Trading update

There was an 404 error when clicking on the myfxbook link. It required additional verification. That’s fixed now.

Account’s up from previous week to $90.81 but still in the red.

Notable trades

More of a notable session. The 31st was memorable. There were a few economic news items that countered some of the analysis I’d done over the previous weekend. That threw me for a bit of a loop and I’d gone down to $64.90 (35.10% Absolute DD). I’d let some trades run while the power went out and had logged back in to see all of them had gone against me. I knew then I’d over-traded a # of positions in an uncertain environment.

I recalibrated. Cleared my head and decided the CAD had strong fundamentals, especially against the GBP and JPY. Plus they hadn’t moved as much till then so I knew there was potential. What happened next was epic:

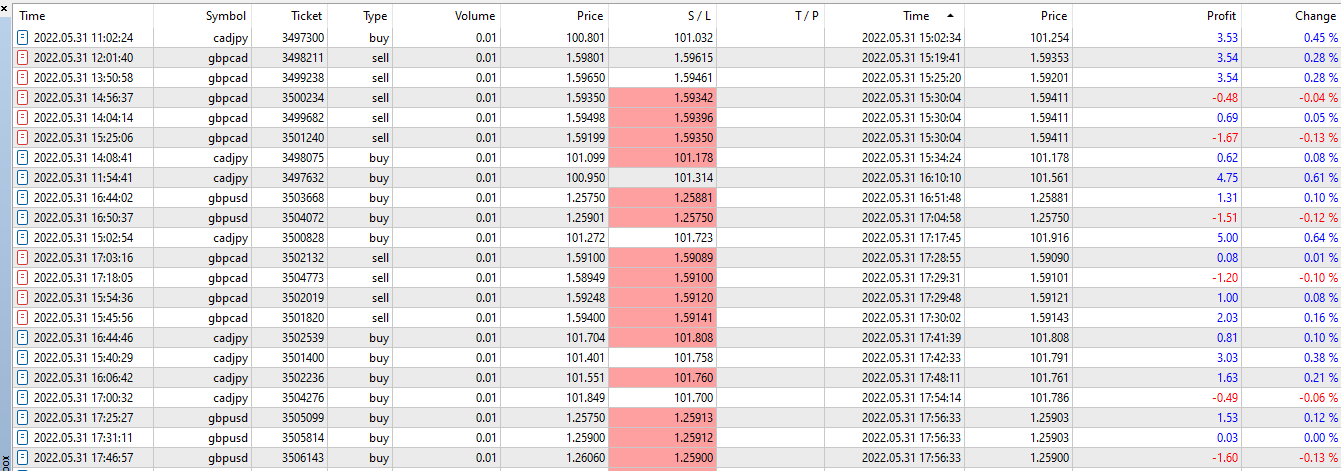

In the 3 hours session I’d basically notched up these numbers:

Netted ~335 pips & ~$26.

I’d tried two different exit strategies. A TP (to free up equity) on the CADJPY and the TSL on the GBPCAD. Whats shocking is if I’d used the TP approach with GBPCAD I would’ve netted more.

Also implemented a different TSL approach as a backup for CADJPY. Instead of a fixed 15-pip TSL right throughout I’d widen it by 5 pips when I’d laddered to another position. So when I’d open a new position 15-pips away I’d widen the TSL of the old position to 20-pips and so on. This is a really good approach I thought till I realised after THU session that I might not even need a TSL with my strategy. I’m working on specific target zones if I’m aiming movement to/from Bollinger extremes, so I’m wondering if the varying TSL is a redundant idea in my case. Still mulling over it.

Part of the reason I wasn’t doing well till then was also I was scaling into positions for the first time and was still figuring it out. This was the first time it’d worked and it worked really well. I’d also switched to M15 charts for the duration and was surprised at how comfortable I felt trading the TF. I’d never used it before. I’ve still got a number of ideas I want to try out but I’ve got to reign in that curiosity and tinkering until the account balance is healthier. This session was mentally taxing. Felt euphoric right after though.

I’d like to attribute the good session to very clear focus and mostly good execution. But it could also be because I changed my playlist to Pantera. Phil Anselmo screaming in my ears is oddly relaxing now.

Takeaways and thing to fix:

- I’m proficient and confident enough to trade the LON & NYC sessions. I’m doing a miserable job with the TYO session. I’m guilty of not going over my earlier session analysis and planning accordingly. That’s a must do.

- My Notion workspace is the backbone to my trading regimen. This was why I lamented losing the first MQL5 code. But it’s not optimized to the current strategy. Right now the screening process is what I’d implemented previously, which was already not perfect, and is just more disjointed now. I’ll need to account for ADX crossovers atleast. Need to brainstorm the changes and plan the implementation (it will need changes not only in Notion but the MQL5 script too).

Trimmed some redundant fields though. Workspace as it is now

- I’m losing some sleep. I have a hard time switching my head off. Not happy about this at all. If it persists I might have to take an extended break to fix the routine first. $100 isn’t something to worry about. But I don’t want bad routines going from bad to worse when I do get around to trading larger amounts. It’s that simple.

Further reading

Nada. This is the first week I haven’t read anything or intend to. Feeling a bit drained. I am reading and absorbing a lot of other stuff around fundamentals & news events during the day though. But I’m not happy that I didn’t make the time to continue the planned additional reading.

Oh, I was able to use Tradingview for some intermarket analysis. I was able to duplicate almost all the methods I wanted to try out on the Tradingview desktop app. The only one I didn’t try yet was a market breadth indicator to see which stocks were trading above/below the DMA200 for an index/market sector. Tbh, I didn’t bother trying to see if such an indicator even existed. Will do another time. Thread discussing the analysis: