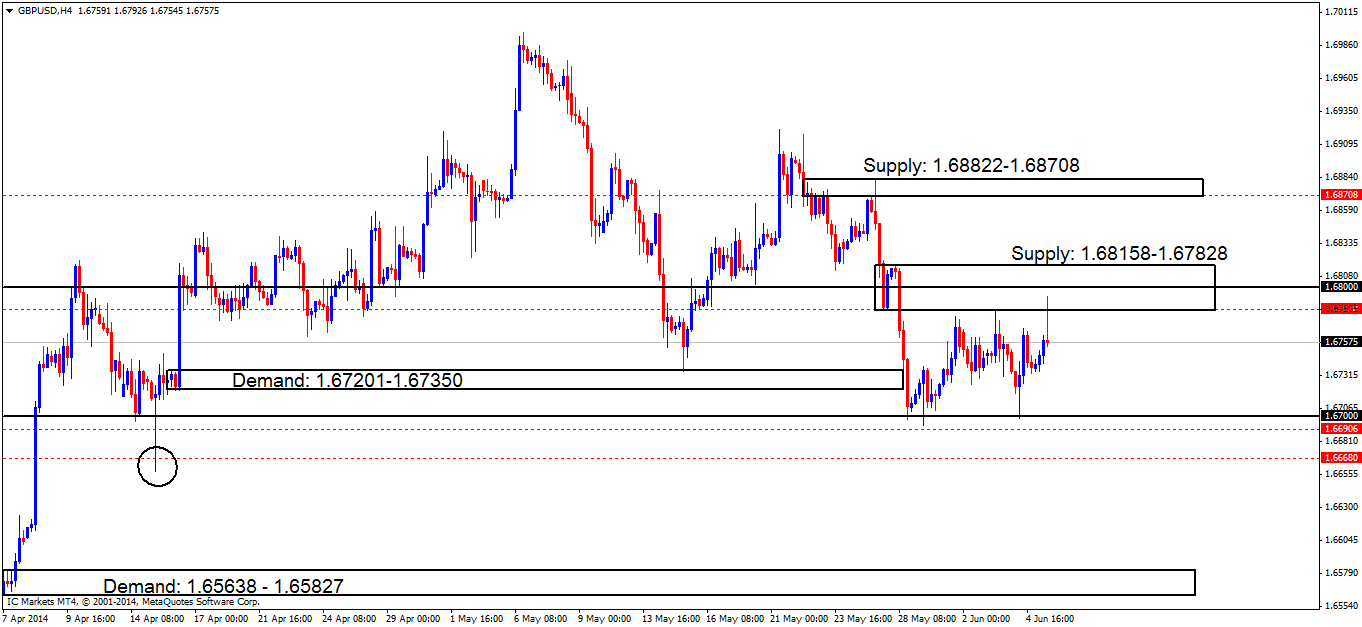

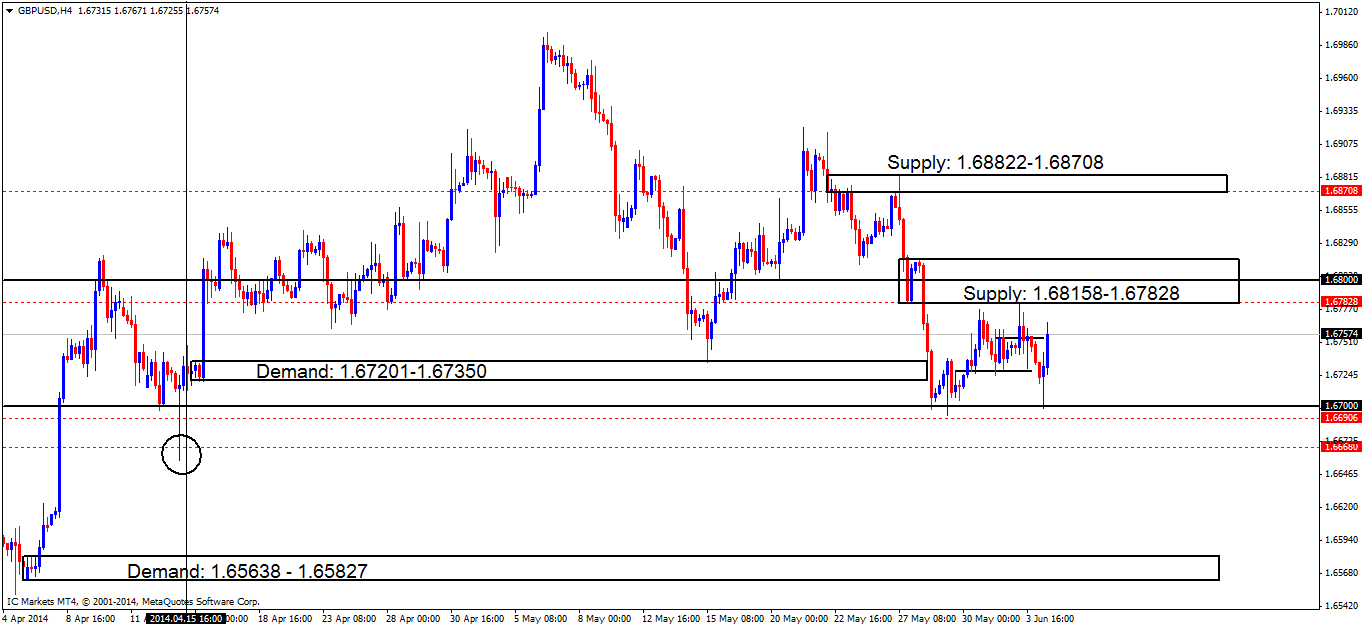

GBP/USD:

[B]4hr TF.

[/B]

The pound saw a decent drop in value, spiking the round number [B]1.67000[/B]. Price still remains capped between the round number just mentioned and supply above at [B]1.68158 – 1.67828[/B]. Notice how easily price dropped through previous price action happened, this was because of the way price approached supply ([B]levels above[/B]) by essentially spiking lower while rallying price north, consuming buyers, clearing the path for a likely sell off which did happen.

[ul]

[li]Buy orders remain the same (marked with red-dashed lines) at [B]1.66906[/B] below the round number[B]0.67000[/B] which was nearly filled, missing the order by about 8 pips. As explained yesterday, a likely break below the round number mentioned above could see price testing the daily S/R flip level at [B]1.66631[/B], permitting the need for a buy order set just above at [B]1.66680[/B].[/li][li]Sell orders (marked with red-dashed lines) remain the same as yesterday; the near-term sell orders are seen around supply ([B]1.68158 – 1.67828[/B]) at [B]1.67828[/B]. If a break is seen above this capped supply area at [B]1.68158 – 1.67828[/B], this could force price to test the supply area at [B]1.68822 – 1.68708[/B]. Sell orders could then be set at [B]1.68708[/B].[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] 1.66906 (SL: 1.66534 TP: [1] 1.67828 [2] 1.68708). Impending orders: 1.66680 (SL: 1.66534 TP: Dependent on future price approach).[/li][li][B]Areas to watch for sell orders[/B]: 1.67828 (SL: 1.68216 TP: 1.67000). Impending orders: 1.68708 (SL: 1.68860 TP: Will be decided on future price approach).[/li][li][B]Most likely scenario: [/B]Similar to the last analysis, a drop in price is still favorable due to higher-timeframe influence, however a spike to either supply area above may happen, the lowest seen at 1.68158 – 1.67828, the highest at 1.68828 – 1.68708.[/li][/ul]