FxGrow Daily Technical Analysis – 25th Nov, 2016

By FxGrow Research & Analysis Team

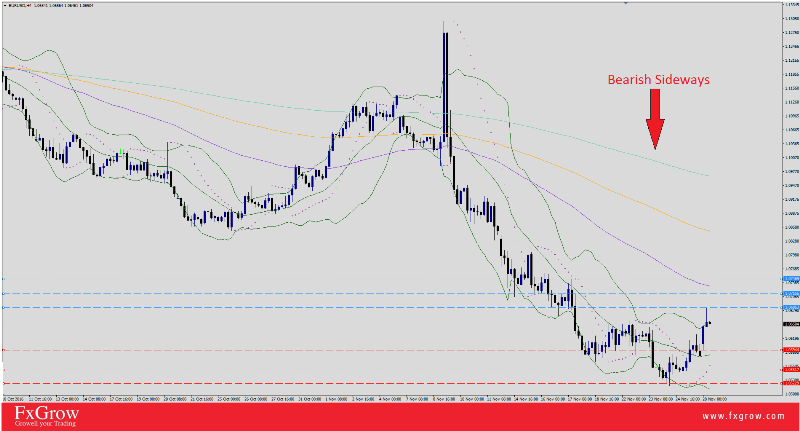

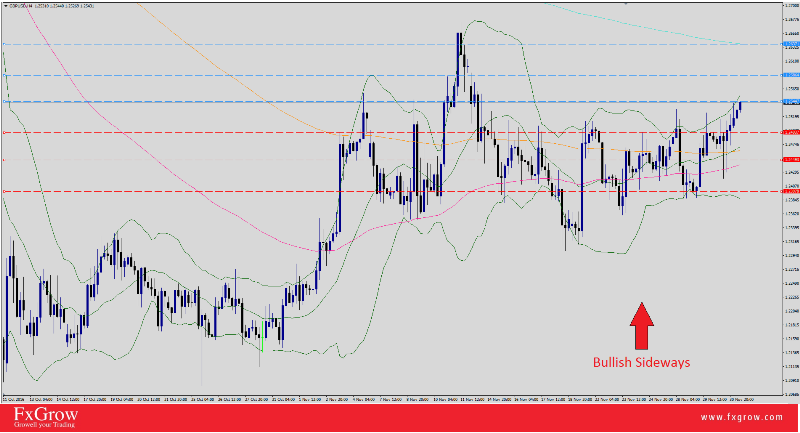

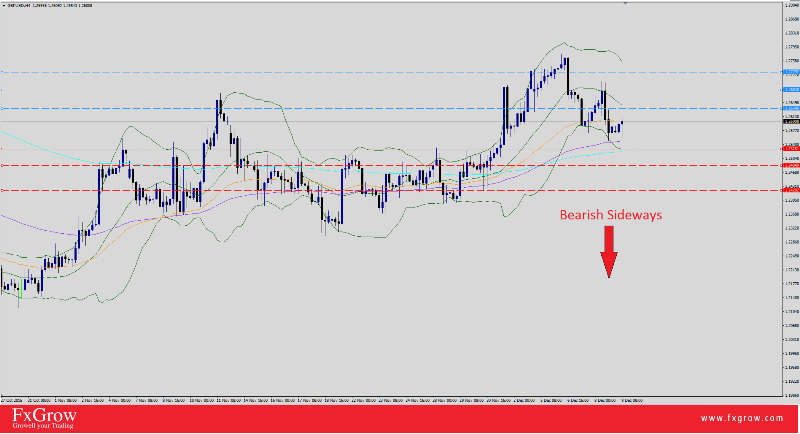

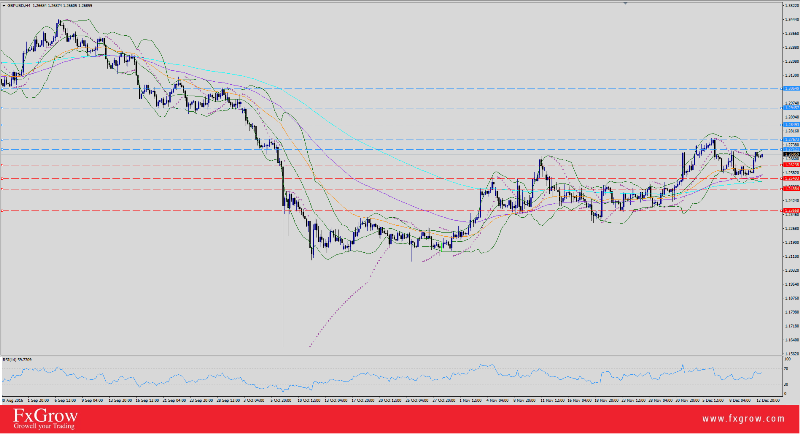

GBP/USD IMMUNE TO DOLLAR PUSHING HIGHER, AWAITING Q3 GDP

GBP/USD is neutral since today’s opening trading sessions. The pair seems to be confused between 1.2428 low and 1.2457 high zone. Although US Dollar is hiking at a fast pace, peeking at new highs 102.11, the British Pound was immune against losses and it seems it to have picked up significant strength facing it’s USD rival. Right now, US index retreated to 101.71, still to be considered high relative to previous trading sessions, and the pair is closing to today’s high, currently trading at 1.2452 above weekly pivot at 1.2419. Also, traders should pay attention to 100 SMA at 1.2461 which to be considered a strong point in case the pair touches it. British Pound has a chance now in absence to US economic news to reclaim some gains and dignity as Sterling awaits second estimate GDP data, scheduled to be released at 9:30 AM GMT today.

Key levels to watch : Weekly Pp 1.2419

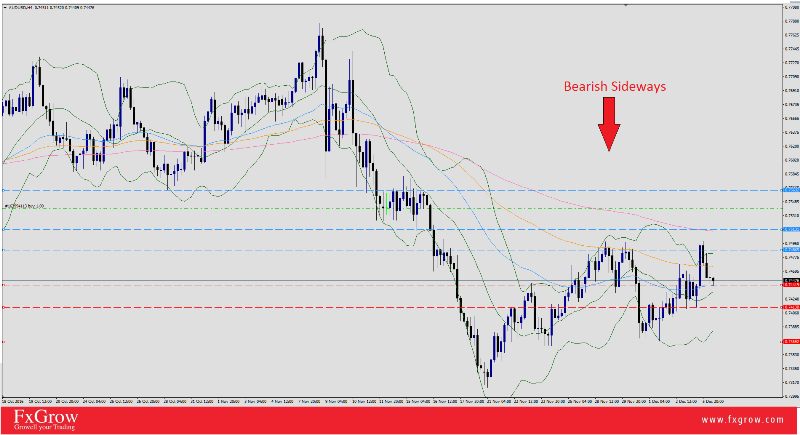

Trend: Bearish sideways

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.