Deere & Company manufactures & distributes various equipment worldwide. The company operates through four segments: Production & Precision Agriculture, small Agriculture & Turf, Construction & Forestry, & Financial services. The company is based in Illinois, US, comes under Industrials sector & trades as “DE” ticker at NYSE.

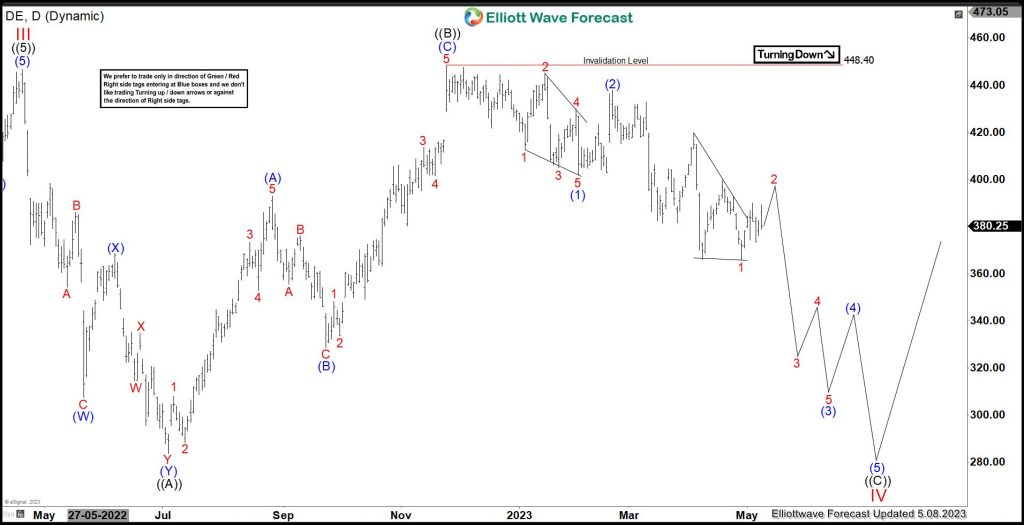

As discussed in previous article, DE showing bullish monthly sequence & favors flat correction in IV before upside resumes. It placed ((B)) of IV at $448.40 high & favors lower in ((C)) wave to finish IV either in running or expanded flat correction before upside resumes in V. Alternatively, IV can do triangle as well before the trend resumes.

DE - Elliott Wave View From 3.26.2023:

In monthly sequence, it placed I at $94.89 high & II at $24.51 low. It has extended wave III as third wave extension, which finished as III impulse at $446.76 high. Within wave III, it placed ((1)) at $181.99 high & ((2)) at $106.14 low. It favored ended ((3)) at $400.34 high & ((4)) at $320.50 low as 0.236 Fibonacci retracement correction. Finally, it ended ((5)) at $446.76 high as wave III.

DE - Elliott Wave Latest Monthly View:

It finished ((A)) of IV at $283.81 low on 7.06.2022 as 7 swing sequence. While, it ended ((B)) at $448.40 high on 11.23.2022 as 3 swing sequence in IV in flat correction. Below there, it placed (2) at $437.88 high & 1 of (3) at $365.89 low. Currently, it favors bounce in 2 of (3) & expect small bounce before downside resumes in 3 of (3). It expects few more lows to finish ((C)) as IV either in running flat or expanded flat correction followed by V higher. Alternatively, it can do triangle in IV before upside resumes.