DAX slips, German consumer confidence ticks higher. GBP/USD consolidates at a 3-month high ahead of US consumer confidence data.

By :Fiona Cincotta, Senior Market Analyst

DAX slips, German consumer confidence ticks higher

- German consumer confidence improves to -27.8

- ECB President Lagarde & Philip Lane to speak

- DAX consolidates below 16000

The DAX, along with its European peers, is set for a slightly weaker start on Tuesday as investors consolidate strong gains across November so far. This month is on track to be the best month for stocks since January for equities.

Easing inflationary pressures and expectations that the Fed and the ECB have finished hiking interest rates and could cut borrowing power next year have helped to boost demand for equities.

On the data front consumer confidence in Germany improved slightly heading towards December amid an improved willingness to buy as inflation eased.

GfK’s consumer sentiment index improved to -27.8 in December, up from -28.3 in November.

The tick higher in morale comes up after three consecutive months of declines and as inflation eases to 3.8% year on year in October, down from 4.5% in September. Easing inflation has had a positive impact on purchasing power.

The data comes after other data from Germany has also shown improvement. German PMIs contracted slower than expected in November and German Ifo business confidence also ticked higher for a second straight month, raising optimism that the downturn in the eurozone’s largest economy may be bottoming out.

Looking ahead, attention will be on ECB president Christine Lagarde, who’s due to speak, and ECB chief economist Philip Lane. Lagarde is unlikely to deviate from her recent speeches where she’s insisted that the fight against inflation isn’t over.

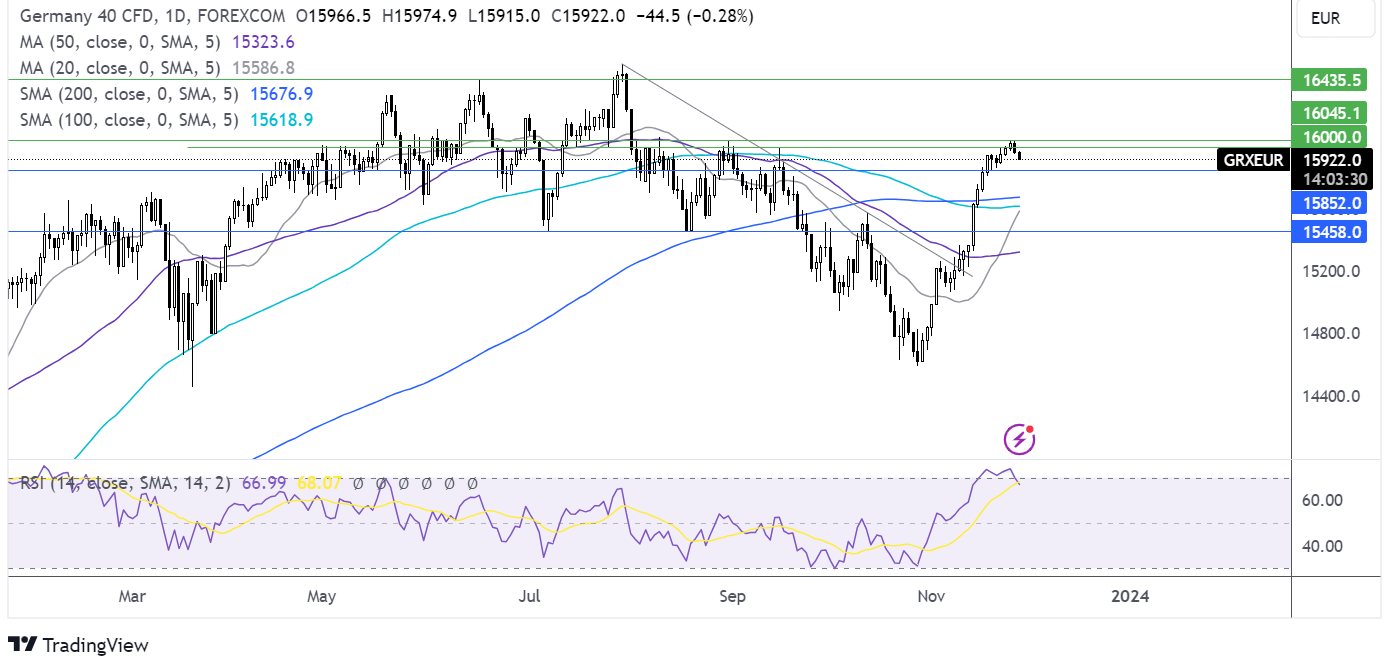

DAX forecast – technical analysis

The DAX powered above the 200 SMA and ran into resistance around 16000. It is consolidating below this level, bringing the RSI out of overbought territory.

16044, the August high, remains the near-term hurdle, with a rise above here needed to bring 16430, the June high, into focus.

On the downside, support can be seen at 15850, last week’s low ahead of 15675 the 200 sma.

GBP/USD holds steady ahead of US consumer confidence data

- GBP/USD at a 3-month high after hawkish comments from Bailey yesterday

- US consumer confidence is expected to decline to 101

- GBP/USD has risen above its rising trendline resistance

GBP/USD is holding steady at a three-month high after gains in the previous session.

On Monday, the pound pushed higher across the board after hawkish comments from Bank of England governor Andrew Bailey. Bailey pushed back against rate cut expectations, saying that the central bank would not cut interest rates for the foreseeable future.

While these comments were hawkish, the Bank of England governor also highlighted concerns over the growth outlook, which he called concerning. His comments come after the government slashed its growth outlook for the UK partly due to high inflation and high interest rates.

With this in mind, the pound’s rally to a 12-week high against the dollar could be based on weak foundations due to the UK’s weak economic outlook.

There is no high-impacting economic data from the UK today. However, attention will be on BoE’s Jonathan Haskell, who is due to speak.

Meanwhile, the U.S. dollar is hovering around the three-month low, where it languishes amid bets that the Federal Reserve has finished hiking interest rates and the next move of the U.S. central bank will be a rate cut.

Attention will now turn to U.S. consumer confidence data and several Federal Reserve officials who are due to speak later today.

U.S. consumer confidence is expected to fall to 101 from 102.1, marking a fourth consecutive monthly decline amid concerns over rising prices and high interest rates.

Attention will also be on Fed speakers for clues over the future path of interest rates. The market considers a rate cut in May more likely than not.

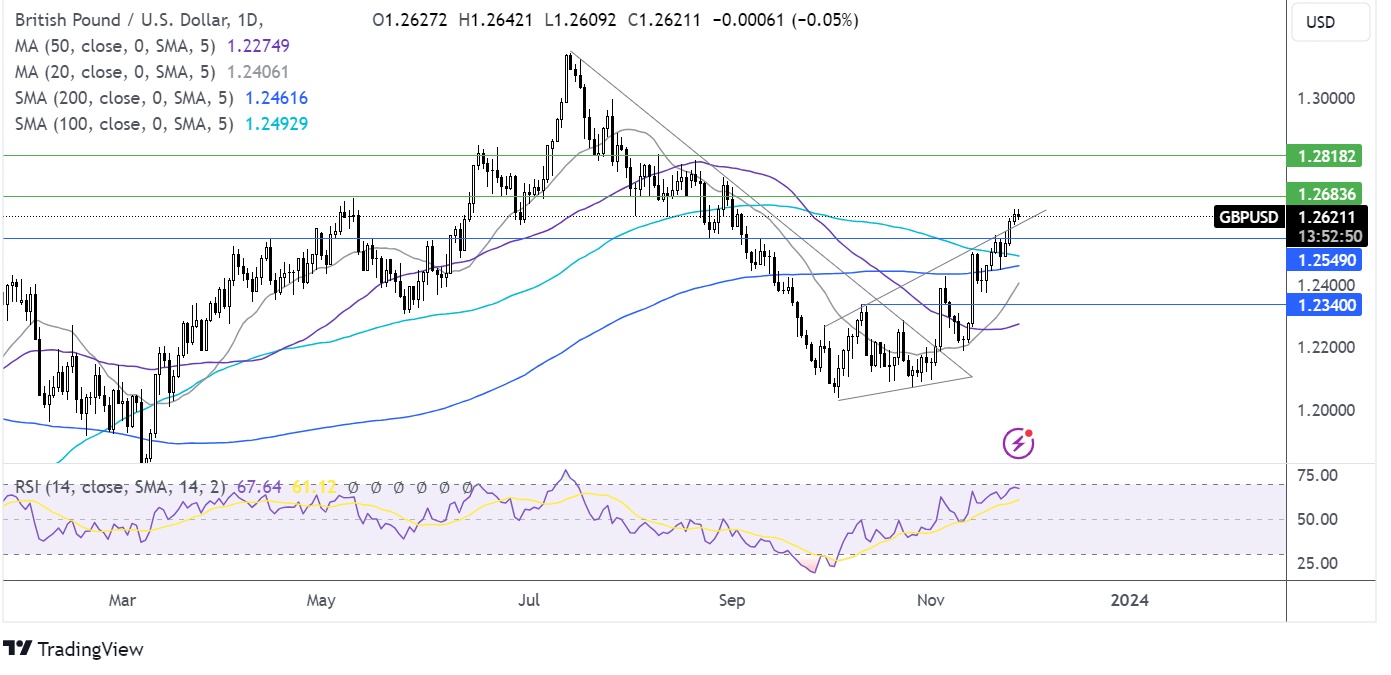

GBP/USD forecast – technical analysis

After rising above its 200 sma, in a series of higher highs and higher lows, GBP/USD has broken above 1.26, the round number and its rising trendline resistance.

GBP/USD hit a fresh 3-month high, but the RSI is heading into overbought territory which could lead to a retracement.

Resistance can be seen at 1.2680 the May high, ahead of 1.2810 the August high.

Meanwhile, a break below the rising trendline support brings support at 1.2550 into play ahead of the 100 sma at 1.25, the psychological level.

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.