I really like the Land Rover… great car, my friend has one and I think its a fantastic car inside/out. The Porsche is lovely, they are my fav cars in terms of looks and was always my childhood fantasy to have one… so I bought a couple. But the reality is… I’m just to big for them, I’m 6’2 and I just can’t get comfy in them much these days… putting on a bit of weight certainly doesn’t help! The steering wheel runs off my thighs when turning and I feel really cramped in them, so this will be my last one… unless I shrink!

Ship it over to Canada and I will send you my Range Rover. I am short 5 feet eight and thin. Your Porsche would be great.

Jeff

I walked into a barclays bank today and asked the cashier if she knew david jefferson…she didn’t.

I’m going to get moaned the hell out off over the weekend or Monday, when all the subscribers of this thread turn up here and read the last 15-25 posts… only about 3 of them are to do with trading… :eek:

Cheers… I want to sell you this system I just chucked together by the way… it has a 99% strike rate… and I’m only charging £97 for it!

You want to buy it?

ps: It will bring you unlimited sums of money and fortunes without any effort or work required… you can then go out and buy a £75,000 Porsche and pretend to be a trader and stuff. :10:

60 day money back guarantee included!

Ok, this is my first try so please be gentle

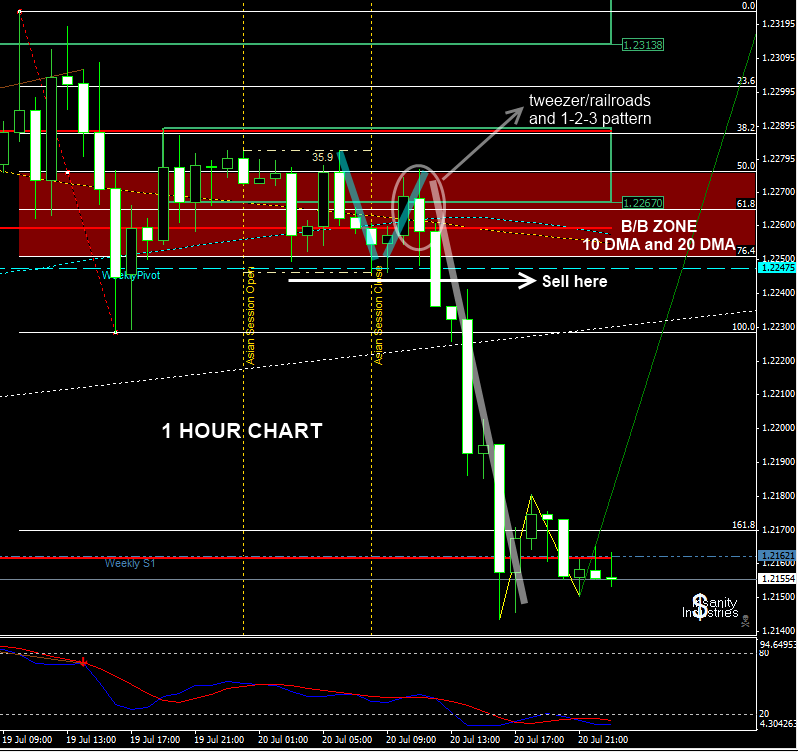

I constructed my B/B zone with thursday’s high and low… I am using the 5 and 10 Daily moving averages ( i made a mistake in the image ) in the 1 Hour chart

The 1-2-3 pattern and the railroads appeared within the B/B zone… in your experience is safe to play this set up?? or is better to wait for a retest of the B/B zone to confirm resistance??

Thank you

http://i1086.photobucket.com/albums/j449/yunny11/eurusd90.png

Hi David, a quick question regarding yesterday’s B/B Zone on the GU. The upper region of the zone 1.5656 is held by the 23Fib

but the lower region has been painted at 1.5630 which is 25 pips below or half way between the 23 and 38 fib. How was this calculated? I see the 5630 line extends to the end of your chart, is it a support resistance line from a higher time frame cos I’m having difficulty finding it!

Pete

Yes and no yunny… I would really need to see the 100-200 MA’s, you say you used 5-10 MA’s. (I already know where the 100-200 were)

Your 1-2-3 is fine, but only because of one reason… as you were in a range… the 1-2-3 doesn’t really apply, so you have to be careful with it. But as your point one, popped out of resistance, point two popped out of support, and then point three stayed under resistance… it was viewed as bearish 1-2-3.

Also your tweezers/ rail tracks look great to me… you identified them at the correct kind of area…

Sorry I’m all out of sticky gold stars… but I can give you a lollypop?

Your analysis was perfectly fine m8… keep it up!

[QUOTE=Pedross56;375693]Hi David, a quick question regarding yesterday’s B/B Zone on the GU. The upper region of the zone 1.5656 is held by the 23Fib

but the lower region has been painted at 1.5630 which is 25 pips below or half way between the 23 and 38 fib. How was this calculated? I see the 5630 line extends to the end of your chart, is it a support resistance line from a higher time frame cos I’m having difficulty finding it!

Pete

Hi pete

There is a daily fib scale there and a 1 hour one.

The daily fibs were taken from the 12th July low to 19th July high.

The 1 hour fins were taken from the 18th July low, to the 19th July high.

Let me know if you understand this…

Hey David, I was wondering which kind of charts/platform do you use? or which you would recommend for a newbie?

Thanks for the speedy reply David.

No probs with the fibs as you can see from the chart below, so a couple more questions if you’ll bear with me on this…

-your zone was from 5656 to 5630, mine from 5656 (23 daily fib) to 5640 (61 hourly fib) which is a ten pip difference

-is there a limit on zone size ie, the daily zone from the 23 fib to the 38 is 50 pips

-if so, is that is the reasoning behind including the hourly fib

-I am still unclear on your 5630 zone line as it doesn’t appear to be a fib line!

Cheers

Peter

Pedross56, I am just learning here but I think the idea is to find a zone of congestion/confluence and trade either the breakout or the retest of the zone confirmed by PA/divergence/123 pattern… that way we can get the main move of the day.

I smell a rat here. Why did you launch an investigation into David’s past and claims unless you had an agenda. There is no record of you doing that with any other thread starter here. Did you really see a guy offering FREE analysis on a forum and then take the time to investigate if where he said he worked was true? Did he commit some sort of crime? I really don’t care if he worked at Barclays or McDonalds. I dont care if he drives a porsche or a pinto, he’s not charging me for his (excellent) analysis. He didn’t ask for my credit card. Why would you launch an investigation unless you had some sort of motive. Do what you want sir, go peddle your worthless EA, go conduct more investigations, just leave us alone and let us learn. Post your signals and let David post his and we will see why he does Drive a Porsch and why you don’t.

You said you will continue to follow the thread, you better be a fast reader because good threads get really long. Stick around, Maybe you will finally make some money TRADING.

Hi David,

do you think we retail traders so small in the big ocean able to rake in profits in the long run consistently?

I think you should be in dreamland as my here is asia time. hehe

I know that your question is for David but I will say I am not near as experienced as David yet I make a good consistent profit every month using my own system, I believe this thread is going to put me on the fast track to full time trading. So to answer the question Yes you can make a good consistent profit.

G’day David,

I’m currently a full time student that is just getting into the forex markets. After reading your informative posts along with the visuals on this thread, I’ve got to thank you for sharing your ideas to newbies such as myself.

From what i can understand, your trades are predominantly placed based upon technical analysis (pro money, bull bear zone etc). Do you ever trade based upon the fundamental data of economies?

Also, how long do you hold your trades for? Do you have a profit target of XX pips per trade or do you place your trades with a ratio risk/reward idea (eg. 1:2 risk reward) ?

Cheers

mrchilled, you are an absolute disgrace, shame on you coming here and “trying” to piss on David’s battery.

I personally took 135 pips on Friday after using some of David’s set-ups which I never would have done prior to him posting here.

Let it be known that you can follow the thread, but don’t expect any favours from David by replying to your posts.

If he is a scammer then he is a bloody good and profitable one, I rest my case.

People like you mrchilled need to get a life and back-off, why come here and spoil the party ? You make me sick !!!

David,

thanks for your response every now and then… correct me if i am wrong the bloomberg terminal and the rest you intro are those places you could find the option barriers? So option barriers analysis are useful in order flow only?

Bloomberg T and prorealtime