FxGrow Fundamental Analysis – 23rd Feb, 2017

By FxGrow Investment Research Desk

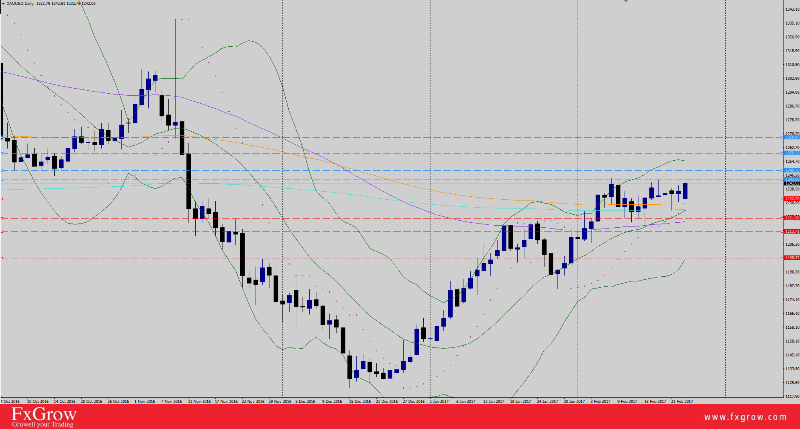

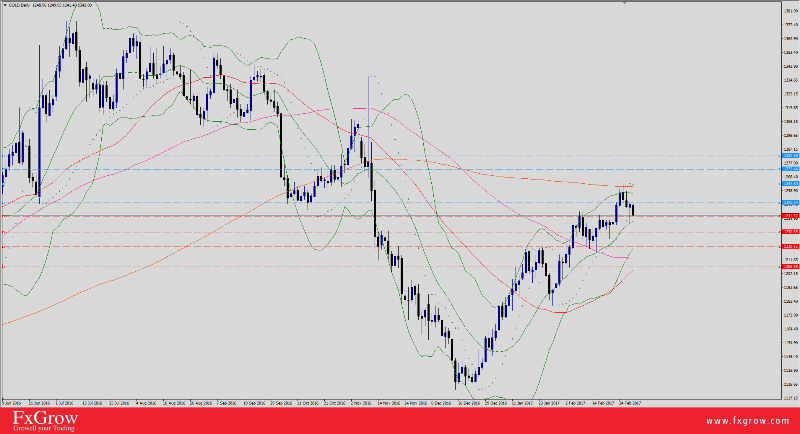

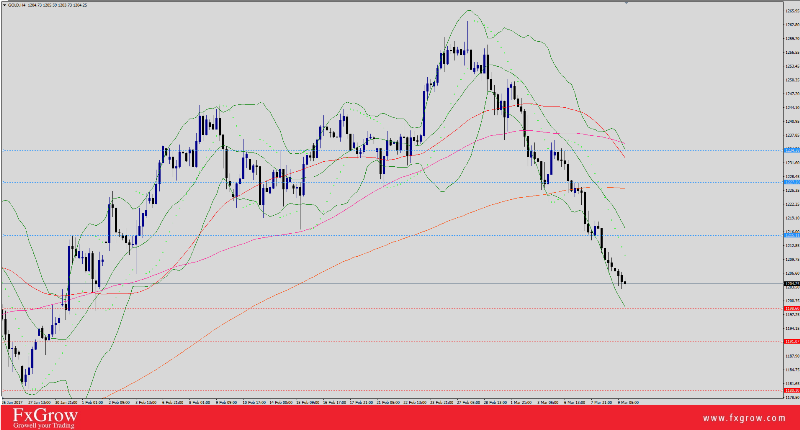

Gold Dodges FOMC’s Strike, Awaiting US Unemployment Claims

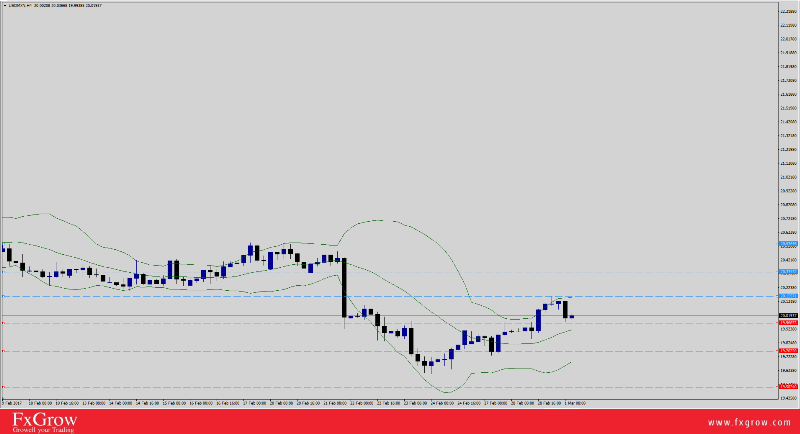

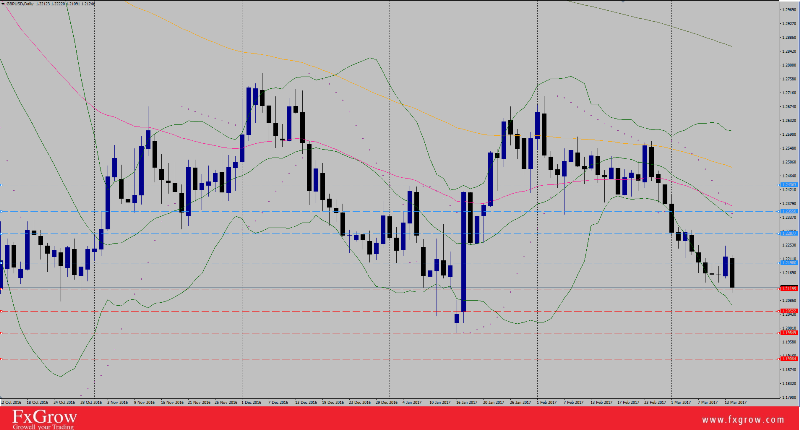

Gold has successfully sustained 1230 levels yesterday after FOMC minute meeting ended with ambiguous hints that US fed rates hike is inevitable without any specifications on date and time, but it’s coming. Traders didn’t digest the released news properly and XAUUSD replied with a rally from 1231 low to 1240.58 high. Gold, which was recently proved a sacred haven metal will undergo further test today as US releases unemployment claims.

Fundamentals :

1 - US jobless claims today at 1:30 PM GMT.

Technical levels to watch :

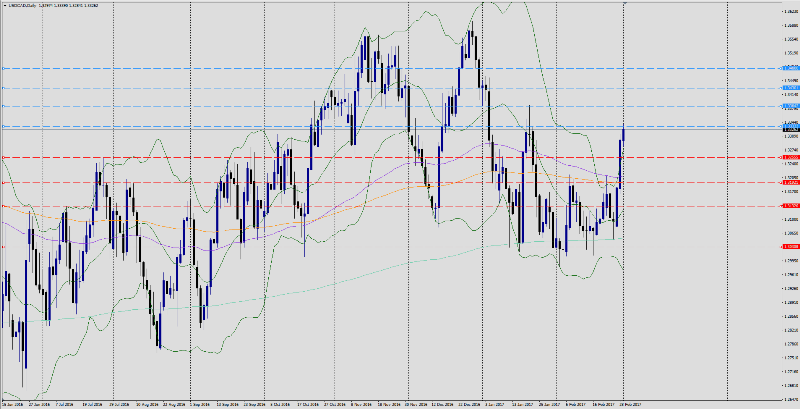

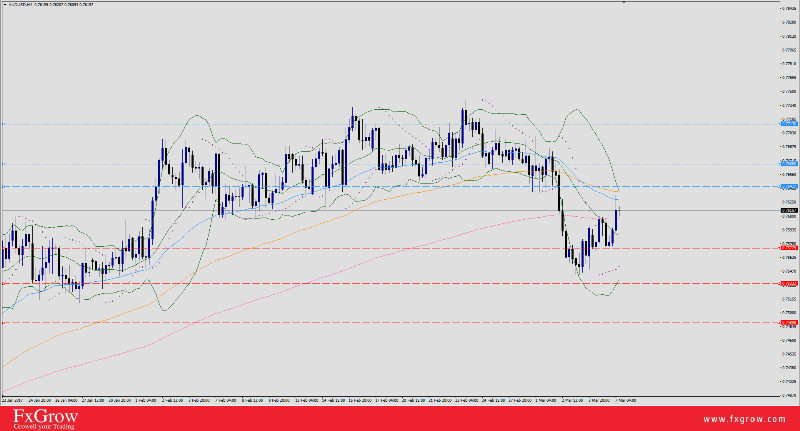

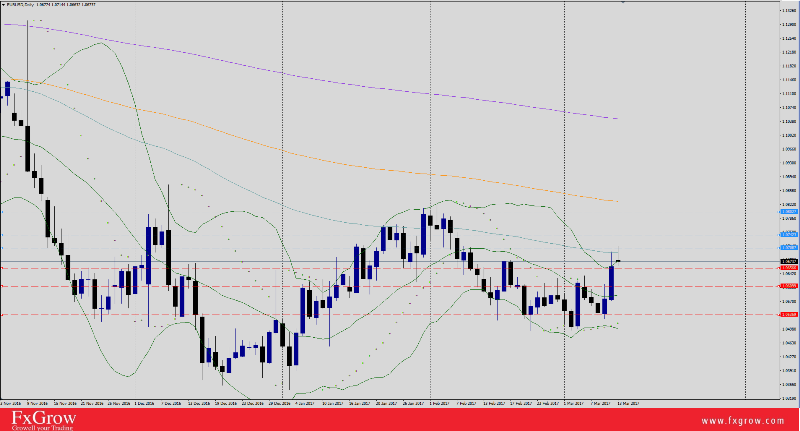

Trend : Up sideways

Daily Pp 1234.13

Resistance levels : R1 1243.90, R2 1249.36, R3 1259.33 , R4 1268.49

Support levels : S1 1232.70, S2 1221.50, S3 1213.71, S4 1198.37

Remark : Gold trend is still up but US data today will creative volatility. Keep in mind that gold has managed to reclaim bearish forces. Stalling above R1 level will spark additional bull waves towards R2&R3 level. Closing below S2 level is needed to shift to downward trend. Be careful from set backs on support levels as a first test.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.