EUR/USD: The fundamental picture around the Democrats winning could support the bullish mood around the pair, long-term. On the upside, current levels are important. If the pair manages to break them, we can expect 1.1600 soon. On the flip side major supports are 1.1380, followed by 1.1300.

The euro rose against the greenback on Wednesday. By the close of US trading, EUR / USD was trading at 1.1440, adding 0.11%. I believe that support is now at around 1.1306, Thursday’s low, and resistance is likely at the level of 1.1500 - the maximum of yesterday’s trading.

Approaching 1.13. If it’s reached today I’ll def open a long, no news and closing the week seems a good squeeze.

The EURUSD accelerates its bearish momentum below the 1.1400 level and drops very close to the 1.1300 zone, which may act as support. The pair even get stuck between the 1.1300 level and the 1.1400. Above the 1.1400 level, its next resistance could be the 55 day EMA around the 1.1500 level.

EUR/USD: FED hinted for another rate hike in December. It should boost the dollar next week.

The Euro broke the 1.13 support. It looks like it has more potential to the downside as the US dollar is gaining strength.

I guess it’s time to sell euro because speculations surface that ECB will extend QE, it’s actually a big sell signal for the euro.

The euro rose against the US dollar on Tuesday. By the close of US trading, EUR / USD was trading at the level of 1.1285, adding 0.59%. I believe that support is now at 1.1216, Monday’s low, and resistance is likely at the level of 1.1502 - the maximum of Wednesday.

EUR/USD: The pair is approaching the 1.1340/60 resistance (Nov 9). If the upward mood prevails, next levels to consider are 1.1430 and 1.1480. The nearest support level is 1.1260, followed by 1.1210.

EURUSD broke the support at 1.13 with a low of 1.1215. Let’s see where it goes next.

The euro rose against the US dollar on Friday. By the close of US trading, EUR / USD was trading at 1.1415, adding 0.77%. I believe that support is now at around 1.1214, Monday’s low, and resistance is likely at 1.1420, Friday’s trading high.

EUR/USD: Currently the pair is trading at 1.1400 support level. If it manages to break it, the next support is at 1.1350. On the upside the next resistance level is located at 1.1490.

Early into the European session the Euro is making some steps towards recovery.

Looks like the Euro’s Current Account level on the calendar missed their forecast by a ton, like 1/3rd down. What does this likely mean for the Euro or the EUR/USD and why?

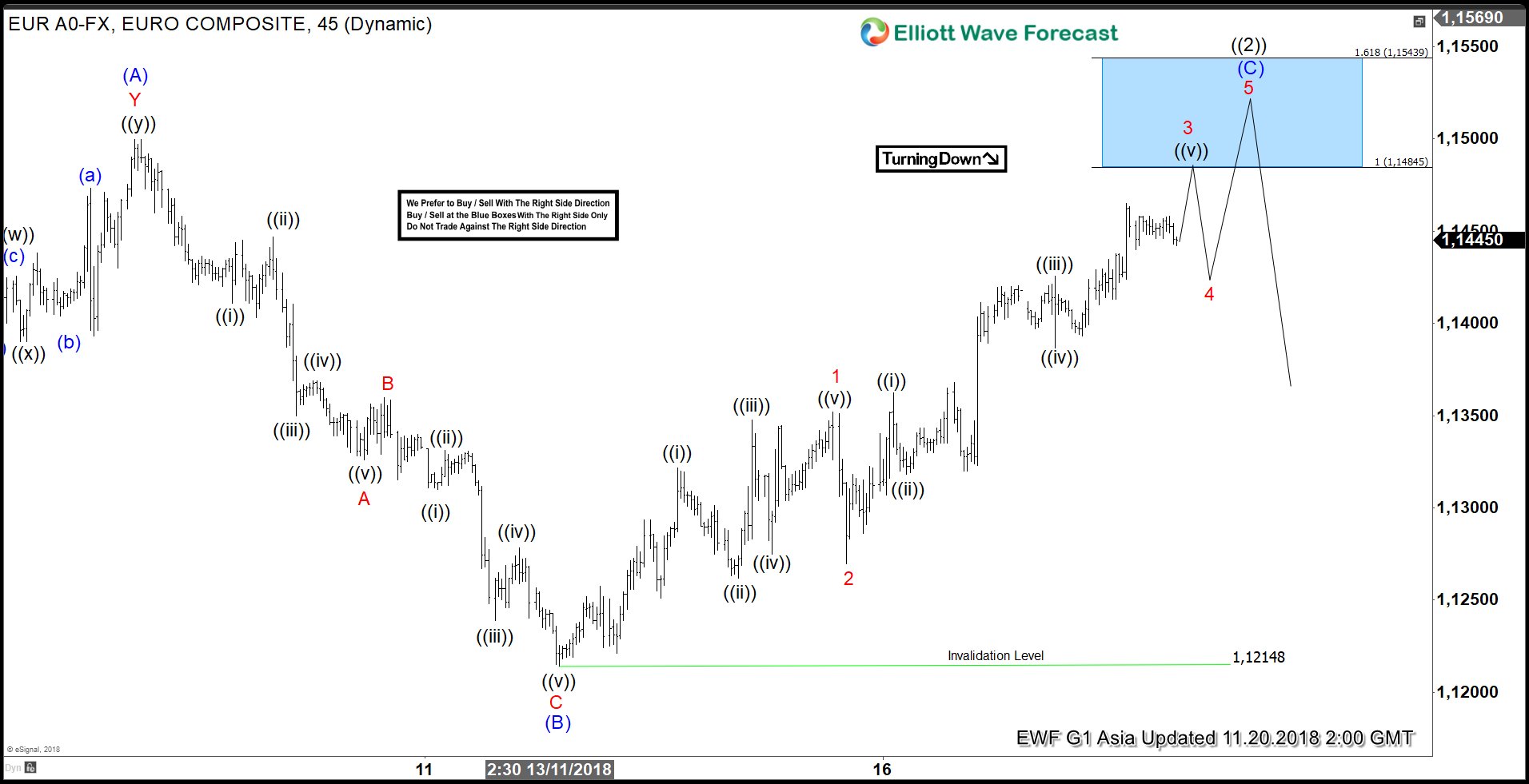

Short Term Elliott Wave View on EURUSD suggests that pair is currently in Primary wave ((2)) rally to correct cycle from Sept 24 high (1.1815) before the decline resumes. Internal of Primary wave ((2)) is unfolding as a Flat Elliott Wave structure where Intermediate wave (A) ended at 1.15 and Intermediate wave (B) ended at 1.1214. A Flat is a 3-3-5 Elliott Wave structure, thus we should expect Intermediate wave ( C ) to be unfolding as 5 waves.

Intermediate wave ( C ) rally higher is taking the form of a 5 waves impulse Elliott Wave structure. Minor wave 1 of ( C ) ended at 1.135 and Minor wave 2 of ( C ) ended at 1.127. Near term, expect the pair to end Minor wave 3 of ( C ) soon, then it should pullback in Minor wave 4 of ( C ) before doing another leg higher in Minor wave 5. The move in Minor wave 5 should also end Intermediate wave ( C ) with projected target at 1.148 - 1.154.

More important than the target area however is the momentum divergence. Minor wave 5 should show momentum divergence with Minor wave 3 before pair ends the 5 waves move. As far as momentum does not show any divergence, we can assume that EURUSD still remains to be in Minor wave 3. As far as pivot at Sept 24 high (1.1815) remains intact, pair is expected to resume lower or at least pullback in 3 waves once the 5 waves move is over. We don’t like buying the pair.

EURUSD 1 Hour Elliott Wave Chart

The euro rose against the greenback on Wednesday. By the close of US trading, EUR / USD was trading at 1.1385, adding 0.13%. I believe that support is now at 1.1271, Thursday’s low, and resistance is likely at 1.1472, Tuesday’s high.

By the close of US trading, EUR / USD was trading at 1.1331, losing 0.63%. I believe that support is now at around 1.1328, the low of Friday’s trading, and resistance is likely to be at 1.1473, the high of Tuesday.

The Euro seems to have found some solid ground. I think consolidation will lead to continuation of the move North.

EUR/USD: The euro/dollar tried to rise up last week, making a peak at 1.1472, but closed down to 1.1334 after failing to break above the trendline resistance. Expectations are bearish for testing 1.1275, but important support remains 1.1215. It should be clearly pierced down to resuming the main bearish trend. The closest resistance is at 1.1385. A clear breakthrough over it will take the price to a neutral zone with testing at 1.1430, but a key resistance is 1.1500.