FxGrow Daily Technical Analysis – 23rd Dec, 2015

By FxGrow Research & Analysis Team

AUDCAD - highest since October 2014

Since 8 weeks there is an uptrend rally at AUDCAD. Without bigger correction price gains more than a 800 pips. Today upward movement is continued and this year’s top was broken above. AUDCAD reached a 15 months high. Correction may begin at every moment, however it is likely that current movement will lead price to supports at 1.0130 or 1.0200. If one of that levels will cause rebound, nearest support is at 0.9970 level.

Wider view, time-frame W1

So rapid movements aren’t new for AUDCAD. However current uptrend is very mature and area to which the price approached should cause a reaction of supply.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 23rd Dec, 2015

By FxGrow Research & Analysis Team

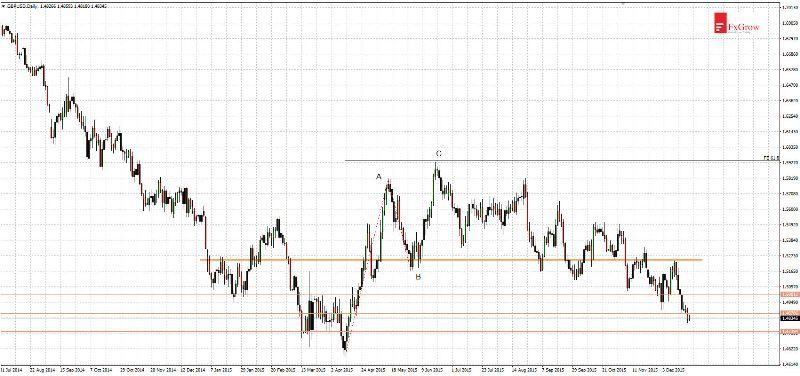

GBPUSD - 8 months low

In previous analysis from December 16 I pointed 2 supports, which could cause correction. They are at levels: 1.4870, 1.4740. First of them stopped declines for 3 days and was broken below, currently price is moving toward second one. Last 7 trading sessions finished with daily red candles, the current downward impulse is very mature. Traders are looking for rebound which should occur anytime.

GBPUSD moves in a downtrend. Upward movement from April-June took a form of simple ABC correction with a Fibonacci extension C = 61,8% A. If supply will break below that support price will test this year’s low area 1.4600. It is likely that 1.4740 level will cause a rebound which could reach one of the resistances: 1.4870, 1.50000, 1.5120.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 23rd Dec, 2015

By FxGrow Research & Analysis Team

GBPCAD - double top pattern in progress

Since August 2013 there is an uptrend at GBPCAD. Resistance which price already reached caused multiple rebounds between years 1994 and 2007. For that reason it is likely that attempt of fast break above that level will be very hard. For the first time in this year 2.0930 made rebound at August 2015 and 2 weeks ago second attempt failed.

Double top pattern can be seen on the chart and it may induce bigger correction. Currently nearest support at 2.0630 level stopped declines. If supply will be able to break below that level next target for falls are at 2.0320, 2.0000 and strongest support at 1.9850 level. Alternatively, if this year’s high will break above new upward impulse will got a chance to reach to support 2.1400.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 28th Dec, 2015

By FxGrow Research & Analysis Team

EURUSD - movement in consolidation

Since December 3 EURUSD moved in a range where its volatility stabilized. Price moves between 1.0800 - 1.1055. Christmas season caused even more reduction in price volatility. Since 5 sessions movement is equal to 100 pips and lasts between support 1.0870 and the resistance 1.0977.

Today 1.0977 level was tested. If demand breaks above this resistance next targets will be at levels: 1.1027, 1.1055, 1,1120. The strongest one form that levels is December’s high 1.1055. However if rebound occurs nearest supports will be at levels: 1.0905, 1.0870, 1.0835, 1.0800. It is likely that 1.0800 (December’s 7 low) won’t be easily broken but if it occurs next support will be located at 1.0730 level.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 28th Dec, 2015

By FxGrow Research & Analysis Team

USDJPY - support stopped declines. For how long?

Strong falls which took since the beginning of December were corrected and price returned to December’s downtrend. Upward movement (correction) which started December 14 was very dynamic, however it took form of ABC simple correction. In this case upper limit of length C was little higher than A=C. This fact and today’s test of 2-months low confirms the downward scenario. If level 120.040 will be break below it is likely that declines will test 118.600 level. Alternatively if today’s rebound will be continue nearest resistance is located at 123.500 level.

Wider view, time-frame D1

USDJPY in entire 2015 year moved in consolidation between levels: 116.00 - 125.70. While in the earlier period between October 2012 and December 2014 the price has gained more than 50%. Currently it is likely both: trend reversal or new uptrend impuls. Key levels for further direction are levels 116.00 and 125.70. Break one of that levels should start new impuls.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 28th Dec, 2015

By FxGrow Research & Analysis Team

NZDUSD - key resistance

Today NZDUSD reached to a key resistance, which is located in area 0.6900. That level is strenghtened by downtrend line and Fibonacci 50% level. Since mid-November price moved in upward channel and succesfully break above that level should lead price to the next resistance at 0.7180 level. However if price will rebound (it is more likely) nearest support is at 0.6760 level.

Wider view, time-frame W1

For 1,5 years price moved in downtrend. Low was established August 24 and there are no new lows. Today demand has attempted to break above downtrend line and gain 6-months high. Supply will definitely try rebound at this level, but if fail there could be a fester upward movement or even a long term trend reversal.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 29th Dec, 2015

By FxGrow Research & Analysis Team

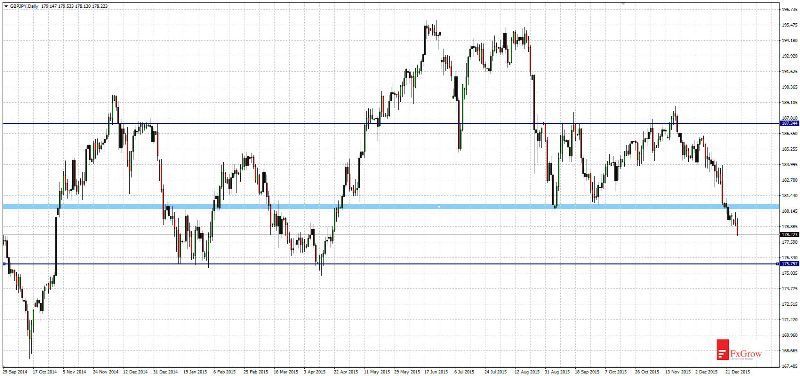

GBPJPY - next break 175.80

In longer term there in an uptrend at GBPJPY however current price behaviour shows that right now correction may be deeper. For 3 years GBPJPY moved in an upward trend and in this particular time it gained 50% of its value.

For this year’s holidays situation looks worst. Price didn’t established new highs. Last weeks was very important for further direction of price movement. In last week price broke below support from August. Today supply continue its downward rally reached 8-months low. Nearest support is 177.60 level. However stronger support which should make rebound is at 175.80 level. Alternatively if rebound occur, resistances are located at levels: 180.60, 184.20, 187.40.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

[QUOTE=FxGrow Support;739527][B]FxGrow Daily Technical Analysis

im shooting for 1.08686 but got a little nervous since 1 hr chart has potential for long trades

FxGrow Daily Technical Analysis – 30th Dec, 2015

By FxGrow Research & Analysis Team

GBPAUD - 6-months low

GBPAUD declines since August 015. Previous upward movement is corrected (it took place between September 2014 and August 2015). Price broke below Fibonacci 38,2% and declines continued (six months low was reached).

Nearest support is 2.0000 and it is target for declines. However it is more likely that rebound will take place at lower level. Stronger support that coincides with Fibonacci 50% is at 1.9800. This level should be a good spot for a rebound. If demand tries to finish this correction and return to uptrend, price will need to break above 2.0450 level.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 04th Jan, 2015

By FxGrow Research & Analysis Team

AUDJPY - attempt of break below the lower limit of the flag pattern

Since August AUDJPY moved in a flag pattern. Flag is a pattern of trend continuation which means that price should break below lower limit of the flag according to a main downtrend. Today there was an attempt of such breakout and price is at two months low.

Break below that level during today’s session may not be successful because at 85.60 there is a support, where price may rebound. However when that support will be broken, price should go back to downtrend. Nearest supports: 85.60, 84.70, 83.60, 82.20. Nearest resistances: 86.80, 88.30, 90.30.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 04th Jan, 2015

By FxGrow Research & Analysis Team

NZDCAD - correction may lead to 0.9000

In previous analysis December 18 entitled: “upward rally is coming to an end?” I pointed that correction may occur because of overbought at NZDCAD. So it happened however correction has started 100 pips above level that I pointed in that analysis. At December 29 at daily chart there is a PIN BAR candle which tested area of highest level of 2015. Since that moment price falls.

Today price is testing 93.70 level however it is likely that falls will be deeper. If current support will be break below next supports are located at 92.20, 91.10, 90.10. It is likely that price will test 0.9000 level. This area is strengthened by support and Fibonacci 61,8% level of previous upward movement. Alternatively if demand is still strong after short correction price could begin consolidation below 2015 top.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 05th Jan, 2015

By FxGrow Research & Analysis Team

GBPJPY - it is time for a rebound

Last week analysis brought a good profit. When price was at 178.22 I pointed that falls will continue in analysis entitled “next break 175.80”. Currently price reached the support in area 175.50 where exchange rate reacted many times between December 2013 and April 2015. It is likely that rebound will occur at current level and further price direction will depend on that rebound strength. However if GBPJPY breaks below this support it will be a confirmation of deeper correction or even a trend reversal. Strong rebound from this support with new local high will be a signal that correction is over and price will return to uptrend.

Wider view.

Since 2012 GBPJPY moved in an uptrend but last six months was highly problematic for demand and achieving new highs. Last time new high was approached in June 21 2015 at 195.87 level and after that price moved with lower highs and lower lows. It is a confirmation that correction is in progress or even a trend reversal.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

[B]FxGrow Daily Technical Analysis – 05th Jan, 2015[/B]

[I]By FxGrow Research & Analysis Team[/I]

[B]EURUSD - consolidation breakout[/B]

Since December 4 EURUSD moved in consolidation between levels: 1.0800 - 1.1040 (blue lines at the chart). Today price broke below lower consolidation band and immediately price broke two nearest supports: 1.0780, 1.0730. Direction of movement is in line with fundamentals which means a politics of both central banks. Dovish EBC and hawkish FED should cause euro depreciation against the dollar what could be seen on today’s chart.

Next supports are located at levels: 1.0680, 1.0630, 1.0560. Currently it is likely that price will return and test lower limit of consolidation at 1.0800. If demand moves back inside the consolidation, then breakout will be a fake one. However if this scenario won’t succeed and price will rebound, then the lows from 2015 should be tested.

[B][I]For more in depth Research & Analysis please visit FxGrow.[/I][/B]

[I][B]Note:[/B] This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.[/I]

[B]FxGrow Daily Technical Analysis – 06th Jan, 2015[/B]

[I]By FxGrow Research & Analysis Team[/I]

[B]EURJPY - approached important support[/B]

The beginning of the year for EURJPY brought 3 sessions of consecutive declines. Price is at lowest level since April 2015. EURJPY moved the entire 2015 inside consolidation without clear trend between 126.10 - 140.50 levels. Rebound may occur in a moment. Key level which should bring demand reaction is located near 126.50. However if rebound won’t succeed and declines will continue (what is currently less likely) break below 126.00 level will confirm that EURJPY is in a downtrend.

[B][I]For more in depth Research & Analysis please visit FxGrow.[/I][/B]

[I][B]Note:[/B] This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.[/I]

[B]FxGrow Daily Technical Analysis – 06th Jan, 2015[/B]

[I]By FxGrow Research & Analysis Team[/I]

[B]

USDTRY - return above 3.0000[/B]

Since more than 5 years USDTRY moves in an uptrend. In September 2015 price reached 3.0000 level and after creation of the double top pattern correction occured. Correction lasted one month and took a form of ABCD simple correction with AB=CD dependence. Since bottom in November 2 price moved upward with higher highs and higher lows.

Today USDTRY broke above key level 3.0000. Next resistances are located at 3.0280, 3.0610. If price will break above last top at 3.0750 it will be a signal for a new uptrend impulse. Alternatively if current breakout won’t succeed and price will fall below 3.0000 nearest supports are located at levels: 2.9850, 2.9400, 2.9050.

[B]Time-frame H4[/B]

[B]Time-frame D1[/B]

[B][I]For more in depth Research & Analysis please visit FxGrow.[/I][/B]

[I][B]Note:[/B] This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.[/I]

[B]FxGrow Daily Technical Analysis – 07th Jan, 2015[/B]

[I]By FxGrow Research & Analysis Team[/I]

[B]GBPUSD - at key support[/B]

Hawkish FED strengthened dollar at all of the fronts. Yesterday FOMC minutes were published and they confirmed FED’s members unanimity in the matter of rates hike. There is 45% chance of next rate hike during March’s meeting.

Due to this fact, GBPUSD fell to last year’s low. If attempt of support breakout at 1.4600 succeeds next support will be find near 1.4250 - 1.4400 area (2010 low). If that level also breaks, historical low from 2009 at region 1.3500 will become a next support. However if price rebounds from current support, nearest resistances are located at levels: 1.4740, 1.4820, 1.4940.

[B][I]For more in depth Research & Analysis please visit FxGrow.[/I][/B]

[I][B]Note:[/B] This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.[/I]

[B]FxGrow Daily Technical Analysis – 07th Jan, 2015[/B]

[I]By FxGrow Research & Analysis Team[/I]

[B]USDJPY - movement to 116.00[/B]

USDJPY continues downward movement which lasts since early December with a short break. It should be noted, price is oversold and since two weeks there wasn’t any correction. However today’s low could be deepened. Yesterday’s support at 118.70 was broken and that fact showed some consequences today. Strong downtrend candle broke below 4-months low and currently 2015 low (area 116.00) is a bearish target.

It is likely that weak correction may appear and 118.70 will be tested. If there will be a rebound at 118.70 level price will fall to 116.00. Behavior of price at this level will be important for further direction of USDJPY movement. Breakout of one year’s low will give a strong sell signal and a trend reversal in the long term.

[B][I]For more in depth Research & Analysis please visit FxGrow.[/I][/B]

[I][B]Note:[/B] This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.[/I]

[B]FxGrow Daily Technical Analysis – 08th Jan, 2015[/B]

[I]By FxGrow Research & Analysis Team[/I]

[B]AUDCAD - support at 0.9870 paused correction[/B]

Previous analysis was extremely precise. I pointed that currency is overbought and correction may occur in a moment, I wrote: “Correction may begin at every moment, however it is likely that current movement will lead price to supports at 1.0130 or 1.0200. If one of that levels will cause rebound, nearest support is at 0.9970 level”. So it happened and price shadow (wick of the candle) exceeded firstly pointed level about 37 pips and dynamic correction occured.

AUDCAD doesn’t like movement in consolidation and by the fact, that upward move which lasted since the beginning of November was almost vertical now correction could be also dynamic. First support at 0.9970 was broken below and a pause in declines caused second support test at 0.9870. If there will be a breakout of that level next stronger support is located in 0.9730 area (conicided with Fibonacci 50%). At one of that supports rebound should occur and it shows current strength of demand.

[B][I]For more in depth Research & Analysis please visit FxGrow.[/I][/B]

[I][B]Note:[/B] This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.[/I]

[B]FxGrow Daily Technical Analysis – 08th Jan, 2015[/B]

[I]By FxGrow Research & Analysis Team[/I]

[B]EURGBP - triple top pattern[/B]

Today’s nonfarm payrolls data were extremely calm, despite that the forecasts were completely different. Unemployment in USA remained at 5% and US economy created almost 50% more work places in nonfarm sector than it was forecasted (292k vs 200k). EURGBP chart looks really interesting, where price (since last year’s April) for the third time reached resistance 0.7480 and rebounded again.

Right now we can see triple top pattern, which is a declines signal. This time demand should try another attack at this resistance and it can even reach again to yesterday’s high. At time-frame H4 the possibility of rebound is confirmed by yesterday’s candle with a long upper shadow. Nearest supports: 0.7420, 0.7320, 0.7250. Key resistance at 0.7480 level.

[B]Time-frame D1[/B]

[B]Time-frame H4[/B]

[B][I]For more in depth Research & Analysis please visit FxGrow.[/I][/B]

[I][B]Note:[/B] This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.[/I]

[B]FxGrow Daily Technical Analysis – 11th Jan, 2015[/B]

[I]By FxGrow Research & Analysis Team[/I]

[B]EURJPY - support reacted, it is time for a bigger rebound[/B]

Last week analysis was very profitable. In analysis entitled: “EURJPY - approached important support”, I wrote: “Rebound may occur in a moment. Key level which should bring demand reaction is located near 126.50”. In fact rebound occurred 50 pips above that level and signal to take the long position was OUTSIDE BAR price action pattern. It is visible at chart H4 (pointed by arrow). Low of that pattern was deepened by long shadow (it required wider SL or renewed long position), after which upward movement continued to first resistance at 128.80.

If this resistance breaks next target for bulls will be located at 129.80, 130.75. However if declines shows once again, supply will want to test area 126.50 and there should be stable rebound.

[B][I]For more in depth Research & Analysis please visit FxGrow.[/I][/B]

[I][B]Note:[/B] This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.[/I]