The next entry in the theme of Corona Virus stocks is DocuSign. Biotech is not the only sector benefitting greatly from the COVID-19 oubreak, software is also making huge gains in some stocks. I am finding new software companies every single day that are making new All Time Highs. $DOCU has been on a monster run lately, lets check out what they do as a company:

“DocuSign, Inc. is an American company headquartered in San Francisco, California that allows organizations to manage electronic agreements. As part of the DocuSign Agreement Cloud, DocuSign offers eSignature, a way to sign electronically on different devices. DocuSign claims it has over 475,000 customers and hundreds of millions of users in more than 180 countries. Signatures processed by DocuSign are compliant with the US ESIGN Act, and the European Union’s eIDAS regulation, including EU Advanced and EU Qualified Signatures.”

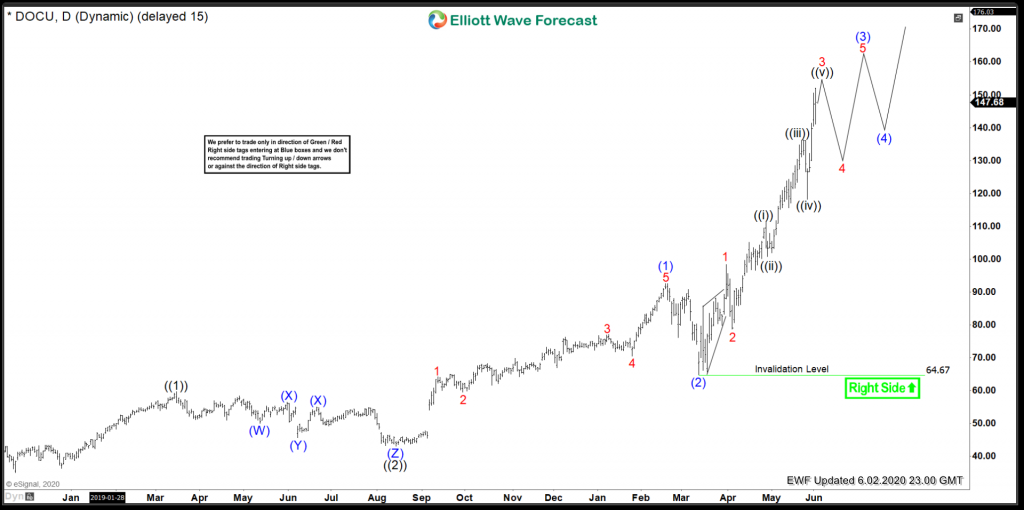

The rally in $DOCU seems to be an ongoing affair, but as always, remains very technical. Lets check out the Daily Elliot Wave view.

DocuSign Elliott Wave Daily View

Medium term term view from 11/20/2018 lows of 35.06. Wave ((1)) was set at 59.62 on 3/15/2019 and wave ((2)) at 43.13 on 8/14/2019. After that, Blue (1) was set at 92.55 on 2/19/2020 and Blue (2) at 64.88 on 3/12/2020. From there $DOCU is in a clear wave (3) of ((3)) advance with the bulls firmly in control. Blue (3) is still underway, with Red 3 expected to form a top in the near term.

In conclusion, this is not a stock for selling, we do not recommend selling at all, since the right side is bullish on daily view. After red 3 finds a top, a buying opportunity with an equal leg pullback in 3,7 or 11 swings may present itself.