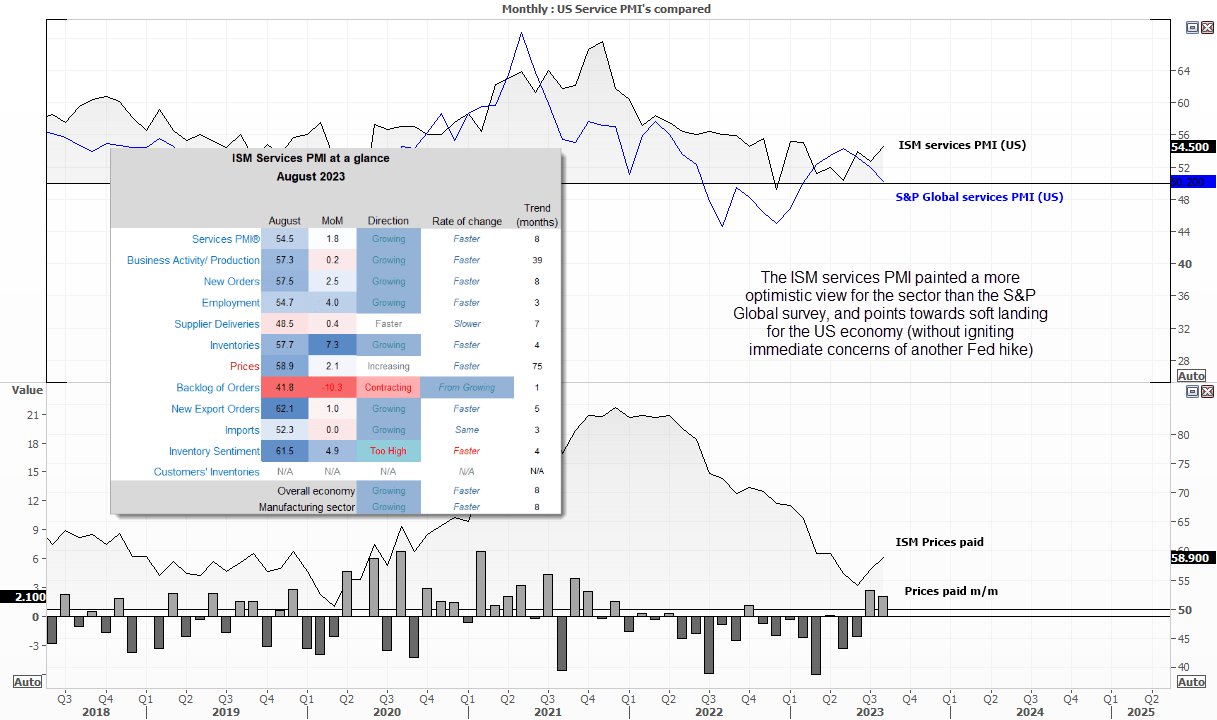

Two key service PMI reports for the US diverged, with the S&P global reporting a minor expansion whilst the ISM painted a more optimistic picture. The ISM services PMI grew at its fastest pace in six month, 13/18 industries reported an expansion and the headline print if 54.5 indicates an annualised GDP rate of 1.6%. The employment index rose to a 21-month high and new orders hit a 6-month high, although prices paid also increased for a second month. Comments from the survey respondents also seemed to back up a soft landing scenario for the US economy, and Fed fund futures continues to imply that the Fed are done with hiking.

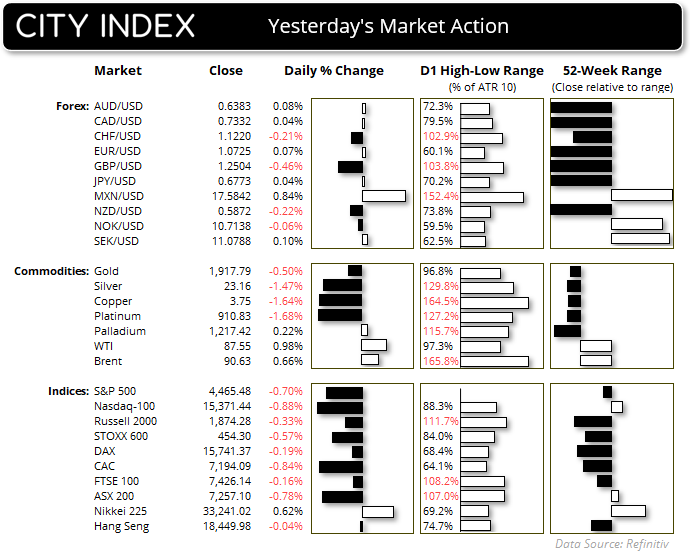

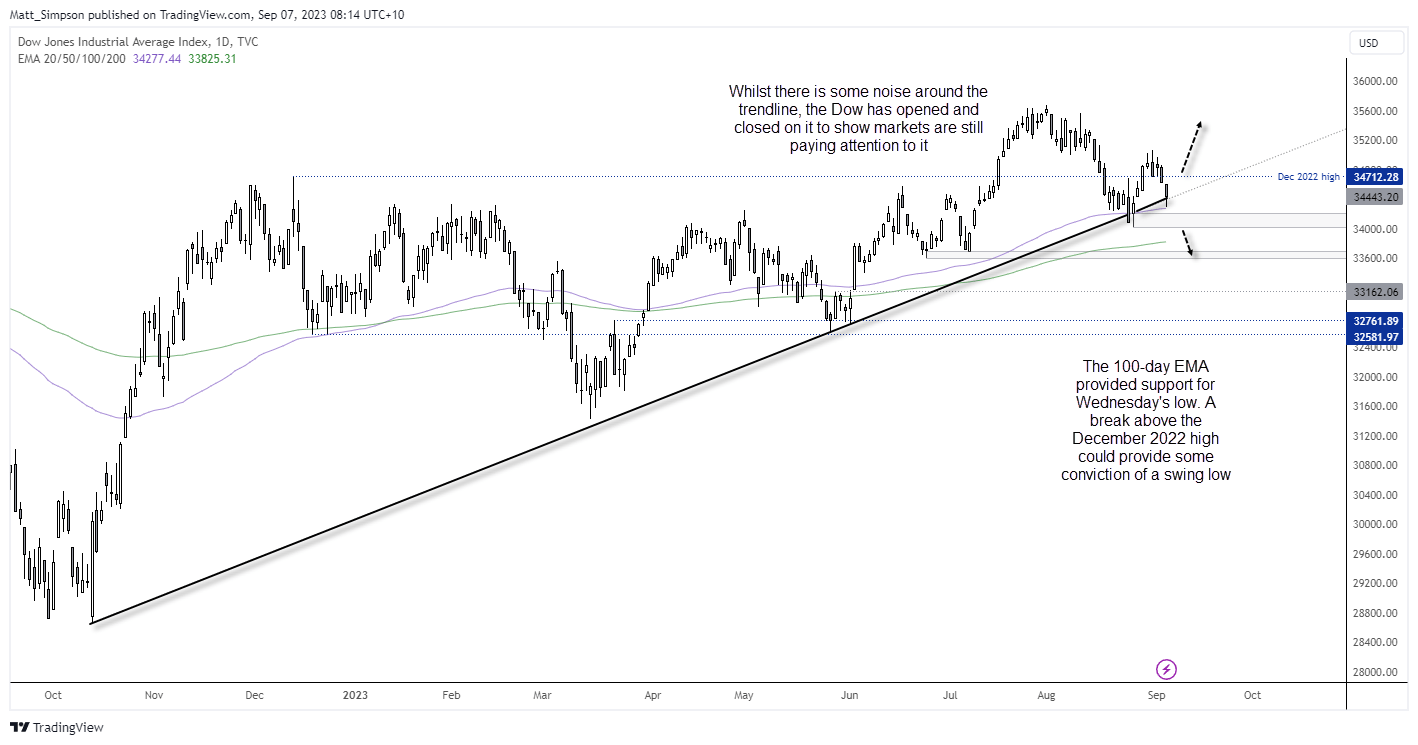

- US bond yields rose for a third day and Wall Street indices pulled back further as the ISM report plays into the ‘higher for longer’ narrative for Fed rates

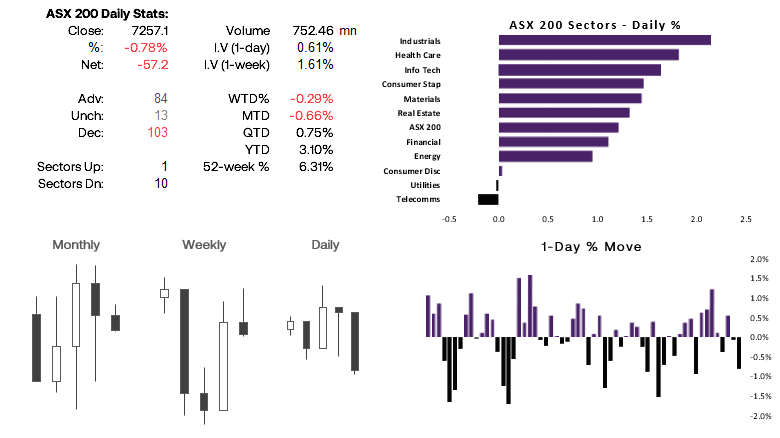

- The S&P 500 pulled back to 4450 during its worst day in eight, the Nasdaq also retreated but found support at the 24 August high

- GBP/USD fell to a 3-month low and was the weakest forex major on Wednesday as BOE governor Bailey said that the central bank was “much nearer” the end of its tightening cycle. This followed on from last week’s comments from the BOE’s chief economists that rates are more likely to plateau

- WTI crude oil rose for a sixth day and held on to gains on a report that crude inventories had dropped for a fourth week

- The Bank of Canada held rates as anticipated but warned that they could hike again of inflationary pressures persist.

- ECB member Knot said that markets are underestimating the risks for further ECB hikes