FxGrow Fundamental Analysis – 07th Nov, 2016

By FxGrow Investment Research Desk

HOW TO TRADE THE US PRESIDENTIAL ELECTIONS?

The presidential US election is knocking on doors. On 8th of Nov, US citizens will have the final decision on whom shall lead the free world. Either Mrs. Clinton representing democrats will stay in white house, or Mr. Trump on behalf of republican will have the upper hand. Along comes questions and debates on US future performance, especially economic sector. Traders, analysts, and financial sectors have their eyes focused on possible outcomes incase either of Trump or Clinton win. Why is that? We will try to break it into simple, reasonable point of views and avoid complications and sophistications.

First, each candidate has his/her own agendas with major decisions on behalf of internal affairs, economic and private sectors, and foreign policy. Any decision can have major layout on economic sectors whether it’s direct or indirect, related on or not related to the economy, if not on the short run, then on the long run as a chain or reactions.

Second, each candidate has his/her own advantages and disadvantages.

Third, as we have mentioned in a previous article on FxGrow’s blog, Fed rate hike is inevitable no matter what, and as long as the US economy is growing and enhancing, the Fed rate increase will be postponed. Well now comes a new catalyst into the equation, the US election. In the article, we gave a hint that federal rates are to be increased in December, maybe that’s the reason why in December. Thus after the election and further data coming this month, US economy would show further signs on the election-economical-outcome, thus determining how far will federal officials go when it comes to increasing rates.

What will happen if Trump wins?

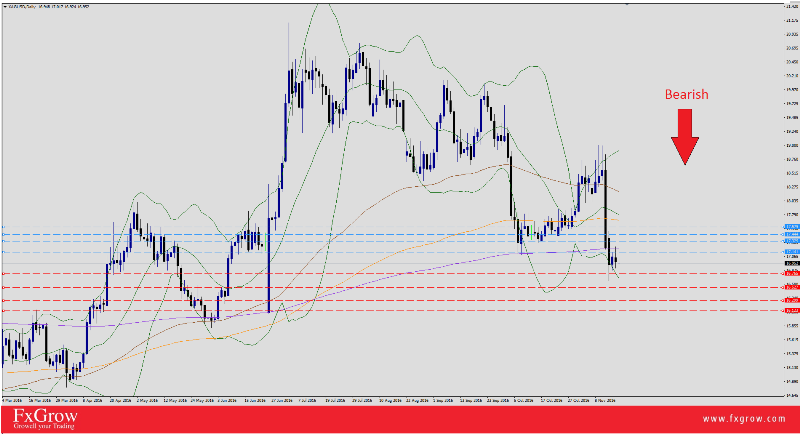

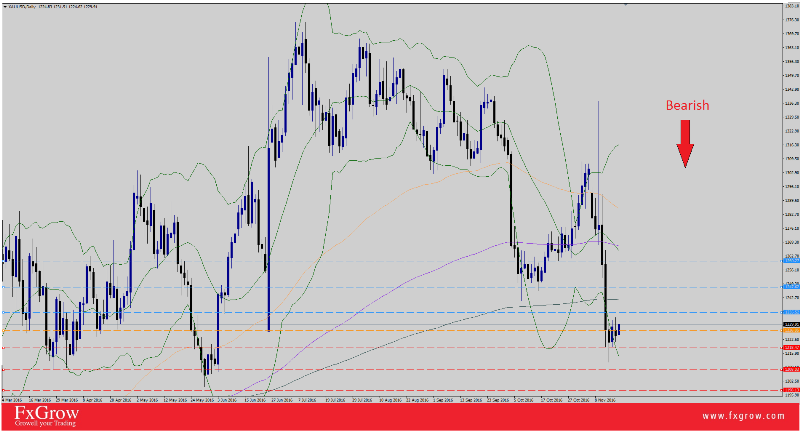

Donald Trump has repeatedly issued statements that are racist, Islamophobic, xenophobic and misogynistic. He constantly criminalizes people of color and has proposed banning Muslims from the country and enacting a deportation force. Analysts at Credit Suisse have downgraded their outlook for the dollar in 2016 and communicated the emergence of a potential new threat to the currency - Donald Trump could be the next big headache for dollar bulls in 2016. If Trump is elected and brings anti-social trading policies which isolate the country from the international community, foreign investors may start to sell their US assets in abundance. Trump drags a gray cloud along with the possibility of him being triumph when it comes to US dollar performance. Last week, US dollar started to show weak signals facing its rivals on US election suspense showing that Trump and Clinton are leading together.

Clinton on the other hand:

Analysts justifies the US dollar weaker movement in past days is that it’s only the election suspense itself, neither Trump, nor Clinton are the reason.

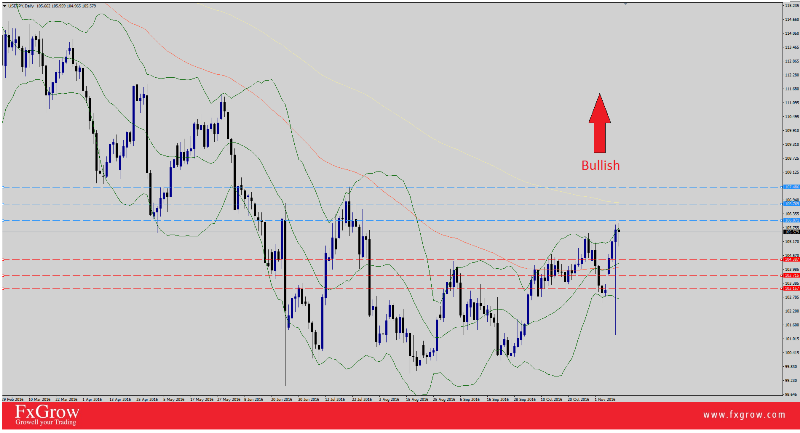

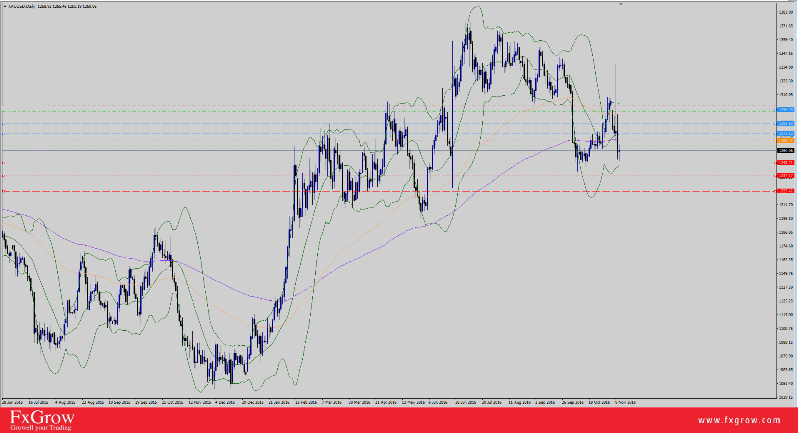

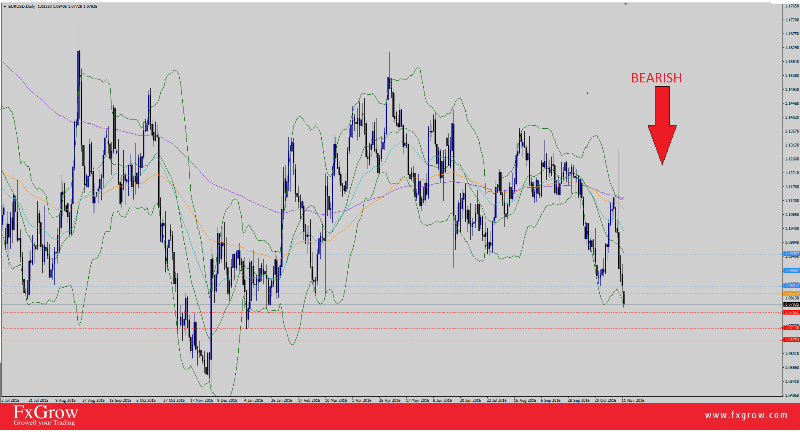

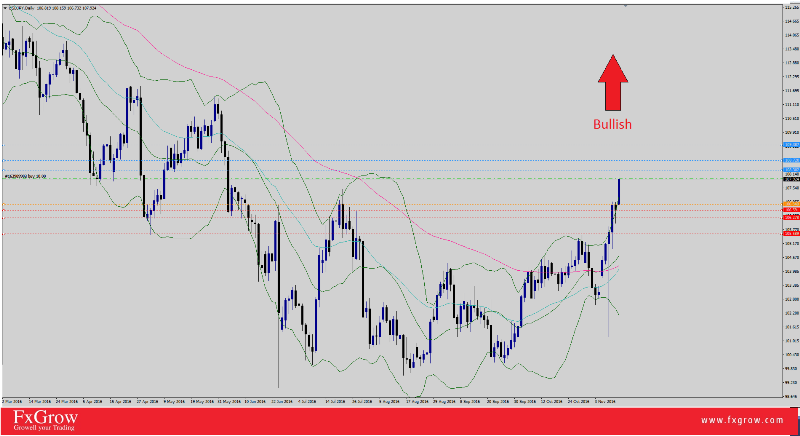

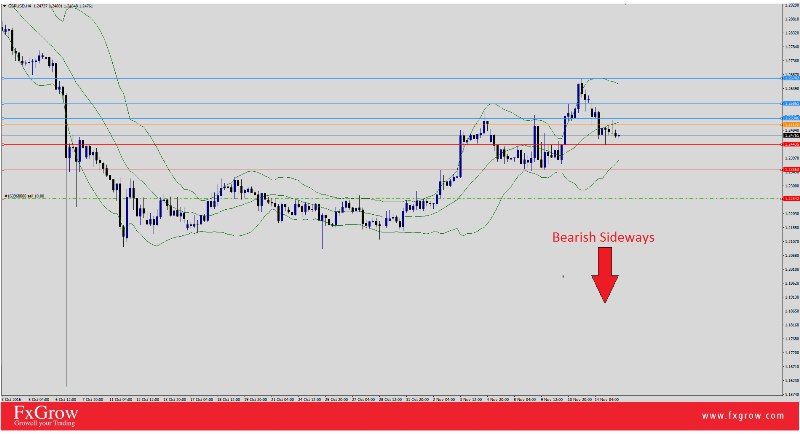

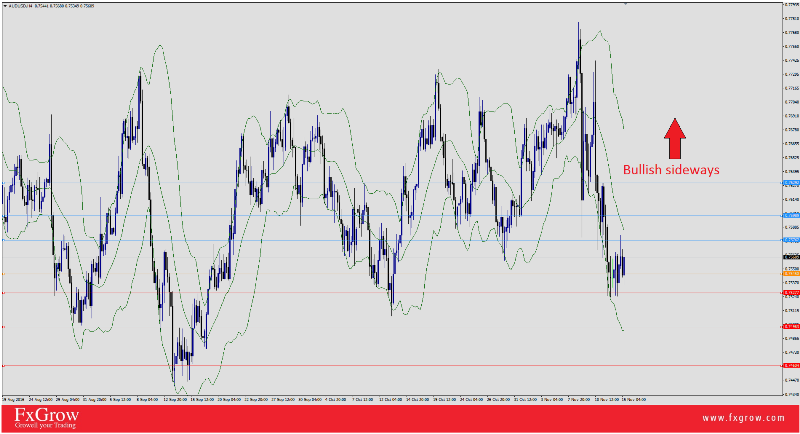

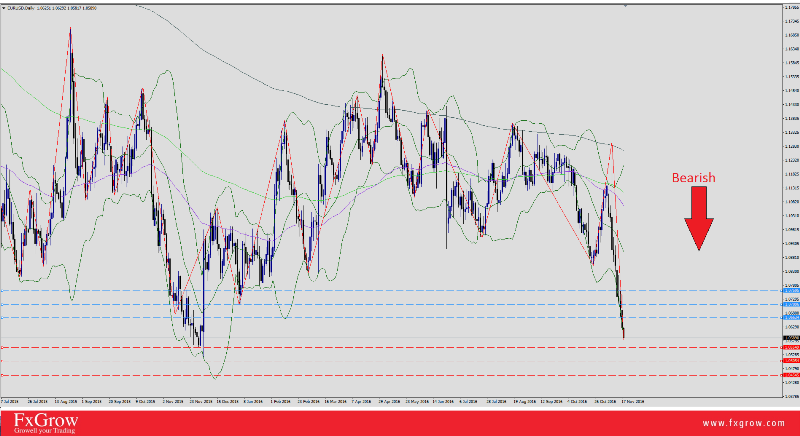

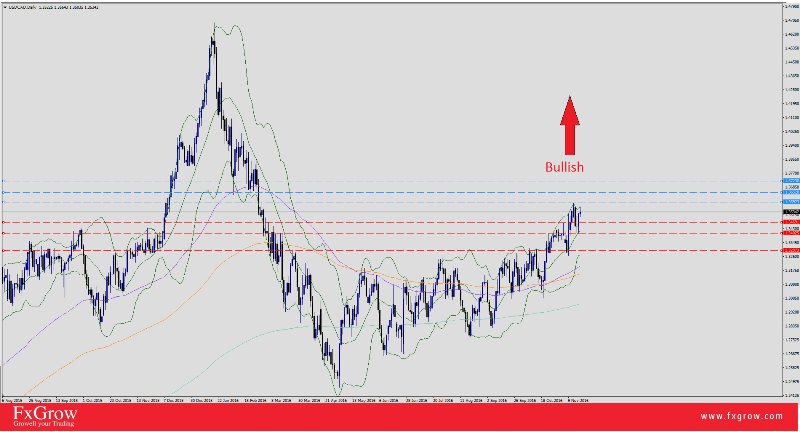

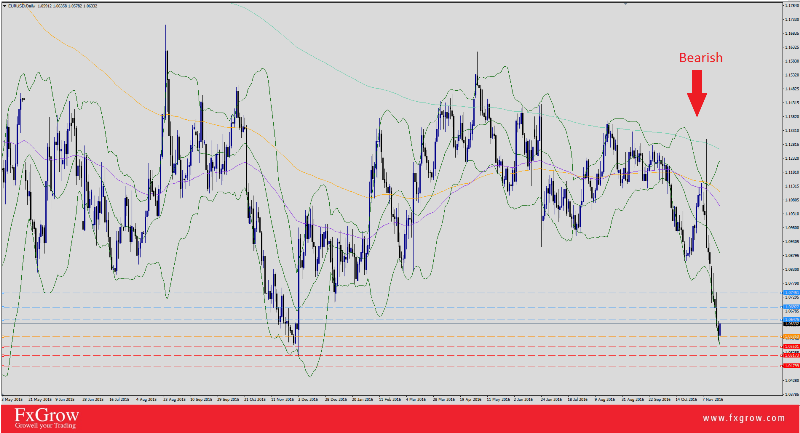

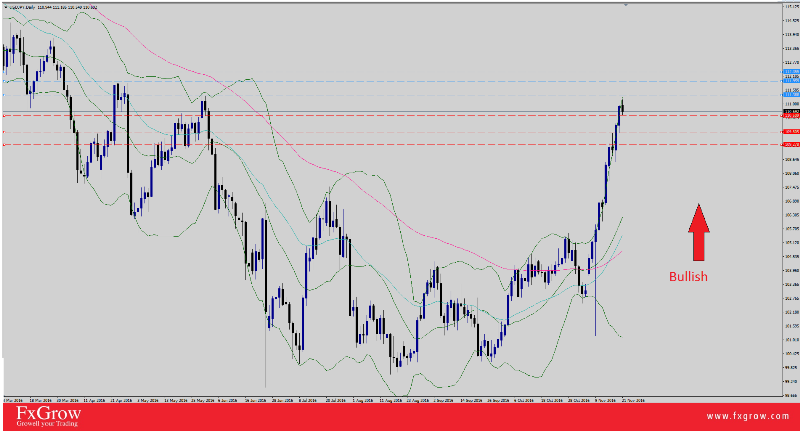

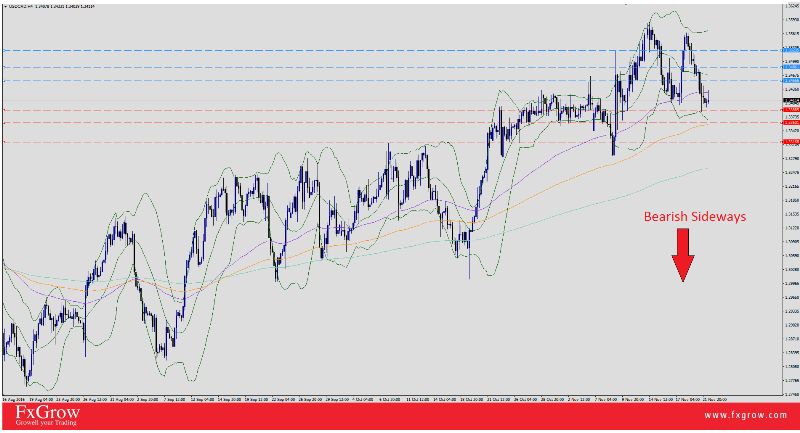

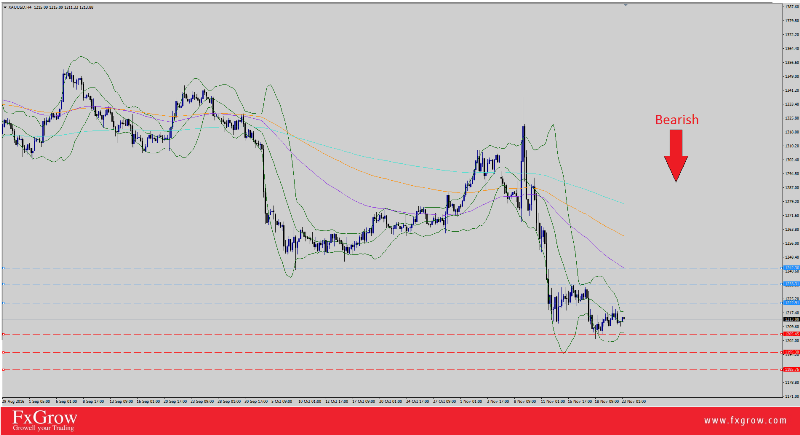

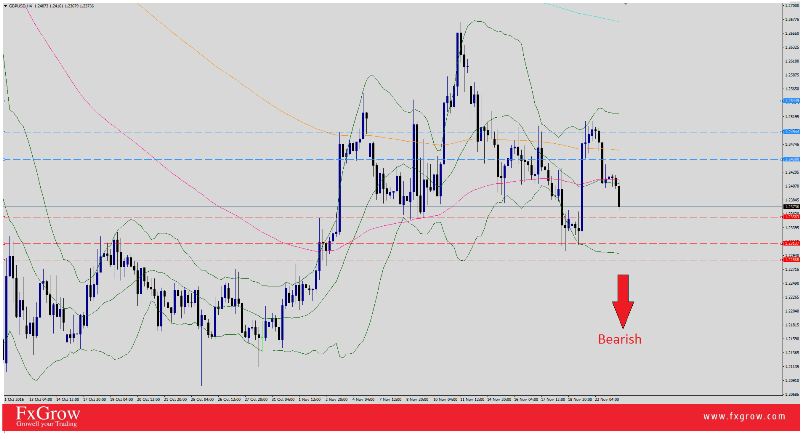

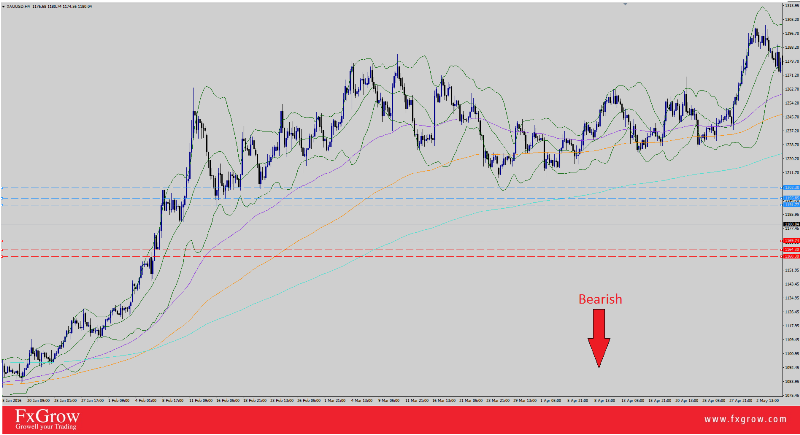

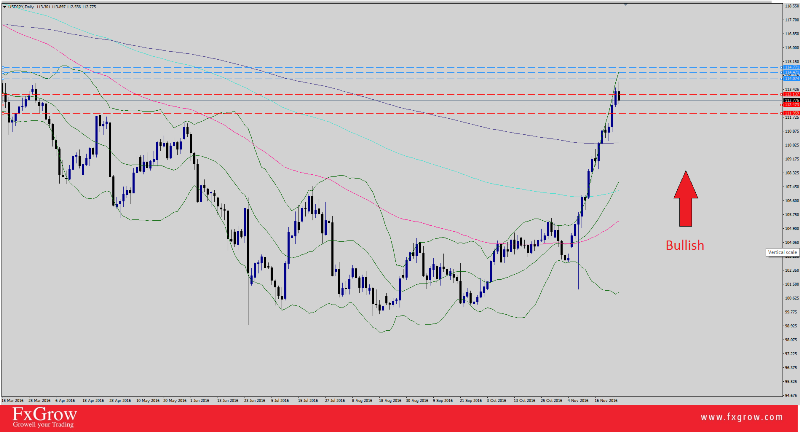

Since last week, US dollar index has tumbled from 99.09 high to 97.11 (today’s low). Gold, Japanese Yen, Canadian dollar, Aussie dollar, Kiwi, even Sterling has strengthen facing its US dollar rival. Forex market is highly volatile these days and expected to extend volatility until Election Day and after that briefly.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.