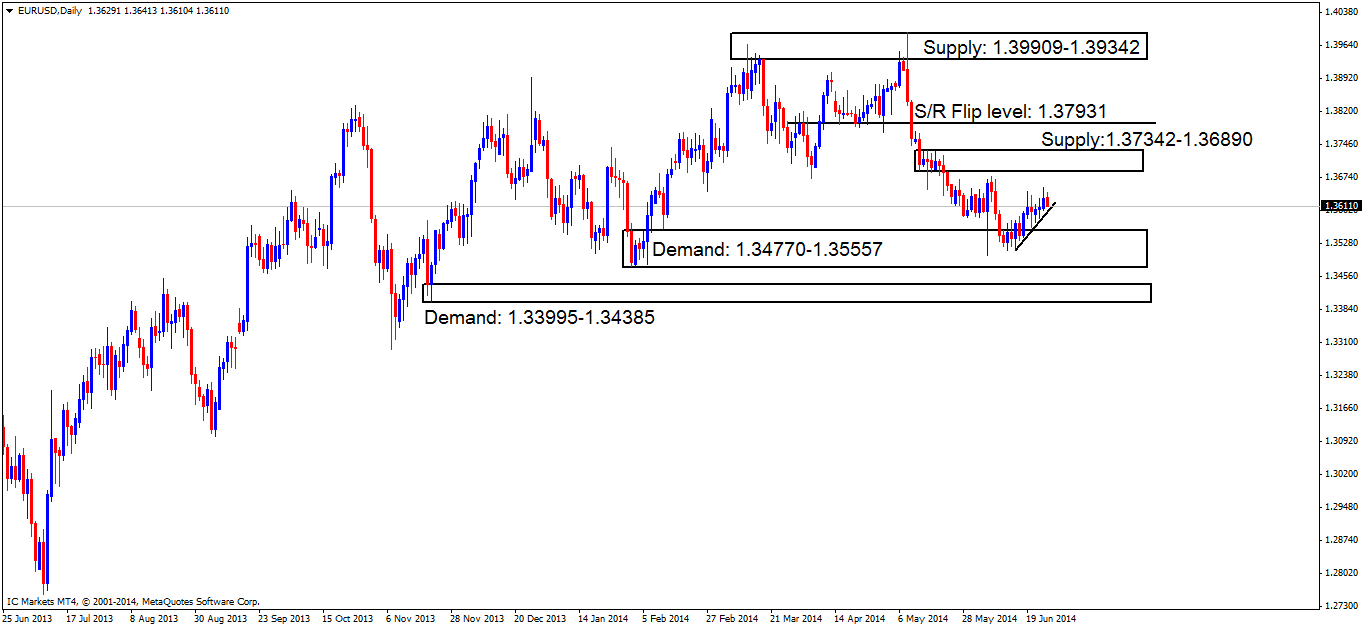

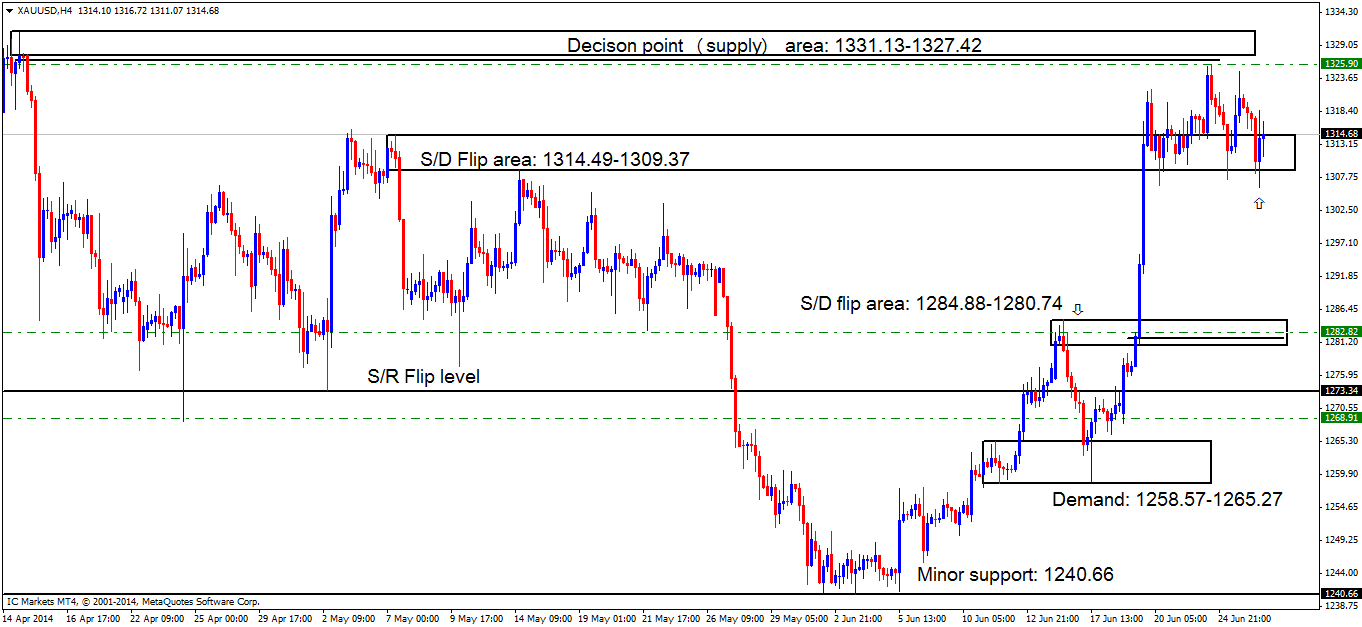

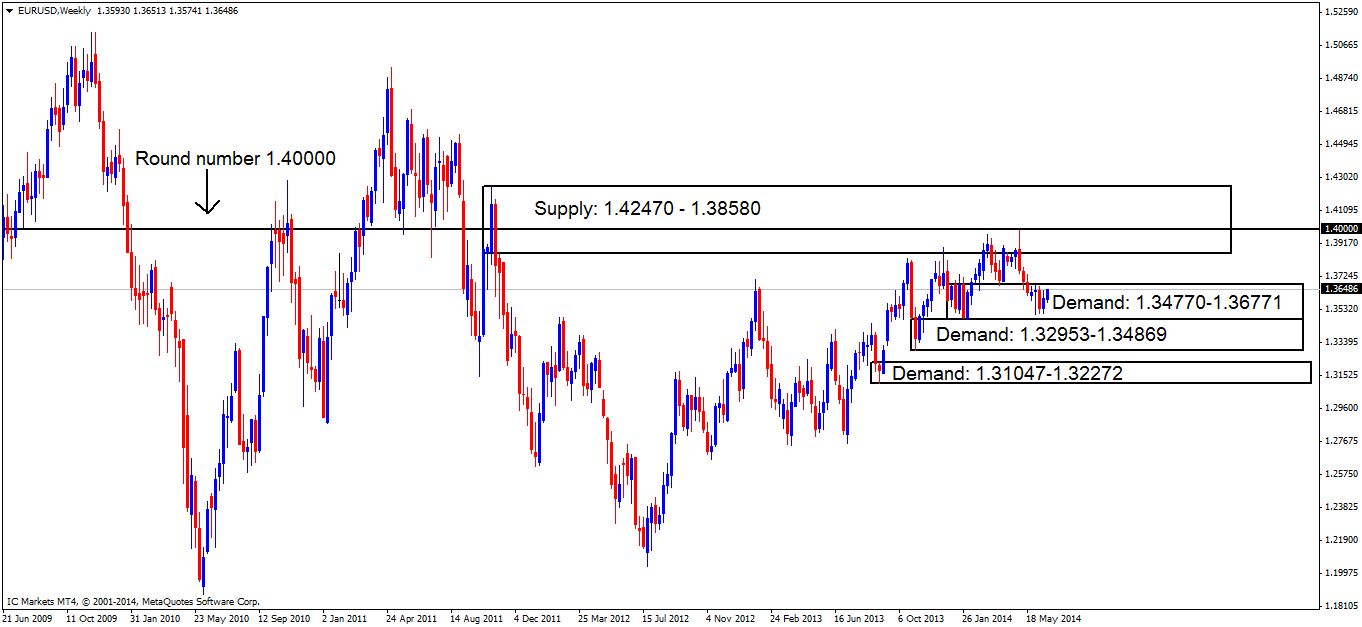

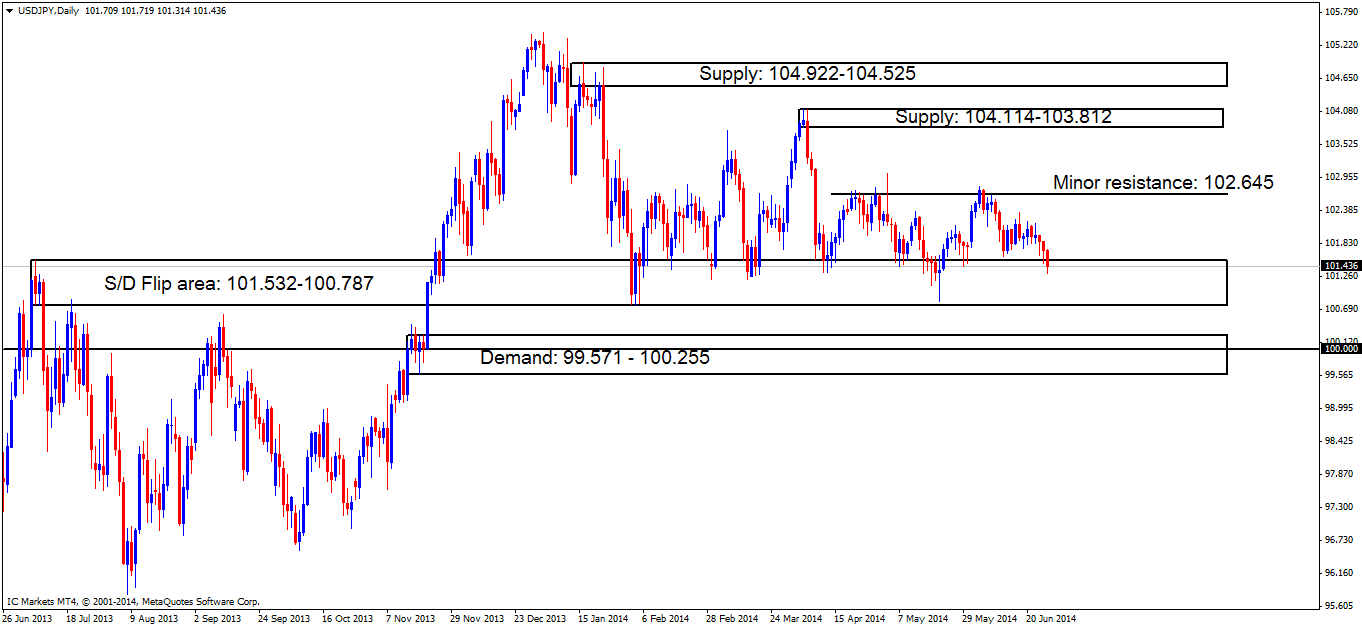

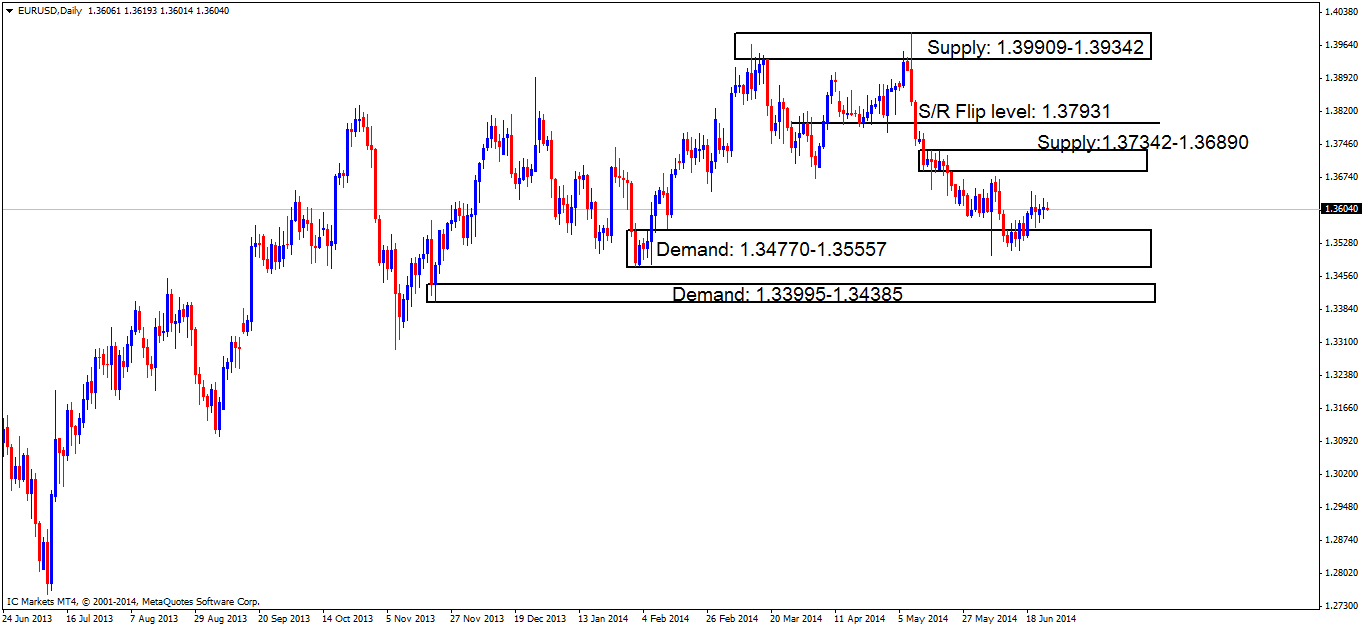

EUR/USD:

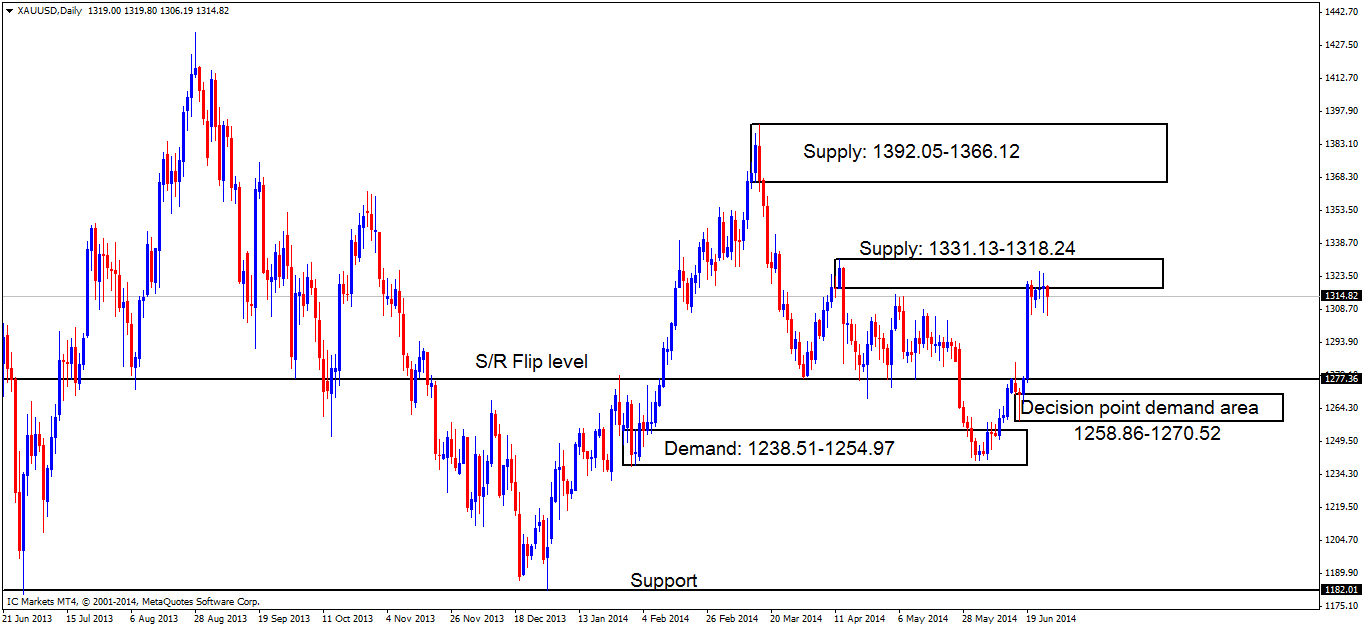

[B]Daily TF.[/B]

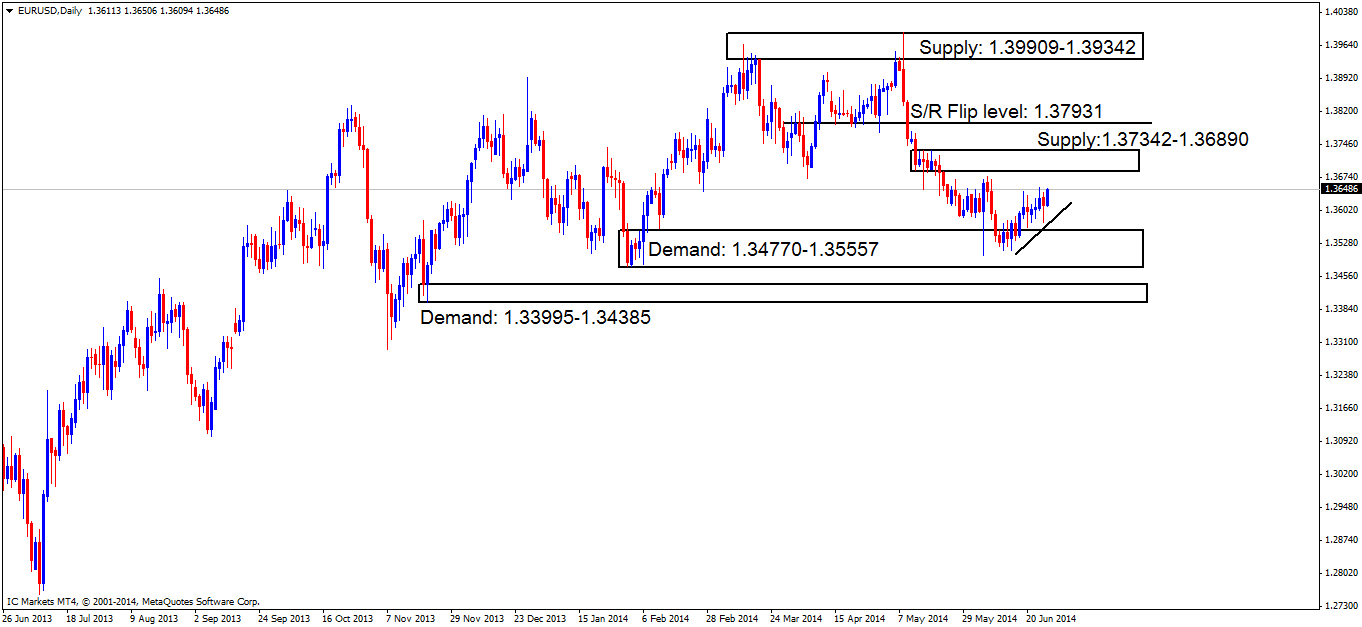

The daily timeframe has not seen much of a change recently; however a reminder will not hurt. Daily demand at 1.34770-1.35557 is currently capping price to the downside, with supply above at 1.37342-1.36890 capping price to the upside.

A break above the supply area just mentioned could force price to test the S/R flip level at 1.37931, conversely, a break below the demand area mentioned above, would likely see price testing oncoming demand seen at 1.33995-1.34385. We favor the former to happen as we are still trading within a much larger demand area seen on the weekly timeframe at 1.34770-1.36771.

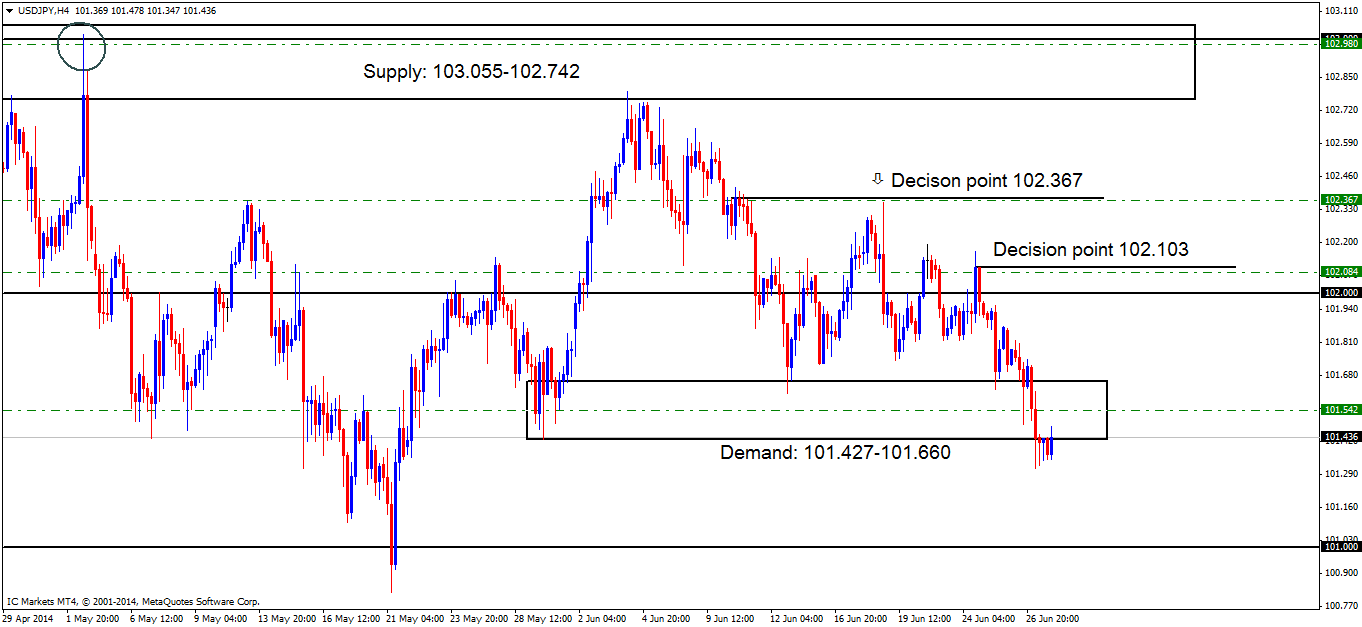

[B]4hr TF.[/B]

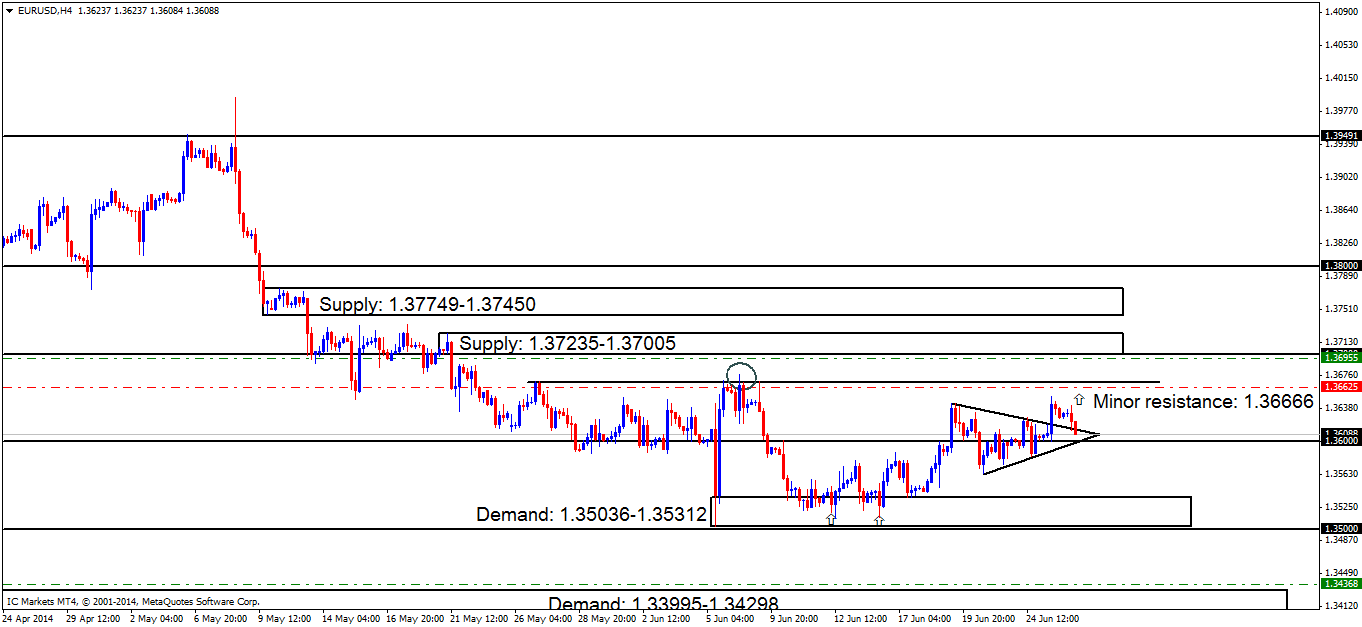

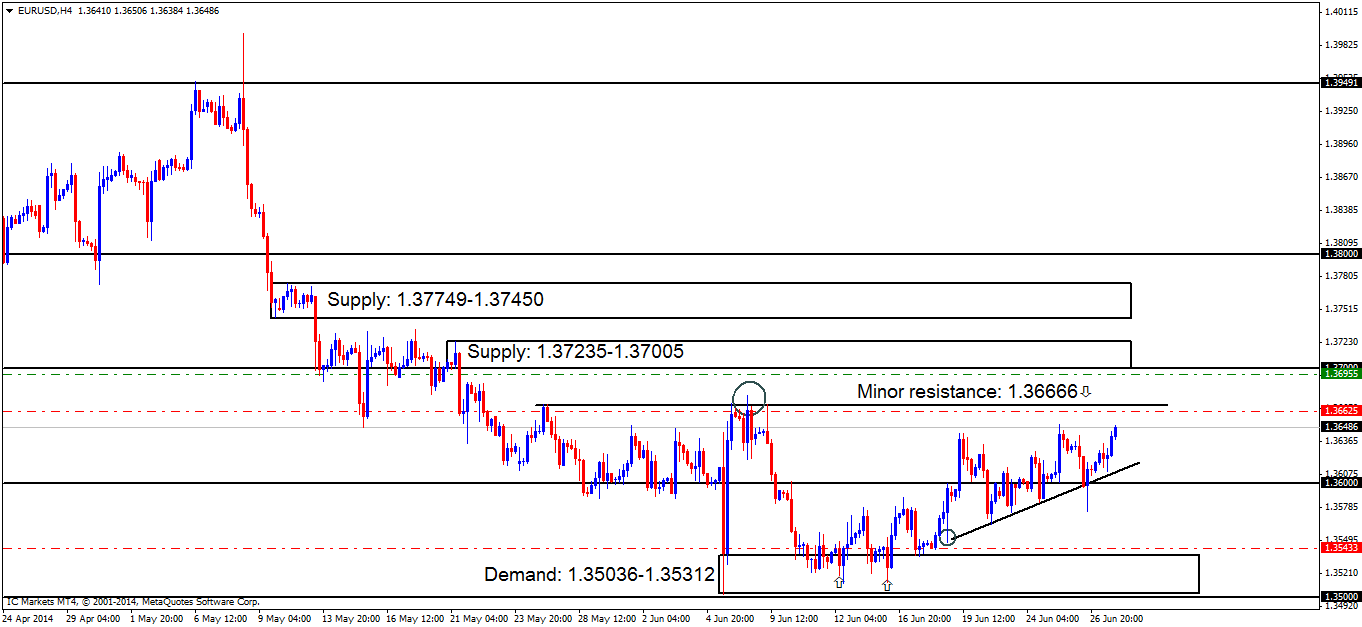

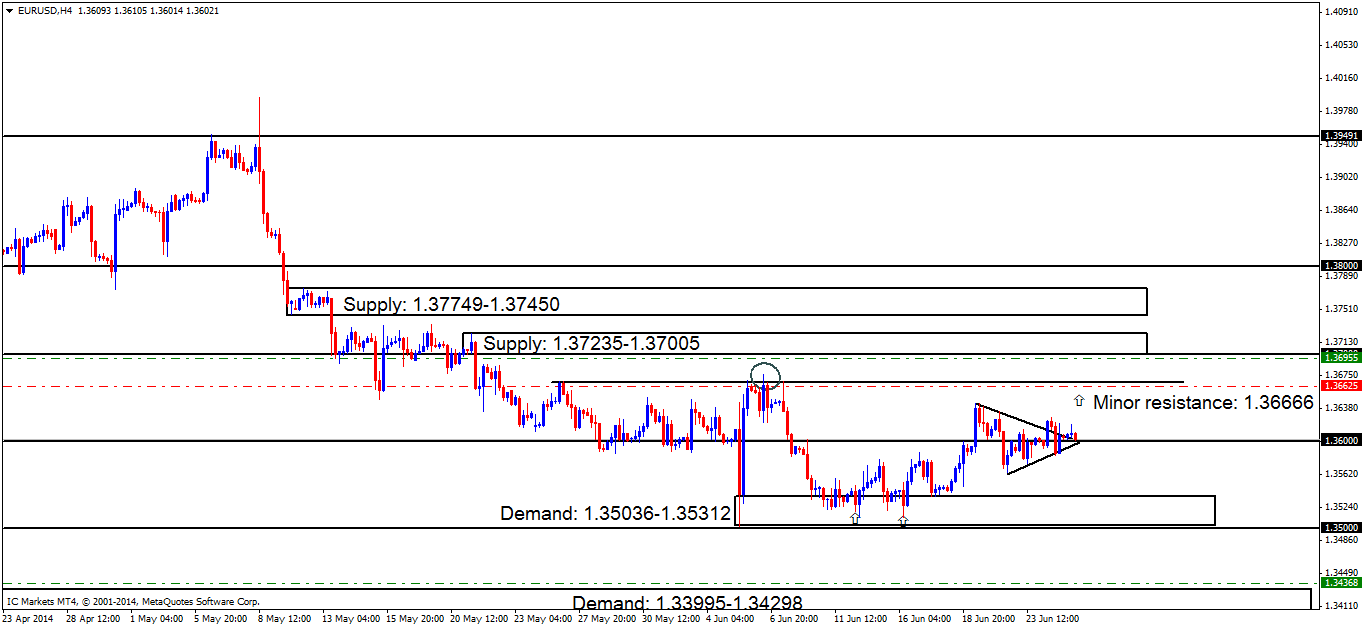

Chart one below shows how price faked out above the original ascending triangle, and then pushed hard to downside, seeing price trading within the triangle once more, a nice fakeout north has been seen here!

Chart 1:

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]Pending buy orders [/B](Green line) are seen around demand (1.33995-1.34298) at 1.34368. This demand area will more than likely see some sort of reaction due to its location seen to the left.[/li][li][B]No P.A confirmation buy orders [/B](Red line) are seen in the current market environment.[/li][li][B]Pending sell orders[/B] (Green line) seen at 1.36955 just below supply at 1.37235-1.37005 are set here since this level remains untouched, meaning unfilled orders are likely still set around this area.[/li][li][B]P.A confirmation sell orders[/B] (Red line) are visible below the minor resistance 1.36666 at 1.36625, this level has proved valid in the past, but still needs to be confirmed due to a spike/wick (circled) seen above resistance, which may have consumed most of the sellers originally there.[B]Do be on your guard with the sell orders above; the higher-timeframes are currently indicating that higher prices may be seen this week (Weekly demand: 1.34770-1.36771).[/B][/li][/ul]

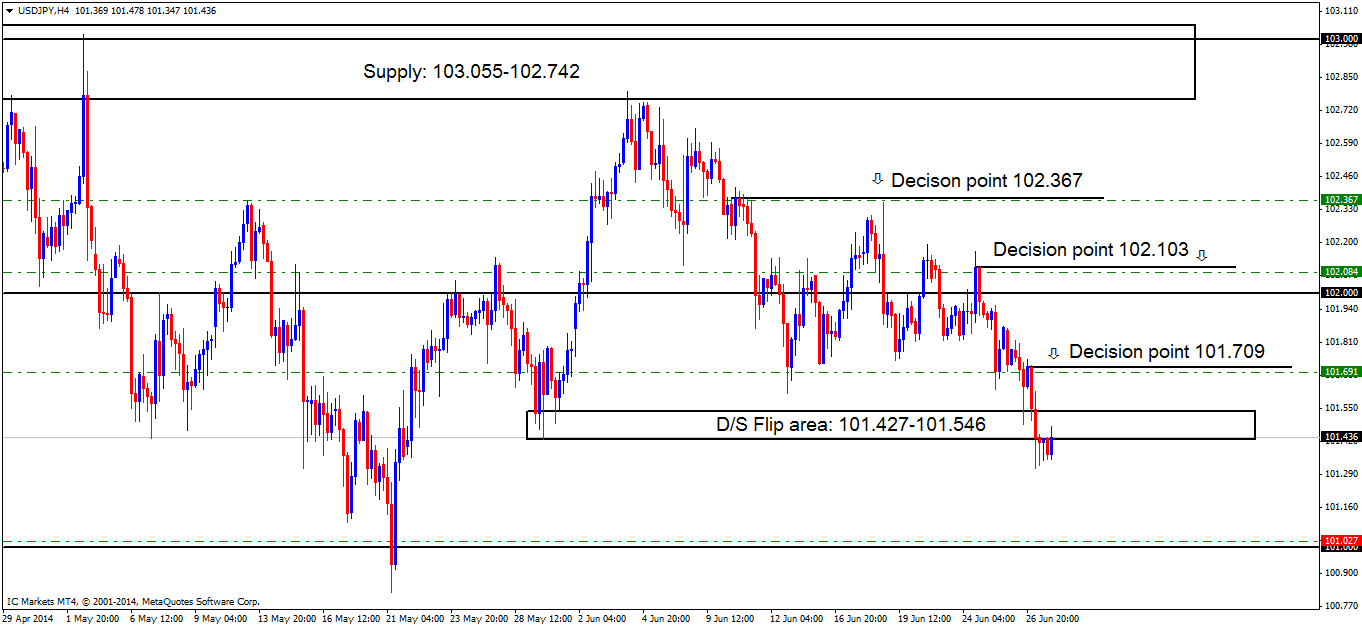

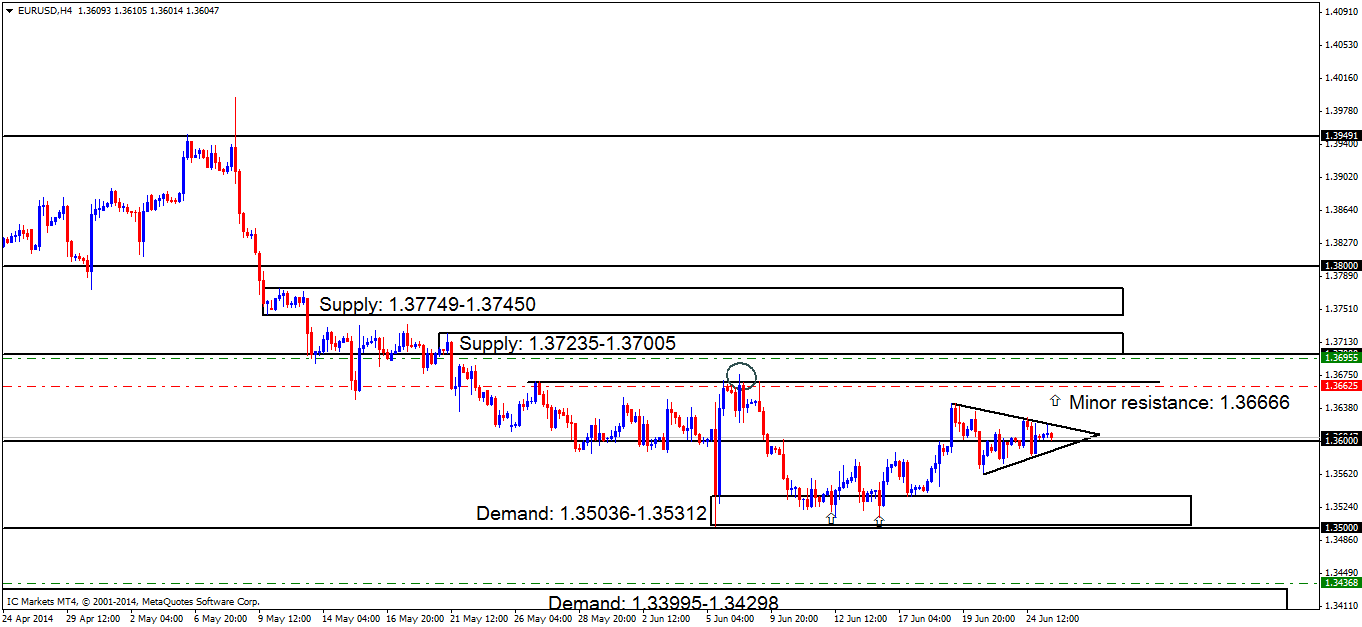

Chart two is follow on from chart one above, showing all price has done is continued forming the triangle around the round number 1.36000. Again, similar to the last analysis, price will likely break the triangle to the upside and then retest it, before advancing towards minor resistance at 1.36666.

A snippet from yesterday’s analysis, just in case anyone missed it:

[I]Price still remains capped between demand below at 1.35036-1.35312 and supply above at 1.36666 (minor resistance). A break above this supply could see price testing oncoming supply at 1.37235-1.37005; conversely, if price breaks the demand area (levels above) below, price could very well hit demand at 1.33995-1.34298.

[/I]

Chart 2:

[B]Quick Recap:[/B]

A small fakeout north was seen out of the ascending triangle seen on the 4hr chart, however, all price did was essentially expand the triangle rather than break it. Price is very condensed within the triangle at present, a break to the upside is highly expected, which will see our P.A confirmation sell order set at 1.36625 get triggered.

[ul]

[li][B]Areas to watch for buy orders:[/B] [B]P.O:[/B] 1.34368 (SL: 1.33926 TP: Dependent on how price action approaches the zone) [B]P.A.C: [/B]No P.A confirmation orders seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O:[/B] 1.36955 (SL: 1.37270 TP: [1] 1.36666 [2] 1.36000) [B]P.A.C:[/B]1.36625 (SL: 1.36810 TP: Dependent on where price ‘confirms’ the level).[/li][/ul]