Bitcoin hardware makers are like the picks and shovels of the gold rush in California. Ebang is a shovel maker, in the new Bitcoin era. Ebang has had a nice run so far but is there more in store? lets take alook at the company profile.

“Ebang International Holdings Inc. is a blockchain technology company with strong application-specific integrated circuit ( ASIC ) chip design capability. With years of industry experience and expertise in ASIC chip design, it has become a leading bitcoin mining machine producer in the global market with steady access to wafer foundry capacity. With its licensed or registered entities in various jurisdictions, the Company seeks to launch a professional, convenient and innovative digital asset financial service platform to expand into the upstream and the downstream of blockchain and cryptocurrency industry value chain. ”

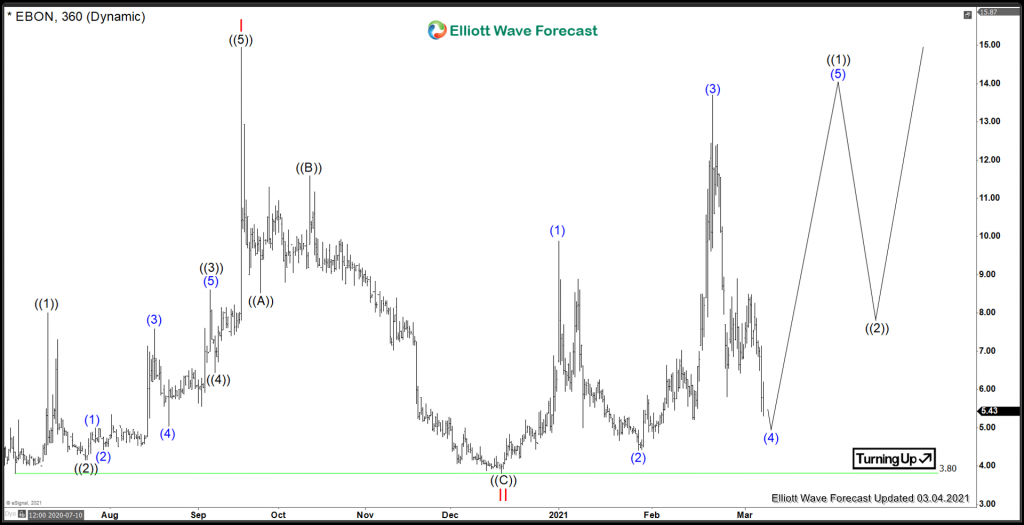

As you can see on the chart below, there has been quite a large pullback from the recent peak. Lets take a look at the Elliottwave View.

Ebang Elliott Wave View:

Medium term term view from the all time low in July 2020. Ebang has had a fairly volatile 2020. From the low in July, Ebang set a leading diagonal 5 swings higher which peaked on Sep 17 2020. Since that peak, it is had been very choppy, and is favoured to be presently correcting in a blue (4) before heading higher for one more swing. It is important to realize, this sector is very volatile, and proper risk management must be observed. Currently the stock is favoured to be correcting in blue (4) before heading higher in (5) of ((1)). However, while above the 3.80 low, further extension higher is favoured.

In Conclusion, with the data that is present, this stock is favouring further extenson lower before higher in at least one more high before correcting in a larger degree. But at this point, it is important to observe good risk management as the 5th wave can take on many shapes and forms.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Source: Ebang International Holdings ($EBON) Nesting for higher