US CPI strengthens expectations of rate cuts, while the European Central Bank remains cautious

Thursday’s US Consumer Price Index (CPI) data and the latest European Central Bank (ECB) decision delivered mixed signals to global markets, prompting investors to reassess the policy direction of major central banks. US inflation data was broadly in line with market expectations, and combined with recent soft labor market data, reinforced expectations that the Federal Reserve (Fed) will initiate an easing cycle in September. Meanwhile, the ECB maintained interest rates unchanged, emphasizing its cautious, “meet-by-meeting, data-dependent” approach rather than committing to a pre-set path.

US CPI data and interest rate cut outlook

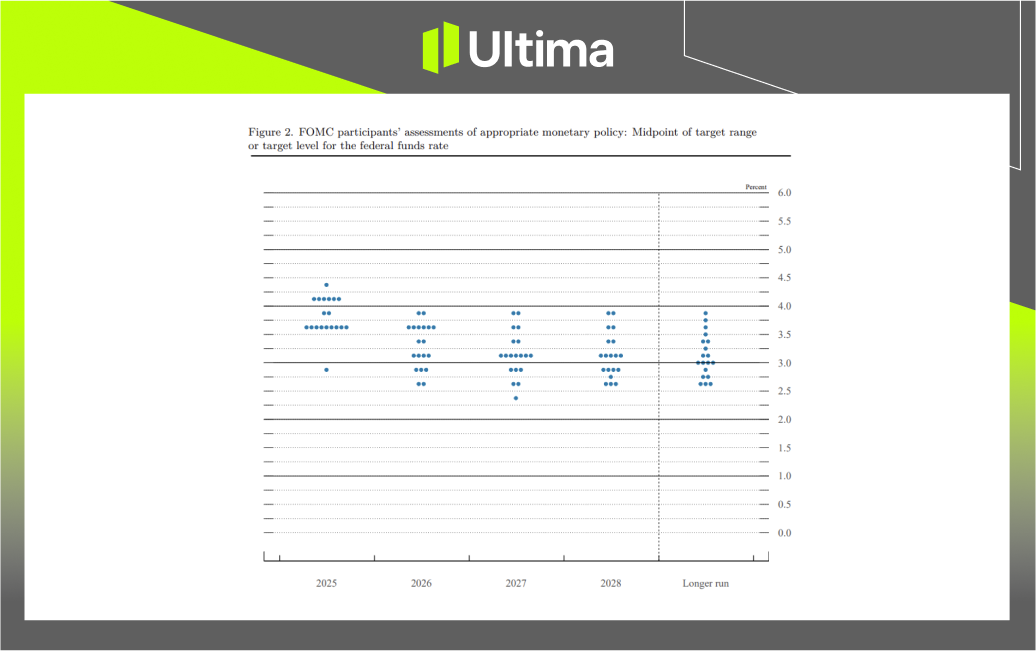

August’s US CPI data showed a slight pickup in inflation, but it remained in line with market expectations. The core CPI annual growth rate remained at 3.1% . While inflation remains above the Federal Reserve’s 2% target, the data has given the market confidence in the prospect of an interest rate cut later this year. Some analysts even believe the Fed may accept inflation stabilizing around 3% as the “new normal” in the post-pandemic era.

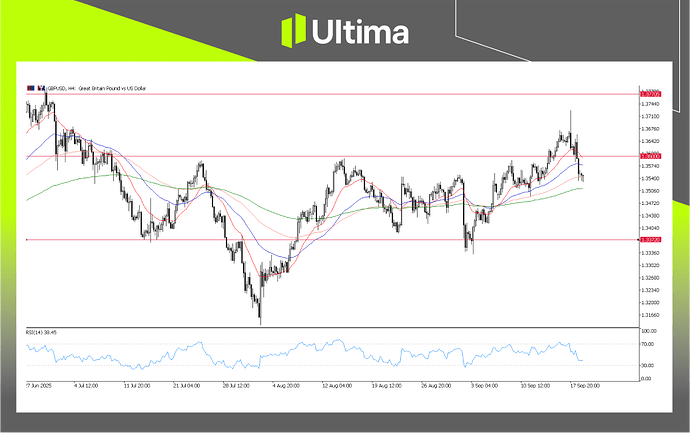

Divergence in monetary policy between Europe and the United States

The ECB’s latest decision stands in stark contrast to the Federal Reserve’s projected path. The ECB believes the Eurozone economy is resilient and expects inflation to gradually return to target. However, the bank refused to commit to a timeline for future rate cuts, which the market interpreted as a cautious stance and tempered expectations for aggressive easing.

This policy divergence is expected to be a key driver of the euro, dollar and bond market trends in the coming months.

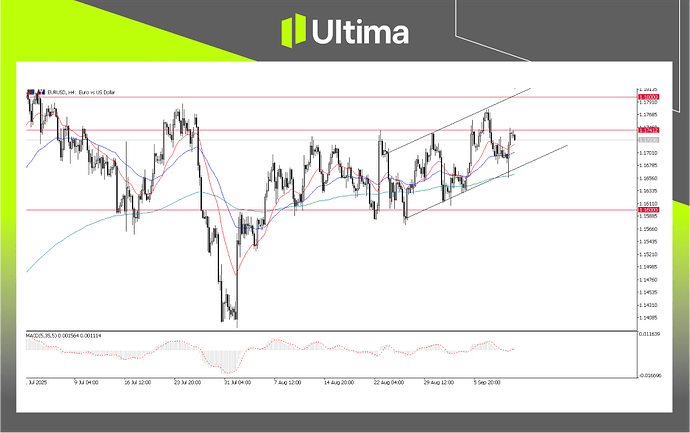

EURUSD Technical Analysis[

](https://substackcdn.com/image/fetch/$s_!5NbB!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F46d35983-3d37-4489-9a93-c4d06b4969c1_1036x651.png)Image Source: Ultima Market MT5

The Euro/US Dollar (EURUSD) exchange rate has been range-bound recently. While diverging monetary policies between Europe and the US may provide support for the Euro, technically, the pair is currently facing key resistance at 1.1740–1.1800 . A breakout above this range could open up further upside; failing to do so, the pair is expected to continue its consolidation pattern.

Risk Warning : Trading leveraged derivatives involves a high level of risk and may result in capital loss.

Author:Joshen Stephen|Senior Market Analyst at Ultima Markets

Disclaimer : The commentary, news, research, analysis, prices, and other information contained herein are for informational purposes only and are intended to assist readers in understanding market conditions. They do not constitute investment advice. Ultima Markets has taken reasonable steps to ensure the accuracy of this information, but its accuracy cannot be guaranteed and is subject to change without notice. Ultima Markets assumes no liability for any loss or damage (including, without limitation, lost profit) arising directly or indirectly from the use of or reliance on such information.