Euro and Pound Lose Support Amid Strong US Data and Inflation Expectations

European currencies remain under pressure: EUR/USD and GBP/USD continue their decline, reflecting the strengthening influence of the US dollar. Last week, US inflation data exceeded forecasts: the Producer Price Index (PPI) and University of Michigan inflation expectations both rose, signalling persistent price pressures in the economy. This factor reinforced the dollar’s position and increased expectations that the Federal Reserve will adopt a more cautious stance on monetary easing.

Additional support for the dollar came from labour market data, which confirmed employment resilience. Together, these developments limit the scope for aggressive rate cuts. Against this backdrop, the euro and pound remain vulnerable ahead of their own inflation releases in the coming trading sessions.

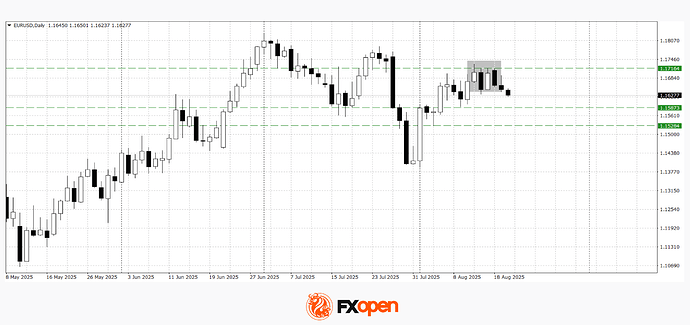

EUR/USD

The inability of EUR/USD buyers to hold above 1.1720 has led to the formation of a tower top reversal pattern on the daily chart. Technical analysis suggests the possibility of a deeper downward correction if the price consolidates below 1.1580. A break of this bearish scenario could occur following a firm move above 1.1720.

TO VIEW THE FULL ANALYSIS, VISIT FXOPEN BLOG

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.