Trade Uncertainty and Tech Earnings Weigh on U.S. Equities

U.S. stock indices ended lower on Wednesday, failing to sustain recent gains , driven by the resurgence of trade tension and a mixed start to Big Tech earnings.

Market sentiment turned cautious following reports that the Trump administration is considering expanded restrictions on “software-enabled exports” to China , seen as a direct counter-measure to Beijing’s rare-earth export controls. Although President Trump maintains an optimistic stance, saying he “thinks we’ll make a deal” with Xi Jinping , market wariness of renewed escalation remains high. The disappointment, highlighted by Netflix’s stock plunging nearly 10% after its latest results , combined with the renewed macro risk from China, is pressuring the tech and growth sectors.

U.S. Equities Technical Outlook

-

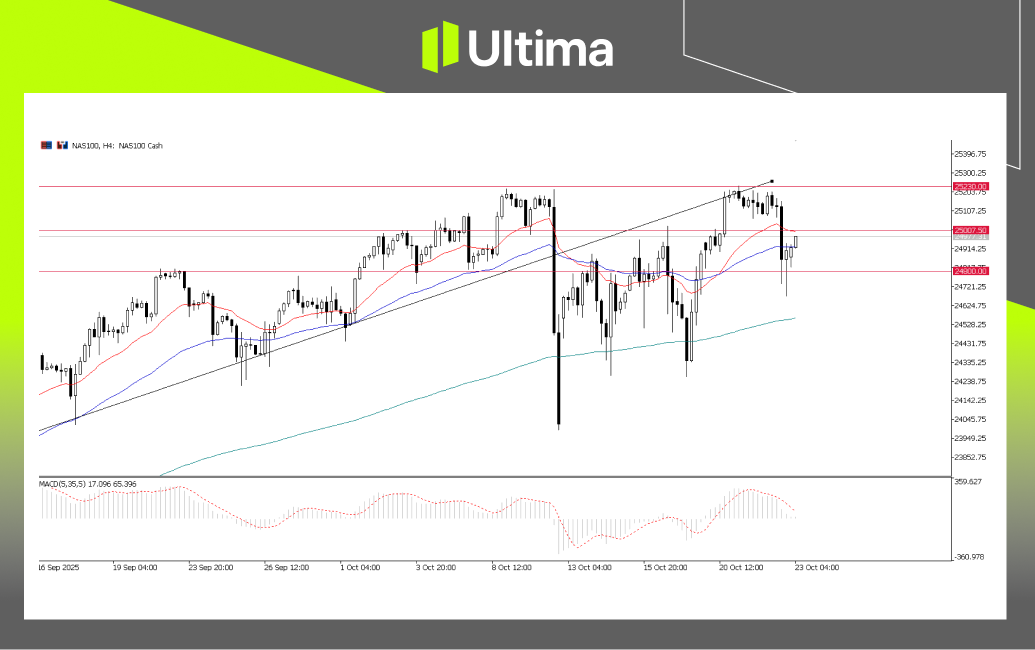

Nasdaq 100 (NAS100): Is now facing resistance near its previous record high of 25,230. Technically, the NAS100 may be forming a “double-top“ pattern, which could signal a potential downside reversal. Traders should watch whether the price remains pressured below the 25,000–24,800 zone—a failure to reclaim this area could confirm a near-term bearish shift.

NAS100, H4 Chart | Source: Ultima Market MT5 -

S&P 500 (S&P 500): The key support level remains 6,700. A break below this zone could bring renewed downside pressure; however, a sustained move above it would help maintain the current bullish structure.

SP500, H4 Chart | Source: Ultima Market MT5

Daily Market Outlook: U.S. Equities

While U.S. equities have shown overall resilience, the combination of renewed trade uncertainty and a mixed earnings outlook is beginning to cloud the upside momentum. The market’s next directional cues will likely hinge on next week’s high-level U.S.–China trade talks in Malaysia and the upcoming Trump–Xi meeting at the APEC summit in South Korea. Any meaningful progress could restore confidence; a breakdown in negotiations may trigger a deeper corrective move across equities.

Risk Warning: Trading leveraged derivative products involves high risk and may lead to capital loss.

Author:Joshen Stephen|Senior Market Analyst at Ultima Markets

Disclaimer: Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice.