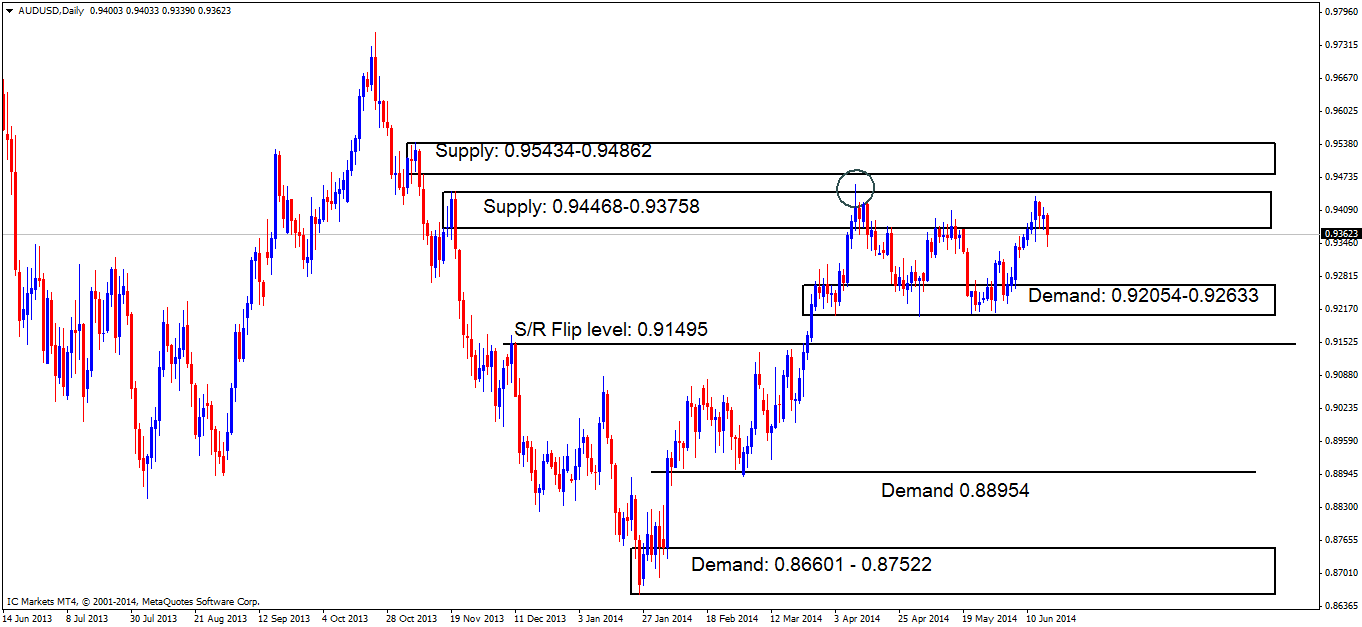

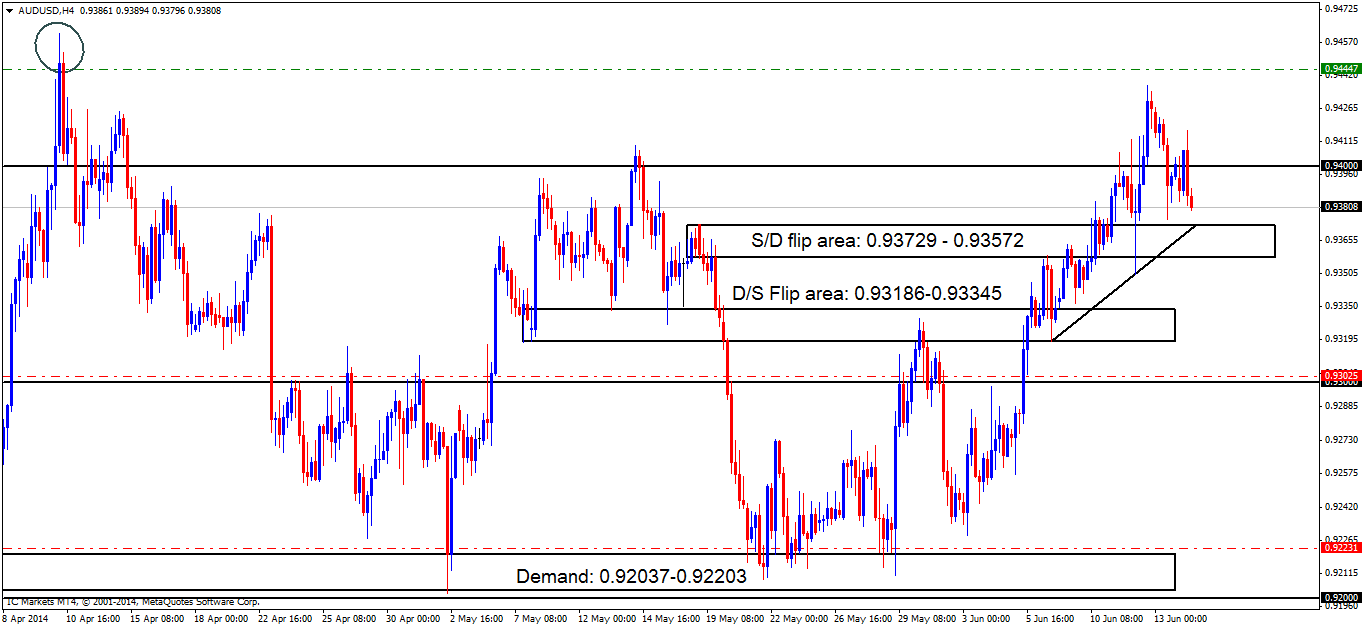

AUD/USD:

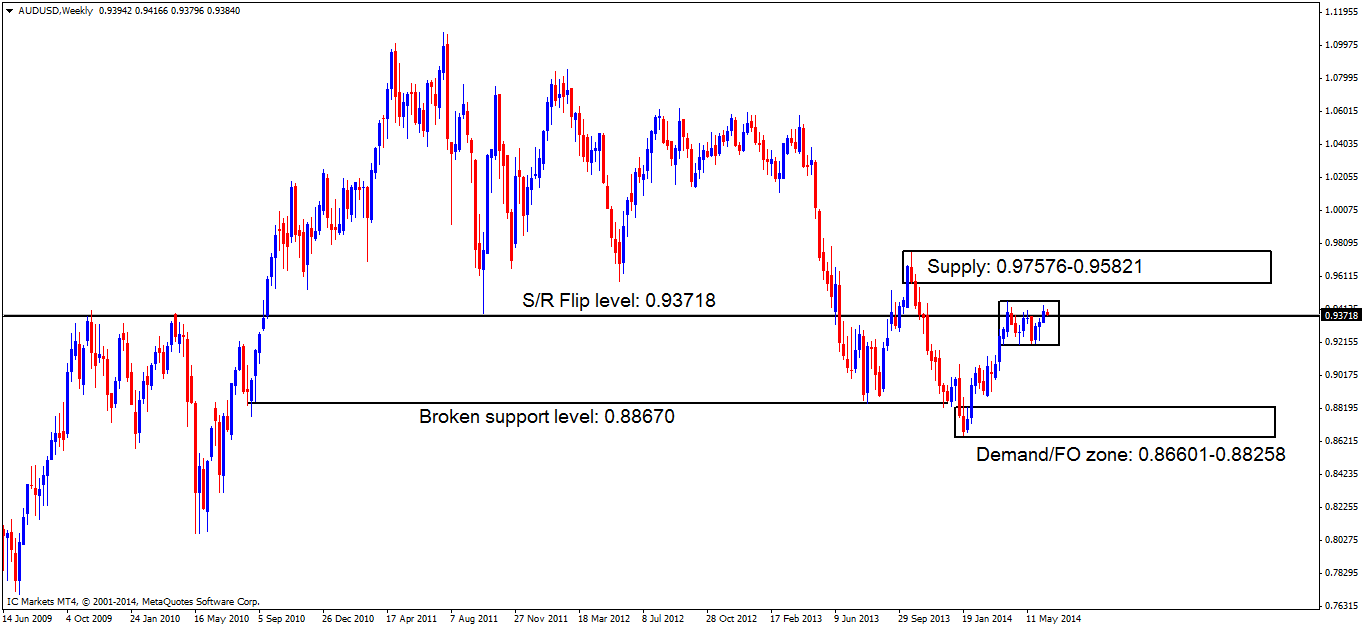

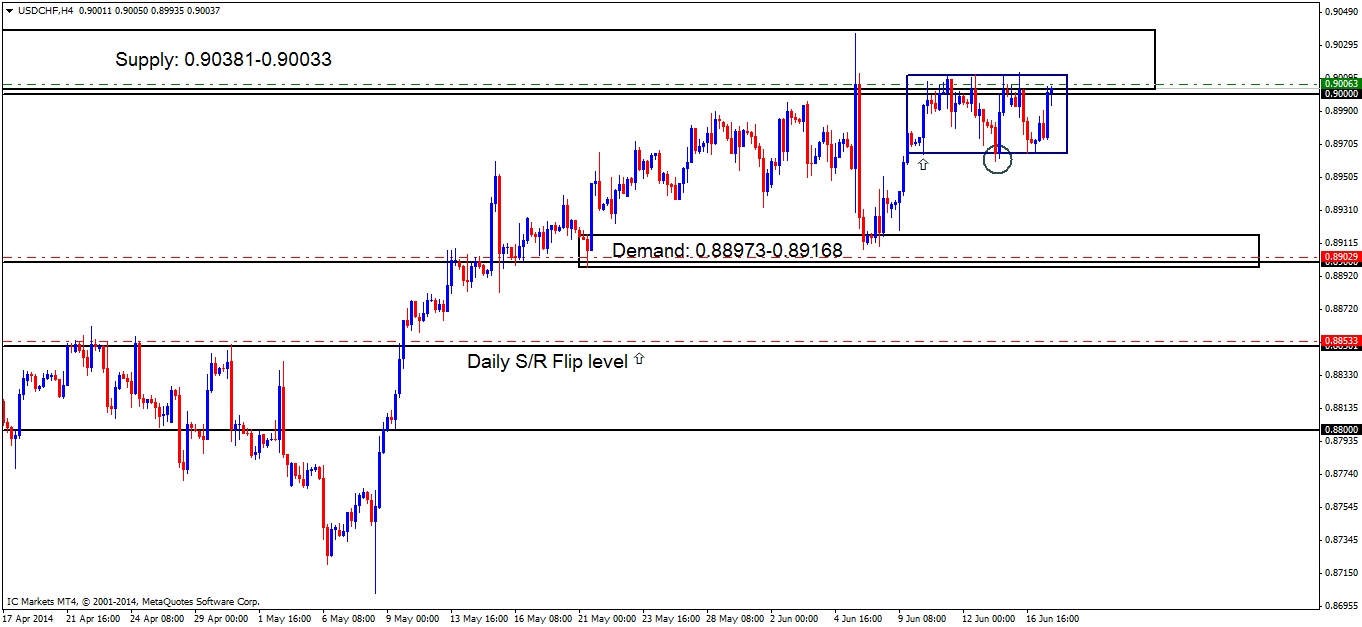

[B]Weekly TF.[/B]

A quick reminder of the weekly timeframe, price is currently seen consolidating around the S/R flip level 0.93718, with a positive break in either direction yet to be seen.

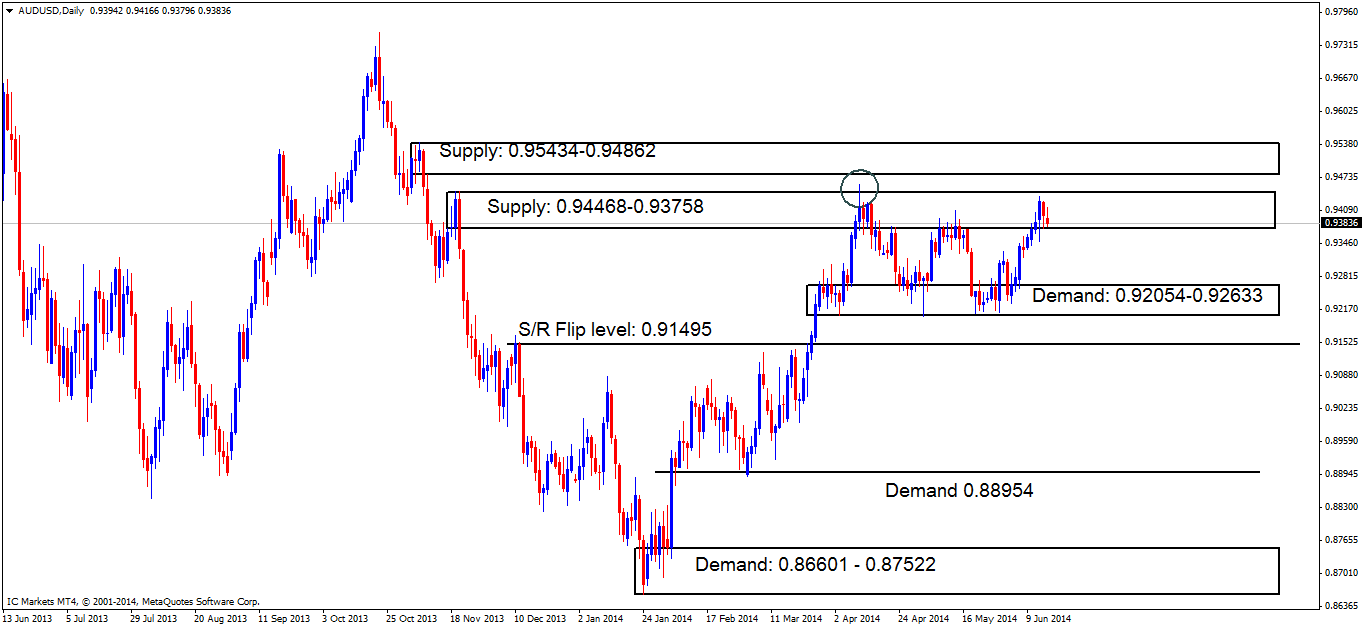

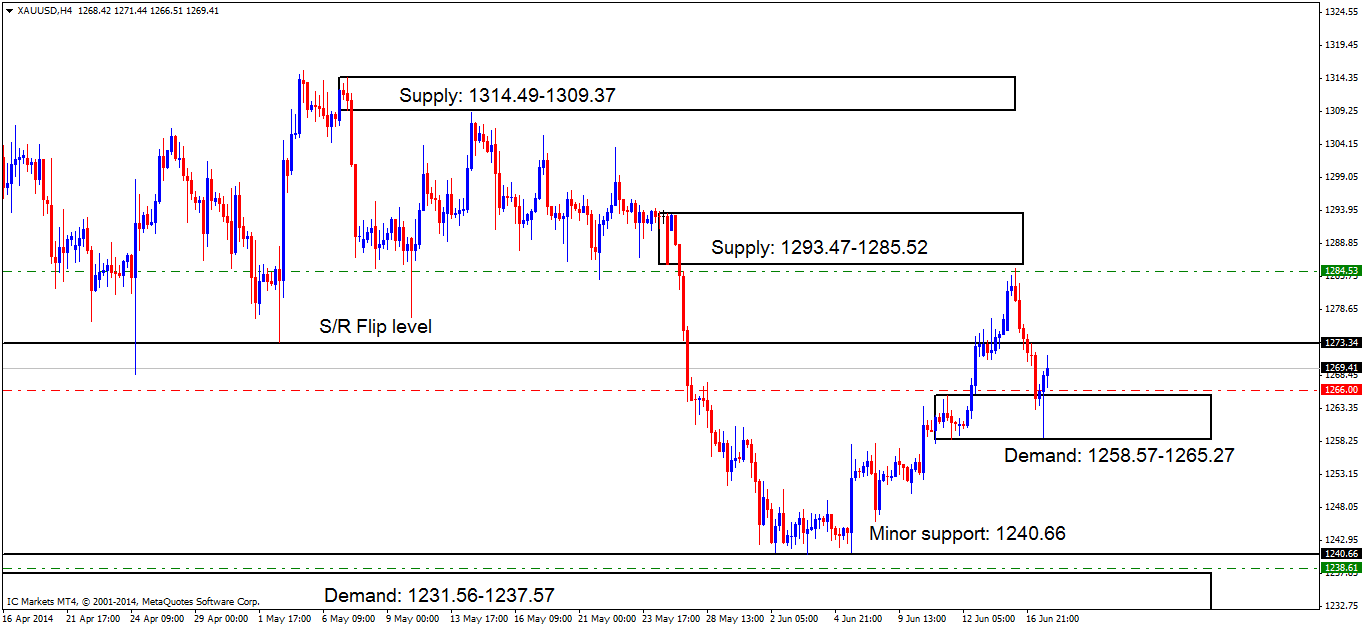

[B]Daily TF.[/B]

The sellers are starting to show some interest within daily supply at 0.94468-0.93758, nonetheless, how long this interest may last is difficult to tell, as this supply area appears to have been weakened by the wick/spike (circled), that likely consumed most the sellers in and around this area as explained in yesterday’s analysis.

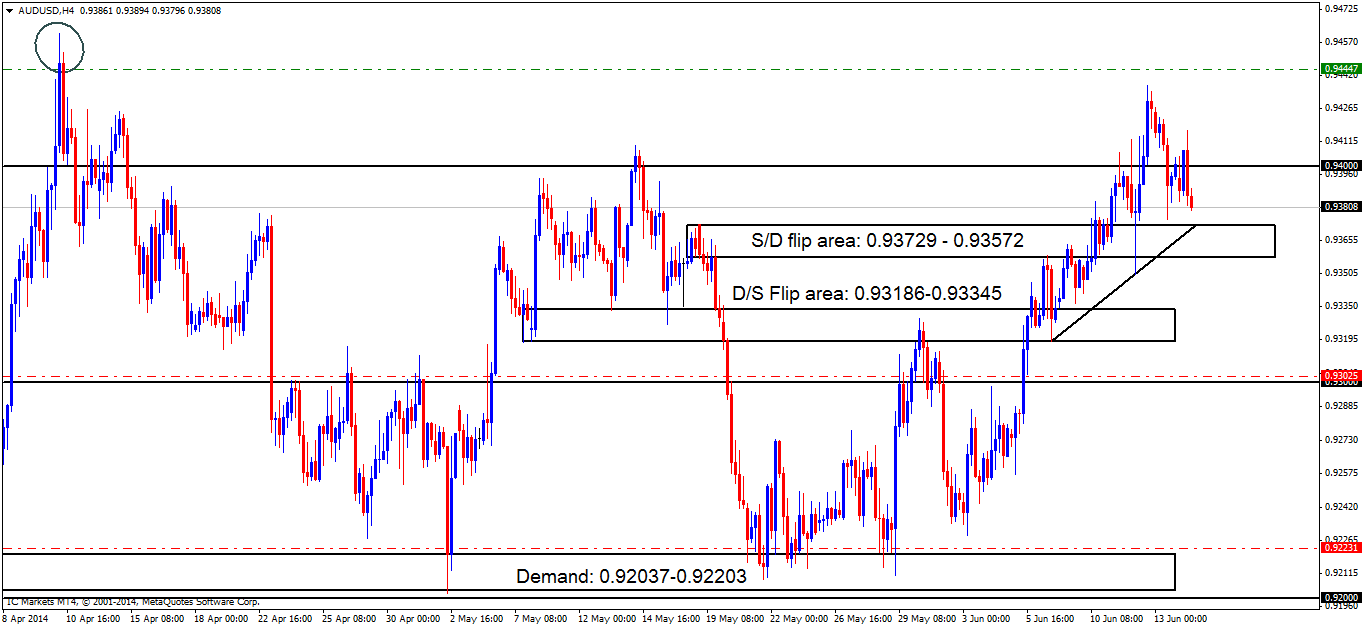

[B]4hr TF.[/B]

Technically, not much has changed since the last analysis; price has been seen dancing in and around the round number at 0.94000, no doubt creating frustration with the lower-timeframe traders seeing stops taken from both buyers and sellers.

The mini trend line is not attached to represent a trend as such; it is more to show how pro money has likely been consuming small demand pockets while price is still rallying. Price appears relatively free to drop down to at least the round number 0.93000, as there is no ‘obvious’ fresh demand areas seen on this timeframe.

Taking all of the above into consideration, pro money may require more buy orders to push price down to the round number just mentioned above, so, a rally to the highs may be seen beforehand at 0.94613 (circled), this will entice momentum buyers to follow price on the lower timeframes, thus giving pro money enough orders to possibly sell right into!

[ul]

[li][B]No pending buy orders[/B] (Green line) are seen in the current market environment.[/li][li][B]P.A confirmation buy orders[/B] (Red line) are seen at 0.92231 just above demand at 0.92037-0.92203. It would be too risky to set a pending order around this area, since deep spikes into this demand zone have been seen (levels above) possibly consuming the majority of buyers in the process.[/li][li][B]P.A confirmation buy orders[/B] (Red line) are visible just above the round number 0.93000 at 0.93025. We require confirmation of this level because previous price action has warned us deep tests both north and south happen on a regular basis, hence the need to wait for confirmation rather than getting stopped out time after time through lack of patience[/li][li][B]Pending sell orders[/B] (Green line) are seen at 0.94447, if price manages to get up to this level, active sellers are likely waiting because of how quickly price changed in direction, only pro money have the account size to do this, indicating unfilled sell orders may still be unfilled there.[/li][li][B]No P.A confirmation sell orders [/B](Red line) are seen in the current market environment.[/li][/ul]

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: No pending orders are seen with current price action. P.A.C:0.92231 (SL: more than likely will be at 0.91984 TP: Decided if/when price ‘confirms’ the level) 0.93025 (SL: Dependent on where price ‘confirms’ the level TP: Dependent on where price ‘confirms’ the level).[/li][li][B]Areas to watch for sell orders[/B]: P.O: 0.94447 (SL: 0.94667 TP: Dependent on how price action approaches the area). P.A.C: No P.A confirmation sell orders seen in the current market environment.[/li][li][B]Most likely scenario: [/B]It is very unlikely price will rally back up to the highs at 0.94613 as we are in Weekly and Daily higher-timeframe supply (0.93718/0.94468-0.93758). During the week we will likely see a decline to the round number 0.93000 below, as most of the demand areas visible on this timeframe have been consumed.[/li][/ul]