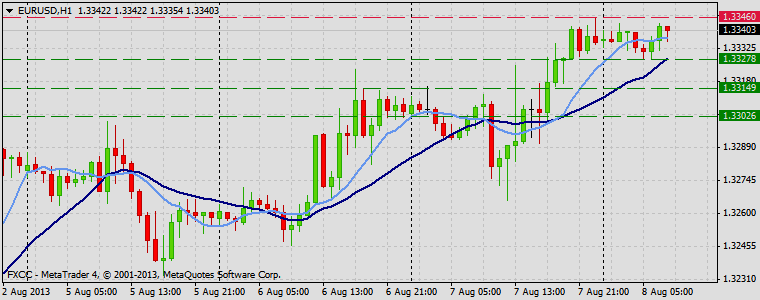

EURUSD

HIGH 1.29166 LOW 1.28878 BID 1.28983 ASK 1.28988 CHANGE -0.12% TIME 08 : 24:40

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: The possibility of an upside price progress is seen above the resistance level at 1.2931 (R1). Evaluation above this mark might initiate bullish pressure and expose medium-term interim targets at 1.2952 (R2) and 1.2974 (R3). Downwards scenario: We placed our support level right above the yesterday low at 1.2881 (S1). Clearance here is required to open way towards to our interim target at 1.2862 (S2) and then final aim locates at 1.2842 (S3).

Resistance Levels: 1.2931, 1.2952, 1.2974

Support Levels: 1.2881, 1.2862, 1.2842

GBPUSD :

HIGH 1.50777 LOW 1.50268 BID 1.50465 ASK 1.50478 CHANGE -0.16% TIME 08 : 24:41

OUTLOOK SUMMARY : Down

TREND CONDITION : Down trend

TRADERS SENTIMENT : Bearish

IMPLIED VOLATILITY : High

Upwards scenario: Nonfarm Payrolls announcement might change overall technical structure. We see potential to overcome our next resistive barrier at 1.5090 (R1). Any prolonged movement above it would suggest next intraday targets at 1.5120 (R2) and 1.5151 (R3). Downwards scenario: Risk of price depreciation is seen below the support level at 1.5024 (S1). A fall below it might prolong medium-term weakness towards to next support at 1.4992 (S2) and any further market decline would then be targeting final support at 1.4959 (S3).

Resistance Levels: 1.5090, 1.5120, 1.5151

Support Levels: 1.5024, 1.4992, 1.4959

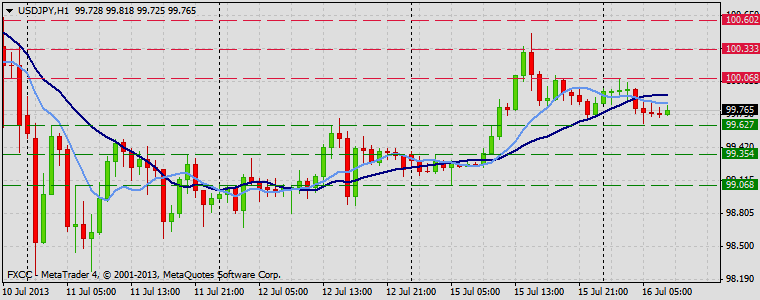

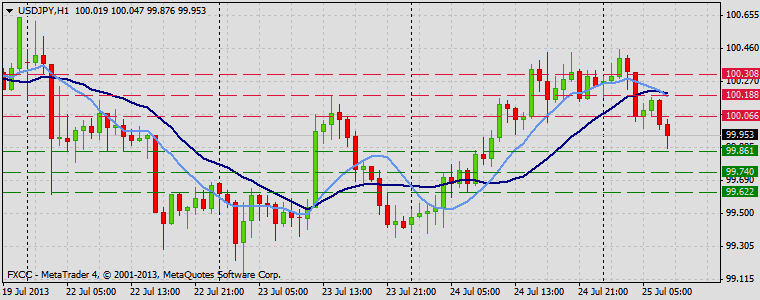

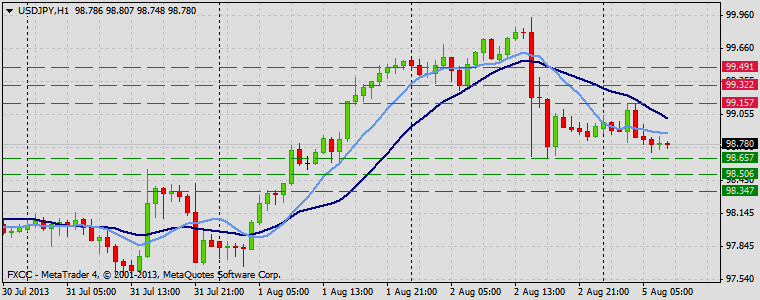

USDJPY :

HIGH 100.458 LOW 99.999 BID 100.257 ASK 100.261 CHANGE 0.22% TIME 08 : 24:42

OUTLOOK SUMMARY : Up

TREND CONDITION : Upward penetration

TRADERS SENTIMENT : Bullish

IMPLIED VOLATILITY : Medium

Upwards scenario: Neutral tone dominates on the hourly chart frame. Local high offers an important resistive structure at 100.45 (R1). Any penetration above that level would suggest next targets at 100.68 (R2) and 100.90 (R3). Downwards scenario: Possible downside expansion is limited to the next support level at 100.15 (S1). Break here is required to open way towards to initial targets at 99.92 (S2) and 99.70 (S3).

Resistance Levels: 100.45, 100.68, 100.90

Support Levels: 100.15, 99.92, 99.70

Source: FX Central Clearing Ltd,( http://www.fxcc.com )[/B]