FxGrow Daily Technical Analysis – 16th Dec, 2016

By FxGrow Research & Analysis Team

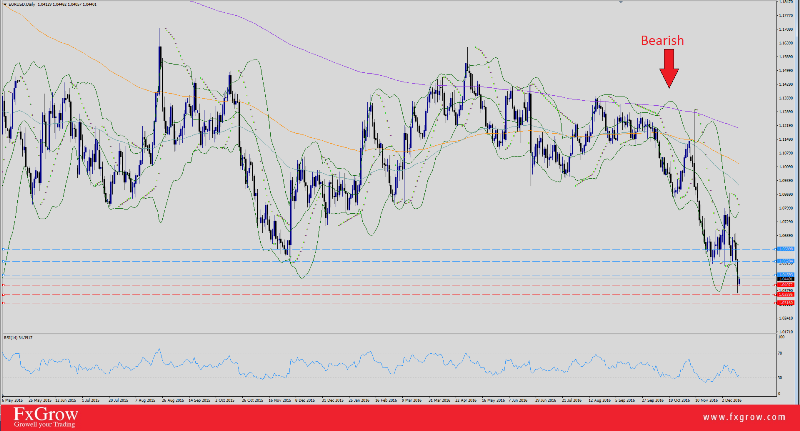

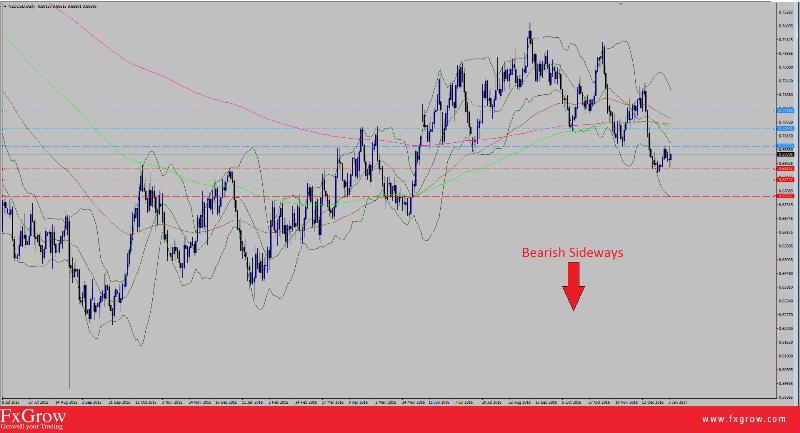

EUR/USD Extends Comatose Further More, Awaiting Local Data

EUR/USD is on a roller coaster since last Wednesday after a peek at 1.0872, market couldn’t swallow ECB decision on zero change-bid-rate and extending bond purchasing further more with a 20B Eur cut from initial 80B Eur. The pair collapsed on Thursday hitting rock bottom at 1.0530. EUR/USD didn’t stop at that stage as the pair declined further more after a 0.25% hike on US Fed rates given US dollar additional boost. EUR/USD sank to 1.0365 yesterday, then re-bounced as a short term correction, currently trading 1.0438 intraday. US index hiked to 103.56 2003-March-fresh-highs yesterday then retreated to 102.97 today. EUR index hit rock bottom at 85.77 2016-fresh-low, currently trading 86.29 intraday.

Trend : Bearish , the downside prevails.

Resistance Levels : R1 1.0461, R2 1.0543, R3 1.0628

Support Levels : S1 1.0407, S2 1.0359, S3 1.0316

Remark : Key resistance at R1 1.0459. Short positions below R1 will set an alarm to support levels. A full H4 candle above 1.0459, look further for bull moves towards R2. Look forward for economic news which will give a better outlook for the cable.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.