Continually one of the biggest topics of discussion, the US Dollar. The USDSGD is a pair I’ve kept an eye on since I’ve started trading. The pair readily has strong movements and tends to follow basic technical analysis.

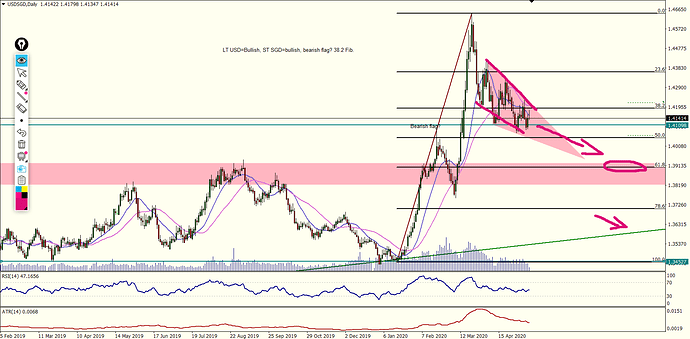

Since its’ bullish trend in March, it has slowly but surely moved downwards. It created a bearish flag, but I’m still waiting for a strong downwards push. There seems to be a nice support level around the 61,8. The 200-day MA might come in play here as well. After that, the long term trendline, indicated by the green line might be the next level of support.

The volume and volatility have subdued, which means the next, strong push downwards would have an increase in both. The RSI is around 50 which means the market might be a bit indecisive. However, if there is a selloff in equities/indices, the USD might just gain bullish momentum and test its highs from March.

Comment below and we can have a discussion.

Let’s spread the love in these difficult times.