Gold Price Consolidates Losses, Crude Oil Price Could Correct Gains

Gold price started a fresh decline below the $1,785 support zone. Crude oil price struggling near $78 and might correct gains in the near term.

Important Takeaways for Gold and Oil

· Gold price faced resistance near $1,825 and corrected lower against the US Dollar.

· There was a break below a key bullish trend line with support near $1,798 on the hourly chart of gold.

· Crude oil price gained bullish momentum above the $72.00 resistance zone.

· There is a major bullish trend line forming with support near $76.10 on the hourly chart of XTI/USD.

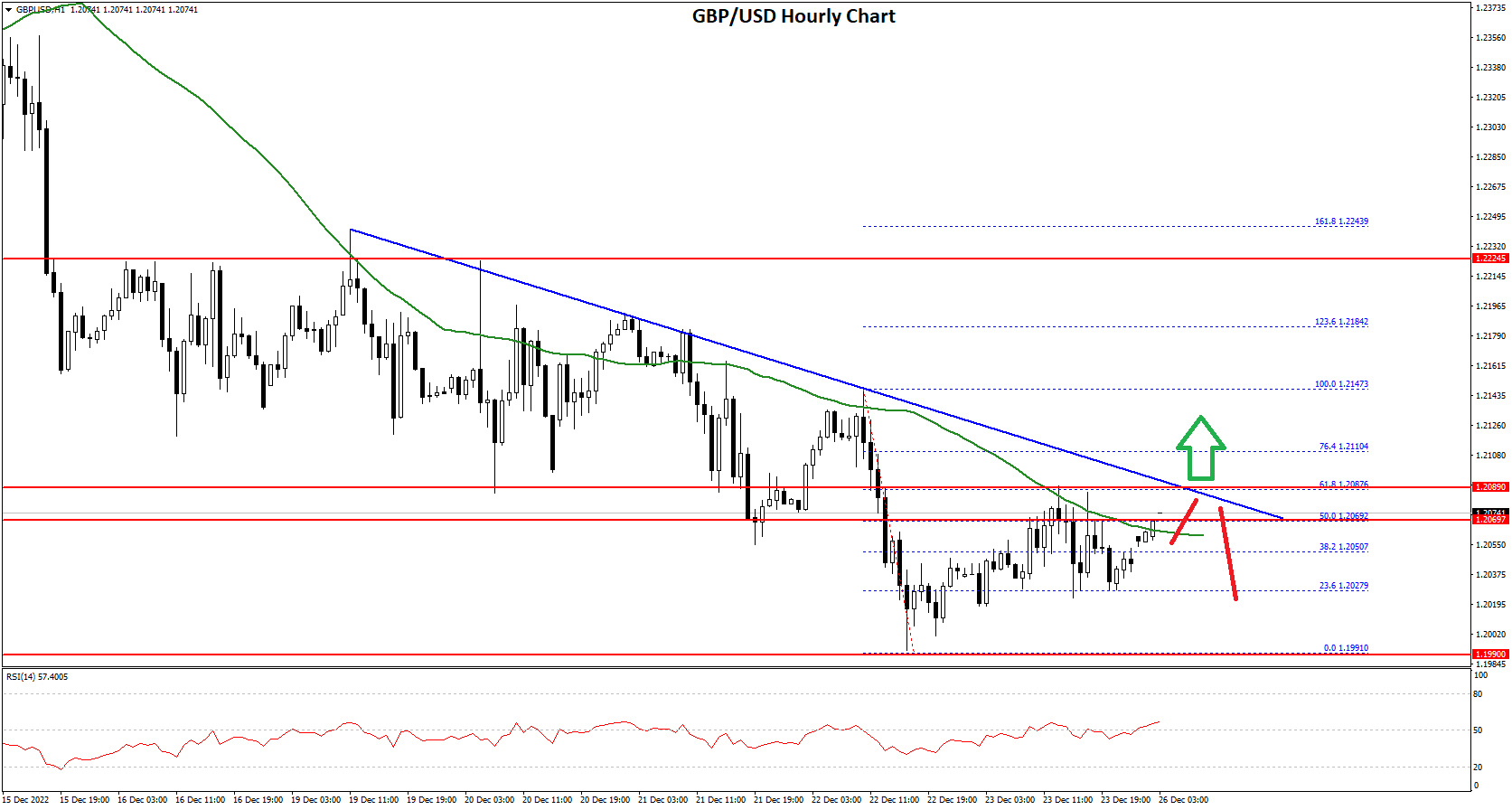

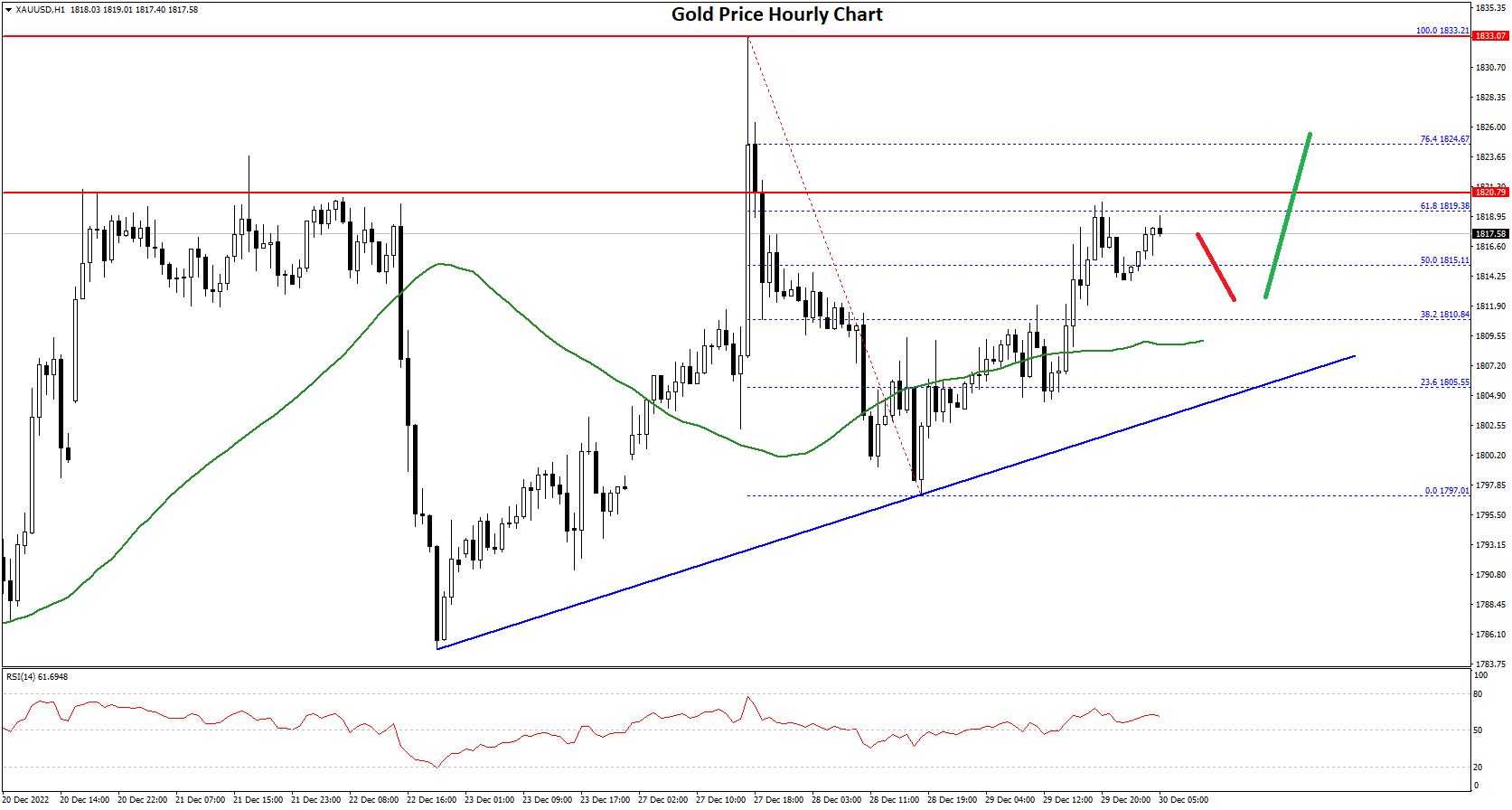

Gold Price Technical Analysis

Gold price traded high above the $1,810 resistance zone against the US Dollar. The price even cleared the $1,820 level, but the bears were active near the $1,825 zone.

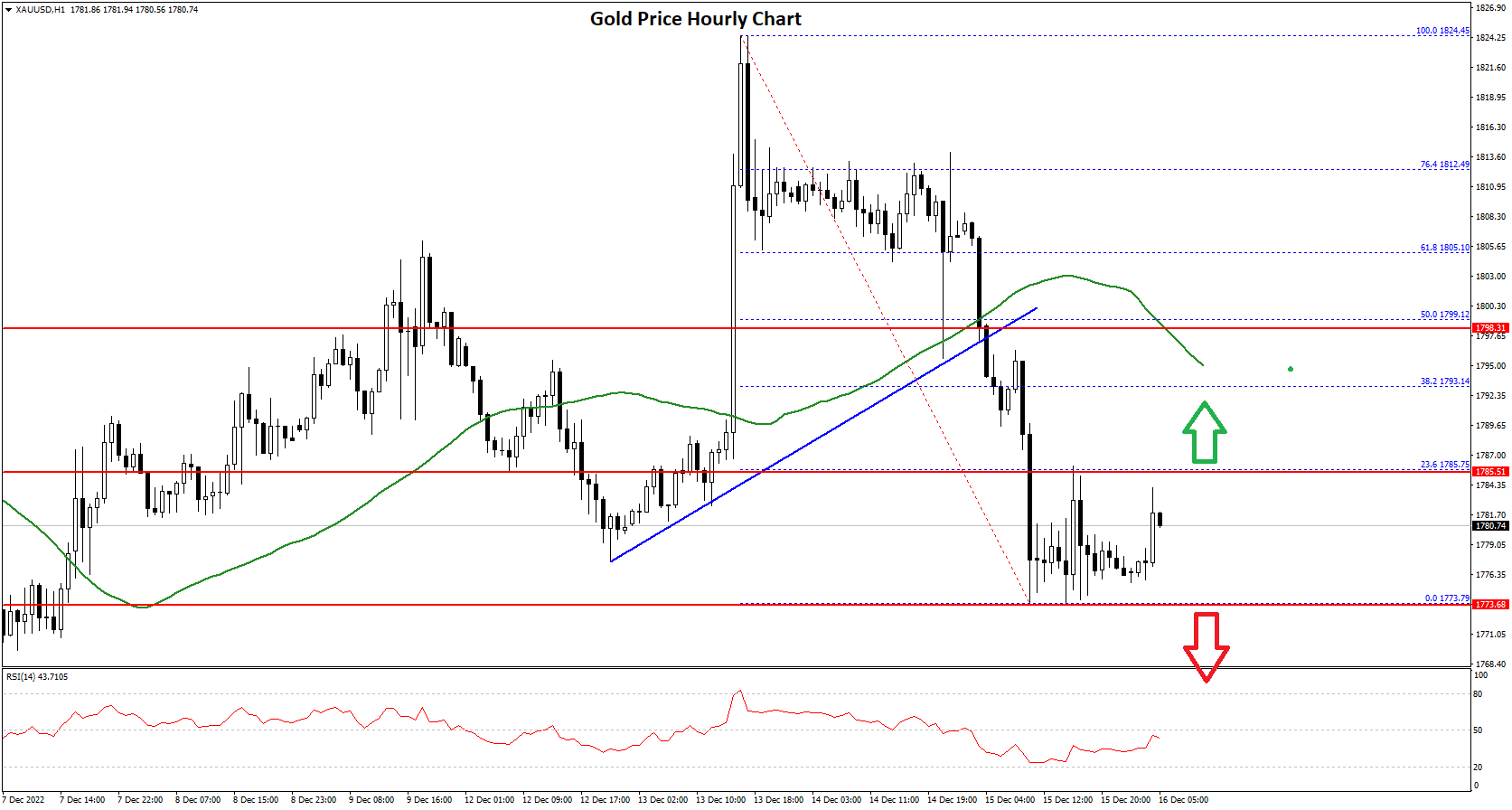

A high was formed near $1,824 and the price started a fresh decline. There was a clear move below the $1,810 and $1,800 support levels. Besides, there was a break below a key bullish trend line with support near $1,798 on the hourly chart of gold.

Gold Price Hourly Chart

The price settled below the $1,785 level and the 50 hourly simple moving average. It traded as low as $1,773 on FXOpen and is currently consolidating losses. On the upside, the first major resistance is near the $1,785 level.

The 23.6% Fib retracement level of the downward move from the $1,824 swing high to $1,773 swing low is also near the $1,785 level. The main resistance is now forming near the $1,800 level and the 50 hourly simple moving average.

The 50% Fib retracement level of the downward move from the $1,824 swing high to $1,773 swing low is also near the $1,800 level, above which it could even test $1,820. A clear upside break above the $1,820 resistance could send the price towards $1,840.

An immediate support on the downside is near the $1,772 level. The next major support is near the $1,760 level, below which there is a risk of a larger decline. In the stated case, the price could decline sharply towards the $1,750 support zone.

VIEW FULL ANALYSIS VISIT - FXOpen Blog…

Disclaimer: This forecast represents FXOpen Companies opinion only, it should not be construed as an offer, invitation or recommendation in respect to FXOpen Companies products and services or as financial advice.