DAX rises to an all time high on rate cut bets. GBP/USD look to BoE’s Bailey & US ADP payrolls.

By :Fiona Cincotta, Senior Market Analyst

DAX rises to a fresh all-time high boosted by rate-cut bets

- ECB hawk Isabel Schnabel’s U-turn boost stocks

- EZ retail sales forecast to rise 0.2% MoM in Oct vs -0.2%

- DAX rises to 16568 all-time high

The DAX and its European peers are pushing higher following on from a strong session in Asia. Weak US labor market data fueled bets that the Federal Reserve could soon start to cut interest rates. Optimism surrounding a Fed rate cut is offsetting concerns surrounding the Chinese economy. Stocks in Asia had fallen sharply in the previous session after Moody’s downgraded its outlook on Chinese credit to negative.

Optimism that the ECB could also start cutting interest rates soon continues to underpin demand for equities. ECB known hawk Isabel Schnabel said another rate hike was rather unlikely given the remarkable slowdown in inflation. Eurozone CPI cooled to 2.4% YoY in October. Her U-turn prompted the markets to ramp up bets of an interest rate cut as early as March.

Attention is now turning to eurozone retail sales, which are expected to rise 0.2% after falling -0.2% in September. A pickup in retail sales would indicate that consumer confidence is improving, which could help ease concerns over recession in the eurozone region.

The data comes after PMI data yesterday showed that business activity remained in contraction in November despite the composite PMI rising to a 4-month high.

Looking ahead, US ADP data could also influence sentiment in the US session. Weak jobs data could fuel Fed rate cut bets.

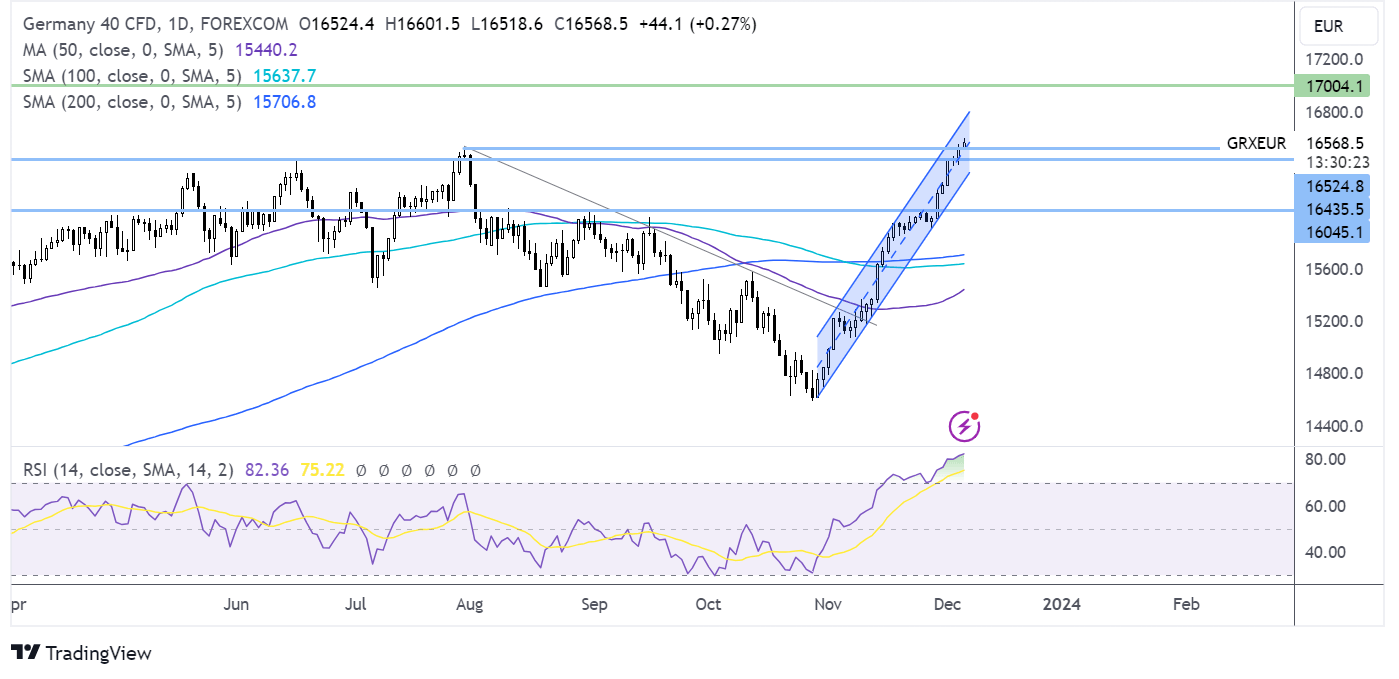

DAX forecast – technical analysis

DAX continues its ascent in a rising channel, rising above 16530, the July high, and reaching a fresh all-time of 16568. The RSI is deep in overbought territory, so buyers should be cautious.

Buyers could look for a rise above 16568 to extend gains towards the upper band of the rising channel at 16750 before bringing 17000 into focus.

Support can be seen at 16530, the previous all-time high, and 16430, the June high. A break below here opens the door to 16044, the August high.

GBP/USD looks to BoE’s Bailey & US ADP payroll data

- BoE Andrew Bailey to speak

- US ADP payroll data to rise to 130k vs 113k

- GBP/USD steadies around 1.26

GBP/USD is inching higher after two days of losses as the rally in the USD studies. Still, the pound has broadly been supported as BoE policymakers push back on rate cut expectations and on growing expectations that the Fed could cut rates early next year.

Attention is on Bank of England Governor Andrew Bailey, who is due to speak. Last week, Andrew Bailey’s hawkish comments that he will do whatever is necessary to bring inflation back to the target 2% level boosted the pound above 1.27. Any comments today regarding the future path for interest rates could influence the pair.

Bailey’s speech comes after data yesterday showed that the composite PMI returned to growth after four months thanks to an upward revision to service sector activity, easing fears over a recession.

Construction PMI figures are out today; however, given this accounts for around 10% of the UK economy, they are not expected to influence GBP/USD.

Meanwhile, the US dollar is holding steady as investors look ahead to ADP payroll figures, which are expected to rise 130K in November, up from 113 K in October.

The data comes after yesterday’s JOLTS job openings fell more than expected, indicating that the labor market could be cooling. After the Fed’s aggressive rate hiking cycle, demand slows, and firms are reining in hiring expectations.

Weaker ADP payroll figures today could reinforce that view of a cooling labor market and support the idea that the Federal Reserve could cut rates in Q1 next year. The data also comes ahead of Friday’s nonfarm payroll report, and Fed policymakers are in a blackout period ahead of next week’s FOMC meeting.

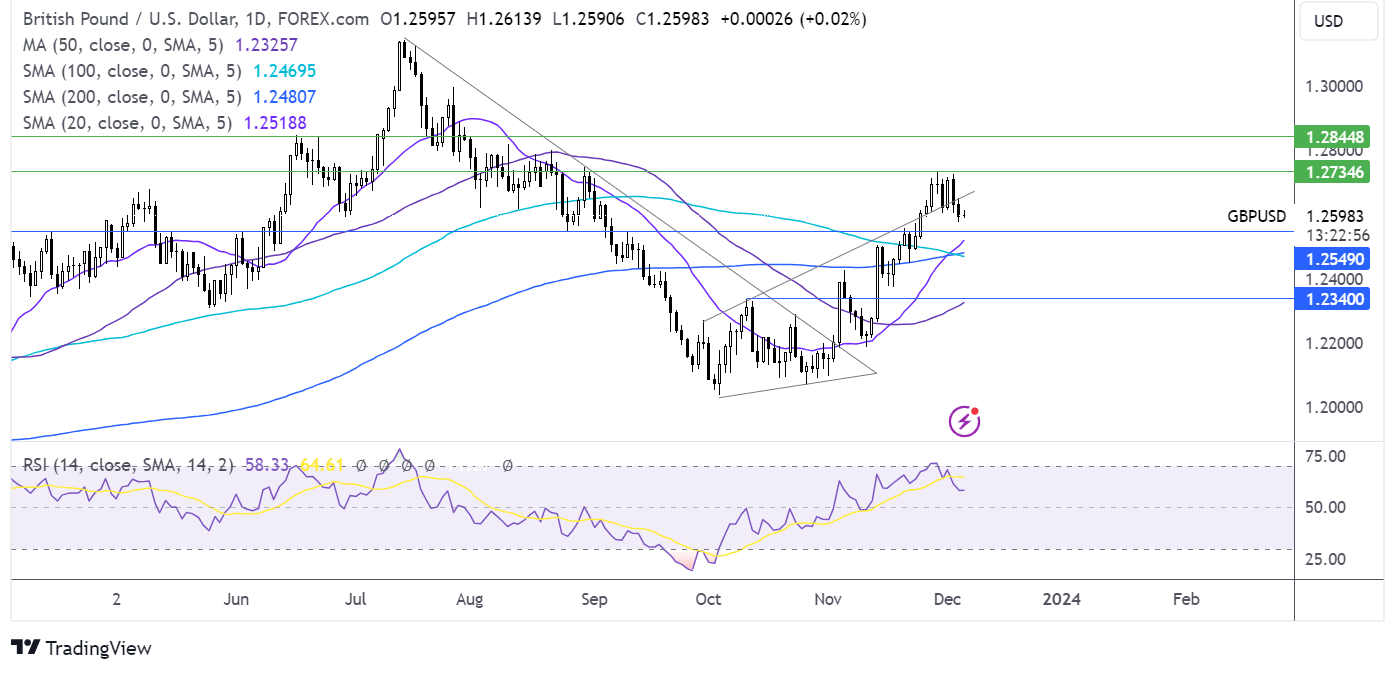

GBP/USD forecast – technical analysis

GBP/USD rebounded lower from resistance at 1.2730, falling below its rising trendline, dating back to early October.

Support can be seen at 1.2550, the August low, ahead of the 200 sma at 1.2470; below here, sellers could gain momentum.

On the upside, buyers will look to rise above 1.2650, the rising trendline resistance to extend gains towards 1.2730 and create a higher high. ]

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.