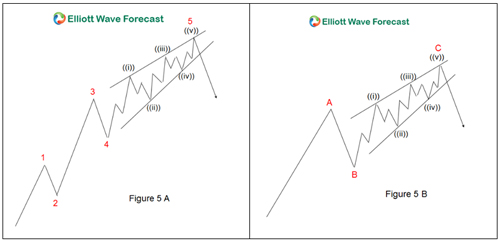

An ending diagonal is an Elliott Waves structure that is wedge-shaped and can appear within an impulse as wave 5 or within a correction as a wave C. This type of structure internally is composed of 5 waves and each of these 5 waves is subdivided into 3 or 5 waves creating two possible structures 3-3-3-3-3 or 5-3-5-3-5.

An ending diagonal indicates that the end of a cycle is near and this has two consequences: 1. The market corrects the finished cycle and then continue with the trend 2. We have a short, medium or long term trend change depending on the cycle that the market is ending. This makes the ending diagonal a very powerful technical structure because gives us great trading opportunities. For more information on Elliott’s Theory you can visit this link: Elliott’s Wave Theory.

Coffee Ending Diagonal

Above we can see in early November that an ending diagonal was forming in Coffee ($KC #F). We have a corrective structure (A) (B) © from the peak, where wave © is an ending diagonal indicating that the correction was about to finish and we should see a bounce in 3 swings at least or continue with the uptrend. For the moment Coffee continues with the bullish movement and does not indicate any change in the trend until it does not break the invalidation level of 102.14.