Christian Noyer: Does Europe face the prospect of a lost decade?

As we can see the Mr. Noyer expects the EUR economy to get in better shape in the long-term but as I interpret the currency will be still bearish in the short-term.

Christian Noyer: Does Europe face the prospect of a lost decade?

As we can see the Mr. Noyer expects the EUR economy to get in better shape in the long-term but as I interpret the currency will be still bearish in the short-term.

That was interesting, thanks for posting it! He definitely seems to have a positive long-term view for the Eurozone, but is realistic about the challenges it faces, especially in the short term.

He points out, as a problem, the “disconnect” between inflation and growth in the Eurozone, and that this is probably due to strong capital inflows. He specifically mentions the appreciation of the euro as a problem.

Since the Governing Council’s solution to this problem is to dramatically increase liquidity in the Eurozone to “encourage financial intermediaries to actively put their cash balances at work both on credit and asset markets”, and to send " a clear sign that monetary accommodation [I]should persist for a very long time[/I]", I would definitely take his statement as bearish for the euro.

Thanks for sharing this! I do agree that the euro zone economy could improve at some point or another, what with all the stimulus they’re injecting through rate cuts and LTRO right now. For meantime though, until those signs of a pickup emerge, the euro might still be in a bearish trajectory and the ECB might keep pumping out their easing measures.

+1 to all of these - I am currently holding short EUR/USD and it has been playing well so far.

Just to add some recent Eurozone reports to that:

Positive impact

Improved Spanish economic data (May 2014)

Negative impact

German ZEW Economic Sentiment is low (May 2014)

Eurozone GDP growth is weak (May 2014)

European PMI decreased (May 2014)

EUR interest rate decreased (June 2014)

Good luck,

CxInvestor,

Fundamental Trader

Just a heads up…

Forex rollover charges in Euro pairs have surged since yesterday.

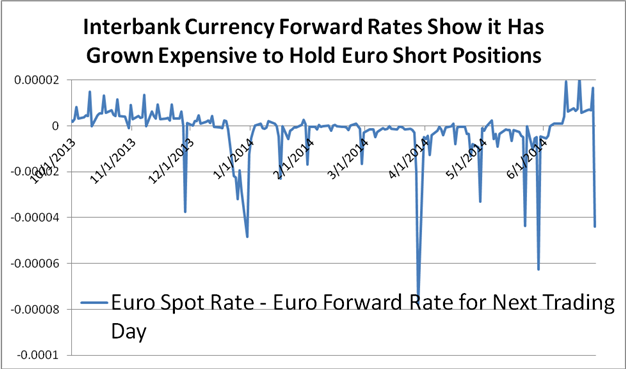

A look at interbank forward markets shows that holding Euro short positions versus the US dollar and Japanese yen has become exceedingly expensive since yesterday.

Those forward rates showed that traders could earn interest rate credits in holding EUR/USD-short positions just yesterday. Yet a sharp shift now means that being short EURUSD is now at its most expensive since a similar spike in borrowing costs at the end of last month.

Source: Bloomberg Generic Price - “Consensus” Pricing

Just wondering Jason, looking at the chart you posted above I can’t work out what was the “trigger” that caused you to go long at the point you did. Forgive me if I’m missing something obvious

Here is a little post from David Rodriguez back at the end of April, note the similarities on the month end, the holiday coming up etc.

Check out then the first week of May on Fibre.

Euro Short Positions Expensive as Rates Spike into Month-End, Holiday

Interesting. Any biases ahead of this week’s euro zone flash CPI releases and ECB rate decision?

EUR has been very difficult to trade last this month, its further trend has been in a state of confusion.

I am not buying current EUR/USD rally, and waiting for the trend to go flat on a daily chart. It would be a good time to sell.

Good luck,

CxInvestor,

Fundamental Trader.

Hi CxInvestor,

I do not know if you sold on the top but your patience could pay out for you. Hopefully you took advantage from the EUR selloff today!

Good luck further on

In case you missed the ECB press conference yesterday, here is the introductory statement:

Mario Draghi: ECB press conference - introductory statement

It is not so clear what the reaction of the people was to the report as yesterday because at the same time there were US and CAD tier 1 events.

However it is not a hawkish report. That is for sure

I believe the Euro will actually strengthen against a number of currencies such as EURUSD and EURAUD. I am uncertain the ECB monetary policy is sufficient to execute a short trade. The technical end of the market actually suggests a moderate recovery to 1.3700. Of course, it will not occur in one day but it is the expected target for EURUSD in the short/medium certain.

Hi Traders,

does someone has any idea what is behind the EUR rally today? The only report scheduled for today, EUR Industrial Production came out worse than expected but the EUR is still getting higher! Any ideas? This rally goes mostly against the GBP. GBP is losing this time without a main catalyst.

Thanks

Just in case some of you would like to read about EU countries news, but about countries which are not part of the EUR, then here are some Fundamentals about economic prospects and financial forecasts which could be applied for basically the whole Eastern European territory: Mugur Isărescu: Relations between euro and non-euro countries within the Banking Union

Nice! Thanks for sharing this.

Hi guys,

here is the speech from Draghi in Jackson Hole:

Thanks for sharing this!

With the rate cut from the ECB, the Euro remains vulnerable to further loses, especially if the NFP report comes out better than expected.