EUR/USD holds steady ahead of retail sales data. USD/JPY slips after steep gains last week & with inflation data in focus.

By :Fiona Cincotta, Senior Market Analyst

EUR/USD holds steady ahead after losses last week

- German factory orders rise 0.3% vs -3.8% prev.

- Eurozone retail sales are forecast to fall MoM -0.3% vs 0.1% prev.

- EUR/USD consolidates below 1.0950

EUE/USD is holding steady after falling 0.85% last week as investors digest the latest German trade and factory orders figures whilst also looking ahead to retail sales data shortly.

German factory orders rose by less than expected, up 0.3% MoM in November after tumbling -3.8% in October.

Meanwhile, trade data improved, with exports rising 3.7% and imports also rising 1.9%, lifting the German trade surplus to €20.4 billion up from €17.7 billion. This suggests that the demand environment could be starting to improve, although it is still in its early days.

Attention will now turn to eurozone retail sales, which are expected to fall -0.3% MoM in November after rising 0.1% in October. The retail sales data comes after sales in Germany plunged -2.5% month on month. Retail sales fell as interest rates remain at a record high and inflation has started to tick higher again. Eurozone inflation data on Friday showed that CPI rose to 2.9%, up from 2.4%, which raises concerns of stagnation in the region.

Rising inflation also raises questions over the ECB’s ability to cut interest rates as soon as March. The market has been pricing in an aggressive series of rate cuts from the ECB this year, but if inflation proves to be sticky, the market may need to reprice the expectation.

Meanwhile, the US dollar is holding steady versus its major peers as investors continue to digest the mixed non-farm payroll report on Friday and after hawkish comments from Dallas Fed President Lorrie Logan over the weekend. US inflation expectations data is also due to be released.

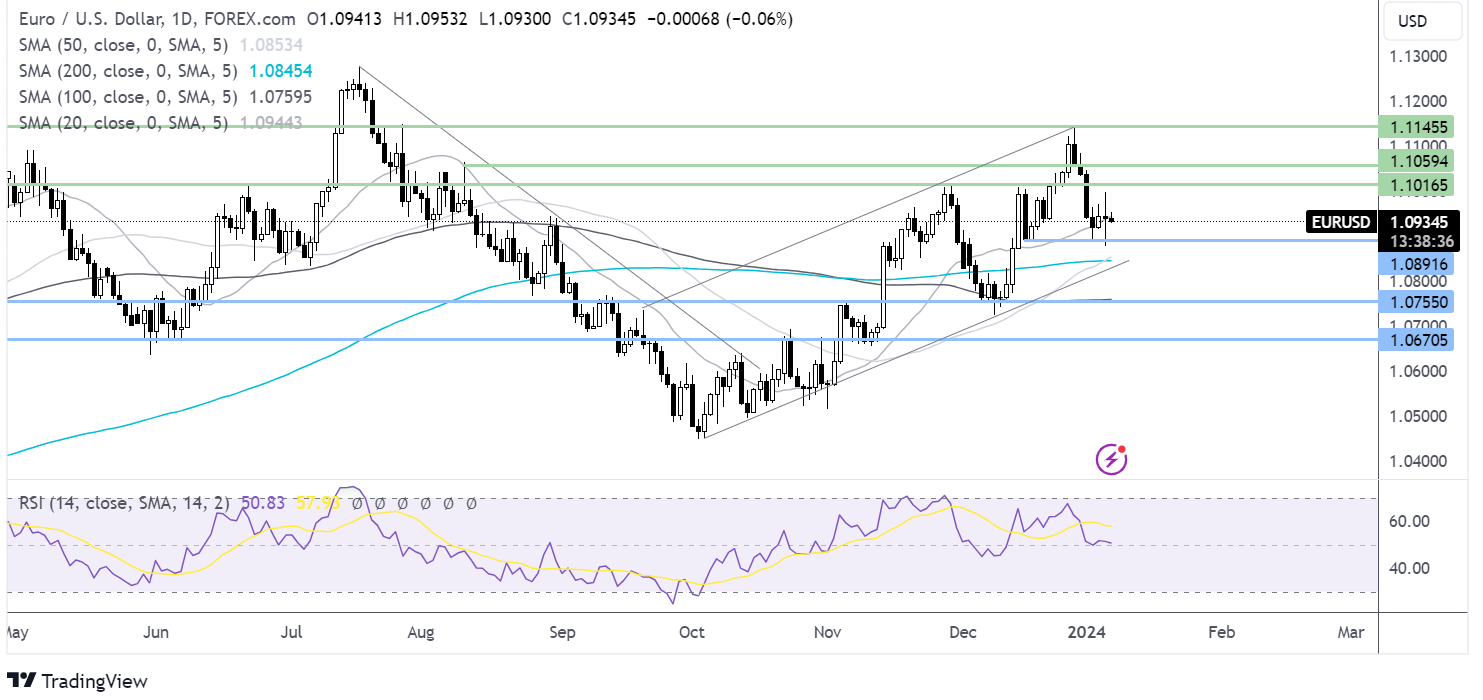

EUR/USD forecast – technical analysis

EUR/USD is holding steady, consolidating just below 1.0950. The RSI is neutral, so traders could look for a breakout trade. Buyers will be looking for a rise above 1.10 on the psychological level. A rise above here opens the door to 1.1140 the December high.

On the downside, sellers could look for a drop below 1.0890/80, the mid-December low, and January low. A break below here exposes the 200 SMA at 1.0845.

USD/JPY looks to inflation data after strong gains last week

- The pair fell 2.5% last week on easing dovish Fed bets

- US & Tokyo inflation data in focus

- USD/JPY consolidates below 145.00

USD/JPY is consolidating after surging 2.5% last week as investors reigned an aggressive Federal Reserve interest rate cut expectations for 2024.

Friday’s non-farm payroll report was mixed with the headline figure rising to 216,000, well ahead of the 150,000 forecast; however, the two previous months saw a downward revision of 71,000 jobs. Meanwhile, the government added 52,000 jobs, a large chunk of the report, which is hardly the basis of a roaring economy.

According to the CME Fed watch tool, the market is pricing in a 60% probability of the Fed cutting interest rates in March, down from 73% at the end of December.

Over the weekend, Dallas Fed President Lorie Logan emphasized the importance of maintaining tight financial conditions in order to prevent a resurgence of inflation.

Investors will be looking towards a speech from Atlanta Fed President Raphael Bostic for further clues on the timing of the first Fed rate cut. US inflation expectations will also be in focus ahead of inflation data later in the week. US CPI will be the key release week and could set rate-cut expectations.

While the yen fell sharply last week, the sell-off appears to have stabilized. The yen is finding support from the off mood in the market after a notable sell-off in equities in Hong Kong and China.

Looking ahead, today is a public holiday in Japan but Tokyo inflation data will focus. Hotter-than-expected inflation could pressure the BoJ to consider a pivot away from negative rates.

Household spending data will also be under the spotlight. Economists forecast that household spending will increase by 0.2% in November. A pickup in spending could also drive demand in driven inflation, supporting a more hawkish approach from the BoJ.

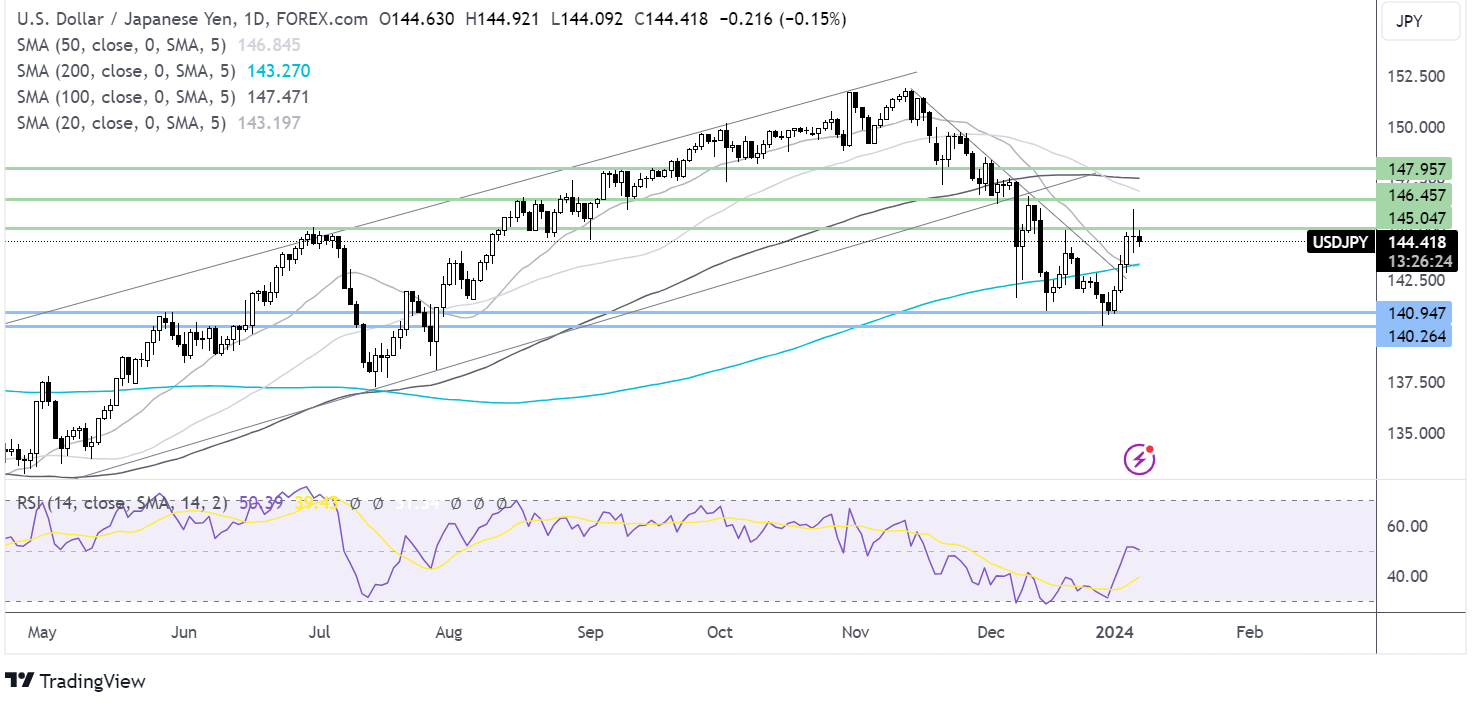

USD/JPY forecast – technical analysis

USD/JPY extended its recovery from 140.25, rising above the 200 SMA and the multi-month falling trendline.

The price briefly spiked as high of 146.00 last week, which now acts as a resistance for bulls to beat ahead of the 100 SMA at 147.50 and 148.00 round numbers.

On the downside, sellers will look for a break below the 200 SMA at 143.30 to gain momentum towards 140.25.

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.