Amazon (AMZN) shares fall around 3% in a single day

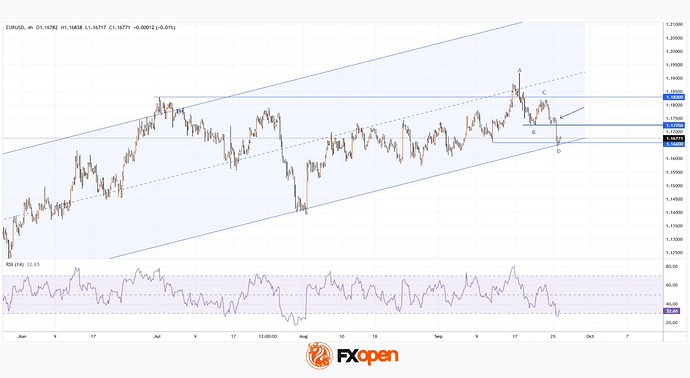

As the chart shows, Amazon (AMZN) shares fell by roughly 3% yesterday after reports that the US Federal Trade Commission has launched a probe into the company over alleged “dark patterns”.

According to the allegations, Amazon may have deliberately complicated the process of cancelling Prime subscriptions in order to retain customers. Should the charges be proven, this could result in significant fines and have a major impact on one of Amazon’s key revenue streams.

Amazon’s share price dipped below $220 yesterday for the first time since 12 August. Could the decline continue?

TO VIEW THE FULL ANALYSIS, VISIT FXOPEN BLOG

Disclaimer: This article represents the opinion of the Companies operating under the FXOpen brand only (excluding FXOpen EU). It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.