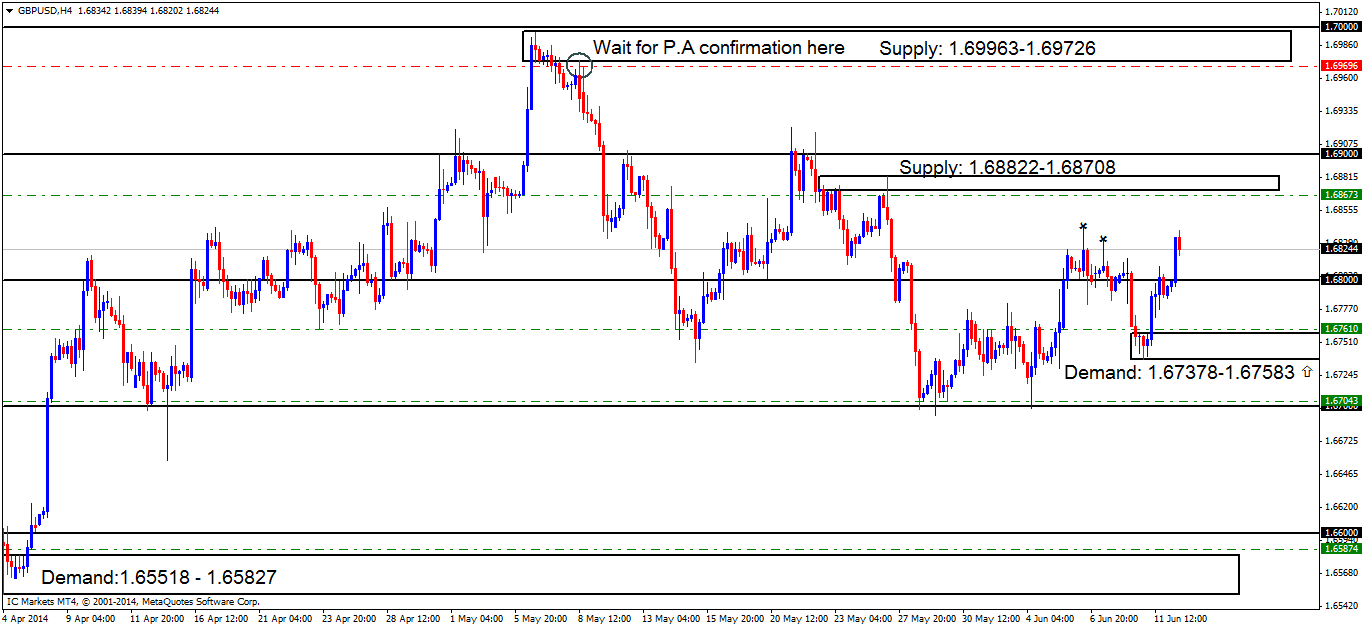

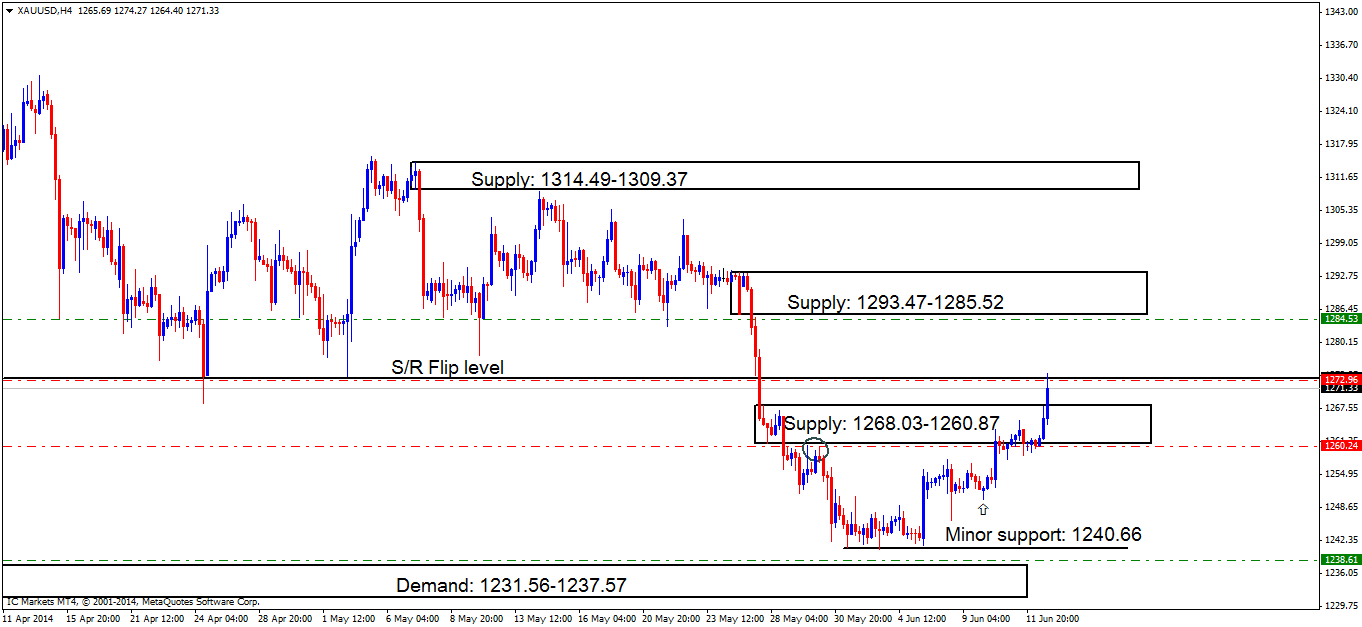

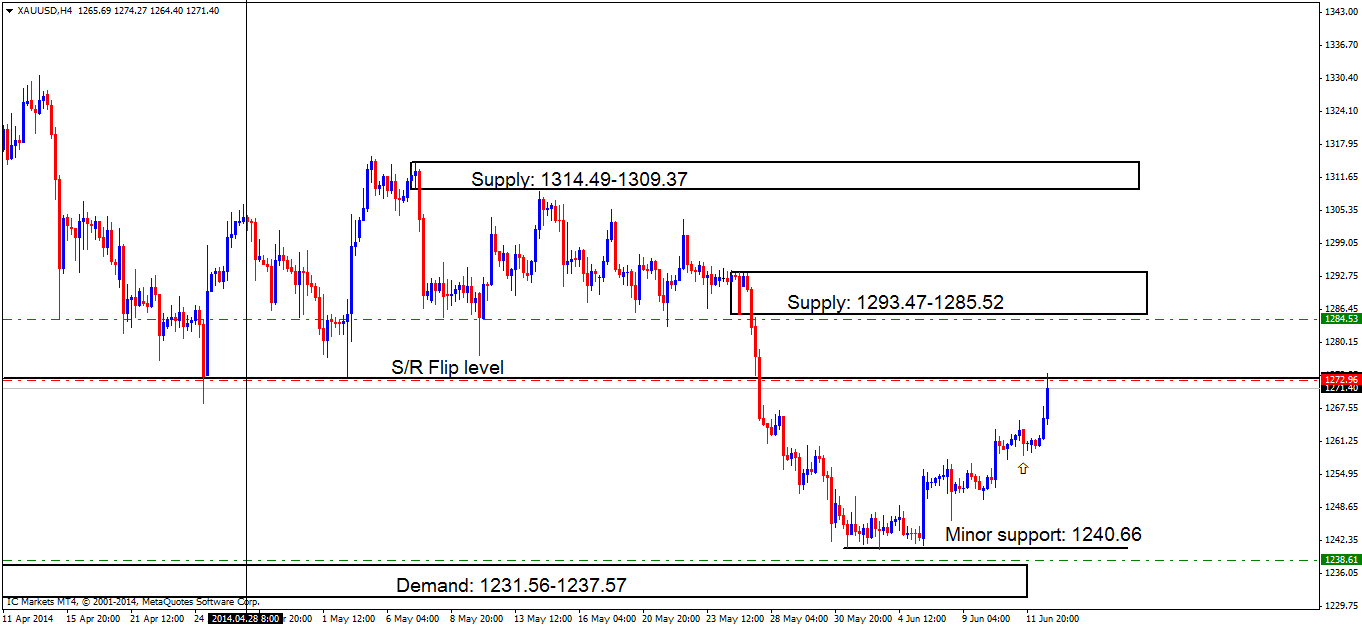

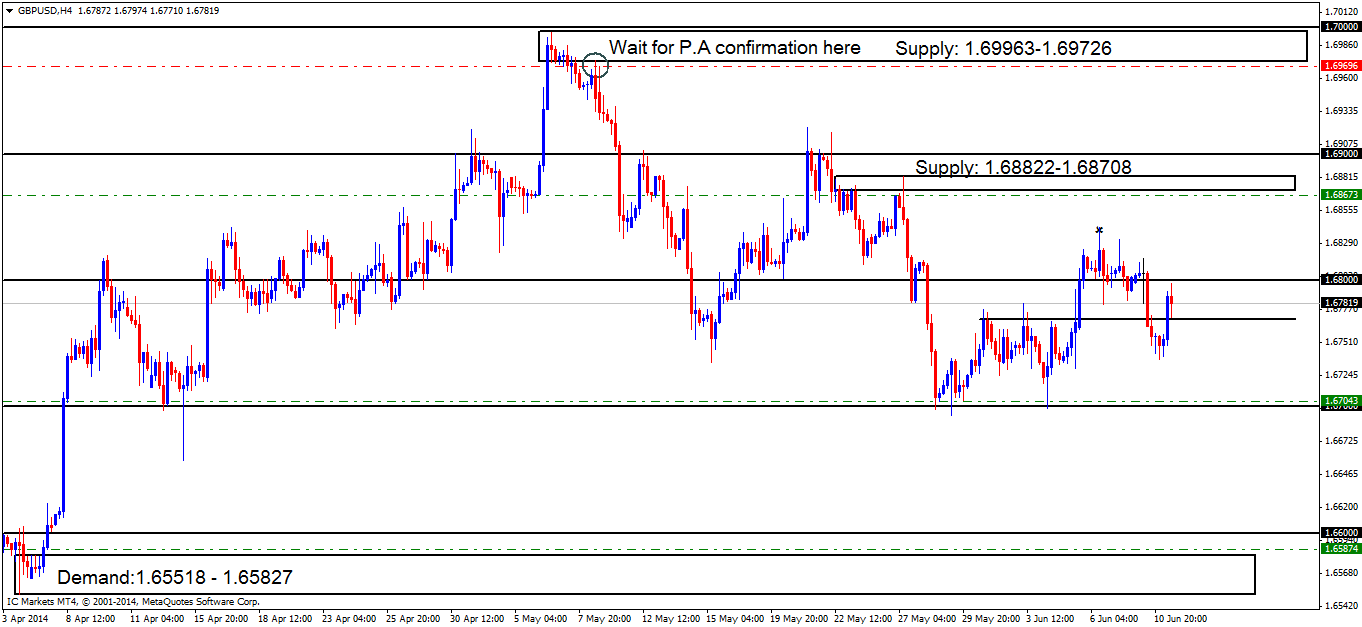

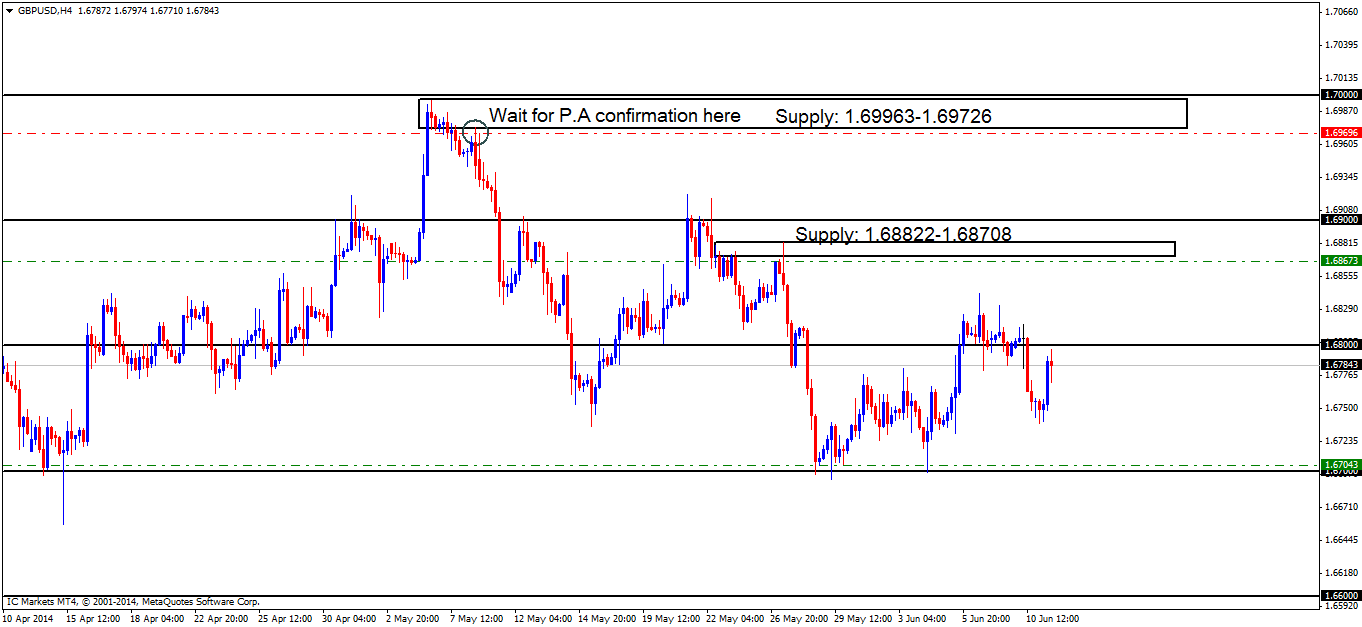

GBP/USD:

[B]4hr TF.[/B]

A sharp drop through the minor S/R flip level at 1.67686 has been seen, stopping out any buyers trying to trade long there as seen on [B]chart 1[/B].Price is now currently capped between supply at 1.68000 and demand below at 1.67000 as seen on [B]chart 2

[/B]

[ul]

[li][B]Pending buy orders[/B] (Green line) are seen below (1.65874) just above demand at 1.65518-1.65827. This area shows great potential as the momentum away from the base indicates unfilled orders may still be in play.[/li][li][B]The next set of pending buy orders[/B] (Green line) are seen just above the round number 1.67000 at 1.67043, this area will likely see a reaction due to the amount of credible touches this level has seen, making it an area to watch out for.[/li][li][B]Small P.A confirmation buy orders[/B] (Red line) that were visible at 1.67727 just above the minor S/R flip level (1.67686) have now been cancelled. Price dropped too far from the entry level and was unable to consume the high 1.68419 marked with an x, deeming this level to be invalid.[/li][li][B]Pending sell orders[/B] (Green line) are visible below supply (1.68822-1.68708) at 1.68673 due to strong momentum away from this area, indicating unfilled orders may still be hiding there.[/li][li][B]P.A confirmation sell orders[/B] (Red line) are seen at 1.69696 just below supply at 1.69963-1.69726. The reason this level requires confirmation is due to the wicks spiking the area as price left the base (circled) warning us sellers may have already been consumed.[/li][/ul]

Chart 1:

Chart 2:

[ul]

[li][B]Areas to watch for buy orders:[/B] P.O: 1.65874 (SL: 1.65472 TP: Dependent on approaching price action nearer the time) 1.67043 (SL: 1.66527 TP: [1] 1.68000 [3] 1.68708). P.A.C: No P.A confirmation buy orders are seen in the current market environment.[/li][li][B]Areas to watch for sell orders[/B]: P.O: 1.68673 (SL: 1.68846 1 TP: 1.68000 but may be subject to change). P.A.C: 1.69696 (SL: More than likely will be at 1.70030 TP: Dependent on where price ‘confirms’ the level).[/li][li][B]Most likely scenario: [/B]This pair is becoming increasingly difficult to give an accurate analysis on. Price is currently seen trading between the round number 1.68000 above and the round number 1.67000 below. Depending on what develops in the next few trading sessions, price will likely test the round number 1.67000 before completely consuming sellers at the round number 1.68000.[/li][/ul]