Was re-reading portions of Ashraf Laidi’s book because I couldn’t apply anything in there during the time my laptop was out of commission.

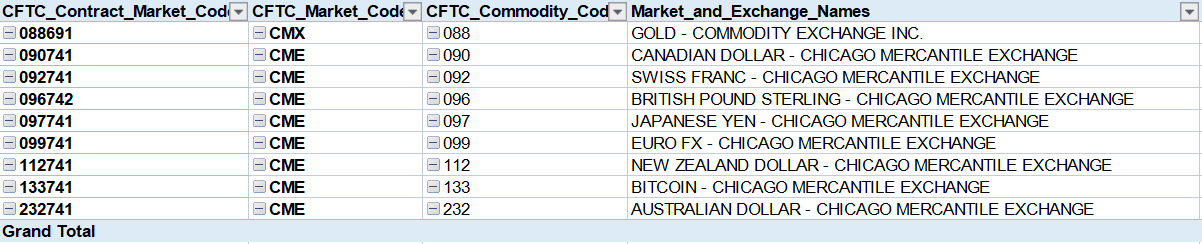

While going through the first chapter on Gold I remembered watching a real vision finance interview with Tony Greer that discussed BTC and it’s possible risk off traits. I wanted to know if there were any numbers that justified it. The only place I thought of looking were maybe COT reports. I don’t know futures and didn’t know if there was a BTC future. Luckily found this that indicated it’s availability.

Downloaded a few of the variations of the reports and figured out which one the Insider Week website was sourcing it’s data from (“Futures Only” here), how the numbers were derived and why they were derived that way.

It’s a steep learning curve for someone with no knowledge of futures. But satisfying to understand, ateast the parts I wanted to know. Some data for future reference if I have to trawl through the data again:

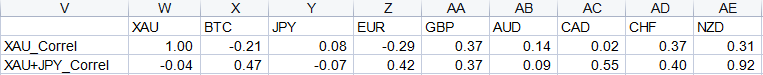

Decided to look at the correlation for the entire 2 year period and it’s inconclusive. Just a cursory glance indicates no relationship/weak relationships between Gold and other instruments

Looking at 2 years worth of data doesn’t tell me whether there were changes to the the relationship mid way. Meaning there’s a possibility that there were periods of strong correlationship between XAU and the other instruments.

Implemented a rolling 12-week correlation to to gold. No real significance to the 12 week duration. The books outlines a 6 month rolling correlation but for a 7-8 year span. It showed times when BTC and Gold were strongly correlated, FEB-APR & again in JUN-JUL

The rest of the correlations to the AUD & JPY didn’t make a lot of sense. Especially the positive & negative correlations, respectively, in the first half of the year. That made no sense.

The exercise was meant to determine whether BTC is a risk off assett but I was only considering Gold as the only risk off indicator so far. That wouldn’t make sense if some of the capital/contracts that would traditionally have gone to Gold are now taken up by BTC instead. This is evident if you standardise the open interest for XAU & BTC (07JAN20 = 100) and plot them side by side.

What the chart clearly shows is that BTC contracts, at the end of 2021, are at ~231%, compared to the open interest figure on 07JAN20, while XAU contracts in comparison are ~65% of the corresponding volume

For a more meaningful correlation it’d make more sense to look at the aggregated open interest for BTC & XAU, which if considered for the entire 2 year period would look like:

When looking at overall numbers the near zero correlation with the strongest risk off currency and a positive correlation of 0.92 with a currency that has the most hawkish central bank makes no sense. The rolling 12 week exercise was applied again after applying correlations to the aggregated XAU/JPY open interest with more encouraging behavior.

Number of takeaways from the graph:

- The NZD & AUD show a strong correlation to each other, atleast in the first 3Q of the year. That’s consistency is encouraging.

- Why do the risk on currencies have a positive correlation to risk off assets (not just the aggregated XAU/BTC but also the JPY)? Were the AUD/NZD that weak in the periods MAR - early MAY and late JUN - SEP?

- The risk on currencies show the same dip to no relation that Gold showed to BTC for the same time period, between MAY & JUN

- While the NZD is more inconclusive toward the end of the year, its encouraging to see the strong positive correlation against the JPY and the strong negative correlation against the AUD at year end, which gives credence to the theory of BTC of being a strong risk off asset.

Some of the anomalies can be explained as folls:

-

The dip to no correlation of XAU to BTC and later XAU+BTC to NZD & AUD - The timeline is significant. This is when all hell broke loose with BTC after the ransomware attack on the colonial pipeline on 07MAY. That began a cascade of events, like the US government’s crackdown on BTC, Musk’s announcement to stop accepting BTC payments for TSLA & China’s eventual ban on cryptocurrency mining. Further confirmed by the sudden dip in daily hashrates for BTC in MAY.

source - Bitcoin Hashrate Chart

-

The NZD’s non correlative behavior in Q4 - Does this coincide with the drastic coronavirus lockdowns that began with the discovery of it’s first cononavirus case since FEB? I remember that’s when we were expecting the RBNZ to increase it’s interest rates. The first Central Bank at the time. Though I’m keen to pin the lack of correlation to the unexpected market environment caused by the drastic measures taken for the coronavirus lockdown I’m a bit hesitant to say that’s the certain cause without more data points for validation.

-

The positive correlation between AUD/NZD (Risk on) and XAU+JPY (Risk off) Open Interest for MAR-MAY & again from JUL-SEP is a huge cause for concern. That’s just not supposed to happen, atleast not to the best of my limited knowledge. Recap of that behavior on the same chart with remarks:

Decided the best way was to determine the validity of the behavior was to apply the same correlation to the indices for the same currency pairs. In the absence of an instruments like the DXY equivalent (atleast not that I’m aware of atm) for the USD. I decided to use the TWI or the EER equivalents. Thankfully there’s a centralized repository for the EERs at the BIS here. The only issue is that this might be real when I’d thought till date that nominal effective exchange rates was the way to go.

Is there a positive correlation between the JPY and AUD/NZD in the effective exchange rates?

Unlike other correlations I decided anything > -0.4 is significant. Simply because we expect risk on/risk off instruments to mirror. This period overlaps with the anomalous zones determined by the opened interest positions in the COT data, which, for now atleast, doesn’t invalidate the approach I took. But to even see a correlation > 0.4 between the JPY and AUD/NZD at some points is really surprising and cool. Didn’t expect that.

Conclusions/Takeaways:

- At present BTC & Gold is used as part of portfolios for Risk off behavior and the COT data can quantify that.

- Applying a rolling correlation can give a lot of insight into an instrument’s behavior in light of changing market conditions. Credit for this idea in this instance is with Mr Laidi in his book where he demonstrated it:

- Risk on instruments can at times have positive correlations with risk off instruments!

I’m looking for an alternative that’ll help aggregate the table data. Microsoft announced a notion alternative, Loop, that’ll I’ll also look into.

I’m looking for an alternative that’ll help aggregate the table data. Microsoft announced a notion alternative, Loop, that’ll I’ll also look into.