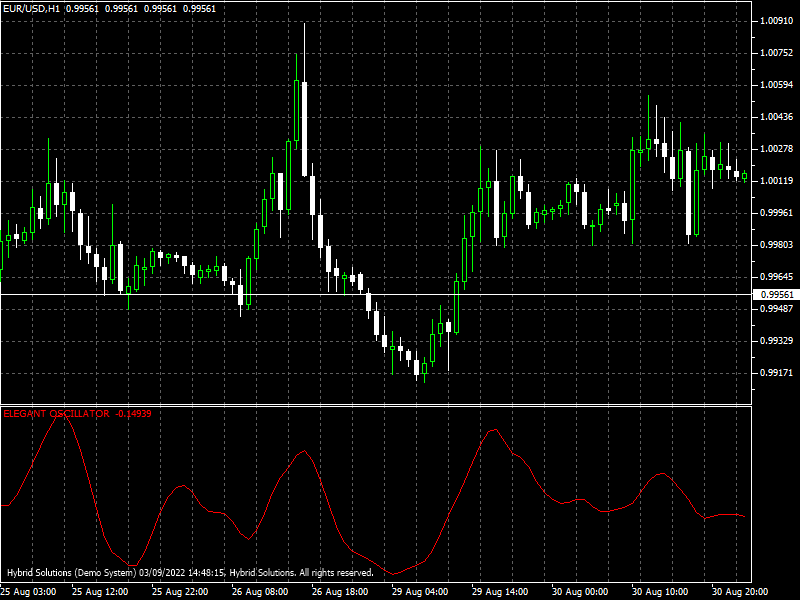

The elegant oscillator is client side VTL indicator. It is based on signal processing algorithms and used in mean reverting trading systems. Mean Reversion theory suggests that after an extreme price move, asset prices tend to return back to normal or average levels. Prices routinely oscillate around the mean or average price but tend to return to that same average price over and over. Mean reversion strategies open trades when price moves to extreme levels, expecting price to return to the historical mean price. This is a counter trend trading strategy.

The elegant oscillator helps in identifying extreme price levels. Elegant Oscillator is a technical indicator based on signal processing techniques. It calculates the inverse Fisher transform of price and applies the smoothing filter to it. The resulting line oscillates between the values -1.0 and +1.0. Find out the extreme levels it reached in the historical chart and open a counter trend trade when it reaches around the historical extreme levels. It is better to be used with other indicators to confirm the signals.

Parameters:

Band Edge – Parameter to calculate the band edge, default is 20

Oscillator Period - Number of bars in the indicator calculations, default is 50

Price - Price field to calculate the indicator. 1 Close, 2 Open, 3 High, 4 Low, 5 Median, 6 Typical, 7 Weighted

Test the indicator on charts with different parameter values and pick the best parameter values for each instrument before using it in trading.

Elegant Oscillator.zip (2.4 KB)