[B]Forex Technical & Market Analysis FXCC Jun 04 2013

Fitch cuts Cyprus to B-, negative outlook

Fitch Ratings has downgraded Cyprus’s long-term foreign currency issuer default rating by one notch to ‘B-’ from ‘B’ while keeping a negative outlook due to the country’s elevated economic uncertainty. The rating agency had placed Cyprus on negative watch in March. With this decision, Fitch pushed Cyprus further into junk territory, now 6 notches. “Cyprus has no flexibility to deal with domestic or external shocks and there is a high risk of the (EU/IMF) program going off track, with financing buffers potentially insufficient to absorb material fiscal and economic slippage,” Fitch said in a statement.

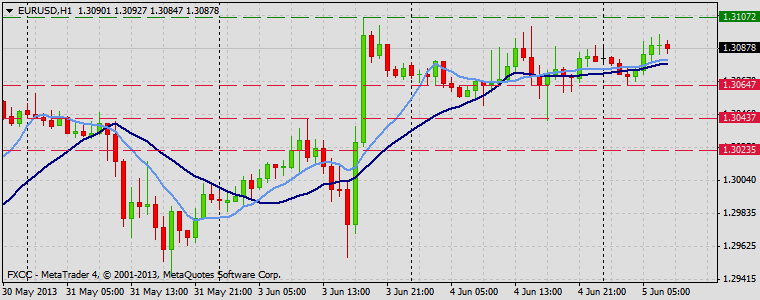

The EUR/USD finished the day sharply higher, at one point trading all the way up to 1.3107 before leaking lower later in the day to close up 76 pips at 1.3070. Some analysts were pointing towards weaker than expected ISM data from the US as the main catalyst for the bullish move in the pair. Economic data out of the US will slow down a bit the next few days, but volatility is certain to pick up as we approach the ECB Rate Decision on Thursday, as well as the Non-Farm Payrolls number due out of the US on Friday.

https://support.fxcc.com/email/technical/04062013/

FOREX ECONOMIC CALENDAR :

2013-06-04 08:30 GMT | UK. PMI Construction (May)

2013-06-04 09:00 GMT | EMU. Producer Price Index (YoY) (Apr)

2013-06-04 12:30 GMT | USA. Trade Balance (Apr)

2013-06-04 23:30 GMT | Australia. AiG Performance of Services Index (May)

FOREX NEWS :

2013-06-04 04:30 GMT | RBA Interest Rate Decision stays unchanged at 2.75%

2013-06-04 03:20 GMT | Will economic data later in week free EUR/USD from range bound behavior?

2013-06-04 02:13 GMT | EUR/AUD finds some ground in the 1.34 round area

2013-06-04 02:00 GMT | AUD/JPY advances capped below 97.50

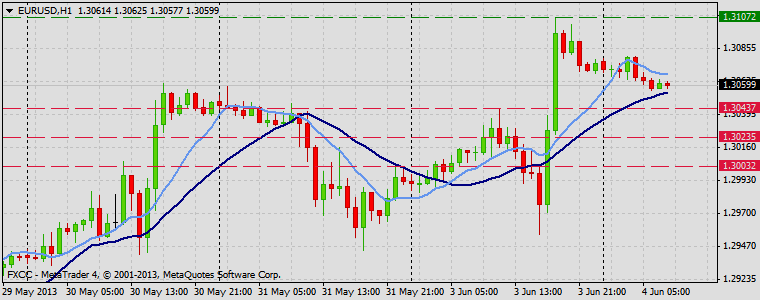

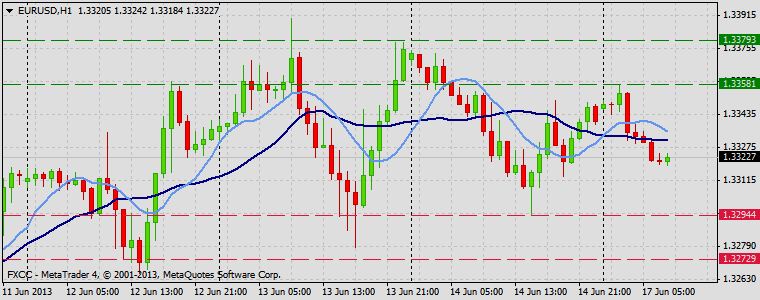

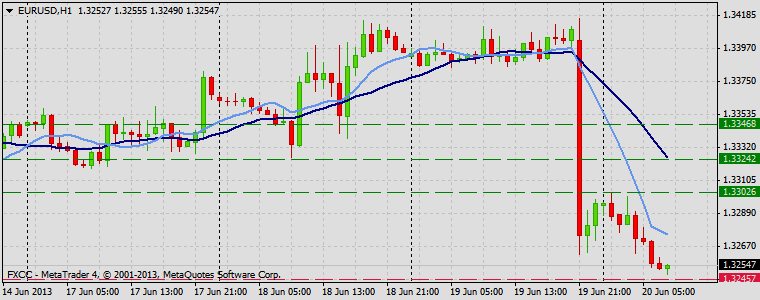

EURUSD :

HIGH 1.30804 LOW 1.30566 BID 1.30572 ASK 1.30575 CHANGE -0.14% TIME 08 : 22:51

OUTLOOK SUMMARY Up

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY Medium

MARKET ANALYSIS - Intraday Analysis

Upwards scenario: While price is quoted above the 20 SMA, our technical outlook would be positive. Yesterday high offers next resistance level at 1.3107 (R1). Any price action above it would suggest next targets at 1.3127 (R2) and 1.3147(S3). Downwards scenario: On the other hand, price pattern suggests bearish potential if the instrument manages to overcome next support level at 1.3043 (S1). Possible price regress could expose our initial targets at 1.3023 (S2) and 1.3003 (S3) in potential.

Resistance Levels: 1.3107, 1.3127, 1.3147

Support Levels: 1.3043, 1.3023, 1.3003

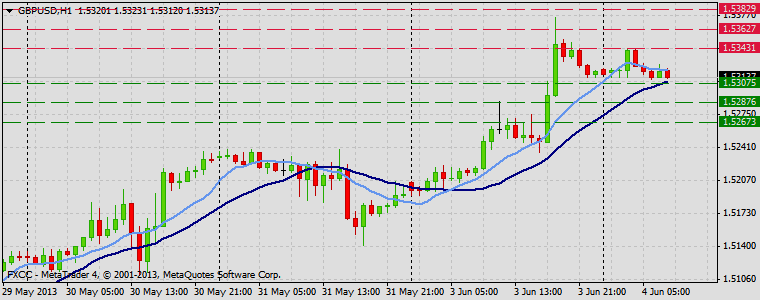

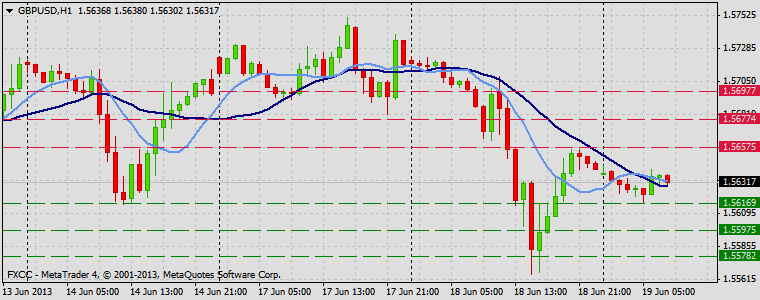

GBPUSD :

HIGH 1.53427 LOW 1.53101 BID 1.53115 ASK 1.53119 CHANGE -0.05% TIME 08 : 22:52

OUTLOOK SUMMARY Up

TREND CONDITION Up trend

TRADERS SENTIMENT Bearish

IMPLIED VOLATILITY Medium

Upwards scenario: Next barrier on the upside lie at 1.5343 (R1). Surpassing of this level might enable our initial target at 1.5362 (R2) and any further gains would then be limited to last resistive structure at 1.5382 (R3). Downwards scenario: On the downside our attention is shifted to the immediate support level at 1.5307 (S1). Break here is required to enable bearish forces and expose our intraday targets at 1.5287 (S2) and 1.5267 (S3).

Resistance Levels: 1.5343, 1.5362, 1.5382

Support Levels: 1.5307, 1.5287, 1.5267

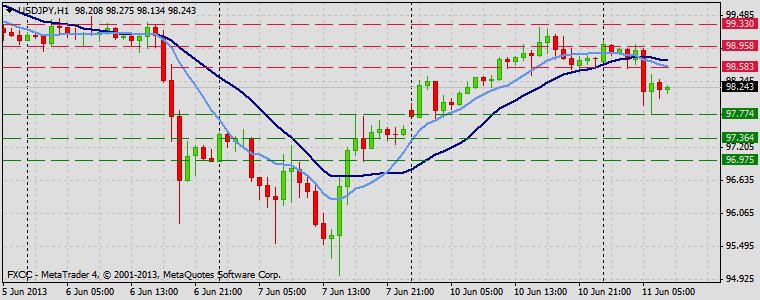

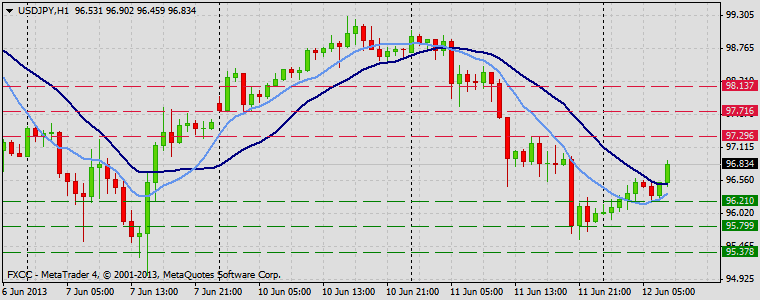

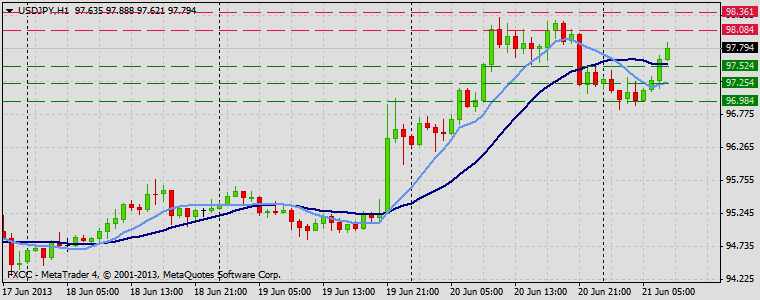

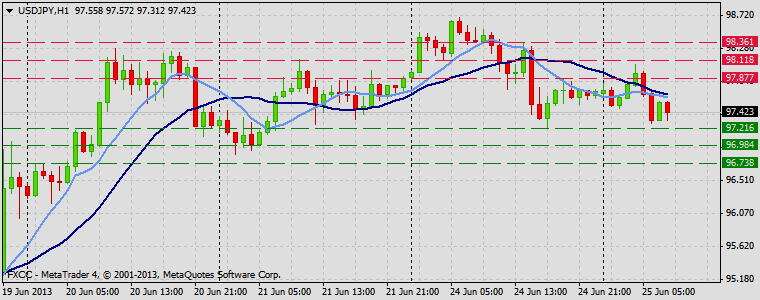

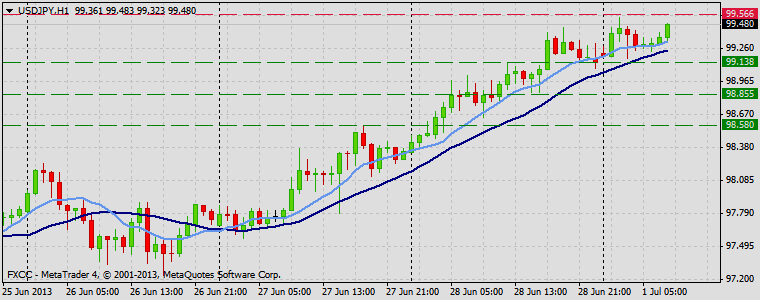

USDJPY :

HIGH 99.88 LOW 99.333 BID 99.838 ASK 99.839 CHANGE 0.31% TIME 08 : 22:52

OUTLOOK SUMMARY Down

TREND CONDITION Upward penetration

TRADERS SENTIMENT Bullish

IMPLIED VOLATILITY Medium

Upwards scenario: Possible bullish penetration might face next challenge at 100.02 (R1). Break here is required to establish retracement action, targeting 100.32 (R2) en route towards to last resistance for today at 100.65 (R3). Downwards scenario: Penetration below the support at 99.31 (S1) is liable to put more downward pressure on the instrument in the near-term perspective. As a result our supportive means at 99.04 (S2) and 98.75 (S3) might be triggered.

Resistance Levels: 100.02, 100.32, 100.65

Support Levels: 99.31, 99.04, 98.75

Source: FX Central Clearing Ltd,( Forex Training | Best Automatic Forex Trading Platforms | FXCC )[/B]