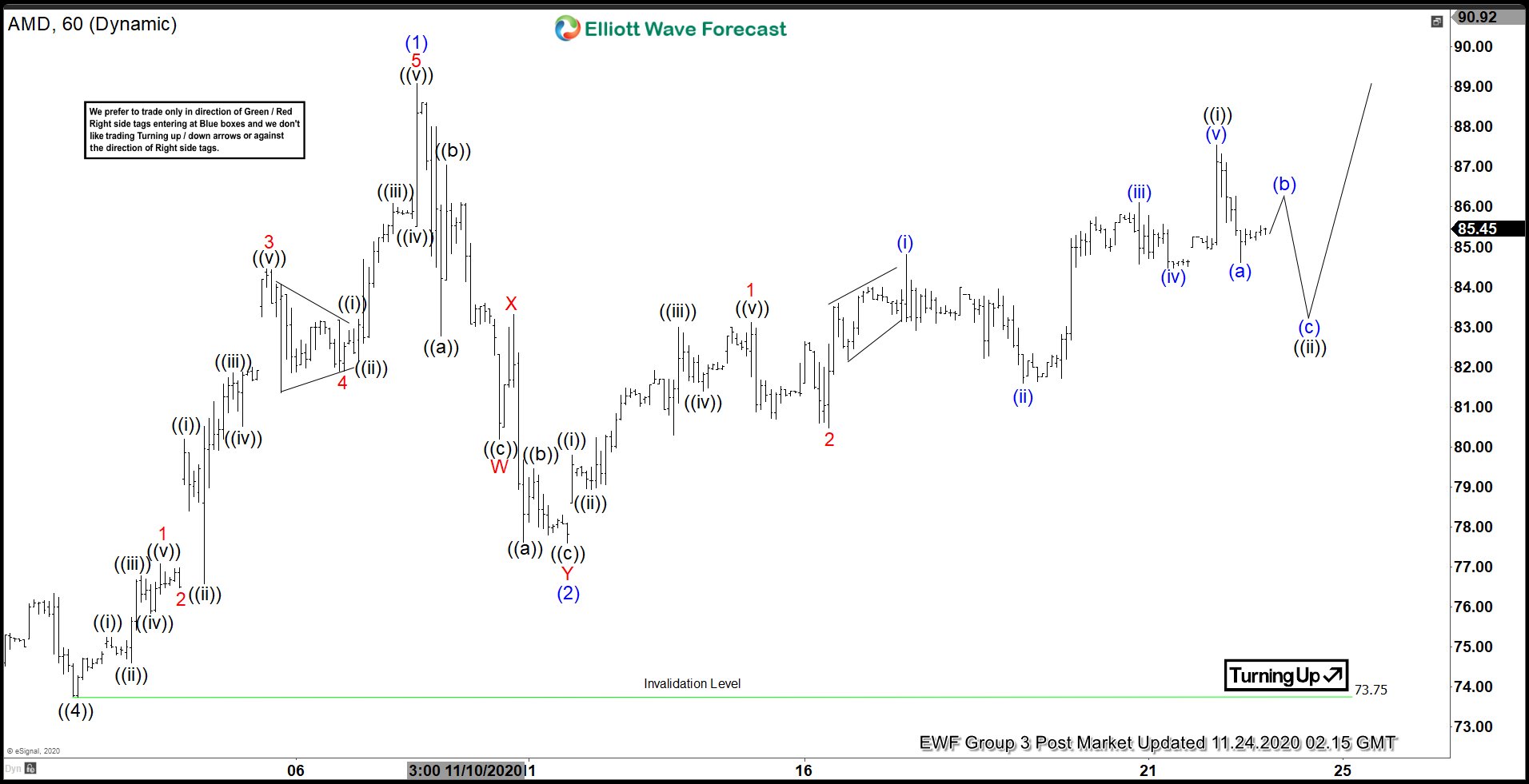

In this article we are going to review and analyze The Elliot’s Wave structure of the shares of Advanced Micro Devices Inc in the last days of November. Here’s the 1-hour AMD chart presented to our members on November 24th. After finishing a cycle as wave (2) at 77.56, we could see 5 waves up as wave 1 in red, then a zig-zag correction and another 5 waves up as wave ((i)). Thus, we looked for a movement to correct the cycle of wave ((i)) as simple as (a) (b) © correction to develop a wave ((ii)).

AMD Zig-Zag and Rally

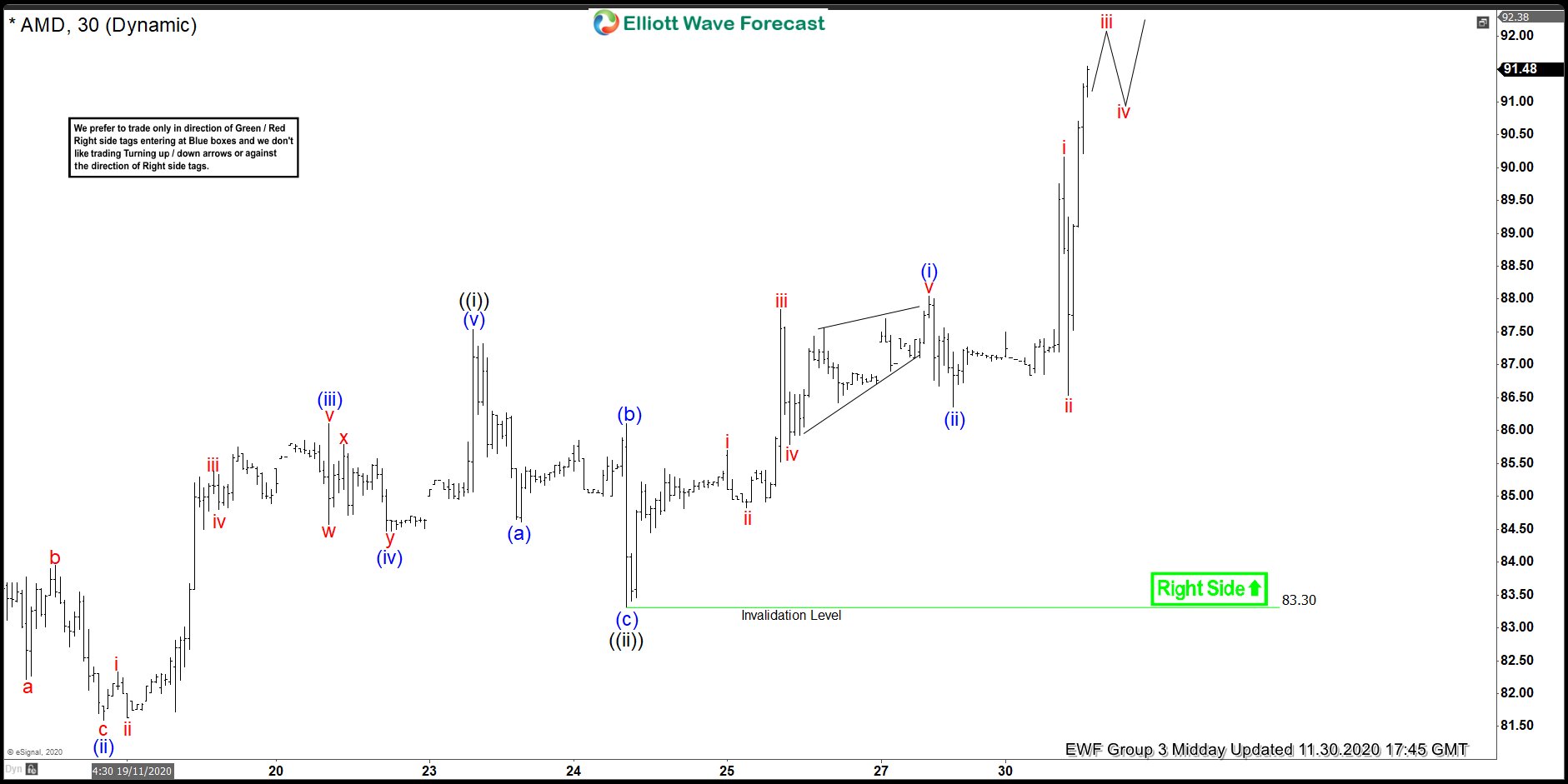

This is the chart of November 30 where we can see that the wave ((ii)) we were looking for performed a zig-zag Elliott wave correction, to have more information on Elliott Theory can visit the following link: Elliott’s Wave Theory. The market bounced back at 83.30 and continued with the uptrend following the right side of the market. We could see 5 waves developing an impulse as wave (i) and then a zig-zag correction as wave (ii). From here, the stock rally again and we are expecting more upside to complete wave (iii) and small correction as (iv) and one more high to complete a cycle from 83.30 level.

Source: Drawing the Market in the Advanced Micro Devices Inc (AMD)