Since the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured from 0 to 2019’s high projected from March’s low, equal legs. Since we begin with this analysis on February 13th, we bought the share in 160.97 - 165.89 area.

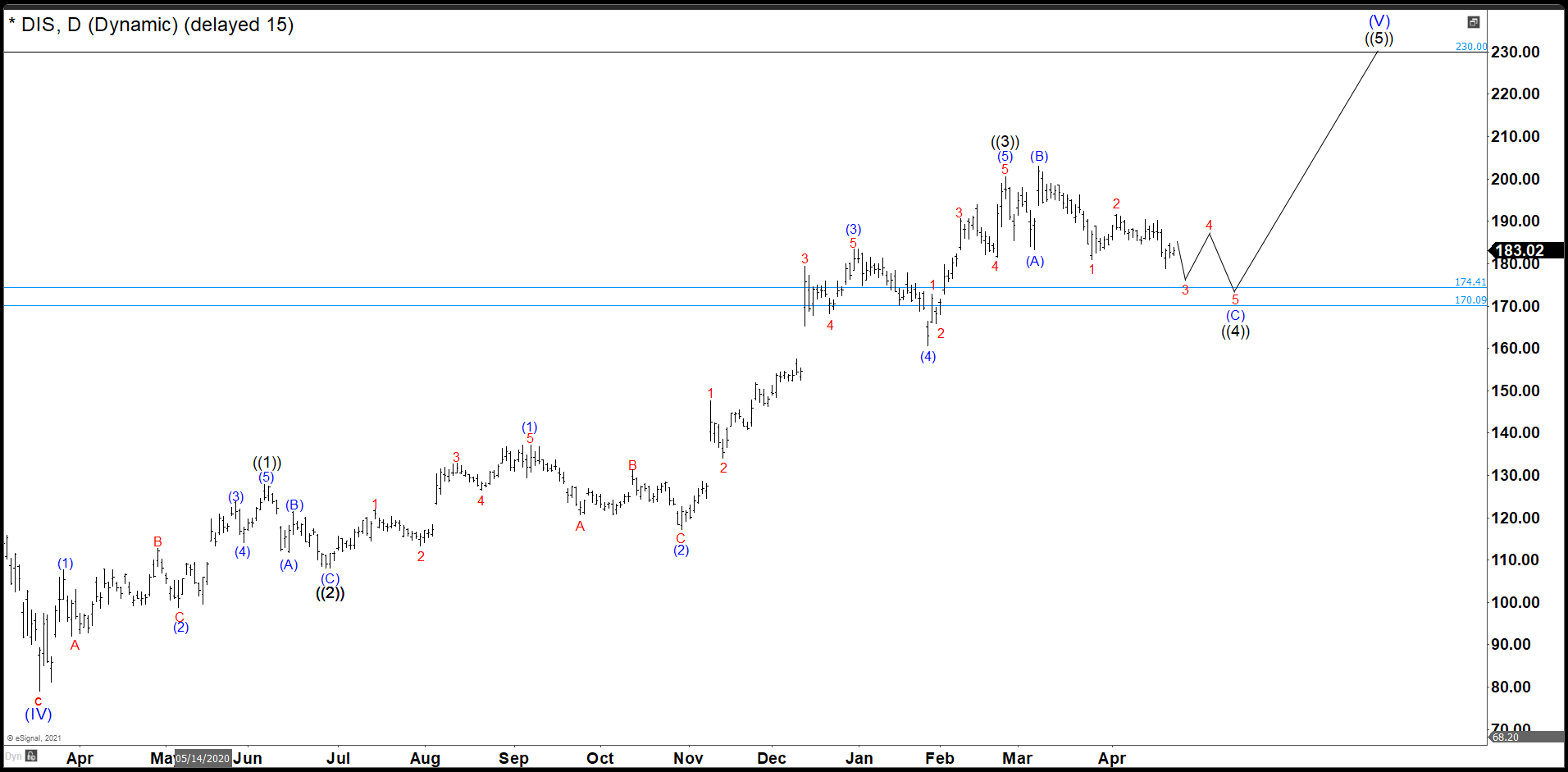

Disney Old Daily Chart

As we see in the daily chart, the waves ((1)), ((2)) and ((3)) of the impulse are done. We hit our first target at 190.88. The target gave us a return of +18.58% from 160.97. Disney dropped showing us that an irregular flat took place, and it has not finished yet. The rally to $230.00 must wait.

As we see in the daily chart, the waves ((1)), ((2)) and ((3)) of the impulse are done. We hit our first target at 190.88. The target gave us a return of +18.58% from 160.97. Disney dropped showing us that an irregular flat took place, and it has not finished yet. The rally to $230.00 must wait.

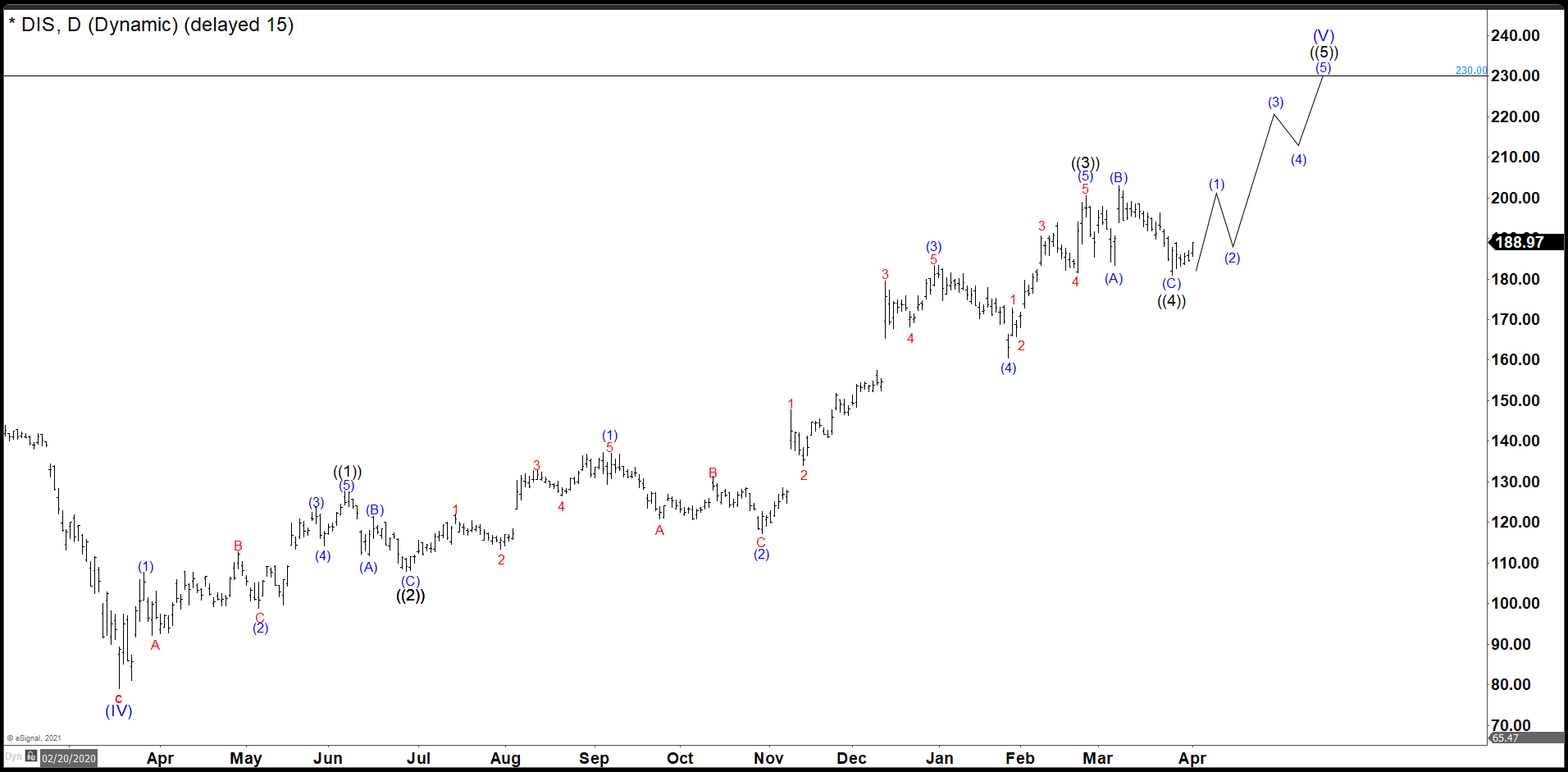

Disney Current Daily Chart

Therefore, the market breaks below wave ©, then it should be extended. The breaking is not clear, and it is more like that wave © of ((4)) should end in 5 waves as a ending diagonal, that means, Disney could continue ranging to the downside until we see a movement above 192.00 and more important 203.00, in that case we will confirm wave ((4)) is done. (If you want to learn more about Elliott Wave Theory, please follow this link: Elliott Wave Theory).

Source: Disney Wave ((4)) Has Not Ended And Needs To Talk More