US may avoid recession whereas Europe may plunge deeper

Just before the weekend began, reports from the United States showed that there is finally some light at the end of what has been a very long tunnel as inflation began to decrease.

On Friday, figures were released showing that consumer price increases eased to 7.7% in October which, although still high compared to the levels most consumers in North America have been used to over recent years, is a definite step in the right direction after inflation headed over the double figures mark a few months ago.

In Europe, however, things are not showing any signs of change. In the United Kingdom it remains just under 10%, and in the Eurozone its 10.7%.

Whereas the majority of the Eurozone and Britain were locked down periodically for over a year and a half, some parts of the United States remained free of any such draconian rules and had managed to maintain productivity. Some of those areas were the states of Florida and Texas, which are both highly urbanized states with large industrial capacity.

This is certainly one factor, as by comparison the Eurozone and United Kingdom had their entire economies postponed for a sustained period of time and are now in fiscal dire straits with that as a major contributing factor.

This morning, analysts at Morgan Stanley reinforced this dynamic, stating that Britain and the euro zone economies are likely to tip into recession next year, whereas by contrast the United States may avoid a recession thanks to a resilient job market.

Morgan Stanley’s analysis of this situation also focused on the Federal Reserve’s interest rate policy, and the investment bank considers that the Federal Reserve is likely to keep the interest rates at a high level during 2023 as although inflation has decreased in October, 7.7% is still high enough to warrant maintaining high interest rates.

According to a report by Reuters today, Morgan Stanley predicts a sharp split between developed economies in 2023 which are “in or near recession” while emerging economies “recover modestly” but said an overall global pickup would likely remain elusive. China’s economy was predicted to grow 5% in 2023, outpacing the average 3.7% growth expected for emerging markets, while the average growth in the Group of 10 developed countries was forecast at just 0.3%.

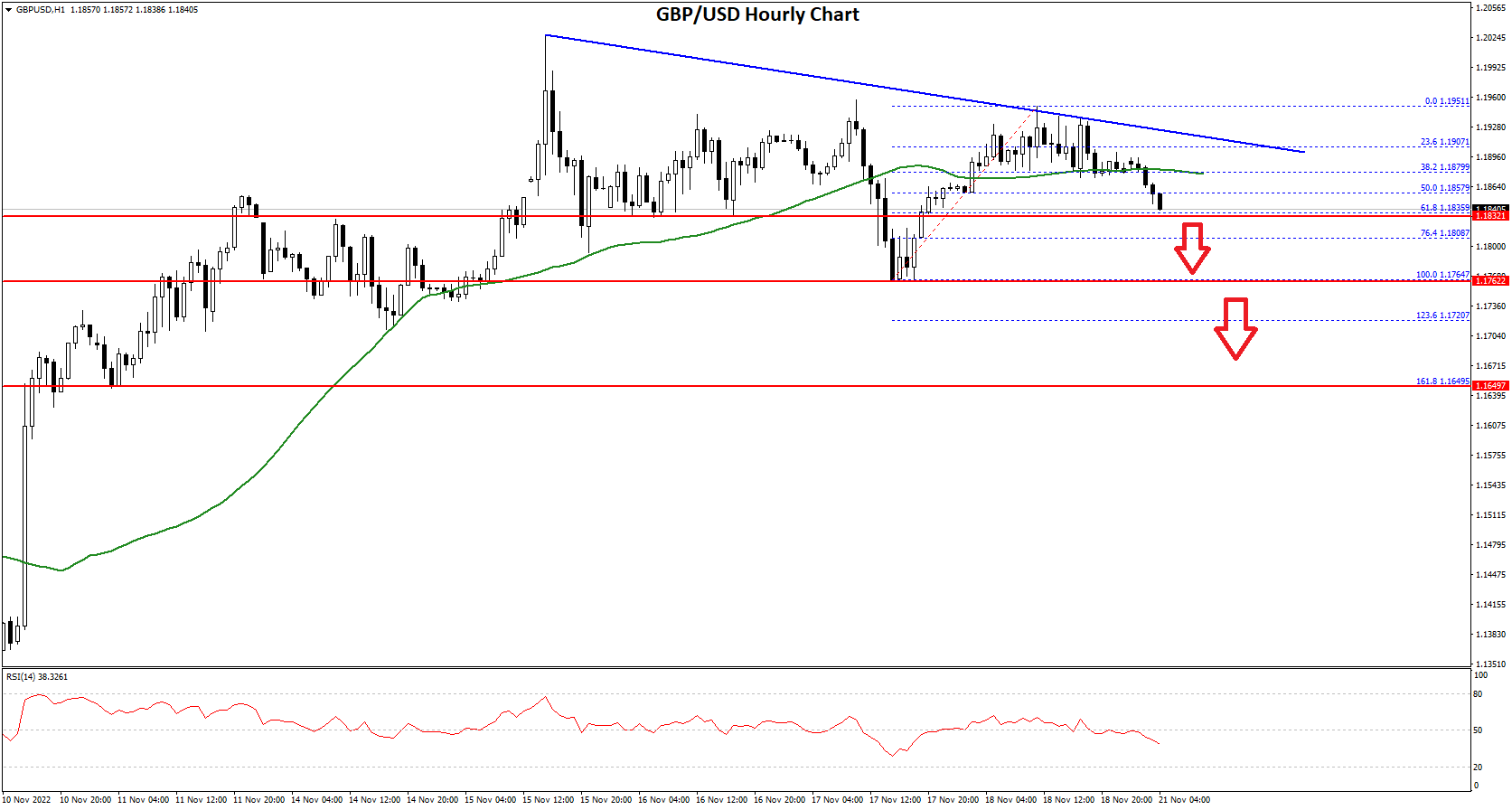

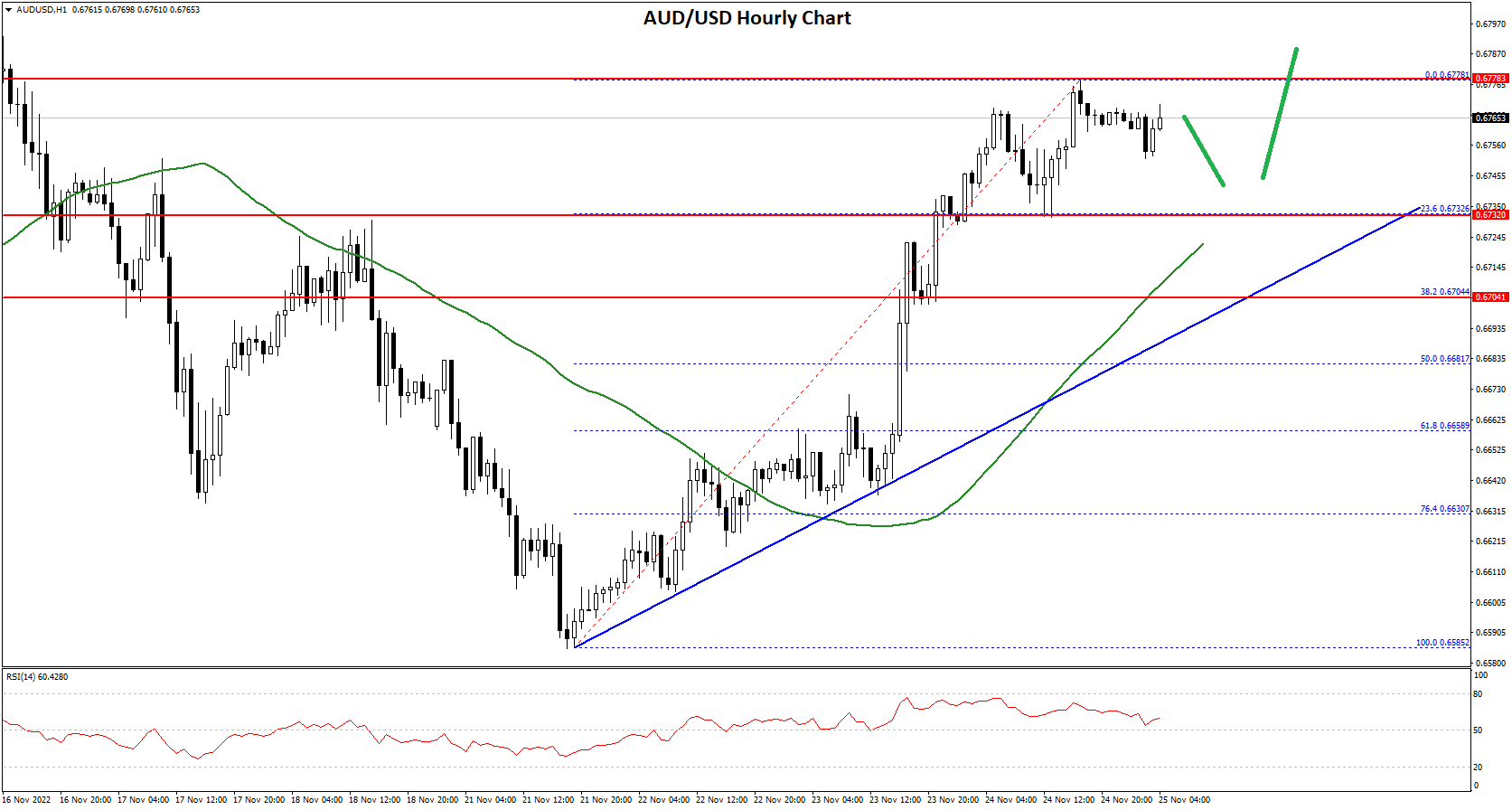

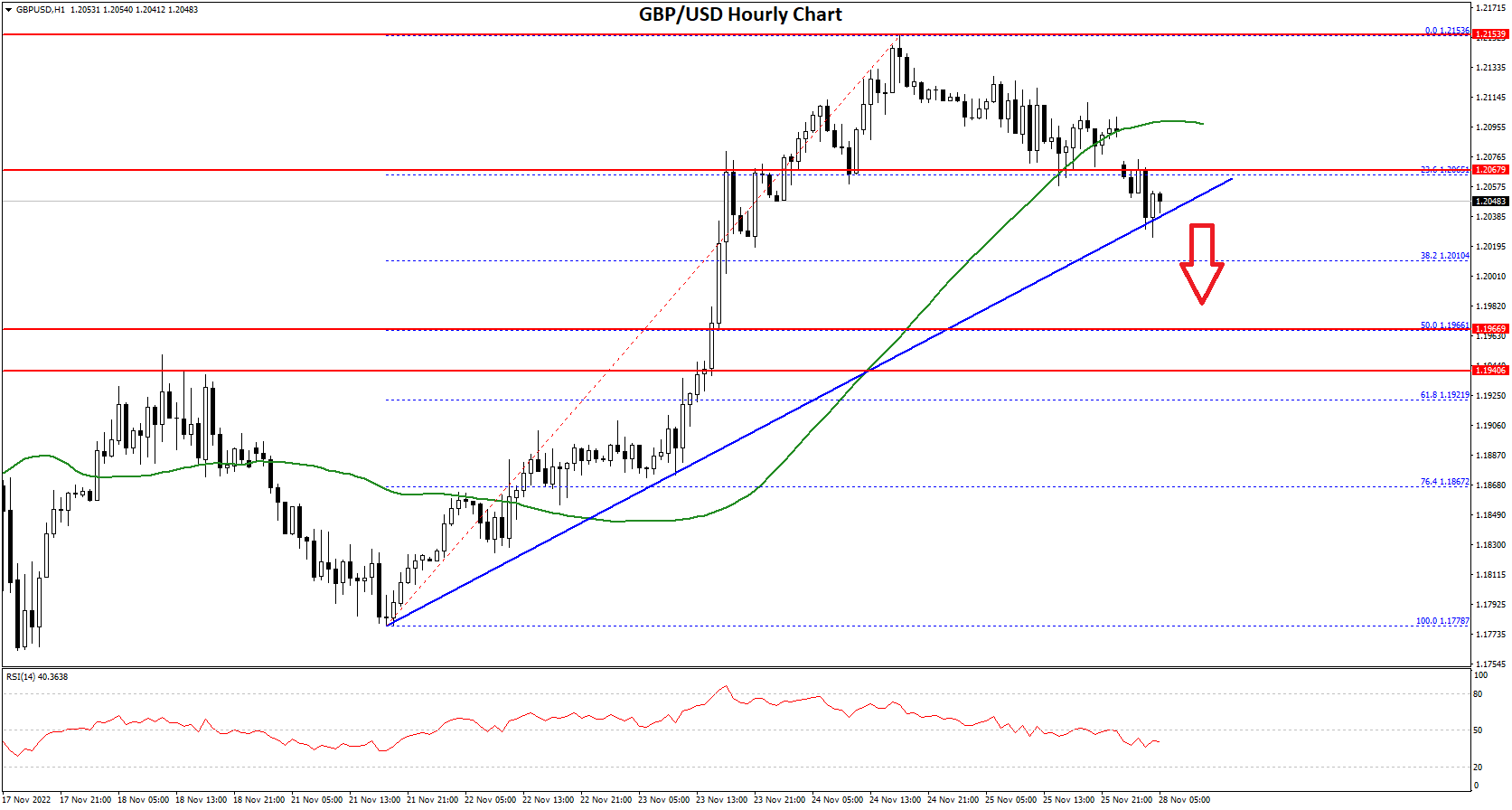

The value of the British Pound against the US Dollar has performed accordingly, as the Pound dropped in value this morning on the opening of the London trading session, after a substantial rise in value over the weekend, marking a steady move away from several weeks of plummeting Pound values.

VIEW FULL ANALYSIS VISIT - FXOpen Blog…

Disclaimer: CFDs are complex instruments and come with a high risk of losing your money.