FxGrow Fundamental Analysis – 15th March, 2017

By FxGrow Investment Research Desk

Crude Oil Plunged Over Concerns of An Increase On U.S Shale Drilling

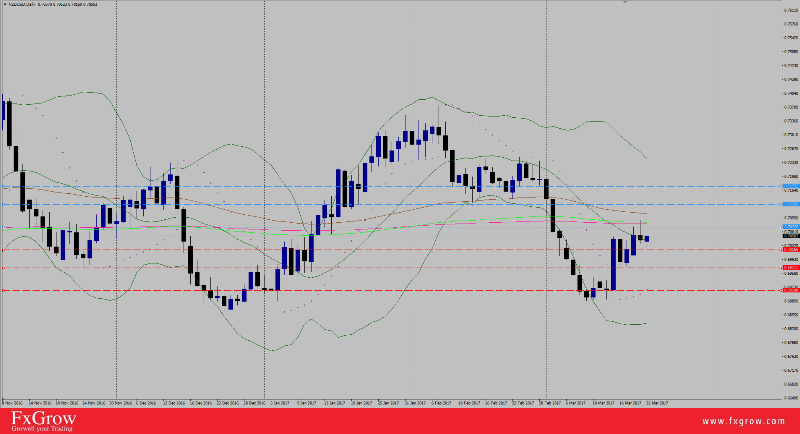

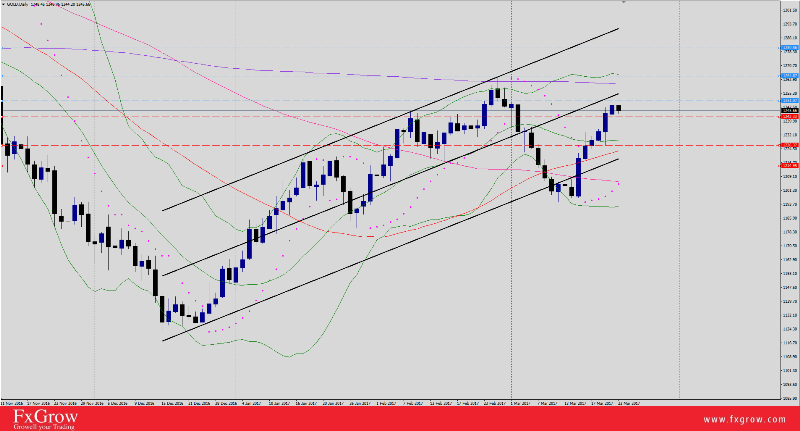

U.S has finally nailed the bulls eye and managed to plunge oil levels below $50 pb at 47.08 2017-fresh-lows. Today, oil prices managed to make an correction with a gain of $1.71 with 48.79 high, and currently oil is pushing for additional profits, lifted by lifted by a surprise draw-down in U.S. inventories and helped by figures from the International Energy Agency (IEA) suggesting OPEC cuts should push the crude market into deficit in time.

“For those looking for a re-balancing of the oil market the message is that they should be patient, and hold their nerve,” the IEA said in its monthly report.

The IEA reported global inventories rising in January for the first time in six months despite OPEC cuts since Jan. 1, but said if OPEC stuck to limits the market should see a deficit of 500,000 barrels per day (bpd) in the first half of 2017.

OPEC’s compliance with output cuts remained high even though the group’s monthly report indicated a rise in global crude stocks and a production jump from Saudi Arabia, Goldman Sachs said on Tuesday. Goldman said in a research note that market re balancing is still progressing, and it saw demand for oil finally exceeding supply in the second quarter aided by production cuts, despite an expected rise in U.S. shale output.

However, OPEC on Tuesday reported a rise in oil inventories and raised its forecast for production in 2017 from outside the group. It said its biggest producer, Saudi Arabia, increased output in February by 263,000 barrels per day (bpd) to 10 million bpd.

The Organization of the Petroleum Exporting Countries is curbing its output by about 1.2 million barrels per day (bpd) from Jan. 1, the first reduction in eight years. Russia and 10 other non-OPEC producers agreed to cut half as much.

OPEC said in the report oil stocks in industrialized nations rose in January to stand 278 million barrels above the five-year average, of which the surplus in crude was 209 million barrels and the rest refined products.

“Despite the supply adjustment, stocks have continued to rise, not just in the U.S., but also in Europe,” OPEC said.

“Nevertheless, prices have undoubtedly been provided a floor by the production accords.”

In the report, OPEC pointed to an increase in its members’ compliance with the deal, according to figures from secondary sources that OPEC uses to monitor output.

Supply from the 11 OPEC members with production targets under the accord - all except Libya and Nigeria - fell to 29.681 million bpd last month, according to these figures.

That means OPEC has complied by more than 100 percent with its plan to lower output for those nations to 29.804 million bpd, according to a Reuters calculation. OPEC gave no compliance figure in the report.

But the report revised up its estimate of oil supply from producers outside OPEC this year, as higher oil prices following the supply cut help spur a revival in U.S. shale drilling. ( Reuters )

Production outside OPEC is now expected to rise by 400,000 bpd, 160,000 more than previously thought. U.S. oil output in 2017 was revised up by 100,000 bpd.

Finally with the significant down-drawn in U.S shale and forecasts for U.S inventories today is 3.3M compared with previous week 8.2M, we are looking for an ascending increase for oil price.

Remark : Look forward of U.S Curde Inventories today at 2:30 PM GMT.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.