EUR/JPY sits near two-month highs heading into the BOJ and ECB interest rate decisions, consolidating after a strong rally that saw the pair add nearly eight big figures from the lows of December.

By :David Scutt, Market Analyst

- EUR/JPY sits near two-month highs ahead of the BOJ and ECB interest rate decisions

- Neither central bank is expected to deliver a major policy surprise

- With mostly second-tier data releases on the calendar in both regions, US economic data may determine which direction EUR/JPY travels

- With markets having pared and delayed Fed rate cut expectations, grounds for further upside in US yields may be limited near-term

EUR/JPY sits near two-month highs heading into the Bank of Japan (BOJ) and European Central Bank (ECB) interest rate decisions this week, consolidating after a strong rally that saw the pair add nearly eight big figures from the lows of December.

However, with neither bank predicted to flag, let along make, any sweeping changes to policy at their respective meetings, outside of a major policy surprise, how the pair evolves may be determined by external factors. US interest rate expectations, along with geopolitical risks involving the Middle East, stand out as two prime candidates.

EUR/JPY rally pauses for breath

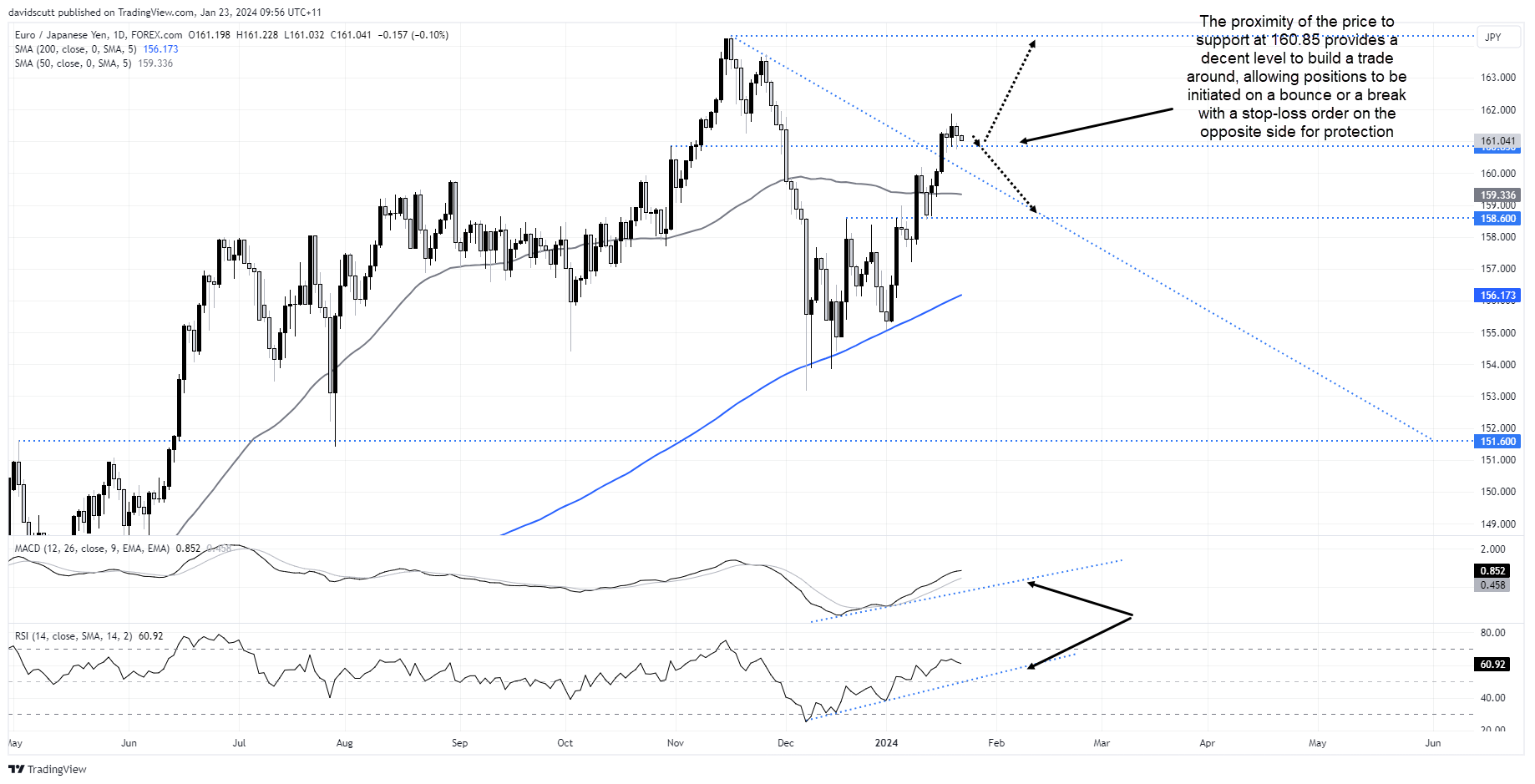

You can see the rebound in EUR/JPY over the past two months on the chart below, seeing it launch from the 200-day moving average before breaking several layers of horizontal resistance, taking out the downtrend it was in since early November. With MACD and RSI showing no sign of threatening their respective uptrends, the near-term risks appear biased to the upside. The price action since breaking higher last Wednesday has also been constructive with EUR/JPY attracting bids on dips below 160.85 for three consecutive sessions.

With the price respecting this level, the proximity provides decent risk-reward to build a trade around. For those considering longs, dips towards 160.85 could be used to initiate positions targeting 164.30, with a stop below support for protection.

Alternatively, if price were to break 160.85 and hold, it would allow for short trades to be initiated targeting a retracement to 158.60, where the pair did plenty of work over the turn of the new year. A stop above 160.85 would offer protection. Given its checkered history with the 50-day moving average, sometimes respecting it and other times totally ignoring it, those considering shorts should factor this when evaluating the risk-reward of the trade.

BOJ and ECB rate decisions on tap, but is there scope for surprise?

While recent price action has been constructive for bulls, as mentioned earlier, whether the BOJ or ECB interest rate decisions provide a major catalyst for the pair is debatable. I’ve written numerous times recently about the risky backdrop the BOJ faces with no clear evidence as yet that the inflationary pulse rippling through the Japanese economy will lead to permanent price increases.

With so many ECB governing council members speaking at Davos last week, including President Christine Lagarde, can the ECB really spring a surprise on markets? Lagarde told us rate cuts by the summer were likely but that markets pricing in up to six rate cuts this year were making the task of lowering inflation difficult. I expect we’ll hear more of the same.

Outside the central bank decisions, the economic calendar for the Japan and euro area only contains second-tier releases outside the latest Tokyo consumer price inflation print. And economist forecasts for that release are usually on the money, limiting the scope for surprise.

It points to the potential for external influences to dictate the trajectory for EUR/JPY in the days ahead. While geopolitical tensions in the Middle East are obvious, judging how they’ll likely evolve is incredibly risky.

Directional risks may be determined by US yields, not BOJ or ECB

Instead, as shown in the chart below, the similarities between EUR/JPY and yield spreads between US and Japanese 10-year bonds, rate differentials may determine where the pair evolves from here.

Source: Refinitiv

With an advanced reading of US Q4 GDP and core PCE inflation on Thursday, a monthly read on core PCE inflation on Friday, the US Treasury quarterly refunding plan released next Monday and Federal Reserve January policy meeting on Wednesday, the calendar is bursting at the seams when it comes to major risk events.

With markets having scaled back the degree of easing expected from the Fed in 2024, with the first cut now expected in May rather than March, it may be difficult for yields to advance much further in the near-term. And if the data confirms the prevailing disinflationary trend remains intact, it could easily spark renewed downside for traders itching for the Fed to pull the policy easing trigger. If that were to eventuate, downside risks for EUR/JPY would build.

– Written by David Scutt

Follow David on Twitter @scutty

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.