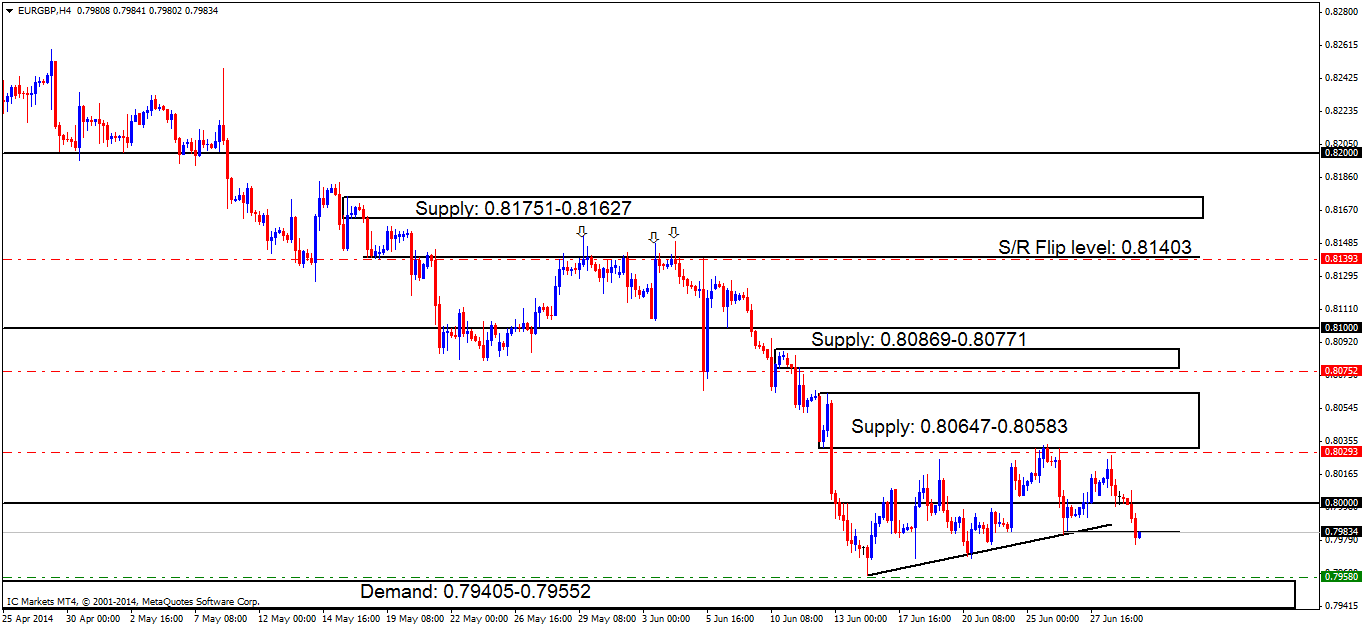

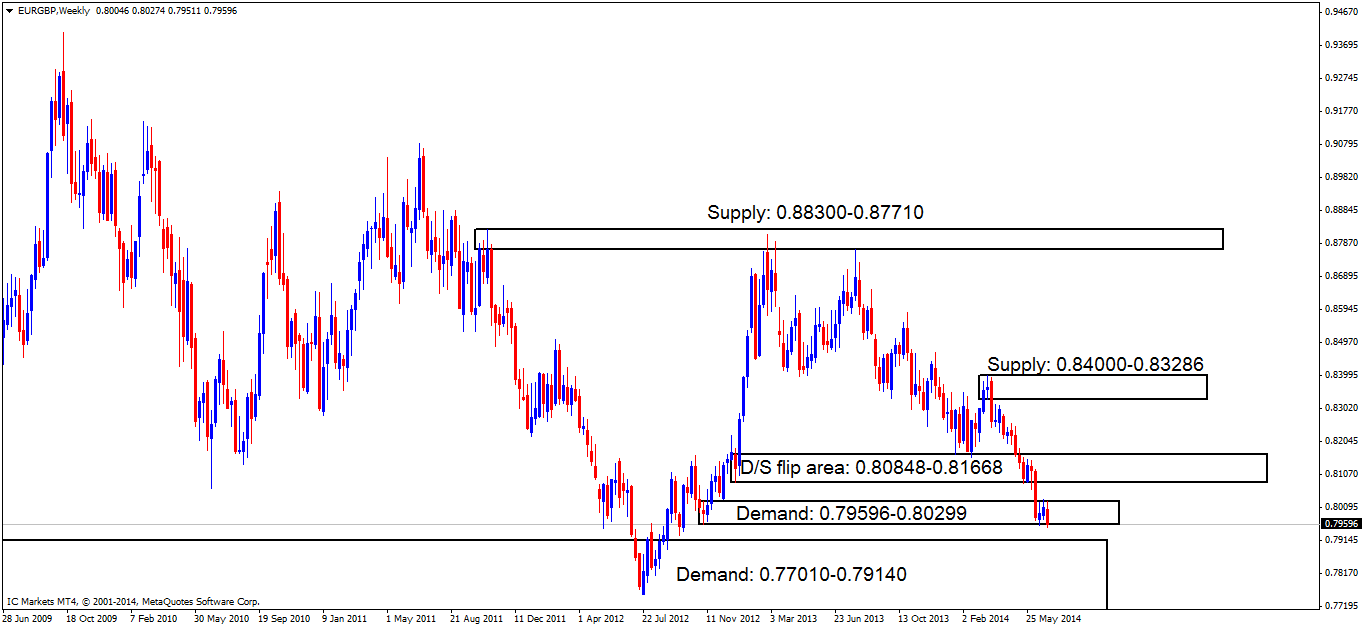

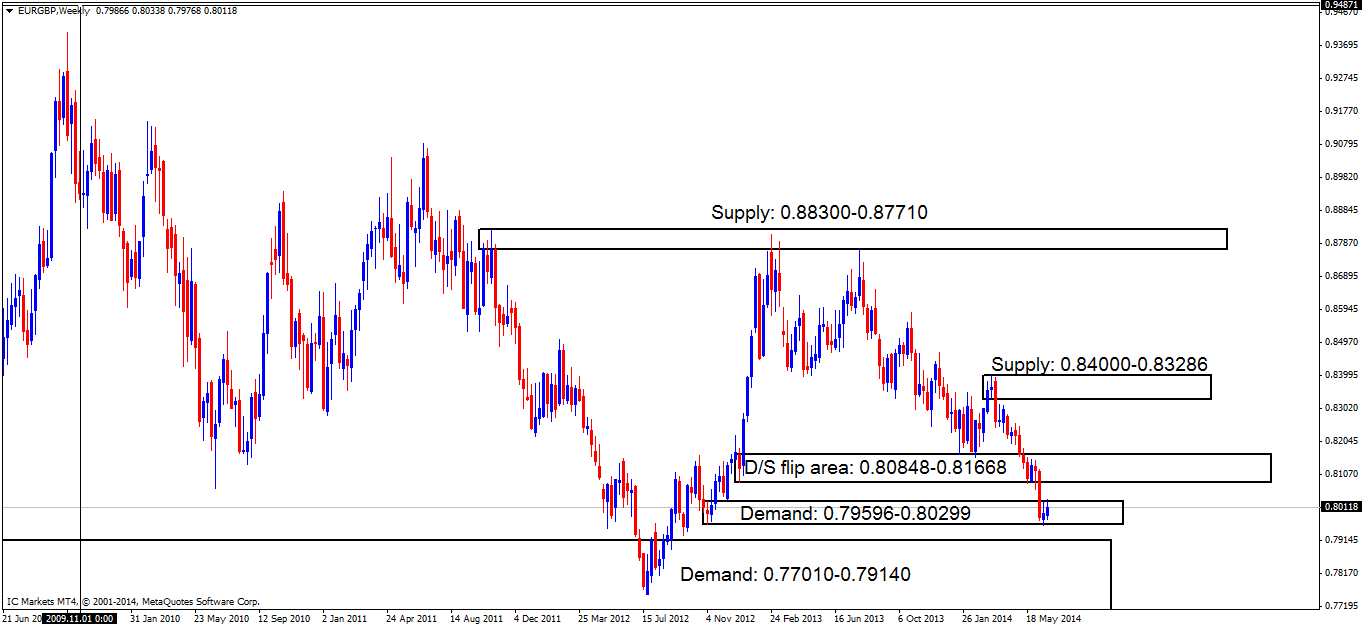

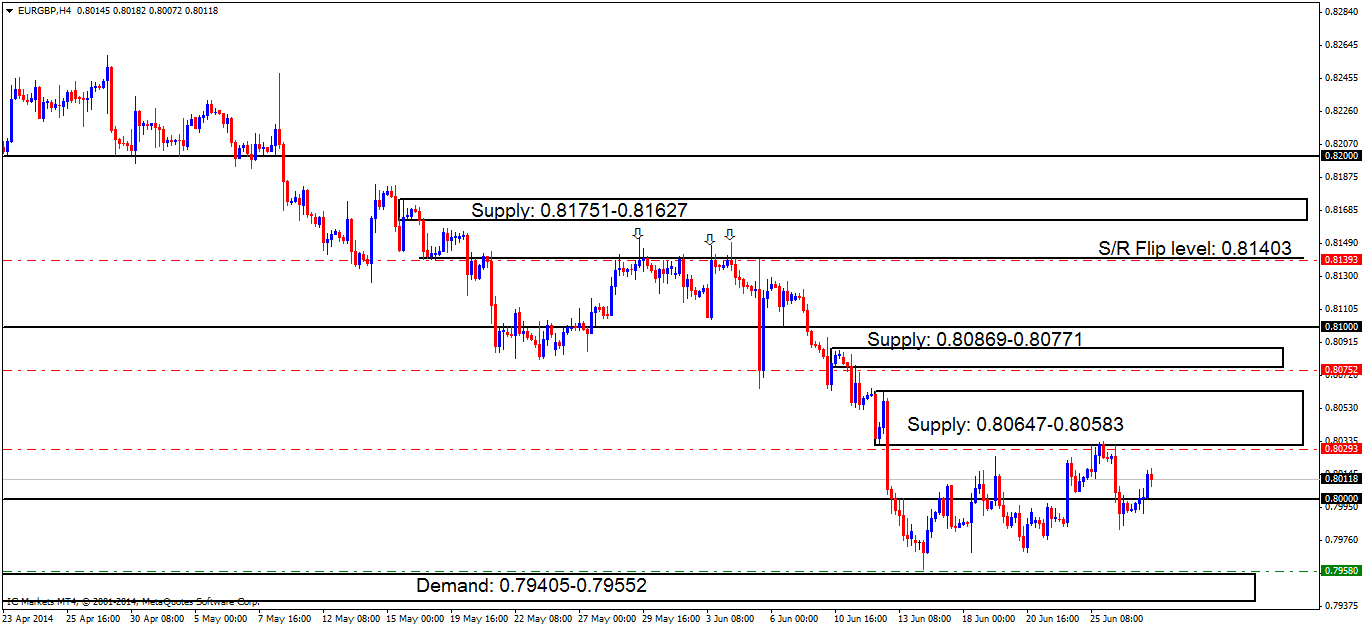

EUR/GBP:

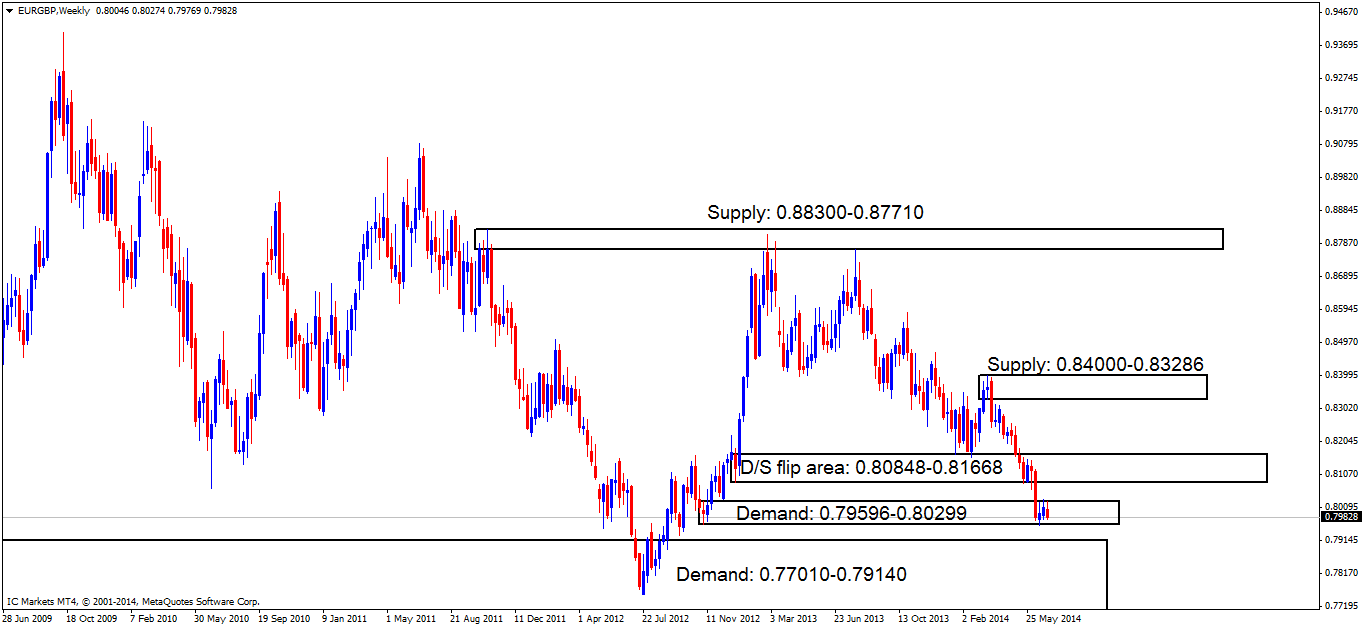

[B]Weekly TF.[/B]

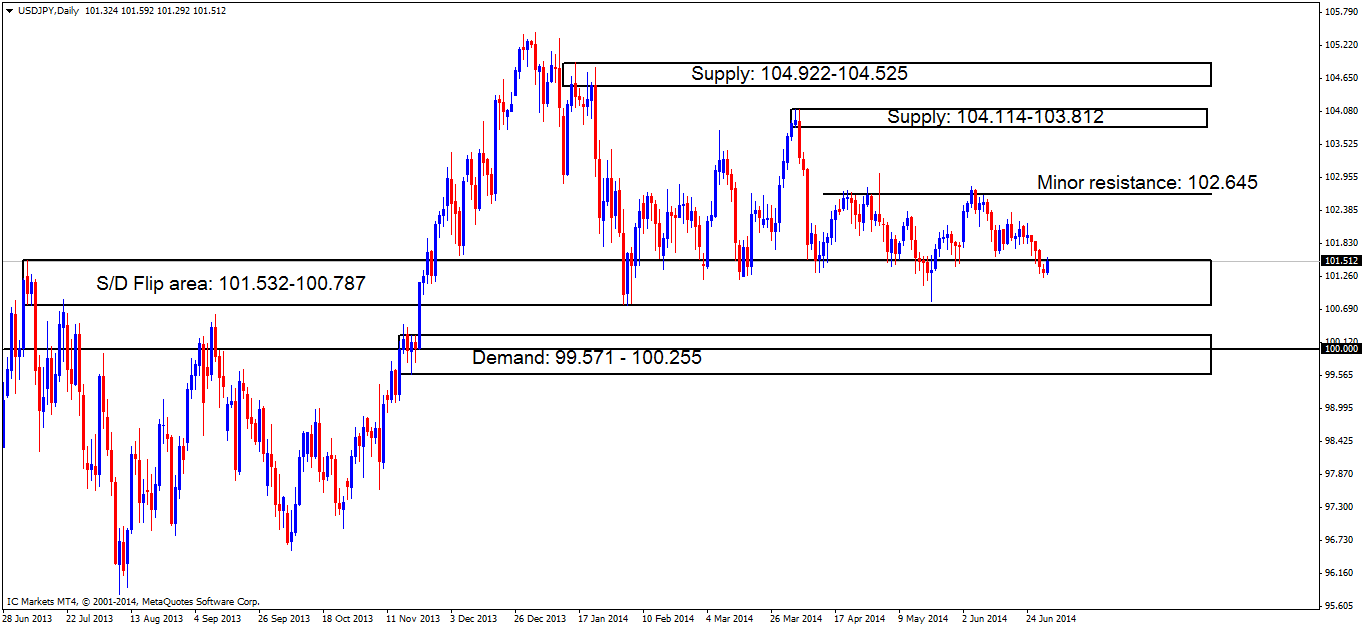

Active buyers were seen within weekly demand at 0.79596-0.80299 last week. Price managed to trade above the previous weekly high (0.80251) forming a higher high at 0.80338. As per this timeframe, higher prices are expected to be seen this week, but do not discount the possibility of a retracement beforehand (lower timeframes will no doubt provide more information regarding the possible retracement).

Price still remains capped between the weekly demand area just mentioned and weekly supply at 0.80848-0.81668.

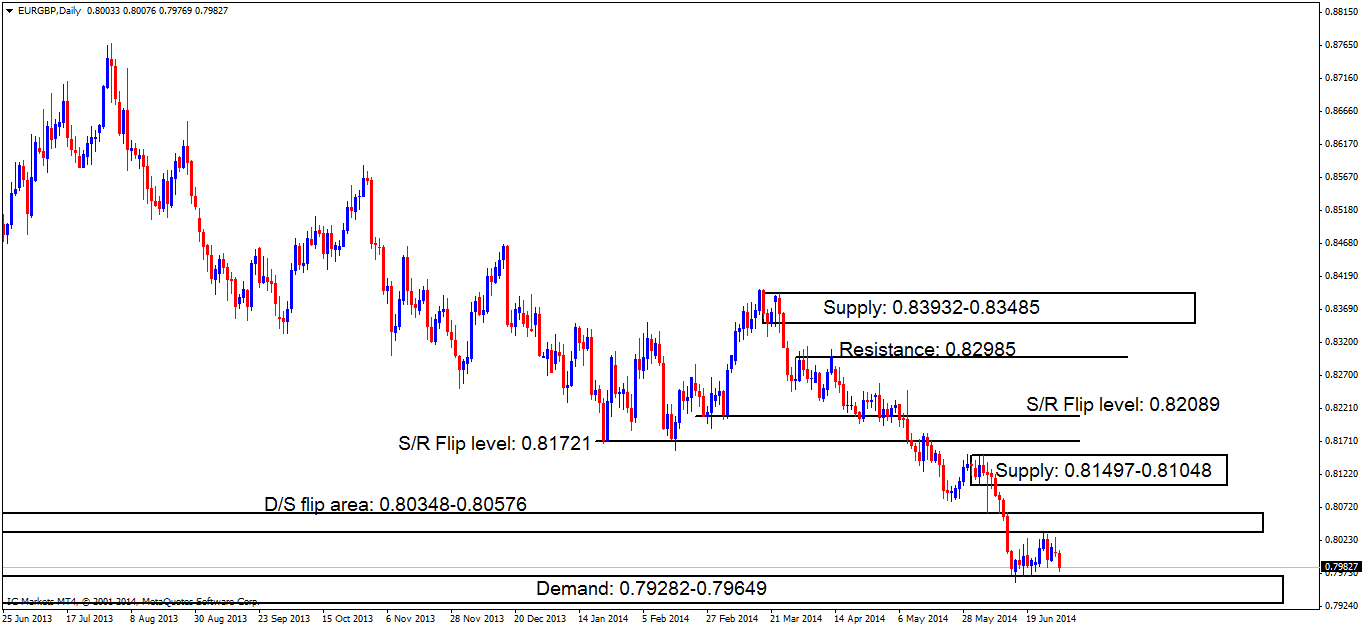

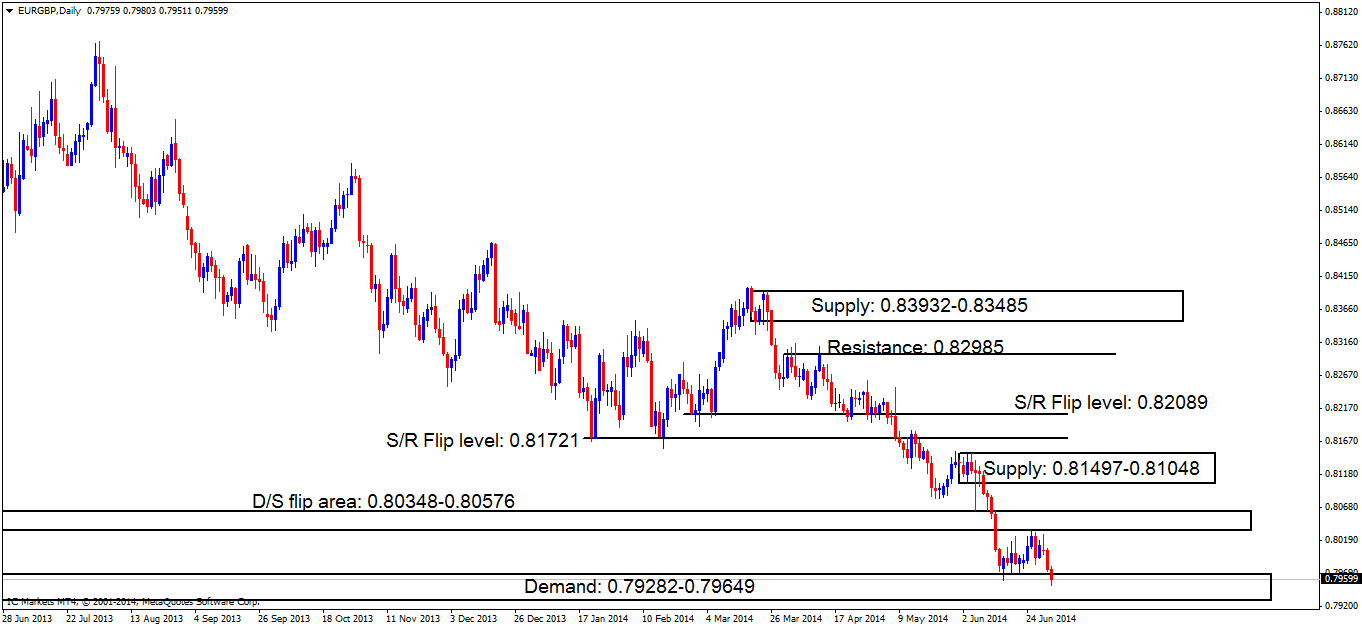

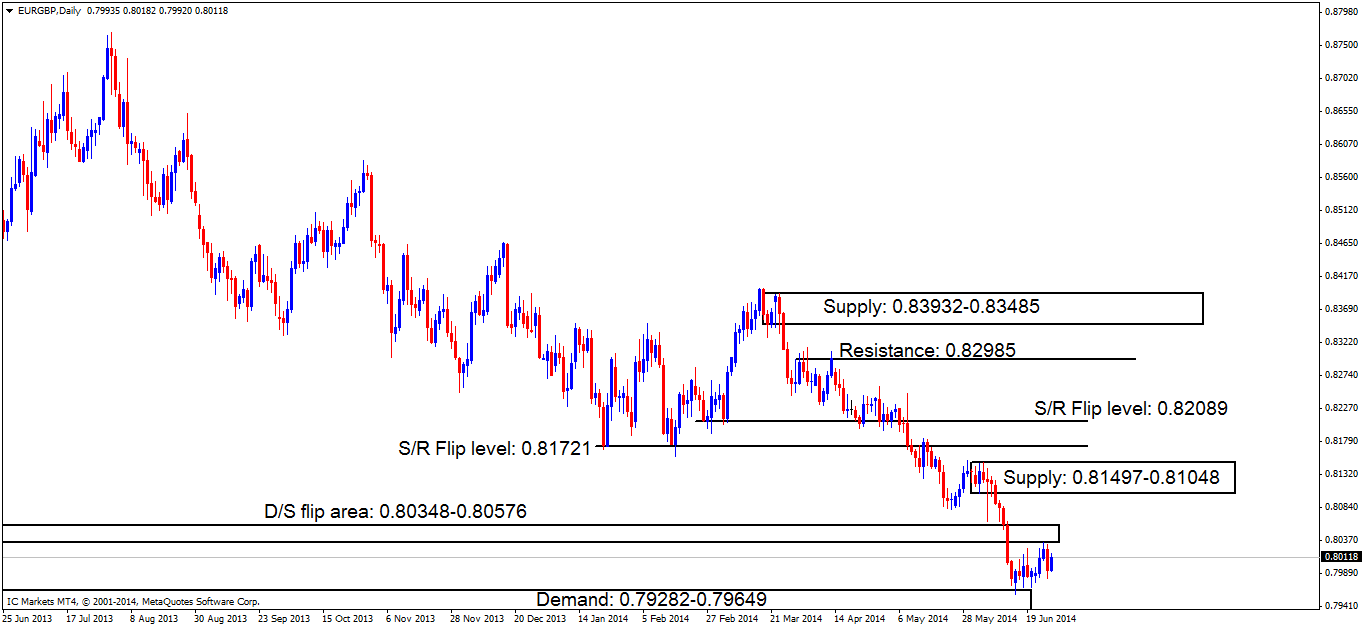

[B]Daily TF.[/B]

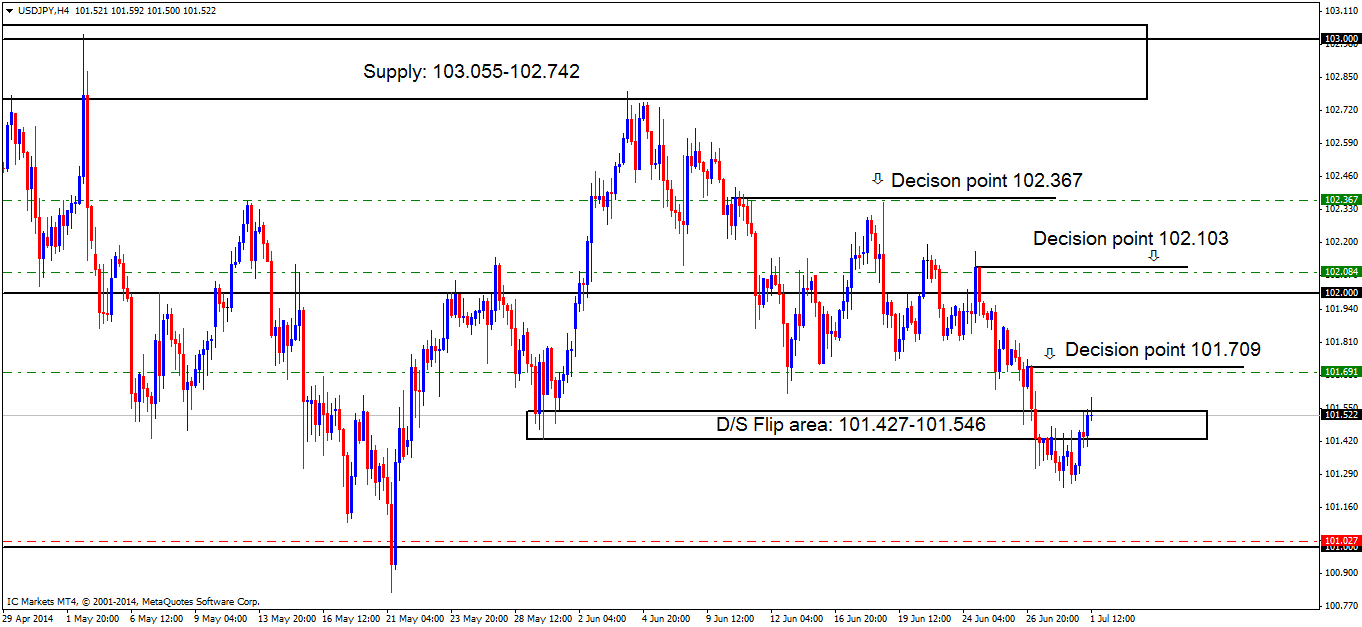

Price still remains capped between daily demand at 0.79282-0.79649 and daily supply (D/S flip area) at 0.80348-0.80576. According to the weekly timeframe above, we may see the daily supply area just mentioned get consumed, with price using the daily demand area mentioned above to push prices higher, hence the chance of a retracement happening before a rally occurs.

If price does indeed break above the daily supply area (levels above) we will likely see daily supply at 0.81497-0.81048 get tested soon after.

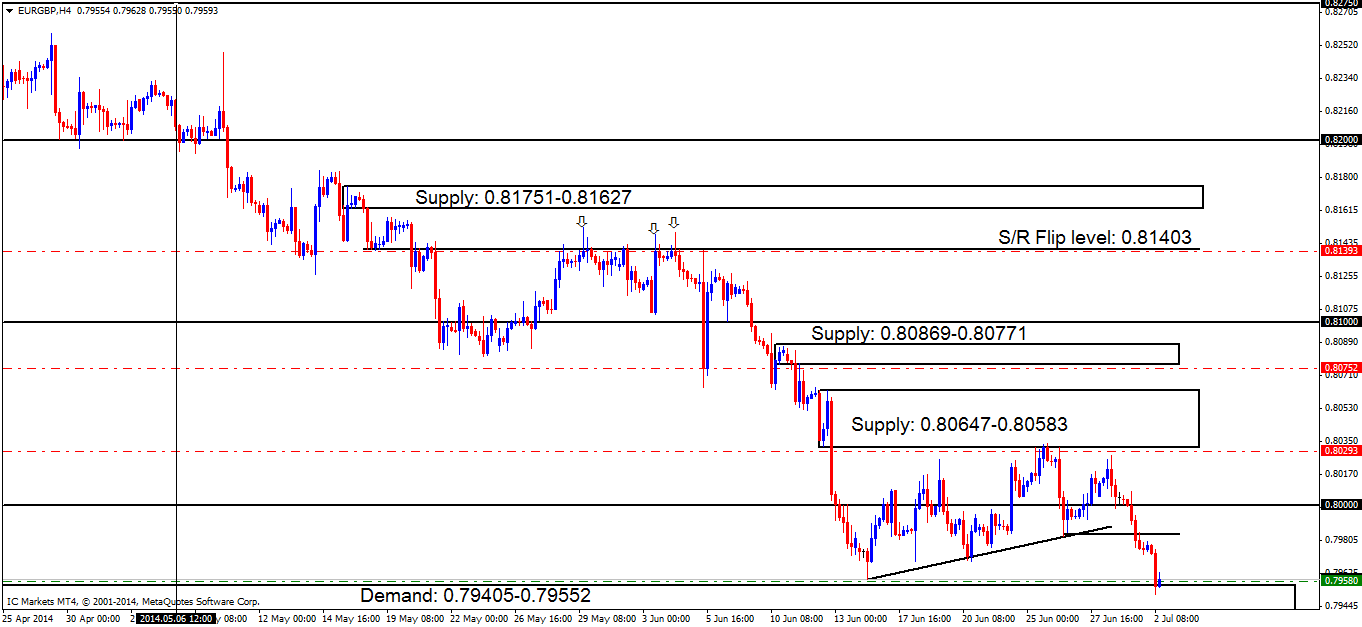

[B]4hr TF.[/B]

Price still remains capped between supply at 0.80647-0.80583 and demand below at 0.79405-0.79552 with a break either side yet to be seen. The weekly timeframe shows price is trading around higher-timeframe demand (levels above); this does not however mean price will rally immediately today, breaking supply at 0.80647-0.80583. Pro money will likely bring prices south sometime this week to around 4hr demand at 0.79405-0.79552 thus allowing them to collect the much-needed liquidity (sell orders to buy into) for a rally higher in price.

[B]Pending/P.A confirmation orders:[/B]

[ul]

[li][B]A pending buy order[/B] (Green line) has been set at 0.79580 just above demand at 0.79405-0.79552. The rationale behind this is because buyers have likely consumed the majority of the sellers lurking around the round number 0.80000 and supply above at 0.80647-0.80583 likely clearing the path for higher prices. A small retracement to demand (levels above) will possibly be seen to collect more buyers for a rally higher, thus triggering our pending buy order.[/li][li][B]No P.A confirmation buy orders[/B] (Red line) are seen in the current market environment.[/li][li][B]No pending sell orders[/B] (Green line) are seen in the current market environment.[/li][li][B]P.A confirmation sell orders[/B] (Red line) under the S/R flip level 0.81403 at 0.81393 is an area where a reaction is likely, however there were too many wicks north seen marked with arrows, indicating sellers are drying up, thus, the need to wait for more confirmation.[/li][li][B]P.A confirmation sell orders [/B](Red line) are seen just under supply (0.80869-0.80771) at 0.80752. Confirmation orders were used here because price is trading around a weekly demand area (0.79596-0.80299), which means price could easily consume this supply level as the higher timeframes usually overrule the lower timeframes.[/li][li][B]The P.A confirmation sell order [/B](Red line) set just below supply (0.80647-0.80583) at 0.80293 [B]is now active. Considering the higher-timeframe location seen on the weekly chart (Weekly demand: 0.79596-0.80299) , the sellers will need to consume the majority of the buyers around the 4hr demand area below at 0.79405-0.79552 to confirm this zone; a pending sell order can then be set awaiting a possible retracement[/B].[/li][/ul]

[B]Quick Recap:[/B]

The weekly timeframe currently shows active buyers within weekly demand at 0.79596-0.80299, while on the daily timeframe price remains capped between supply 0.80348-0.80576 and demand at 0.79282-0.79649. The 4hr timeframe is displaying a small uptrend that is just beginning, however do not be fooled by this, as price could very well turn south anytime this week to around 4hr demand at 0.79405-0.79552 before the real up trend begins.

[ul]

[li][B]Areas to watch for buy orders: P.O:[/B] 0.79580 (SL: 0.79368 TP: [1] 0.80000 [2] 0.80583 [May change if any new developments in the market are seen]) [B]P.A.C: [/B]No P.A confirmation buy orders are seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: [B]P.O:[/B] No pending sell orders are seen in the current market environment. [B]P.A.C:[/B] 0.81393 (SL: Will be likely set at 0.81564 TP: Will be likely set at the round number 0.81000) 0.80752 (SL: likely to be set at 0.80900 TP: Dependent on where price ‘confirms’ the level) 0.80293 [B](Active-awaiting confirmation)[/B] (SL: likely to be set at 0.80648 TP: Dependent on where price ‘confirms’ the level).[/li][/ul]