![]() XAUUSD (Gold) Daily Technical Analysis – July 16, 2025

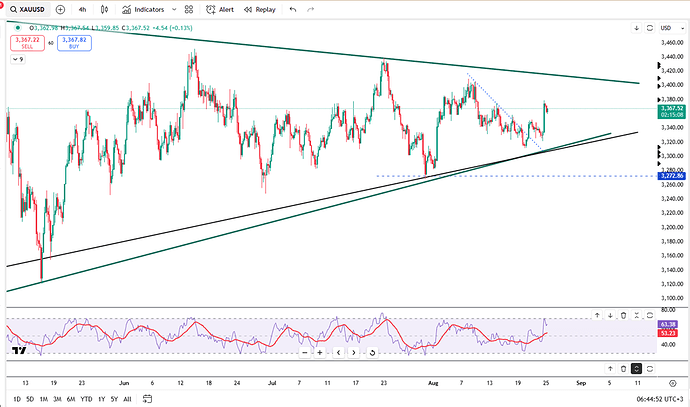

XAUUSD (Gold) Daily Technical Analysis – July 16, 2025

Timeframe: M30

Current Price: 3339.66

Bias: Neutral-to-Bearish

Key Focus: Breakout or Rejection at Resistance Zone

![]() Market Overview:

Market Overview:

Gold (XAUUSD) is currently trading around 3339 after a volatile session over the last few days. Price has formed a double-top structure near 3368 and rejected sharply, indicating seller dominance around that level. A series of lower highs is also visible on the M30 chart, suggesting weakening bullish momentum.

![]() Technical Levels to Watch:

Technical Levels to Watch:

Major Resistance Zone: 3358 – 3368

Minor Resistance: 3348

Current Zone: 3339

Immediate Support: 3325

Strong Support Zone: 3305 – 3310

![]() Trade Setup Ideas for Today:

Trade Setup Ideas for Today:

![]() Sell Setup:

Sell Setup:

Sell Limit: 3348 – 3355

Target 1: 3325

Target 2: 3308

Stop Loss: 3365

Reason: Price is retesting the previous supply zone. A bearish engulfing or pin bar in this area will confirm seller strength. Use confirmation candlestick patterns on M15-M30 before entering.

![]() Buy Setup (Only if breakout happens):

Buy Setup (Only if breakout happens):

Buy Stop: Above 3368 (after 15min candle close)

Target 1: 3382

Target 2: 3395

Stop Loss: 3350

Reason: Clean breakout and retest of 3368 level can invite bulls again. Volume and momentum must support the breakout.

![]() Summary:

Summary:

We are currently at a decision zone. Market is likely to reject from 3348–3355 for a short-term sell opportunity unless we see a strong breakout above 3368. Watch price action closely in that area.

![]() Trading Tip of the Day:

Trading Tip of the Day:

“Don’t chase the trade, let the trade come to your level.” – Wait for confirmation before entry. Follow proper risk management.