FxGrow Fundamental Analysis – 30th March, 2017

By FxGrow Investment Research Desk

Gold Bullish Forces Decelerate By Awakening U.S Dollar, Awaiting Further Data

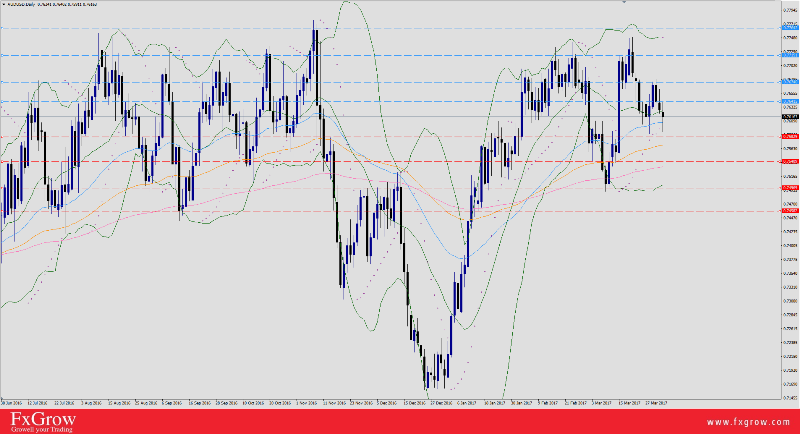

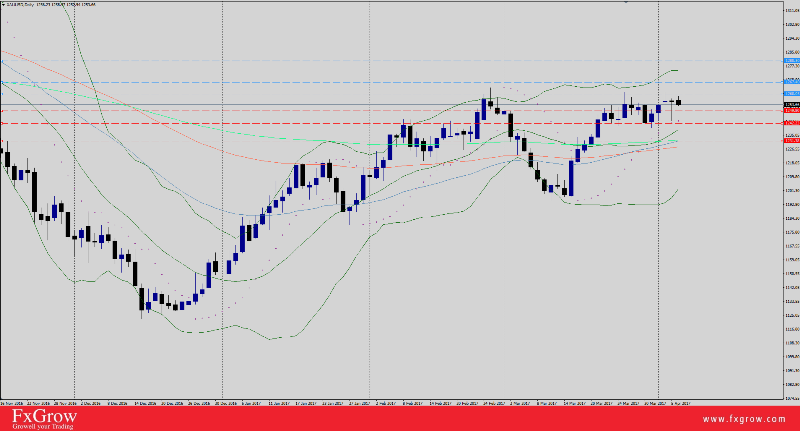

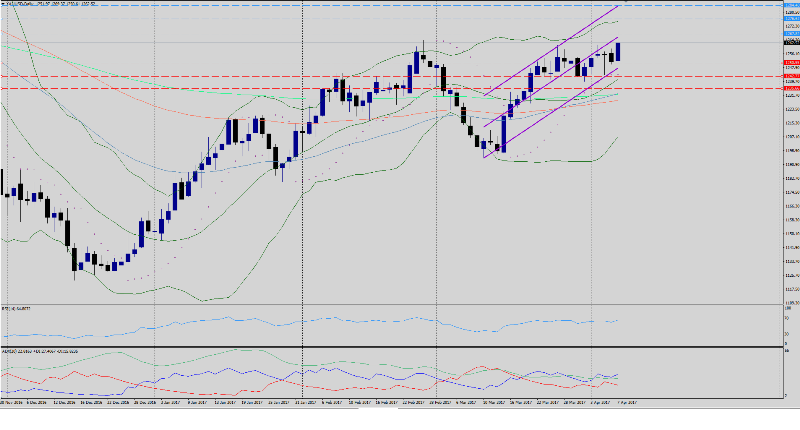

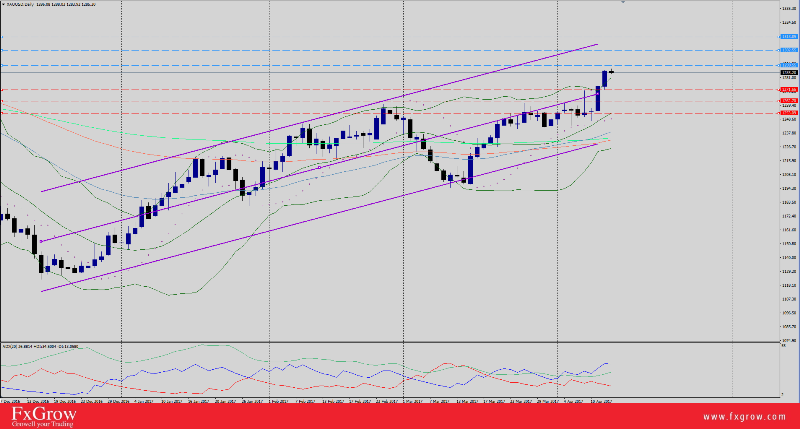

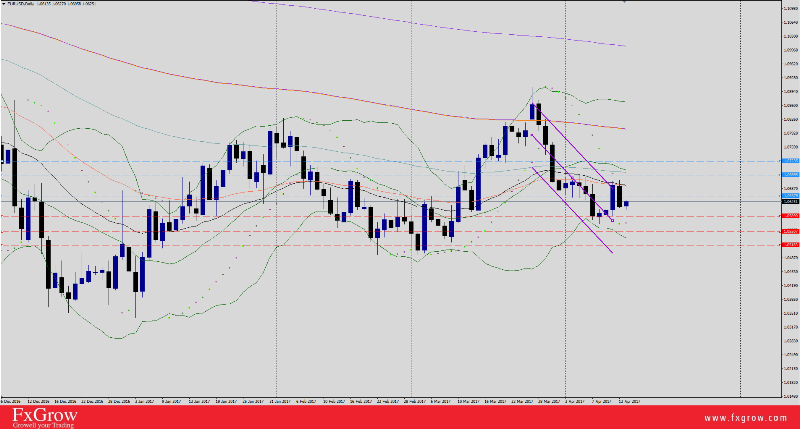

Gold has entered the 6th bullish consolidation session and has been jailed with 200-pips price action. The yellow metal plunged to 1248.30 low today after a long struggle with 1250 handle, and yesterday, XAUUSD couldn’t overcome the 1255 hitch which still supports the bullish trend. On Tuesday, gold peeked to 1258.47 high, keeping a tight range between Monday’s 1261.10 high, as U.S index sank to 98.65 2017 low, and markets expected gold to jet ride for higher levels giving the circumstances.

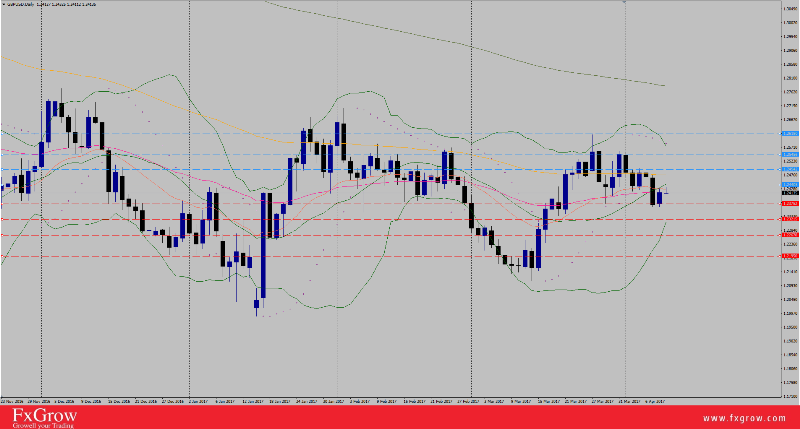

Gold bullish forces were tackled by positive U.S CB consumer confidence which sparked USD bearish levels and U.S index showed a minor recovery today with 99,89 high, postponing gold sky trip for another session as U.S releases today unemployment claims, but the main focus will be on the GDP as analysts tend to relate it directly to U.S fed policy and their in take. U.S GDP today will set the tone for next FOMC members speech with the possibility of hawkish or dovish tone regarding next interest hikes, and traders has to take U.S data today as articular as well gold levels will.

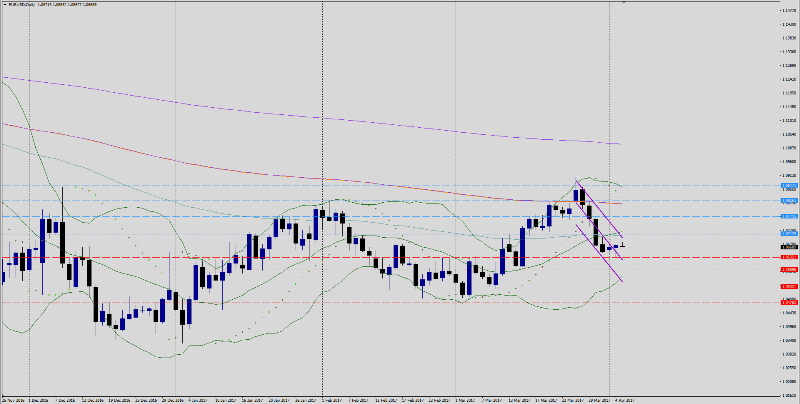

Note: Keep in mind that releasing Article 50 with the French coming election could provoke uncertainties around EU, and gold prices could rally as traders tend to turn to XAUUSD as a sacred haven metal instead of currencies.

Fundamentals:

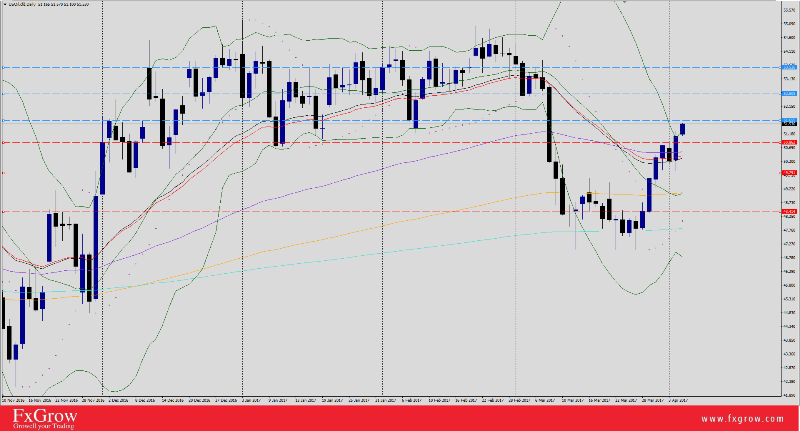

USD - Unemployment Claims today at 1:30 PM GMT.

USD - Final GDP q/q today 1:30 at 1:30 PM GMT.

Technical:

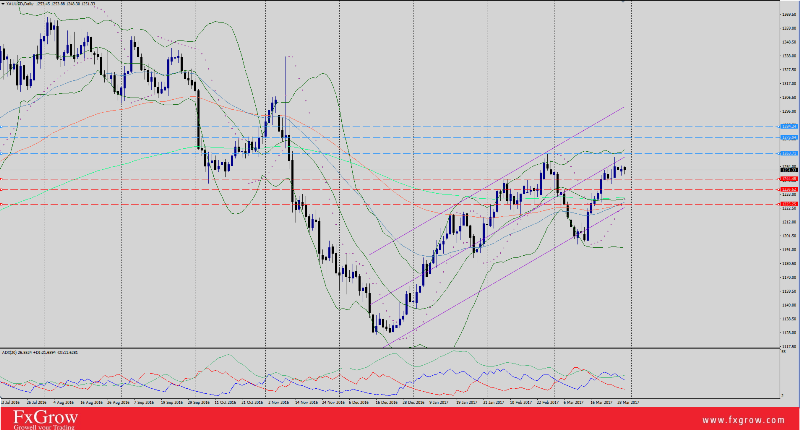

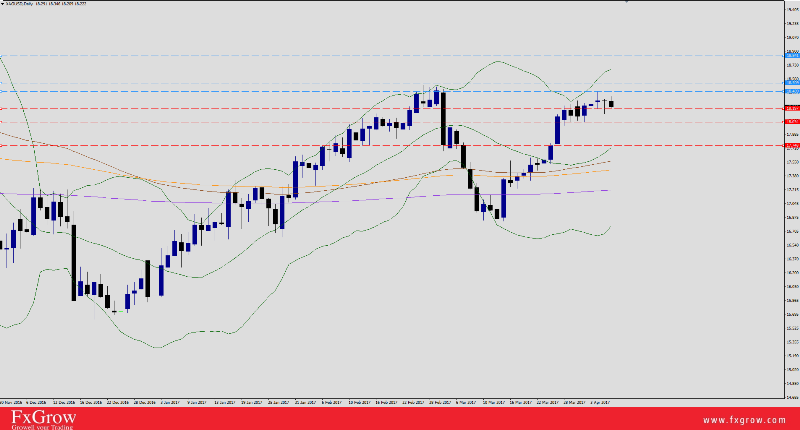

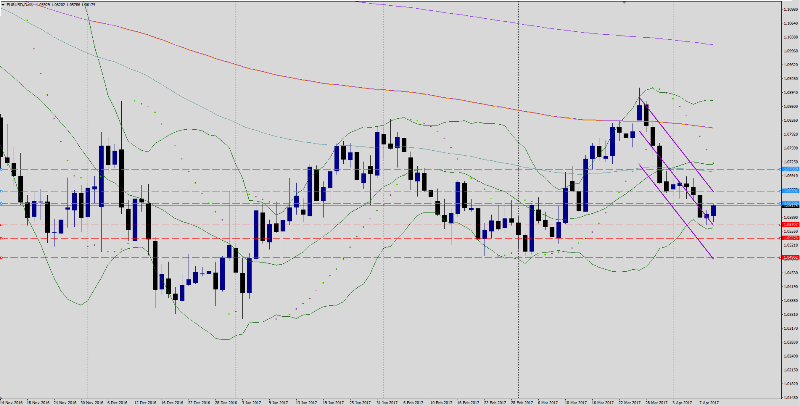

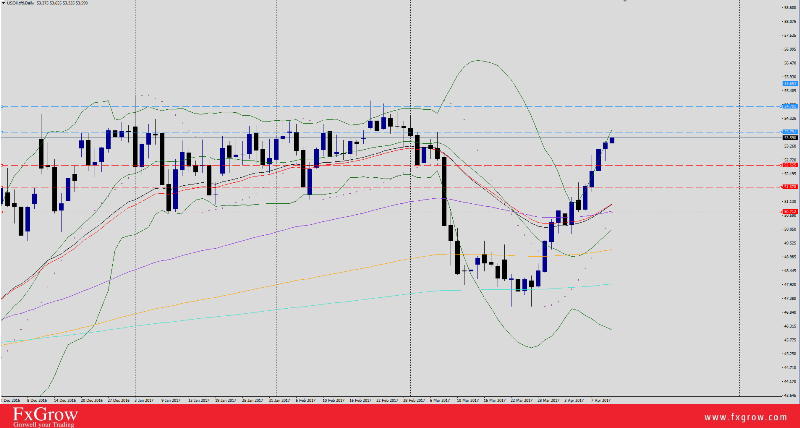

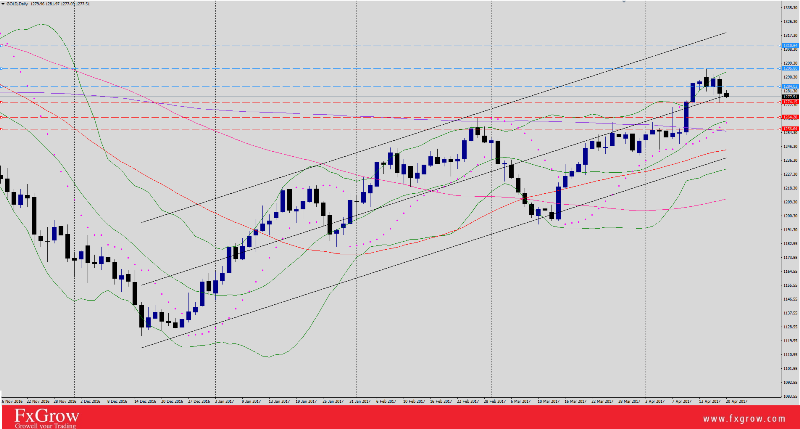

Trend: Bullish Sideways

Resistance levels : R1 1263.71, R2 1275.94, R3 1284.24

Support levels : S1 1244.48, S2 1236.62, S3 1225.25

Remark: The market remains bullish and calls for additional attacks towards R1 although U.S index has showed vital signs. A break above R1 which is considered articular which projects intensive bullish waves towards R3 level due to previous retracements and setbacks from R1. Staying within Monday’s range keeps bullish forces in action as well as the trend. A penetration for S2 levels, signals a beginning for bearish trend and closing below S3, market to consider gold downward. U.S economic data not to be missed today in corelation with U.S Index levels which impacts gold levels directly.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.