[B]Weekly TF.

[/B]

Price has completely consumed the resistance level at [B]1.11230[/B], which as per this timeframe is the last obstacle (potential sellers) up to major supply at [B]1.17230 – 1.15410[/B].

However, as we can see, there were a lot of higher-timeframe sellers at resistance ([B]level above[/B]), and price is possibly retracing to the most logical demand area below at [B]1.05883 – 1.07274[/B], due to this selling pressure.

Price is capped between supply at [B]1.17230 – 1.15410[/B] and demand at [B]1.05883 – 1.07274[/B].

[B]

Daily TF.

[/B]

As per this timeframe, price is trading between minor support at [B]108142[/B], and the lower of the two stacked supply areas at [B]1.10039 – 1.09356[/B]. Price will likely break/consume the minor support area just mentioned sometime this week, then likely sell hard towards demand at [B]1.05883 – 1.06779[/B], which is located deep within weekly demand at [B]1.05883 – 1.07274[/B] (shown on the weekly chart above).

[B]

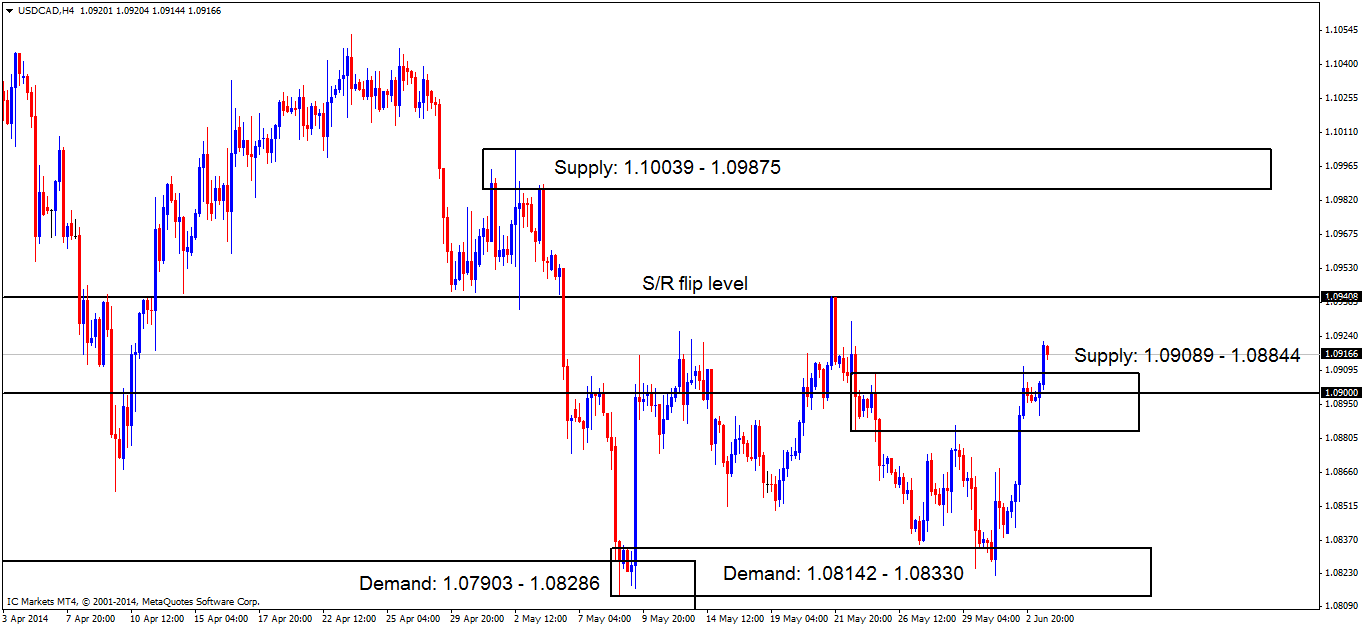

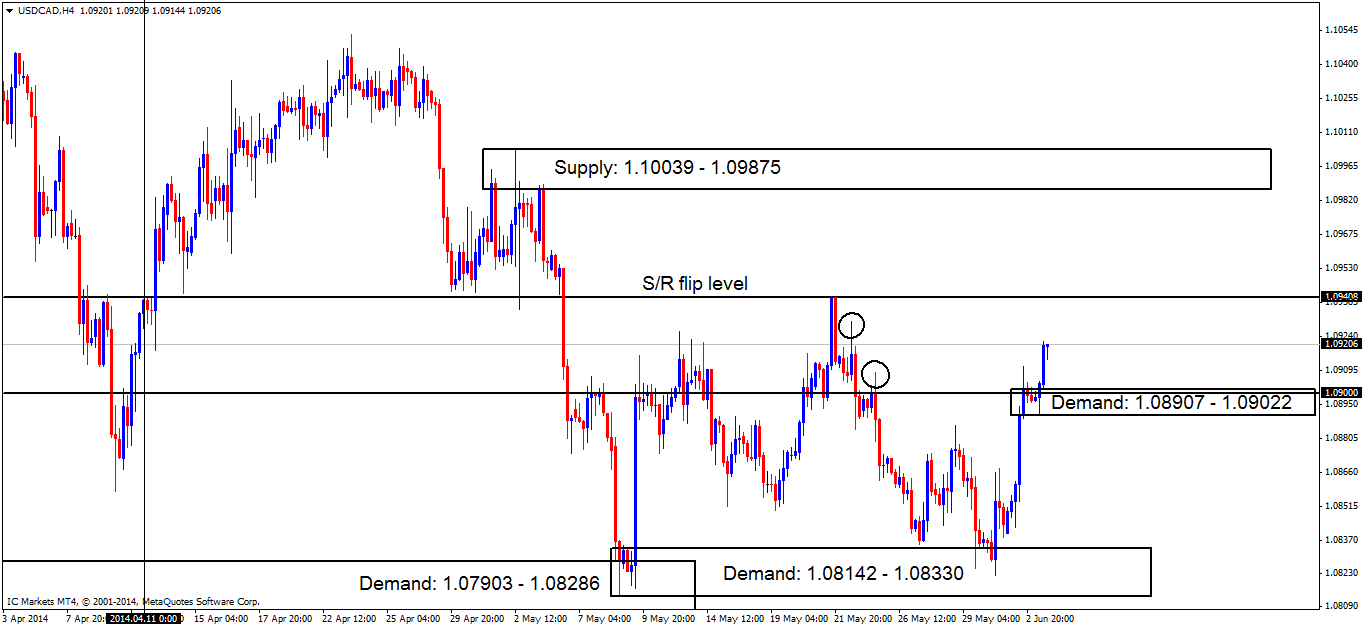

4hr TF.

[/B]

A closer inspection on the 4hr timeframe shows price is caught trading between supply at [B]1.09089 – 1.08844[/B], incorporating the round number [B]1.09000 [/B]within, and two stacked demand areas below at[B]1.08142 – 1.08330/1.07903 – 1.08286[/B]. No break of either area has yet to be seen.

Today, price will likely remain trading between the two areas mentioned above, but a break of the demand area may happen early this week, so no buy orders are to set as it is not worth the risk.

Sell orders are set at [B]1.08844[/B] with stops above at [B]1.09112[/B], targeting the base of the weekly demand area at [B]1.07274[/B] (seen on chart 2 below) as there’s very little stopping price from dropping once the 4hr demand areas are consumed ([B]levels above[/B]).

Here is price to the left; the circled area resembles the top of the weekly base demand area for reference purposes.

[B]

Orders:

[/B]

Buy(s) at: [B]N/A[/B]

[ul]

[li]Stop(s) at: [B]N/A[/B][/li][li]Target(s) at: [B]N/A[/B][/li][/ul]

Sell(s) at: [B]1.08844[/B]

[ul]

[li]Stop(s) at: [B]1.09112[/B][/li][li]Target(s) at [B]1.07274[/B][/li][/ul]