I’m very impressed with this style of music, and the band itself. I subscribed, and will follow learning about their charitable cause. Thanks for this @darthdimsky - an unexpected bonus from this forum.

If you want to hear some good, non-mainstream music, check out this Mongolian band, The Hu. Very talented and use traditional Mongolian instruments and Mongolian throat singing. I say non-mainstream, but they are gaining in popularity.

Love these guys!  They did a killer cover of Metallica’s “Through the Never”. I love this particular track though. Has an epic feel

They did a killer cover of Metallica’s “Through the Never”. I love this particular track though. Has an epic feel

Current Reading

Dropped “How to Read a Book”, Adler. Too dry. Picked up some hints in the first 100 pages that will definitely speed things up for me but it feels dated (1972) and is a tough read atm. Will revisit later. Instead picked up and finished reading

Good read. Very practical advice with examples. At the moment requires a lot of conscious effort to implement some of the ideas because I intentionally have to slow down from my usual speed to practice concepts.

Further reading

Further reading will be centered more around mind maps, effective learning and memory improvement. Downloaded Obsidian the other day to start implementing the Zettelkasten method. Never tried it before but the sooner I start the better. It’ll pay a lot in the long run for the kind of reading/learning I want to take on going forward.

Anki reviews

Anki reviews are back online. 5 consecutive days reviewing my flash cards. Haven’t made any in a long time. Have plans to include new ones based on further reading material down the line. Here’s how they’re supposed to work.

To do list

4H/1H analysis still underway. Admit to a lacksadaisical start, but steady progress. No progress on the grading systems either. Sri Lanka is going through daily power outages. 2-3 per day. That’s impacting the to do list. While the power is out I’m able to whip out the phone and continue reading a pdf, which is why my reading’s progressed much further than the action items.

Hello again my friend. This may or may not be relevant to your quest, but I had to refer back to one of my old favourites this week in my current consulting contract. We were running down the rathole of trying to please everyone with everything during an extended stakeholder discovery and requirements gathering exercise that is now a week behind schedule. I had to stop, and go back to analyze the work that had been documented before I inherited a project mid-stream.

The book is called Flawless Consulting by Peter Block, who has been around probably as long as I have.

I re-read just the chapters 10 - From Diagnsosis to Discovery, 11 - Getting the Data and 12 Whole-System discovery. 44 pages out of a whole book of 370 pages. 12% of the book - about two hours of effort. I was then able to write up in tabular form a critical reduction of planned effort to move from data collection (restricted to four options including do nothing) and get back on track with confidence that we remained in the green status area of red, amber, green or “RAG” status.

How is this relevant to Forex, you may well ask. So it is exactly the same process I went through about 12 months ago in setting out my strategy, then plan for a Forex business investment plan. It has taken me over 15 years to get to this stage, but it has been well worth it.

I have my colleague Phil to thank for this. He has 20 years less time served as a consultant than I do, but he recommended this book, and used it religiously in his pursuit of being a highly productive project manager. He was not always popular with all stakeholders in the programme of works that lasted over 12 months, but he was pivotal to the programme in being able to complete ALL deliverables within the timeframe and budget assigned. That is all that matters in the end. Is it quantity of reading, or quality of understanding the text and the context that matters?

I got this book for £6 on eBay. Admittedly I could have bought a more up to date copy for £42.78 on Amazon, but I applied my 80/20 rule. I figured by spending 20% of the new published price I would get the benefit of 80% of the book (old version versus new version). That gives me a 4X advantage over anyone happy to pay list price. That is probably one of the reasons I have become profitable after over 15 years of trading. Unwillingness to “pay list” for anything in life - whether goods or services. Enjoy all of it or some of it, but for £6, you can’t complain.

Thanks for the recommendation. The amazon reviews for the book are really glowing (atleast for the more expensive 3rd edition  ). I have a feeling the book will help draw a lot of tangents to things that need work outside trading.

). I have a feeling the book will help draw a lot of tangents to things that need work outside trading.

Doing the same thing about noting books on other topics that I expect will have a similar impact, like @ponponwei’s thread of books on stoicism. There are some solid recommendations from the folks in the thread.

Your RAG status mention has got a few wheels spinning in my head. If I can combine that with something like a progress bar, for the things I’m working on, it will give a lot of context to the med term stuff I already have in the works.

I like the perseverance!! Good job!

Power cuts have stopped. Stopped everything forex related while they were ongoing. I found it a bit difficult to cope with and instead relieved some of the pent up stress playing a video game on the downtime instead. Back to the grind now and re-resumed my Anki sessions and other projects (Obsidian/mind mapping).

Article below explains the state of my country with key macroeconomic indicators. Factual and well written article I think.

Session Analysis

Downloaded 5 years worth of H1 data and did some rudimentary analysis. I had questions that could only be answered by looking at data.

While analyzing the data I understand why GMT+2 was adopted for MT5. Besides Metaquotes being Russian based, the NY session also closes at midnight on FRI on the same timezone. Fits like a glove. Revised previous listed time zones as follows:

Table:

Chart:

Notes:

- The calculation and charts assume SYD session start at 0000hrs (as opposed to the 2200hrs from the previous day). I don’t have the computing power to make the necessary adjustments. My spreadsheet crashed a few times already while working on the large dataset.

- Pip values are determined by calculating the difference between session open and session close. Pip values are larger if you calculate intra-session movements (the lower the time frames the larger the aggregated pip movement). If you account for intrasession volatility the rankings may change

- Labelled as directional pip movement (could be incorrect labelling on my part) because the difference calculated is a positive value, irrespective of whether there pairs moved up or down during the session.

- DST isn’t accounted for while calculating the session times. I ignored it because making the adjustments over 5 years to account for a skew of 1 hour didn’t make sense. Too much work for a marginal change to the numbers.

- Data according to my broker LP. Though highly unlikely, it may differ significantly enough to the data from other LPs, and may not be an accurate representation of the aggregated volume for all retail LPs.

Top 5 Pairs by session for the past 5 calendar years (2017-2021)

Top 5 Pairs for 2021 by Quarter

Since I had to determine the session overlaps anyway, in the course of identifying session start/end times, it made sense to make look at session overlaps too. NYC/SYD session overlap not accounted for due to the 0000hr SYD session adjustment.

Top 5 Pairs by session overlap for the past 5 calendar years (2017-2021)

Top 5 Pairs for 2021 by Quarter

Unintended finding

Was suprised to find out that broker data can also have gaps and may not be as complete. Determined that while analyzing some errors in the data. Like the missing GBPJPY data below. Out of the 24 records for the day I could only download 11.

These errors were very rare though and had minimal impact on the analysis (~0.7% sessions excluded from analysis as a result of missing data).

Further analysis

What I really wanted to know was whether the Asian session was a potential leading indicator or trailing indicator. With the trading volume and significant news releases in the LON & NYC sessions it’s not difficult to believe that SYD & TYO trail. But is that consistently the case for all the currencies? That’s what I really want to understand. Might not be able to pull it off but I’ll try.

4H/1H analysis

Going well since the power resumption. Also evolved the way I analyzed each trade. Found a potentially better way to quantify it and will have to revisit some of the earlier analysis to apply the same standard consistency. Power cuts are back on but my area isn’t facing it as badly as the rest of the country. Feeling something like survivors guilt because of the suffering the rest of the population is going through atm.

Journal grading

Dropped the idea for now. Waste of time for now. I’m better doing it when I have a sizeable data set of journal reviews. I usually get the best ideas while I’m actively working on data, which is something I don’t have atm.

I will apply the same principles on a trade grading system. It complements the work I’m doing with the 4H/1H analysis already and is more relevant. Rather than blathering on and on about it now I’ll just do it with the data I’m already preparing atm.

Further reading

Read a bit here and there from a # of books when the power is out. No serious studying atm. More focused on getting that analysis out of the way to start the live trading.

Oof lots of lines of code involved though. But I love that it’s just within Notion.

For Mindmaps I’ve tried using Miro. There’s also Coggle but it sucks because ideally everything is all in just one place. For now they’re in my physical notebook.

Yea, Miro appears to be the most popular one out there. I think most of the videos comparing mindmapping software use Miro as the base. I remember looking at coggle too (cuz it was free!) and decided against it cause it had 3 private spaces. I settled on another free version (freeplane) which is a software download. Steep learning curve in my case though. Even the user manual is one massive mindmap, which is actually pretty cool because you start getting used to collapsing/expanding and see how the devs use it

Atleast you’ve got the habit of doing it. I’ve never bothered till now so it’s a bit difficult to get it to be habit forming, which is why I’m including it in the journal too (for accountability). In time hopefully!

You lost me there hahahhaa. That sounds crazy  But yeah cool like you said once you get the hang of it!

But yeah cool like you said once you get the hang of it!

Yea, it won’t make sense till you see it. Pretty amazing how they set it up.

I’ll have to check this out!

If you’re really interested I think you should check out @MikeWolski’s blog. He put his trading plan down and it’s a great reference if you want to use it for ideas.

Edit: Found the specific post with 2 mindmaps as folls:

Something had come up and I took a break from anything trading related for a few days.

H4/H1 analysis

Had finished the analysis for all 4 currency pairs well before the break. Revisiting and revising earlier work for standardisation is currently pending.

Reading

Wanted to create Anki cards for Ashraf Laidi’s book, but I’ll have to give it a quick re-read. Before doing that I decided to look at John Murphy’s book on intermarket analysis.

https://www.amazon.com/Trading-Intermarket-Analysis-Financial-Exchange-Traded/dp/1119210011

That’s because this was the foundation for the more advanced stuff in Mr Laidi’s book. So far a really good read. Creating Anki cards and also decided to use Obsidian for the first time. Early stages still but this will be a great tool to scale into when I start learning about other instruments and subject matter.

Random

Not all stuff I see on the Real Vision Finance I’ll watch. Stuff on NFTs and cryptos especially I skip. If I see something on the macro view of the market or FX related I’ll shortlist it. This is a good one and contains two of my favorite speakers on this channel.

It’s starting to make a lot more sense, especially with the reading I’m doing now. For e.g. towards the end Darius discusses how even within REITS there are non-cyclicals and gives examples. With the current knowledge base this is a really good nuance. Another good resource for me is reading up on the weekly market outlook put up by @katetrades right here at BP. It’s commercial content and I’m not promoting it. But it happens to agree with how I want to look at the markets.

What I’m trying to pick up is not the content itself but the analysis and the context to which it’s applied. Events may not transpire as discussed because there are just so many variables. But how these analysts view markets is insightful.

Checked it out. Love Mike Wolski also. RE: Mindmaps, I feel like it can look overwhelming at first glance. I need to get over that part lol

Though it’s in the public domain, my journal’s always intended for my consumption primarily. It’s a tool to marshall my thoughts and stay the course to meet objectives set earlier. My approach to date is to write it as I would if it were private. A little worried that might start to change now that I’ve shared it with family and friends recently.

H4/H1 analysis

Correcting prior observations carried out. It’s taken close to 5 months. In two minds about the duration. Feels it took way too long considering I was only testing one strategy. On the other hand the analysis did get me to see charts/price action very differently from how I was seeing earlier. Plus found a novel way to execute my strategy.

Brief rundown:

There was a disconnect with the previous method I was using. It was methodical and well thought out but I’ve always felt there was something missing. Decided to look at things from the bottom up. This was accomplished by isolating 100-pip+ moves on the D1 chart and identifying common denominators on the D1, H4, H1 TF. Used the 4 most liquid currency pairs (EURUSD, USDJPY, GBPUSD & AUDUSD) to limit it’s scope. Duration for each CP was 12 months (01-DEC-20 - 30-NOV-21).

The common denominators were around indicators that I found best suited my goals. There could objectively be better indicators to suite the fulfill the same purpose that I’ve yet to try out. I’m pretty confident I’ve not even used the existing indicators (especially the ADX) to it’s fullest potentials, which I why I’ve made it a point ot read up on articles/books by their proponents. For e.g. J. W. Wilder and Ashwani Gujral.

Strategy:

It’s a combination of Elder’s Triple Screen & a Bollinger bands mean reversion strategy, where the novelty is the change to the Bollinger band SMA parameters. The basic premise is that price expands from and contracts to a price determined by market forces, which are reflected in the SMAs.

This is a one off graph which showed testing at 1st Std Dev levels. Could be a one off instance because I didn’t see it at other times and in other CPs. Price, however consolidates around the 100SMA before a move and then snaps back to oscillate around it again.

Findings:

Isolated 109 x 100-pip moves. Of which 90 were found to be feasible entries on preliminary observation (moving in direction with the overall trend and is not usually the first move after a reversal).

Raw numbers:

Standardised %s:

Though close to it I can’t call it a trade grade because it doesn’t take into account any false positives from the sub 100-pip movements in between.

Downsides:

Besides the false positives there’s also the sample size. ~100 is too low. A minimum of 300-500 is more significant. The # of estimated trades within the ~100 samples should amount to 300+ trades but that’s just a visual estimation.

USDJPY, unlike the others also had about half of it’s D1 entries initiate from an MA, the rest from a Boll band. Will have to double check this later. This is an anomaly compared to the other CPs.

Prior workflow:

The existing process will impact the screening process I set up in my Notion workspace. Will have to find a way to make it compatible.

Previous screening for D1 trends:

Mind map:

Thought a simple mind map describing my triple screen would be good to have. Would like to have one each for my entry & exit rules though. Good for a first start.

Further reading:

3/4th of the way through John Murphy’s book. Excellent read. One of the best books I’ve read on trading so far. Put it on hold before the 4th part to focus solely on the H4/H1 analysis.

The obsidian map is fleshing out really nicely. It’s fascinating. The more learning and context applied to the topics the more valuable each note becomes. It’s really start to shine when I read and make notes from more books going forward. I’m sure there are better ways to use this but this is already very marked improvement to my learning process.

Created Anki cards for the first 100 pages or so only so far. Will do them after I finish the rest of the book and finish obsidian note taking.

Next up:

- Configure fxblue/myfxbook accounts

- Resume weekly analysis

- Live trade commencement on MON.

PC problems

I had an issue with my PC. My screen had water damage from earlier and was on it’s last legs. It gave out THU, 19MAY. I managed to figure out how to mirror the screen onto my phone and manage some trades the following day but gave it up for repairs on MON. Got it late this THU and was able to trade a bit on FRI. Missed 5/10 days since going live because of repairs.

Trade summary

Not the best. Down $18.59 (DD% and Equity loss% is the same since it’s a $100 account) in the 5 days traded so far. Not too worried about it though because the only winners I had (~20% win rate) were on the 4th day (the day after the PC issues). This FRI (5th day) I had 2/3 that were timed wrong but were going in the direction I had placed my trades. TBD later.

All in all I was reconciling the workflow and process I was following earlier with the new strategy and I had a number of hiccups. I believe I’m still weaning some of the rules I had in place from the previous process, mentally.

The goal of the workflow and the journal in Notion is to relieve a lot of unnecessary analysis and doubt at the time of the trade. I do most of the long term analysis and list the projections & expectations on the weekends. The workflow also instills a proper routine with the intention of focusing solely on entry/exit strategies for valid trades for the day.

Plus I’d not kept in touch with macroeconomic events and significant news. I definitely remember feeling out of depth on the first day of trading. Was digesting a lot of information and getting the new process down so I’m not too fussed about the loss so far.

Trade trackers

Myfxbook: https://www.myfxbook.com/portfolio/fm-mt5-zero-account-1/9549226

FX Blue: FX Blue - Statement for darthdimsky

Notable Trades

There were a total of 6 trades (4 of which ended up being losses) that were memorable. If they’d worked out I’d easily be in profit right now.

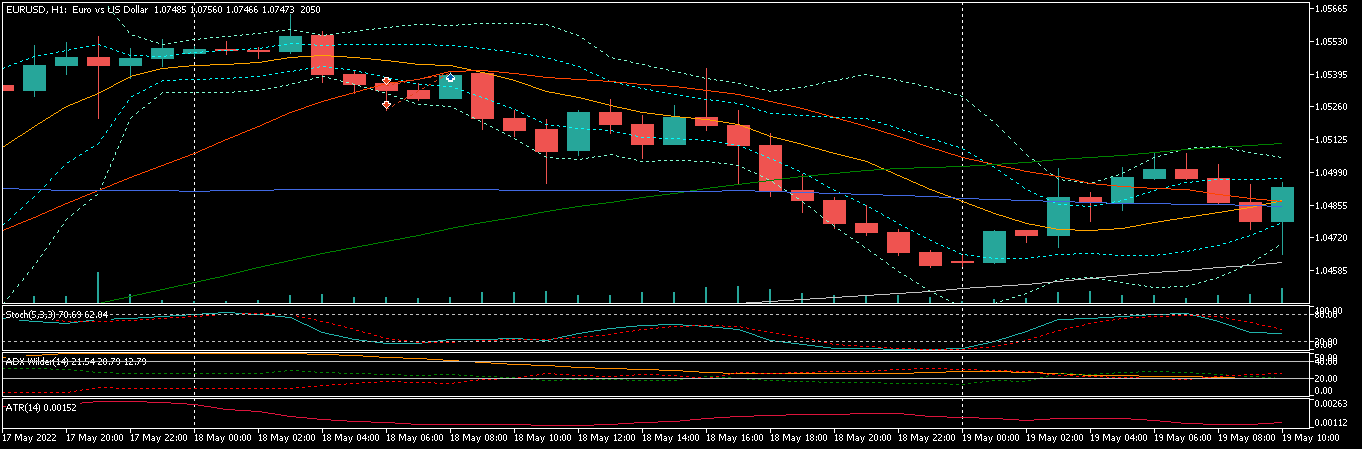

Four of them were on the 18th. Two each against EURUSD and EURJPY. I’d initially opened two of the near simultaneously and tried to scale into them with two others later. I’d set a 15 pip SL and a 15-pip TSL before shutting down my PC for the daily power cut. When I’d logged back in 3 trades were closed. 2 losses, 1 win (~5pips) and I closed the remaining pending order. Situation of the trades at the time of placing the scaled trades:

Colors are mangled because my green colors stopped working a month back and this is what worked on the broken display.

EURUSD

How the trade panned out:

A better entry would’ve been the SMA10/20 intersection at 0900. A trailing stop would’ve stopped me cold though. But If I’d paid more attention to the pair later I’d have been able to get a hold of an ~80 pip move later. Net result: -~10pips

EURJPY

How it panned out:

This was a clear FOMO. I remember looking at the strong downside moves and just getting in. I didn’t notice a possible consolidation area around the SMA200, which is a really good point of entry. Missed out on a ~200 pip move later. I’d closed the still pending scaled trade too in disgust at the losses and didn’t look at this till later in the day. Poor execution and mentality. Net result: -15 pips

Took two trades for GBPNZD on the 27th as folls:

How they played out:

Again mistimed it. Didn’t remember to wait for PA intersection with SMA10, which is what ended up happening and going for a push 50-60 pip push.

Reading progress

Finished John Murphy’s book on the phone while I had no PC. Finished notes in obsidian on the weekend and resumed making Anki cards on the book.

It’s a great book because it’s written for non traders (line graphs used and explanations of SR and very basic patterns in some places). Yet the depth of the information is super useful to retail traders. Explores:

- The cyclical nature of the markets and the intermarket relationships b/w Stocks, Bonds, Commodities & Currencies

- How certain relationships decoupled or strengthened based and the conditions under which they happened.

- Introduction to sector rotation

- How to use ETFs to gauge the various markets and use ratio analysis/relative strength to determine which sectors are benefiting now.

- Brief overview of Monetary policy. Indicators leading to QE/QT and the effects thereafter. Operation Twist and further reading up on it was fascinating.

It’s a book that’s given me a lot of tools to look at markets in a different way. Already downloading certain data sets to practice some of the analysis on the downtime. Also super useful to have the kind of charting capability demonstrated in the books. Amazing charting tool. Going to try Tradingview to see if I can emulate some of the functions.

Read 50 or so pages briefly on the phone on Bond Investing for Dummies. Will resume once I’m done with the Anki cards.

Are you thinking about making one?

You’ve really been putting in the work!! Keep it up!