FxGrow Daily Technical Analysis – 15th May, 2017

By FxGrow Research & Analysis Team

Aussie Marches Steadily Ahead of RBA Policy Meeting

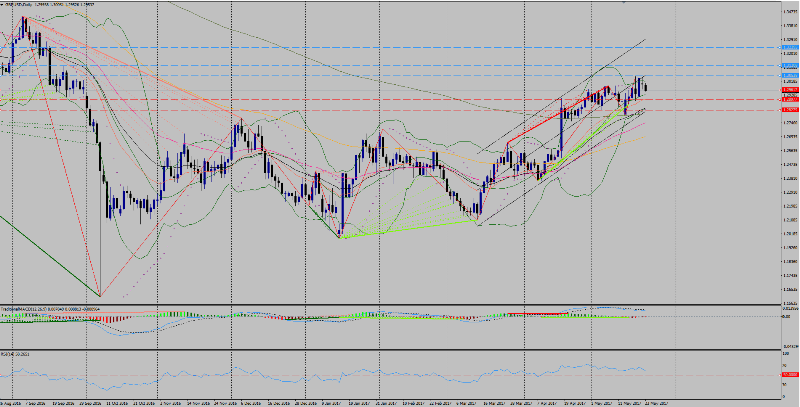

Aussie traded Monday’s session with a sharp tone facing wallowing U.S Dollar. AUD/USD over passed 10-EMA at 0.7400 as the pair peeked today to 0.7445 high with 61-pips price action. Although Chinese Data was negative earlier today which should have a negative impact on the Aussie, but collapsing U.S Dollar gave a higher push for AUD/USD, supported by a rising trend line H1 frame.

AUD/USD is currently trading 0.7419, still above above its pivot point at 0.7375 which should keep Aussie bullish forces in action and the pair could stretch additional gains technically.

As for fundamentals, Aussie awaits RBA Policy Meeting tomorrow early with expectations that the statment will be concluded with a neutral bias given last week negative Australian Data which could impact AUD/USD negatively, but still market has to watch the statement closely with expectations wide open.

Fundamentals:

AUD - RBA Monetary Policy Meeting Minutes tomorrow at 1:30 AM GMT.

USD- Building Permits tomorrow at 1:30 PM GMT.

Technical Overview:

Pivot: 0.7375

Trend: Bearish Sideways

Resistance levels: R1 0.7458, R2 0.7489, R3 0.7522, R4 0.7553 (H1)

Support levels: S1 0.7396, S2 0.7378, S3 0.7341, S4 0.7291 (H1)

Comment: Aussie remains as general trend, but AUD/USD built a promising bullish trend line with expectations for further gains taking into consideration week U.S Dollar. AUD/USD broke 0.7425 from which the pair witnessed intensive declines, and staying above it supports current bullish momentum. Closing above 0.7425 keeps bullish forces in action but be careful from setbacks due to RBA meeting content. Closing above R3 level is needed for daily trend reversal. Keep an eye on U.S Index level with correlation to U.S Data tomorrow.

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.