FxGrow Daily Technical Analysis – 30th May, 2017

By FxGrow Research & Analysis Team

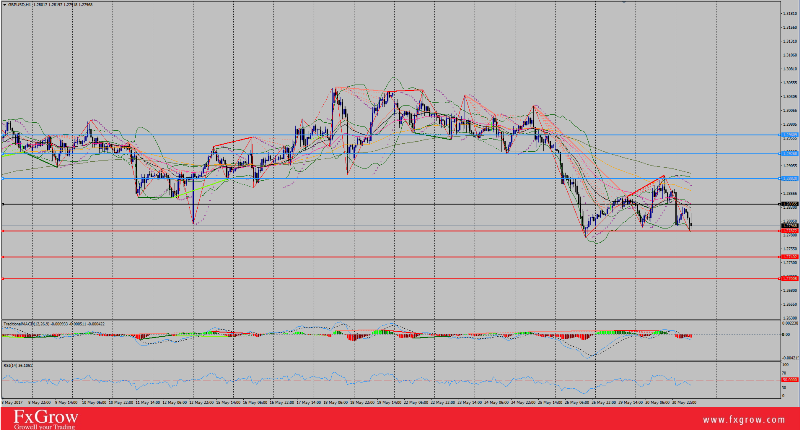

Sterling Loses Momentum As UK’s Election Race Tightens

GBP/USD peeked last Monday to 1.3043, boosted by PM May with her conservative party heading polls. But last week’s terror attack on Manchester costed the conservative party 6 points down as latest surveys indicates, and when election polls looks murky without clear hints about final results, uncertainties revolves around Sterling as election race tightens.

Apparently, question marks has been aroused regarding PM May and her qualifications to lead UK’s Ministry. As a result, GBP/USD has been on a gradual decline ladder since last week and the pair plunged to 1.2794 low today, currently trading …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 30th May, 2017

By FxGrow Research & Analysis Team

Gold Flirts With 1270 With A Setback, Awaiting U.S Data

Gold clocked 1270.50 May-2017-fresh-highs but failed to march forward, hitting a strong resistance with successful test, retreating to 1261.71 low. Technically, gold remains bullish as the yellow metal remains above its 10-EMA at 1257 and 50-EMA at 1249 which keeps gold’s bullish forces in action. Currently gold is trading 1263 intraday, and in case the market closed below 1265, expectations for …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 31st May, 2017

By FxGrow Research & Analysis Team

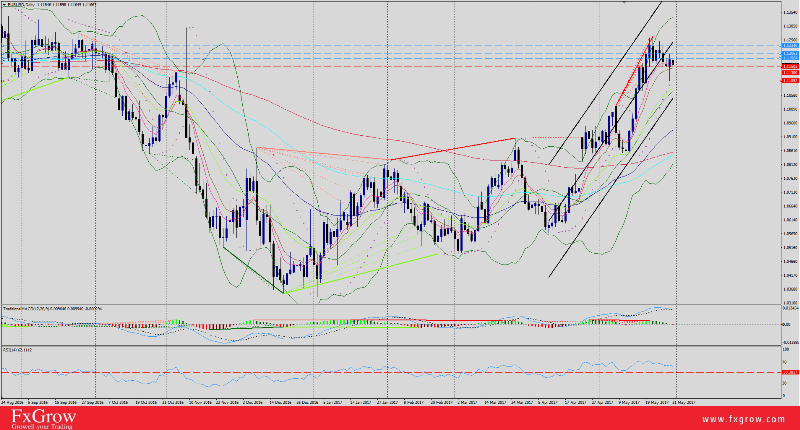

EURO Fuels Over Rumors Of ECB Abandoning QE Program

EUR/USD plunged yesterday to 1.1109 at which, the pair alerted for trend reversal as the downside prevailed, but as rumors were leaked that the ECB could bring some new measures regarding Quantitative Easing Program being removed as a headline (Reuters), the pair reversed its destination and rallied with +96-pips daily price action, landing in 1.1205 high. Negative U.S Consumer Confidence yesterday contributed to cable rallies.

Technically EUR/USD closed at 1.1185, above its daily 10-EMA at 1.1155 which promises of further attacks upward seeing last week’s highs. Currently the pair is trading 1.1172 at 7-EMA (D1), and in …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 31st May, 2017

By FxGrow Research & Analysis Team

GBP/USD Technical Overview

With absence of economic data on both Sterling and U.S Dollar, the pair should trade technically.

Trend: Bearish /Sideways (H1)

Pivot: 1.2835

Preferable scenario: Short positions below pivot 1.2835 holds further dips seeing 1.2787 (S1), in case of penetration next station should be 1.2740 (S2), then (S3) at 1.2700. (H1 supports)

The alternative case, if GBP/USD stayed above pivot 1.2835, expectations for further attacks at (R1) 1.2882 first. If (R1) failed, potentials for additional hikes seeing (R2) at 1.2925, next (R3) 1.2960. (H1 Resistances)

Comment: keep an eye on U.S Index levels, he upward potential is likely to be limited by the resistance at 1.2840.

MACD indicates bearish momentum (H1).

RSI indicates bearish momentum (H1).

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 31st May, 2017

By FxGrow Research & Analysis Team

Negative Chinese Data Tackles The Aussie Ahead of local Retail Sales

Australian Dollar peeked to 0.7475 high on Wednesday’s early sessions, but the incline journey was tackled by negative Chinese Manufacturing and Non-Manufacturing PMI, as a result AUD/USD lost -46-pips and landed on 0.7429 low for today’s session. On the other hand, the Aussie still fails to take advantage of weaker U.S Dollar as the Index dipped today to 96.98 low.

Currently the pair is trading 0.7435, still below its daily 50-EMA at 0.7490, and daily 200 and 100 EMA at 0.7515 as indication of bearish momentum, but AUD/USD has a make a reverse turn …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 6th June, 2017

By FxGrow Research & Analysis Team

UK Election With Potential Impact On Forex Market

Thursday, June 8th 2017, UK election will take place and market will undergo sharp volatility with a reminder of how Sterling was a on chaotic ride between ups and downs during Brexit, but perhaps this time with less severe volatility, but there will be action in the market bringing opportunities for traders.

The latest general election polls indicates that the gap between Labour and the Conservatives has narrowed further still. As uncertainties are still hoovering without any clear signs on how final result could end. At such moments, gold (as safe haven) will be the greatest winner during UK election and today’s sharp rallies are only a starter and it will prolong before and after the election take place depending on the final outcome, along with it GBP. Below are possible scenarios on what market should expect…

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 7th June, 2017

By FxGrow Research & Analysis Team

Crude Oil Dips Over Fears of Market Glut, Awaiting U.S Inventories

Crude oil failed for the 8th consecutive session to break above $50 bp, taking a gradual decline ladder flirting with 46.70 support level, still below its 200-EMA daily level at 49.10.

Middle east tension, specifically Gulf and the media throw-stone between Arab nations was seen in two perspectives.

First market suspected that the rift could affect crude supply with shortage pushing oil yesterday to $48.38.

Second, as image was getting clearer, the thought that Gulf tension could affect OPEC cut extension with fear that the rift could result in breaking the output deal with possibility that market could witness a glut pushed oil prices lower at $46.92 bp yesterday despite OPEC’s effort through media that the pact still holds and there is no fear for agreed 1.8M output cut. But markets needed more …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 8th June, 2017

By FxGrow Research & Analysis Team

EUR/USD Inches Higher, But Will Super Draghi Deliver?

EUR/USD made a test at daily 7-EMA 1.1245 and rebounced successfully but has failed to over top 1.1284 this week high but today, the pair has a chance to surpass recent sessions peeks seeing 1.1300+ as a potential.

Currently the pair is trading 1.1258 with low volatility, confined with 17-pips price action, but expectations that EUR/USD will demonstrate a super volatility ahead of ECB Interest Rates decision with expectations high for no game changer especially that inflation is 1.7% in EU, still below 2%. Then Super Draghi will give a speech on behalf of ECB today, and the Gov. will either confirm recent rumors of abandoning QE program which was the main reason for fueling the EURO and keeping it dwelling above 1.1200 successfully. In case Draghi delivered, EUR/USD prepares for a jet ride with incline destination.

Market should focus on Draghi’s speech and there is scenario that Draghi says that inflation remains low and the ECB sees not reason for changing QE (Quantitative Easing Program), in case this happened, market to take this as …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 8th June, 2017

By FxGrow Research & Analysis Team

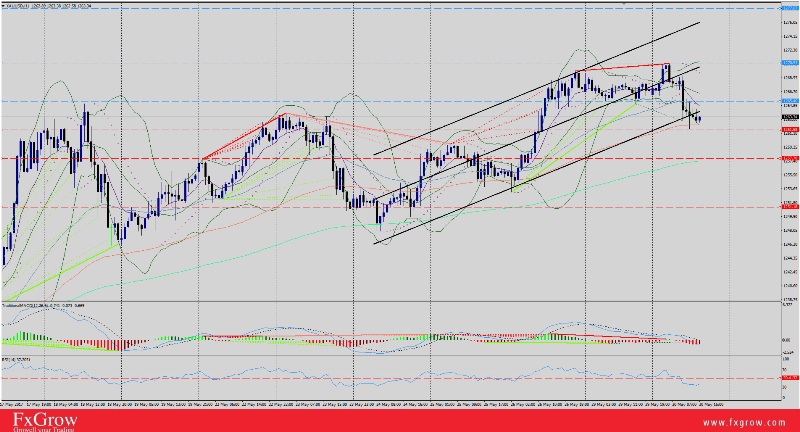

Technical and Fundamentals Why Gold Could See 1300+

As expected, gold bumped into strong resistance level located at 1295 with +1.16 extra as first test on level, ending Wednesday’s session with 1296.16 highest. After that the precious metal has been on a gradual decline retreating with dignity anchoring yesterday at 1282.16 low. Today gold still shows weakness v.s sideways trading greenback between 96.93 high and 96.33 low (U.S Index), and so far XAUUSD scored 1283.19 with expectation for further dips as hourly candle stick shows as a pattern unless gold managed to penetrate 1291 level (R1) and closed above R2 (1295), third destination will be 1305 (R3).

But the question is, what makes 1295 and 1305 so critical levels for gold is that currently, XAUUSD stands on the edge of breaking loose seeing 1310+ as a potential is: A closer look at the chart will explain the triangle or zigzag pattern that gold has been demonstrating …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 12th June, 2017

By FxGrow Research & Analysis Team

EURO/USD Shows Signs of Recovery but Remains Under Pressure

After a busy week conducted for EURO as ECB kept Interest Rates at 0% basis not tapering with QE purchasing program, a negative shock selling wave pushing EUR/USD to 1.1166 testing a strong support and re-bouncing to 1.1237 high in Friday.

Yesterday, the EURO was busy with French Parliament Election and as Macron was set for crushing victory for his party, EUR/USD is showing signs of recovery for today’s trading session with 1.1217 high till now, and expectations for more gains as U.S Index plunged to 97.09 low. As for U.S Dollar, the greenback is under pressure with Trump’s accelerating events through media in a negative pace which could give a lending hand for EURO.

Technically, the pair plunged to 1.1197 low, testing an old support at 1.1190 successfully, and in case EUR/USD managed to …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 12th June, 2017

By FxGrow Research & Analysis Team

Gold Pushes Higher Seeing Weakness In U.S Dollar

Last week, gold market witnessed $30.20 loss equal to -320-pips price action, landing on 1264.64 low after peeking to 1296 on Tuesday which indicated signs of bearish momentum and the downside prevailed for the precious metal.

Today, gold rallied with almost +$5, peeking 1270.32 as high which can be considered signs of a correction phase, still bearish momentum persists in case gold closed below 1264, 100% confirmation for downtrend destination. However, the morning rally could change ground rules for the commodity, in case gold managed to …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 13th June, 2017

By FxGrow Research & Analysis Team

Sterling Remains Under Negative Election Spell Ahead of Local Data

PM May called for snap elections with effort to increase seats for Conservatives to dominate upcoming political decisions and pave the road for solid negotiation for upcoming Brexit with the EU, but instead, UK citizens strafed May giving her 318 seats instead of 326 (Before Election). As a result the British Pound was on an intensive decline destination associated with heavy selloffs.

Since Friday, the pair shed -311-pips, and for three consecutive sessions, the pair flirted with support level 1.2630 with a re-bounce. Today, the pair plunged to 1.2642, and clocked a 1.2683.

Fundamentally, Sterling awaits hefty local data today which could put a stop for further declines depending on the …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 13th June, 2017

By FxGrow Research & Analysis Team

EUR/USD Trades Flat for The Second Session Ahead of U.S Data

For the consolidation session, EUR/USD has been trading fat, hitting support 1.1190 and re-bouncing successfully. Today the pair dipped to 1.1185 with -5-pips testing, but managed clock 1.1224 high for today after receiving a booster by Positive French NFP with 0.4% compared to 0.3% on previous sessions. However, negative German WPI with -0.7% put an end for EUR/USD rising trend as the pair is currently trading 1.1202 intraday, with efforts to hold the 1.1200 level.

EU data is conducted for today, but shortly, the U.S will release PPI and Core CPI which will affect the pair trading shortly as market …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 13th June, 2017

By FxGrow Research & Analysis Team

Gold Technical Overview Ahead Of U.S Data

Currently gold is trading 1263 after plunging today to 1261.68 low and peeking to 1267.12. Overall, signs of bearish momentum persists for the precious metal but U.S data today and major FOMC statement tomorrow will give a better outlook on how gold will trade for the coming days. Closing above 1265 (R1) with a penetration for R2 1269.50 will re-embrace bullish momentum with additional attacks towards R3 at 1274.17.

The other scenario (currently preferable), gold broke below 1265 and tested first support level at 1261.54, in case of penetration, next …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 14th June, 2017

By FxGrow Research & Analysis Team

Crude Oil Desperately Pushes higher With Failure, U.S Inventories Eyed

Crude Oil traded below $50 bp benchmark for the past two weeks, still receiving mixed signals by both OPEC and increasing U.S inventories output and with that, traders are taking precaution measures, avoiding the black gold commodity trading. On Monday, oil peek recorded $46.69 bp weekly high but failed to hold soft gains, still closing below 46.00 level.

Recent political tension in middle east including Qatar and Saudi Arabia fueled oil prices with $48.20 bp high, but as both opponents pledged for the market that despite the rift that’s still going on will, OPEC deal or output production still runs …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 14th June, 2017

By FxGrow Research & Analysis Team

FOMC: Fundamental and Technical Overview

Markets is anticipating a definite rate hike with an additional 0.25% to current 1.00%. Currently, odds are at 100%, confirmed by major sources. In case FOMC delivered a rate increase, the question that follows is how will the FOMC’s statement address Inflation and balance sheet.

Job sector is out performing recently but inflation last reported in April shows 2.2%, still on gradual decline last reported on Feb 2017 at 2.7%, not stable at 2% target as U.S Fed sees ultimate.

Beside (Inflation??), Yellen will have to answer for $4.5 trillion balance sheet supporting US Reserve needs with a surplus, far from market requirement. In case the statement kept asset purchasing without a reduction or setting a specific date, this could send a negative shock to market that could limit U.S Dollar gains

Another matter still revolves in mind, Yellen promised three rate hikes for 2017. Once was delivered on March, second is expected …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 15th June, 2017

By FxGrow Research & Analysis Team

GBP/USD: Fundamentals and Technical Ahead of BOE Decision

GBP/USD inaugurated Thursday’s trading session with further declines at 1.2723 low after peeking yesterday 1.2817 high as the greenback recouped yesterday’s losses with 97.13 high for today after U.S Fed delivered market expectations for 0.25% rate hike. Currently the pair is trading 1.2734 intraday, below 50-EMA daily at 1.2790, with expectation for further declines as U.S Index pushes higher.

There are many fundamentals for GBP today that will contribute with bull and bear forces.

First, BOE Interest Rates decision today at 11:00 AM GMT, with a definite expectation that BOE will keep rates at current 0.25% due to coming Brexit negotiations, disappointing last week election, Conservatives losing majority in Parliament, yesterday’s weaker Average Earnings at 2.1%, last but not least, during last BOE statement after rates were kept untouched, BOE ditched changing rates for late 2019.Logically, when Central Banks keeps rates unchanged, a currency should witness some decline but …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 15th June, 2017

By FxGrow Research & Analysis Team

Gold Downtrend To Be Confirmed Today, Eyes on U.S data

Gold peeked yesterday to 1281.13 after disappointing multiple inflation U.S key figures that decreased Sept Fed hike odds down to 38% after being at 54%. After that, eyes were centered at FOMC meeting yesterday with high anticipation for a definite rate increase with 0.25%, followed by a statement by Yellen which turned hawkish more than expectations. As a result, U.S Index was strengthening, adding pressure on gold, pushing the precious metal downward with almost -$21 (1257.16 low) before closing the session.

Currently gold is trading 1255.49, after plunging to 1253 low (S1), below 50-EMA daily at 1259 which is 100% confirmation for …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 16th June, 2017

By FxGrow Research & Analysis Team

USD/JPY Testing 50-EMA Ahead of BOJ Statement

As expected, BOJ has maintained Interest Rates at current -0.1% with 44-pips price action movement for Friday trading session. USD/JPY rallied to to 111.27 high, currently trading 111.15, flirting with 50-EMA at 111.19. Currently, U.S Index is still pushing higher with 97.54 June record high, giving bull hand to USD/JPY with expectations for further incline for the pair.

The pair still awaits BOJ’s press conference shortly and market will have to wait for Gov. Kuroda statement with expectation for more …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

FxGrow Daily Technical Analysis – 16th June, 2017

By FxGrow Research & Analysis Team

EUR/USD Inches Higher Ahead of Local Data

EUR/USD lost 96-pips value yesterday after plunging to 1.1132. Still the pair pressured by recovering U.S Dollar with 97.54 June record after hawkish FOMC meeting on Wednesday. Currently the pair is trading 1.1156 intraday, still below its 20-EMA at 1.1170. Overall, signs of bearish momentum revolves for EUR/USD taking into consideration boosted U.S Dollar with June hike, but EURO awaits local data shortly, which can give some solid ground to re-climb the 1.1200 again, still market has to see how …

For more in depth Research & Analysis please visit FxGrow.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.